Abstract

The amount of capital required to transition energy systems to low-carbon futures is very large, yet analysis of energy systems change has been curiously quiet on the role of capital markets in financing energy transitions. This is surprising given the huge role finance and investment must play in facilitating transformative change. We argue this has been due to a lack of suitable theory to supplant neoclassical notions of capital markets and innovation finance. This research draws on the notion from Planetary economics: Energy, climate change and the three domains of sustainable development, by Grubb and colleagues, that planetary economics is defined by three ‘domains’, which describe behavioural, neoclassical, and evolutionary aspects of energy and climate policy analysis. We identify first- and second-domain theories of finance that are well established, but argue that third-domain approaches, relating to evolutionary systems change, have lacked a compatible theory of capital markets. Based on an analysis of electricity market reform and renewable energy finance in the UK, the ‘adaptive market hypothesis' is presented as a suitable framework with which to analyse energy systems finance. Armed with an understanding of financial markets as adaptive, scholars and policy makers can ask new questions about the role of capital markets in energy systems transitions.

Policy relevance

This article explores the role of financial markets in capitalising low-carbon energy systems and long-term change. The authors demonstrate that much energy and climate policy assumes financial markets are efficient, meaning they will reliably capitalise low-carbon transitions if a rational return is created by subsidy regimes or other market mechanisms. The authors show that the market for renewable energy finance does not conform to the efficient markets hypothesis, and is more in line with an ‘adaptive’ markets understanding. Climate and energy policy makers that design policy, strategy, and regulation on the assumption of efficient financial markets will not pay attention to structural and behavioural constraints on investment; they risk falling short of the investment levels needed for long-term systems change. In short, by thinking of financial markets as adaptive, the range of policy responses to enable low-carbon investment can be much broader.

1. Introduction

Nothing is more suicidal than a rational investment policy in an irrational world.

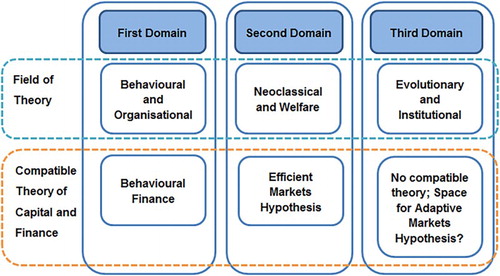

The article is structured as follows. Section 2 describes the theoretical framing of this research. Based on the ‘three domains’ of sustainable development proposed by Grubb et al. (Citation2014), we argue that established literatures exist on the effects of both first- (behavioural and organisational) and second- (neoclassical/welfare) domain theories on financial markets in the energy transition, but there is a gap in the literature on third-domain (evolutionary and institutional) treatments of investment and financial markets. Section 3 comprises the empirical methodology for a study of RE finance in the UK. Section 4 describes the results, identifying structural barriers to RE investment in the UK. In Section 5, these results are analysed in relation to the adaptive market hypothesis (AMH). The authors argue that finance markets for RE in the UK conform to an adaptive (as opposed to efficient) model. Section 6 presents the conclusions from this study and proposes the AMH as useful for energy research and policy formation.

2. Financing low-carbon energy investment: theoretical perspectives

Grubb et al. (Citation2014) argue that analysis of the economic responses to the challenges of climate change requires understanding sustainable development as being constituted by three ‘domains’. Studies that focus on individual behaviours/cognition are classed as first-domain approaches, those that assume rational actors and market efficiency are classed as second-domain approaches, and those that address evolving structural and institutional effects on system change are classed as third-domain approaches. For Grubb et al. (Citation2014), these three domains are not mutually exclusive, and each has a legitimate contribution to make in understanding the political economy of energy transitions. Furthermore, these three domains lead to three complementary pillars of policy responses.

The roles of finance and capital markets are important for the analysis of responses in each domain. However, we argue that, to date, these roles have been conceptualised largely in relation to first- and second-domain approaches, and little has been said about the roles of finance/capital markets in the ‘third domain', which relates to long-term, systemic change. This is important, as Grubb et al. (Citation2014, p. 428) argue that new types of financial instruments are needed ‘to align the financial system with the real physical needs for long-term, sustainable investment’. This is critical to energy and climate policy, as the design of any new financial instruments must operate on assumptions about how financial markets work.

2.1. Investment challenges: first- and second-domain perspectives

Much climate policy analysis has taken a ‘second domain’ perspective, based on neoclassical and welfare economics, in which individuals and organisations are rational actors who make optimal choices based on economic factors. While academic neoclassical economics can envisage short-term irrationality or inefficiency, this is often framed as market failure, which can be corrected on a long enough timescale (Malkiel, Citation2003) if only better markets can be created (Bowman, Froud, Johal, John, & Leaver, Citation2014). Thus, the policy prescriptions arising from neoclassical economics are often a furthering and deepening of markets to shift the good or service being provided towards more ‘efficient’ provision. These assumptions lead policy makers to pursue market-driven solutions for the pricing and exchange of societal and planetary resources. If all actors and organisations are rational, a markets and pricing approach, based on sound cost–benefit analysis, will yield efficient resource allocations (Grubb et al, Citation2014; Styhre, Citation2014). Within this domain, policy research has typically focused on the pricing of environmental externalities, particularly carbon emissions (Aldy & Stavins, Citation2012; Baumol, Citation1972; Ellerman et al., Citation2010), and the construction of market mechanisms and trading to deal with them (Neuhoff, Grubb, & Keats, Citation2006; Harstad & Eskeland, Citation2010).

The theories of finance/capital markets most compatible with the second-domain derive from Eugene Fama's hypothesis of financial markets as ‘efficient’ (Fama, Citation1970; Fox, Citation2011; Soufian et al., Citation2014; Styhre, Citation2014). In the ‘efficient markets hypothesis' (EMH) an ‘army of [rational] investors’ is ‘driven by profit opportunities’ (Lo, Citation2004, p. 16) to quickly recognise attractive investments and will allocate capital to exploit them. This assumes the ‘many’ investors are able to incorporate all available information, forming rational actors that will (in this case) invest in low-carbon transitions once a profit opportunity is created. Masini and Menichetti (Citation2012) argue that much western energy policy implicitly assumes an efficient financial market exists, as evidenced by its reliance on prices and markets to facilitate energy transitions.

Further work has sought to apply a ‘first domain’ perspective, drawing on behavioural economics (Pollitt & Shaorshadze, Citation2011), in which individual and organisations have ‘bounded rationality’, i.e. there are limits to their ability to gather and process relevant information (Simon, Citation1955). Simon (Citation1955) argued that this implies that economic actors primarily seek satisfactory rather than optimal solutions, i.e. they display ‘satisficing’ as opposed to profit maximisation behaviour. This helps to explain why nominally rational decisions on energy and resource efficiency are unevenly adopted, even where cost-optimal measures exist (see Howarth, Haddad, & Paton, Citation2000; Marechal & Lazaric, Citation2011; Pollitt & Shaorshadze, Citation2011; Sorrell, Citation2004).

Here, the compatible theory of capital markets is ‘behavioural finance' (Shiller, Citation2003). Masini and Menichetti (Citation2012, Citation2013) investigate how investors’ a priori beliefs, subsidy preferences, and appetite for technological risk, affect renewable energy investment decisions. They find prior beliefs on technological risk to be more important to investors than perceived effectiveness of existing policies (see also Leete, Xu, & Wheeler, Citation2013). Here, policy should pay more attention to investors’ risk perceptions, as not all investors have sufficient experience of the energy sector to judge risk adequately (Wüstenhagen & Menichetti, Citation2012). Bergek, Mignon, and Sundberg (Citation2013) focus on non-financial investors, similarly finding cognitive aspects of technological beliefs, entrepreneurial appetite, and network learning as important drivers for RE investment. Further work has described how the orientation of business models affects RE investors' behaviour (Pinkse & Van Den Buuse, Citation2012) and how these business models affect investor preferences beyond conditions of technology attributes and price (Loock, Citation2012).

These behavioural finance treatments add to our understanding by using ideas of bounded rationality, but do not consider wider systemic changes relating to the ‘third domain’.

2.2. Third domain: (co)evolutionary structural change

The third domain relates to the challenges of strategic investment for innovation and infrastructure, leading to transformation of energy systems (Grubb et al., Citation2014). Understanding change in socio-technical systems for the supply and use of energy has been the focus of much recent research, but we argue that this has paid insufficient attention to understanding the roles of finance and capital markets.

A co-evolutionary, socio-technical systems approach offers a broad, institutionally focused understanding of how innovations such as REenergy technologies proliferate through complex physical and social systems (Foxon, Citation2011; Hughes, Citation1987; Joerges, Citation1998). This work builds on an evolutionary economics perspective of systems change arising out of firms with bounded rationality interacting under selection pressures (Nelson & Winter, Citation1982), but has tended to emphasise social rather than economic drivers (Foxon, Citation2011). Building on these treatments, socio-technical transitions approaches have described the interplay of actors and processes involved in managing the transition to lower-carbon systems (Bolton & Foxon, Citation2013; Verbong & Geels, Citation2007). Co-evolutionary and socio-technical framings have been applied to energy systems as they display high levels of interdependencies between physical assets, societal practices, economic cycles, and technological change (Arapostathis et al., Citation2013; Hannon, Foxon, & Gale, Citation2013; Verbong & Geels, Citation2007).

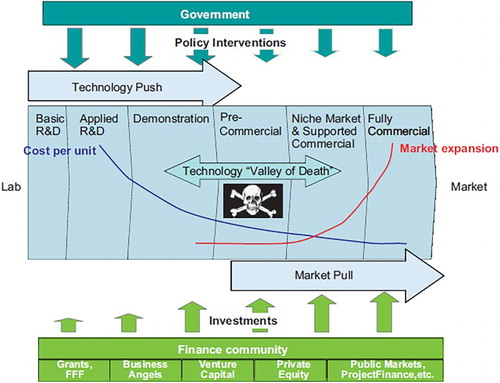

Price support measures designed to incentivise investments in RE are classed by Grubb et al. (Citation2014) as a third-domain policy, as they address the challenge of market under-investment in innovation. These measures assume that if technologies can be pulled through the innovation chain using subsidy (), to the ‘supported’ or ‘fully’ commercial stages , then market mechanisms will ensure their widespread deployment (Gross et al., Citation2010; Munoz, Huijben, Verhees, & Verbong, Citation2014). As such, RE price support mechanisms (third-domain policy) still operate under an EMH framing (second-domain theory), as they assume efficient capital markets will recognise and reliably capitalise supported renewables.

Figure 1. Types of investors in the investment chain and the assumption of ‘market pull/market expansion' Source: Wüstenhagen and Menichetti (Citation2012, p. 5).Notes: FFF, Friends, family and fools.

Many third-domain treatments analyse how energy innovations permeate through large systems and how they face barriers beyond simple issues of grid parity (Bergek & Jacobsson, Citation2003; Foxon et al., Citation2005; Jacobsson & Bergek, Citation2011). The process of technological innovation is non-linear and can be affected by institutional factors (Bolton & Foxon, Citation2015a, Citation2015b; Foxon et al., Citation2005, p. 2127; Grubb, Citation2004). In the technological innovation systems framework (Markard & Truffer, Citation2008), mobilization of resources (including financial) is a key process. Jacobsson and Karltorp's (Citation2013) investigation of onshore wind provides a useful example of the utility of paying more attention to the realities of energy transitions finance. However, more work needs to be done to understand how the features of capital markets influence system transitions and energy/climate policy. Capital markets and finance are often included as important factors (Geels, Citation2011; Künneke, Citation2008), but remain unexamined as a co-evolutionary agent (Hannon et al., Citation2013; Stephens & Jiusto, Citation2010).

2.3. Adaptive markets as third-domain theory

We propose that a theory of financial markets as adaptive markets could provide a compatible theory of finance and capital investment for third-domain analysis of energy systems transformation and policy, as shown in .

Recent work has described the AMH (Lo, Citation2004), in which learning, competition, and evolutionary selection pressures govern market actors. Individual agents are again conceptualised as boundedly rational satisficers (Neely, Weller, & Ulrich, Citation2009), but structural constraints on investors, as well as cognitive constraints, are presented as co-productive of a particular investment environment (Soufian et al., Citation2014). Lo (Citation2004, Citation2012) describes the AMH as grounded in evolutionary economics theory (Nelson & Winter, Citation1982). This is based on the use of generalised evolutionary principles of variation, retention, and selection to explain change and stability in economic systems. This is broader than the notion of market selection used in neoclassical economics, as it takes into account institutional and structural constraints, behavioural routines, and fundamental uncertainties. Change in economic systems is shown to be path-dependent and subject to technological and institutional lock-in (Foxon, Citation2011; Unruh, Citation2000). This focus on evolutionary principles suggests that ideas of adaptive markets fit well with the third-domain view of co-evolutionary systems change.

For example, the market for highly liquid, frequently traded assets, for which there are many competing investors and where the rules of trading are stable over time (such as government bonds), may be more efficient than assets for which these attributes are less evident. The AMH proposes that the investment environment, along with investor behaviour, can change over time; investors’ carefully developed heuristics must adapt to new realities in periods of turbulence or change (Lo, Citation2004, Citation2012; Soufian et al., Citation2014). Thus, the external influence of a structural change, such as the financial crisis, necessitates changes in the environment that investors operate within, forcing investor behaviours and associated institutions to evolve or face extinction. As such, there are two forces acting against the establishment and reproduction of an ‘efficient’ capital market: investor cognition and structural change, both of which co-evolve to produce the capital markets for a given asset at a given point in time.

Whilst a crisis is an obvious agent of structural change, a changing subsidy regime for RE technologies, new financial regulation, and/or technological innovation can all change the structure of the market. How financial markets adapt through the evolution of new structures, institutions, and behaviours to deal with change and exploit new opportunities has not been well studied in this context. Lo (Citation2012, p. 14) states that market efficiency is not an ‘all-or-nothing condition but a continuum, one that depends on the relative proportion of market participants [which changes over time]’. For energy technology finance, which is characterised by large, lumpy investments amortised over several political and even economic cycles (Grubb et al., Citation2014), we might expect the EMH to be much less strong. During the time it takes to draw profit from generation assets, there may be significant changes in governments, policy, societal preferences, technology alternatives, financial vehicles, and market regulation. Thus, we would expect the AMH to better describe capital markets for energy finance under four conditions:

Investors in energy are boundedly rational.

The energy investment environment (policy, regulation, incentives, technology characteristics/options, etc.) changes over time, forcing incumbent firms and investors to adapt to new conditions.

The structures of financial vehicles and wider capital markets affect the submarkets of energy finance.

These behavioural, environmental, and structural characteristics co-evolve, so individuals, firms, and institutions active in the energy investment space enter and exit over time, characterising a turbulent market for energy finance.

First-domain, behavioural theories are making substantive contributions to our understanding of energy finance and the behaviours of individual investors. The insights of the behavioural finance school have satisfied condition (1) (see Energy Policy, 40, 1–120). In Section 5, we analyse recent developments in the UK electricity sector through the lens of the AMH and investigate whether conditions (2), (3), and (4) have been satisfied.

3. Study of RE investment in UK energy systems

Our empirical study examined the investment system for RE generation technologies in the UK, in the light of the UK Electricity Market Reform (EMR, DECC, Citation2012), enacted in the Energy Act 2013 (Great Britain, Citation2013).

RE investment studies have utilised deductive approaches based on questionnaire designs and hypothesis testing, focusing on cognitive factors (Loock Citation2012; Masini & Menichetti, Citation2012, Citation2013). Our research aimed to elicit new knowledge about the factors beyond individual/firm cognition that constrain or enable energy investors. Leete et al. (Citation2013) describes an inductive approach, based on in-depth narrative as suitable for the purpose of abstracting hypotheses. Equally, in-depth qualitative engagement with investors is a recognised methodology for understanding the complexities of RE investment (BNEF, Citation2013; Nelson & Pierpont, Citation2013). Where AMH scholars have often utilised large-n statistical methods to test market efficiency based on rapidly traded commodities (Kim, Shamsuddin, & Lim, Citation2009; Neely et al., Citation2009), this would be impossible for RE finance as no publicly quoted exchange or secondary market currently exists. As such, in-depth qualitative methods are used.

The primary data comprise 16 in-depth interviews from across the RE investment chain: five institutional RE investment professionals or fund managers, three utility executives, two independent RE project developers, two alternative RE finance providers, two public-sector policy professionals, and two institutional finance NGO representatives (these are marked a to e to distinguish between individuals from the same group). These actors from across the investment chain enabled a detailed investigation of investment issues. Interviews were conducted between January 2013 and December 2013.

The interviews investigated the sources of RE finance that have been drawn on and those that could be further drawn on, what mechanisms enable/constrain financiers to allocate capital to RE assets, the effects of the financial crisis, market regulation, energy policy, and institutional/individual behaviour. Through a process of coding and narrative analysis, key discourses and themes were extracted. We found a high level of consistency in relation to these themes across our sample.

4. Developing the third domain: co-evolutionary dynamics in UK energy investment

4.1. UK energy policy context

In 2010 the UK government instigated the EMR, which was explicitly designed to incentivise higher levels of private-sector investment in low-carbon generation, covering both renewables and new nuclear power (DECC, Citation2012). EMR was implemented in the Energy Act 2013 (Great Britain, Citation2013).

EMR incorporates three main features: feed-in tariffs (FiTs) with contracts for difference (CfDs) for low-carbon generation; capacity markets for security of supply; and regulatory institutional frameworks for both. This is informed by a long-term vision in which the main goal is a period of price support followed by a declining role for government as low-carbon generation technologies ‘get to a level of maturity where they are able to compete on a level playing field’ (DECC, Citation2012, p. 25 [our emphases]). This level playing field is widely understood as a levelised cost of electricity supply comparable with existing technologies. EMR is designed so that the ‘market pull’ () is strong enough to expand the use of renewable technologies to a point where economies of scale, learning effects, process efficiencies, or price effects from elsewhere in the system bring costs towards grid parity.

4.2. Investment trends and stakeholders

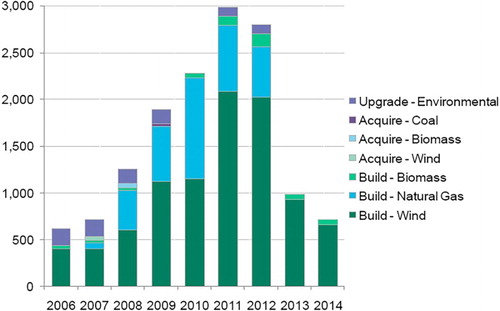

The absolute volumes of capital held by banks, utilities, and institutional investors are more than sufficient for energy transitions (Blyth, McCarthy, & Gross, Citation2014; Nelson & Pierpont, Citation2013). However, concerns have recently been raised over how much of the transition can be financed by incumbent actors, mainly utilities and banks, within the energy sector (IEA, Citation2014; Mitchell, Citation2014; Nelson & Pierpont, Citation2013). For UK RE investment, BNEF (Citation2012) analysis shows rapidly declining rates of investment by the ‘Big Six’ large energy firms, after a peak of £3 billion in 2011 ().

Figure 3. ‘Big Six’ capacity investment 2006–2014 (£ million)

Notes: Includes all projects under construction at the start of 2012.

There is also a large proportion of non-utility finance capitalising renewables in the UK (Blyth et al., Citation2014; BNEF, Citation2012). Where this has and may come from in the future is a key concern for UK energy policy (DECC, Citation2012):

half has come from the balance sheets of the utility companies and the other half has come from banks, project finance from banks. The investment community haven't really had much of a look in. [ … ] The two main ways that infrastructure has been financed so far are companies building infrastructure themselves using their own funds, so on balance sheet, and then the other way is project finance where you create an entity specifically for the project and you seek to finance that project directly. (Institutional RE investment professional, 2013a)

Hence, project finance, where developers set up a special purpose vehicle (SPV) and then go to debt and equity markets to raise finance, has mainly come from bank debt. In project finance, lenders loan money to projects based on that project's risks and future cash flows, and lenders have little/no claims on the assets of the parent company (Groobey, Pierce, Faber, & Broome, Citation2010). The future feasibility of both utility and project finance is crucial to low-carbon energy transitions because they structure the ability of traditional actors to finance new RE capacity.

4.3. Constrained capital availability

Interview respondents described a need for UK energy policy to draw in new types of financial investors to capitalise renewable generation assets. Three narratives were identified from the primary sample and secondary sources (see also Jacobsson & Karltorp, Citation2013):

The insufficiency of utility company balance sheets to finance the transition/the changing role of utilities

A reduction in long-term project debt available from banks

How together these issues culminate in the need for energy policy to attract new participants in RE finance

These changes to the wider landscape of RE finance are happening alongside new subsidy regimes and market reforms. The following sections investigate how the co-evolution of energy policy and market structure has affected both the volume of capital available for the sector and the velocity with which it can be recycled through institutions wishing to adopt positions in the RE space.

4.3.1. Utility balance sheets

The balance sheet financing of new renewables by major UK and European utilities is constrained in two ways (Blyth et al., Citation2014). First, post-crisis reductions in demand undermined the profitability of utilities. Second, utilities have accumulated debt, which was raised to finance merger and acquisition activity after market liberalisation. High debt levels and low profitability mean that an expansion of utility capital expenditure in the short term is unlikely, as utilities endeavour to retain strong credit ratings:

typically utilities would have a big balance sheet and they would make the investments themselves, they would not even go to the finance market to raise financing, [ … ] I think that has shifted because they have either had to reduce debt in their balance sheet and have had to come out and look for partners with whom to put equity … (Institutional RE investment professional, 2013e)

These constraints have led to a period of divestment, in which utilities ‘deleverage’ balance sheets by selling operational assets to institutional investors (Ernst & Young, Citation2013). Some respondents argued that this means a new role for utilities, whose business model must shift from asset owner to developer and operator. This echoes calls for shifts in utility business models from asset owner to asset manager (Ernst & Young, Citation2013, pp. 18–19; also BNEF, Citation2012; Nelson & Pierpont, Citation2013). Utilities, however, have misgivings:

The challenge would be that if you have taken all the risk, you've got the reward for that phase … you've taken it through that phase and like you said it's just sitting on your balance sheet, you finance it off; Can you get the reward? In the past the reward has been running that station for the next 20–30 years. [ … ] We in the energy industry are used to working with that and for twenty years at least it was reasonably stable. I'm not quite sure that it is at the moment or where it is headed. That worries us … (Utility executive, 2013c)

4.3.2. Long-term project finance

RE project finance from traditional sources is also under significant constraint. Our sample described the RE project finance model as being hitherto dominated by bank project finance with relatively low equity stakes by industry equity partners:

Wind farms, the first one got funded in 2007, just before the climate got tough. It was an onshore wind farm with high wind speeds NES, the American utility put up the equity, Barclays bank put up the debt, in those days Barclays bank was prepared to lend 18 year money and it was a beautiful world in many ways. (RE developer, 2013a)

The banks, on the debt financing side is quite challenging [ … ] the crisis has had maybe an impact probably on the availability of debt finance, where it's relatively concentrated in a small number of banks. It is also much more challenging to get long term financing for the life of the asset, so the banks don't really want to lend on any proposition much longer than 5–7 years. So the availability of 15–20 yr money for RE projects is gone. (Institutional RE investment professional, 2013c)

4.3.3. Need to attract new sources of finance

There is a scarcity of traditional project and balance sheet finance. This is on top of an existing shortfall in annual capital expenditure sufficient to meet low-carbon transitions. These capital constraints are key concerns in both in the stakeholder literature (Ernst & Young, Citation2013; PWC, Citation2012) and across our respondents. This is incompatible with innovation policy that assumes an efficient market will capitalise technologies with demonstrable rates of return as market maturity or even a ‘supported commercial’ stage is reached. This constraint has led to a realisation that non-traditional investment actors must be brought into the RE investment space:

private equity is a different option, [ … ] basically taking private investors, large high net worth investors or they're taking institutional money and then deploying it, so these guys are part of filling the gap here (Alternative RE finance provider, 2013a)

the banks who currently do manage project finance aren't going to be able to do it so the mainstream investment community is going to be looked to (Institutional RE investment professional, 2013a [our emphasis])

4.4. Filling the finance gap, the ‘mainstream investment community’

With utilities deleveraging at the same time as project finance from commercial banks became scarce, the challenge for energy policy is to attract new forms of finance into the RE space. This would involve project-level financing from ‘institutional money’ or the ‘investment community’, which comprises funds managing private wealth, insurance funds, pension funds, and sovereign wealth funds. As this has been uncommon in the UK energy sector, the challenge for UK policy makers was described as designing a support framework that could bring in large sources of capital, by matching the characteristics of energy subsidy with risk and return characteristics familiar to institutional investors (BNEF, Citation2012, p. 22).

The UK government's EMR (DECC, Citation2012, Citation2013a; Energy Act 2013; Great Britain, Citation2013) is the primary energy policy, designed to ‘make sure the UK remains a leading destination for investment in low-carbon electricity’ (DECC, Citation2013b). The government recognised the above discourse on capital constraints, explaining ‘the current market arrangements will not deliver this investment, therefore EMR provides the tools needed to meet the challenge’ (DECC, Citation2012, p. 12). The previous market arrangements for RE capacity were renewables obligation certificates (ROCs), which comprise tradable green certificates for renewable generation, which provided additional but uncertain revenue to renewable developers beyond the market price of that energy (Wood & Dow, Citation2011). The ROC regime was seen as contributing to perceptions of the UK renewables market as ‘high risk’, particularly as final prices for renewable generation were subject to ROC and wholesale electricity price fluctuations (Gross et al., Citation2010; Wood & Dow, Citation2011). The move away from a tradable certificates approach for subsidising renewable generation, towards a FiT-type approach (with CfDs), is one of the keystone policies of EMR, designed to reduce price risks by providing greater certainty in order to attract new investors into the RE space (Redpoint, Citation2010).

FiTs socialise price risks by guaranteeing the subsidy support price for the output of a given technology (Gross et al., Citation2010; Mitchell, Bauknecht, & Connor, Citation2006). This guarantees the final payments for low-carbon electricity generated using ‘strike prices’ with CfDs (DECC, Citation2012). Generators are paid the difference between the ‘strike price’ and the ‘reference price’, which is a measure of the average market price. The FiT makes up the difference and levies the cost on consumer bills. This eliminates both the risks of the support mechanism price being defined by a relative scarcity of tradable certificates, and wholesale price risk:

the FIT is potentially 15 years, [ … ] in principle the idea, what EMR could produce is fundamentally something that could be quite attractive to the UK defined benefit pension plans if structured in the right way. (Institutional RE investment professional, 2013c)

4.5. New entrants and structural barriers

Beyond the effects of policy supports, market regulation and capital constraint, respondents identified further structural factors which meant that the market for energy finance did not conform to the assumption, that an ‘army of investors’ (Lo, Citation2004) awaits to capitalise clear profit opportunities. Respondents described an immature investment community for RE assets, because direct financing of renewable generation has historically been done by banks and utilities. The result is an investment community in the UK that is unfamiliar with a complex sector:

… there's a relatively small group of specialists who spend their time worrying about the EMR [ … ] there's a few advisors, probably a half dozen advisors, half a dozen banks and half a dozen equity analyst teams, and once you're outside of that sphere the level of knowledge tends to be pretty low (Institutional RE investment professional, 2013b)

There's lots of ports in the world, there's lots of airports, there's lots of toll roads, these are a pretty well established asset class where things are benchmarked across countries. Renewables are still pretty immature and so as we try and expand the investor universe you're growing a skill base at the end of the day. (Institutional RE investment professional, 2013b)

A second structural constraint relates to the long-term nature of these investments:

So if you're an investor like us and you have lots of retail investors who feel that they can put their money in and take their money out whenever they want, we can't just lock all the money up in a private equity project. We also have regulatory barriers to how much private equity we can invest anyway in these kinds of funds, but we just can't lock that money up like that because our customers might say we want our money back and we can't because we invested it in this ten year project or this 15 year CfD vehicle. So the main way that project finance works at the moment doesn't really work for most investors because it's not liquid. (Institutional RE investment professional, 2013a)

the incentive structures very much push short termism, so the fund managers in the city fund management firms, that have big contracts from the pension schemes know that individually that if they don't out perform an index, if they don't do very well in the short term then those contracts are going to be in peril, their jobs ultimately and then bonuses certainly [ … ]. So there's massive financial incentives at the individual and the firm level to privilege the short term over the long term. (Institutional finance NGO representative, 2013a)

it's a real bleeding edge. We haven't seen any securitised bond issues in this space, there was some breeze bonds a few years ago which didn't work very well, but we haven't really seen much of a growth in this. So, it could be three or four years before we start to see a significant flow of these investment opportunities. Once that happens it will then take a little while, there will be a few early adopters and then the markets will gradually get educated into doing it. It will happen but it could well take the best part of a decade before the mainstream investment community is a big funder and that timeline is rather behind what is probably needed in a UK context. (Institutional RE investment professional, 2013a)

5. Analysing an adaptive market and co-evolutionary dynamics

5.1. Application of AMH to UK energy systems

We now argue that the four conditions above have been shown to be satisfied in our study of drivers of investment in UK energy systems. As stated in Section 2.3, condition (1) was fulfilled by the work of the behavioural finance school and is supported by the responses of actors in our study. For condition (2), where the energy investment environment changes over time, forcing incumbents to adapt, utility consolidation constrained the RE investment environment, forcing incumbent firms and investors to adapt to new conditions. For condition (3), where changes in wider financial markets affected energy finance, the financial crisis affected utility balance sheet strength, but also constrained the other traditional method of RE investment, that of bank project finance. Condition (3) was fulfilled by demonstrating how the financial crisis and subsequent constraints on bank leverage ratios constituted a shift in the ‘rules of the game’ in capital markets, which have filtered into the energy space and caused an adaptive search for new institutions and actors. Thus conditions (2) and (3) are fulfilled, as policy support, market regulation, and capital constraint force incumbent actors to adapt. Condition (4) suggested behavioural, environmental, and structural characteristics would co-evolve so that individuals, firms, and institutions would enter and exit the energy investment space over time, characterising a turbulent market for energy finance. This condition is also fulfilled as new and incumbent actor behaviours are structured by each other, and co-evolve alongside new policy and regulatory frameworks and other financial market structures. Structural changes to the market for energy finance brought in new actors, and three key structural issues – lack of a mature community of investors, mismatches between investment and fund manager timescales, and lack of suitable investment vehicles – are forcing actors to adapt and experiment with new mechanisms of allocating capital finance to UK renewables.

Conditions (1) to (4) are thus supported for the case of investment in RE technologies in the UK. The capital markets for energy finance are illiquid, characterised by lumpy investments, subject to shifting policy and regulatory constraints, are composed of incumbent and new actors, and require substantive structural and institutional change to sufficiently finance RE transitions. RE finance in the UK does not describe an ‘efficient’ market of rational actors waiting at the end of the innovation chain to finance energy transitions. An adaptive markets approach is a more powerful tool for understanding the operations of capital markets in relation to energy policy.

By adopting an adaptive markets approach, we can strengthen behavioural critiques of perfect rationality with an understanding that structural constraints manifestly affect the ‘action space’ (Foxon, Citation2013) in which investors operate. This explains how changes to energy policy, market regulation, capital availability, and financial crises create external structural constraints that complement the internal behavioural constraints on investors’ cognition and decision making identified from behavioural economics analysis. Furthermore, this enables researchers to analyse how external constraints co-evolve with cognitive elements.

The critiques from behavioural finance require energy policy to deal with investors’ perceptions of RE risk (Chassot, Hampl, & Wüstenhagen, Citation2014; Wüstenhagen & Menichetti, Citation2012). This analysis of RE finance describes a sector that learns from and adapts to changing environments gradually. This adaptive behaviour is far more aligned with an evolutionary perspective, where changes in the wider environment force changes in learnt behaviours, providing adaptive, contingent responses to the performance of complex, long-term investment commitments. We argue that this picture of adaptive financial markets can bring back an evolutionary economics perspective into co-evolutionary analyses of long-term energy systems change that had largely focused more on social rather than economic drivers of change (Foxon, Citation2011).

Armed with an understanding of financial markets as adaptive, we can describe a temporal risk that is underappreciated in current energy policy and is relevant to all liberalised energy markets. The risk is that if energy policy assumes the existence of efficient markets, then policy may not provide the conditions for finance capital to adapt quickly enough to capitalise energy investment in time for a meaningful transition to a decarbonised electricity system. By adopting an AMH framing, it is possible to ask new questions about the role of capital markets in systems transitions.

6. Conclusion

This article argues that energy finance can be better described as an adaptive, rather than efficient market. We suggest that this framing provides a more suitable theoretical toolkit with which to build future energy policy. Indeed, we argue that current energy policy operates paradoxically, in that it tries to solve third-domain issues (under-investment in innovation and decarbonisation) with policy based on second-domain assumptions (market efficiency).

This study proposes that the adaptive market hypothesis (AMH) is far more compatible with the existing literatures on transformational change. This would place the AMH as a compatible theory of capital markets within Grubb et al's (Citation2014) ‘third domain’ of planetary economics. Although this study has focused on electricity market reform in the UK, we contend that assessing the financial element of energy/climate policy across the three domains would encourage policy makers and scholars in diverse fields to take account of behavioural effects (first domain), pricing frameworks and market design (second domain), and structural barriers (third domain) when designing policy that relies on the mobilisation of large and diverse sources of financial capital. By adopting an adaptive markets approach, the range of questions researchers and the policy community can ask of the role of financial markets is greatly increased. These include: How diverse is the investor community that is to be called upon to finance system change? How intense is competition in this system? What are the macro- and meso-level structural constraints on financial market agency? What are the mechanisms best suited to your target investors? Put simply, we can ask whether our energy and climate policies are rational strategies for an irrational world.

Acknowledgements

This article builds on research carried out under the ‘Realising Transition Pathways: Whole Systems Analysis for a UK More Electric Low Carbon Energy Future’ Consortium Project funded by the UK Engineering and Physical Sciences Research Council (EPSRC) (grant no. EP/K005316/1). However, the views expressed here are those of the authors alone, and do not necessarily reflect the views of the collaborators or the policies of the funding body.

Disclosure statement

No potential conflict of interest was reported by the authors.

References

- Aldy, J. E., & Stavins, R. N. (2012). The promise and problems of pricing carbon: Theory and experience. The Journal of Environment & Development, 21, 152–180.

- Arapostathis, S., Carlsson-Hyslop, A., Pearson, P. J., Thornton, J., Gradillas, M., Laczay, S., & Wallis, S. (2013). Governing transitions: Cases and insights from two periods in the history of the UK gas industry. Energy Policy, 52, 25–44. doi: 10.1016/j.enpol.2012.08.016

- Baumol, W. J. (1972). On taxation and the control of externalities. The American Economic Review, 62, 307–322.

- Bergek, A., & Jacobsson, S. (2003). The emergence of a growth industry: A comparative analysis of the German, Dutch and Swedish wind turbine industries. In J. S. Metcalfe & U. Cantner (Eds.), Change, transformation and development (pp. 197–227). Heidelberg: Physica Verlag.

- Bergek, A., Mignon, I., & Sundberg, G. (2013). Who invests in renewable electricity production? Empirical evidence and suggestions for further research. Energy Policy, 56, 568–581. doi: 10.1016/j.enpol.2013.01.038

- Blyth, W., McCarthy, R., & Gross, R. (2014). Financing the power sector: Is the money available? (Working Paper). London: UK Energy Research Centre. Retrieved from www.ukerc.ac.uk/support/tiki-download_file.php?fileId=3628

- BNEF. (2012). Big six investment trends: A report for Greenpeace UK on the investment trends of the big six utilities. London: Bloomberg New Energy Finance.

- BNEF. (2013). How to attract new sources of capital to EU renewables (Clean Energy White Paper). London: Bloomberg New Energy Finance.

- Bolton, R., & Foxon, T. J. (2013). Urban infrastructure dynamics: Market regulation and the shaping of district energy in UK cities. Environment and Planning A, 45, 2194–2211. doi: 10.1068/a45575

- Bolton, R., & Foxon, T. J. (2015a). Infrastructure transformation as a socio-technical process – implications for the governance of energy distribution networks in the UK. Technological Forecasting and Social Change, 90( Part B), 538–550. doi: 10.1016/j.techfore.2014.02.017

- Bolton, R., & Foxon, T. J. (2015b). A socio-technical perspective on low carbon investment challenges – insights for UK energy policy. Environmental Innovation and Societal Transitions, 14, 165–181. doi: 10.1016/j.eist.2014.07.005

- Bowman, A., Froud, J., Johal, S., John, L., & Leaver, A. (Eds.). (2014). The end of the experiment?: From competition to the foundational economy. Manchester: Manchester University Press.

- Cetin, U., & Verschuere, M. (2009). Pricing and hedging in carbon emissions markets. International Journal of Theoretical and Applied Finance, 12, 949–967. doi: 10.1142/S0219024909005531

- Chassot, S., Hampl, N., & Wüstenhagen, R. (2014). When energy policy meets free-market capitalists: The moderating influence of worldviews on risk perception and renewable energy investment decisions. Energy Research & Social Science, 3, 143–151.

- DECC. (2012). Electricity market reform: Policy overview. London: Department of Energy and Climate Change.

- DECC. (2013a). Electricity market reform delivery plan. London: Department of Energy and Climate Change.

- DECC. (2013b). Maintaining UK energy security. London: Department of Energy and Climate Change. Retrieved from http://webarchive.nationalarchives.gov.uk/20140405112802/https:/www.gov.uk/government/policies/maintaining-uk-energy-security–2/supporting-pages/electricity-market-reform.

- Ellerman, A. D., Convery, F. J., & De Perthuis, C. (2010). Pricing carbon: The European Union Emissions Trading Scheme. Cambridge: Cambridge University Press.

- Ernst & Young. (2013, August). Renewable energy country attractiveness index. Issue 38. London: Author.

- Fama, E. (1970). Efficient capital markets: A review of theory and empirical work. Journal of Finance, 25, 383–417. doi: 10.2307/2325486

- Freidman, M., Schwartz, A. J., & Bernstein, P. L. (1965). The great contraction 1929–1933. Princeton, NJ: Princeton University Press. [New edition (2008), section citing a quote relayed by Albert J. Hettinger, Jr, from Lord Keynes to the 1931 annual meeting of the investment trust of which he was chairman.]

- Fox, J. (2011). The myth of the rational market. Petersfield: Harriman House.

- Foxon, T. J. (2011). A coevolutionary framework for analysing a transition to a sustainable low carbon economy. Ecological Economics, 70, 2258–2267. doi: 10.1016/j.ecolecon.2011.07.014

- Foxon, T. J. (2013). Transition pathways for a UK low carbon electricity future. Energy Policy, 52, 10–24.

- Foxon, T. J., Gross, R., Chase, A., Howes, J., Arnall, A., & Anderson, D. (2005). UK innovation systems for new and renewable energy technologies: Drivers, barriers and systems failures. Energy Policy, 33, 2123–2137. doi: 10.1016/j.enpol.2004.04.011

- Geels, F. W. (2011). The multi-level perspective on sustainability transitions: Responses to seven criticisms. Environmental Innovation and Societal Transitions, 1, 24–40. doi: 10.1016/j.eist.2011.02.002

- Great Britain. (2013). Energy Act 2013. London: The Stationary Office.

- Groobey, C., Pierce, J., Faber, M., & Broome, G. (2010). Project finance primer for renewable energy and clean tech projects. Palo Alto, CA: Wilson, Sonsini, Goodrich and Rosati.

- Gross, R., Blyth, W., & Heptonstall, P. (2010). Risks, revenues and investment in electricity generation: Why policy needs to look beyond costs. Energy Economics, 32, 796–804. doi: 10.1016/j.eneco.2009.09.017

- Grubb, M. (2004). Technology innovation and climate change policy: An overview of issues and options. Keio Economic Studies, 41(2), 103–132.

- Grubb, M., Hourcade, J. C., & Neuhoff, K. (2014). Planetary economics: Energy, climate change and the three domains of sustainable development. Abingdon/New York, NY: Routledge.

- Grubb, M., & Neuhoff, K. (2006). Allocation and competitiveness in the EU emissions trading scheme: Policy overview. Climate Policy, 6, 7–30. doi: 10.1080/14693062.2006.9685586

- Hannon, M. J., Foxon, T. J., & Gale, W. F. (2013). The co-evolutionary relationship between energy service companies and the UK energy system: Implications for a low-carbon transition. Energy Policy, 61, 1031–1045. doi: 10.1016/j.enpol.2013.06.009

- Harstad, B., & Eskeland, G. S. (2010). Trading for the future: Signaling in permit markets. Journal of Public Economics, 94, 749–760. doi: 10.1016/j.jpubeco.2010.03.004

- Hintermann, B. (2010). Allowance price drivers in the first phase of the EU ETS. Journal of Environmental Economics and Management, 59, 43–56. doi: 10.1016/j.jeem.2009.07.002

- House of Commons. (2014, March). Green finance – environmental audit committee. Retrieved from http://www.publications.parliament.uk/pa/cm201314/cmselect/cmenvaud/191/19105.htm

- Howarth, R., Haddad, B. M., & Paton, B. (2000). The economics of energy efficiency: Insights from voluntary participation programs. Energy Policy, 28, 477–486. doi: 10.1016/S0301-4215(00)00026-4

- Hughes, T. P. (1987). The evolution of large technological systems. In W. Bijker, T. P. Hughes, & T. Pinch (Eds.), The social construction of technological systems (pp. 51–82). Cambridge, MA: MIT Press.

- IEA. (2014). World energy investment outlook: Special report. Paris: International Energy Agency.

- Jacobsson, S., & Bergek, A. (2004). Transforming the energy sector: the evolution of technological systems in renewable energy technology. Industrial and Corporate Change, 13, 815–849. doi: 10.1093/icc/dth032

- Jacobsson, S., & Bergek, A. (2011). Innovation system analyses and sustainability transitions: Contributions and suggestions for research. Environmental Innovation and Societal Transitions, 1, 41–57. doi: 10.1016/j.eist.2011.04.006

- Jacobsson, S., & Karltorp, K. (2013). Mechanisms blocking the dynamics of the European offshore wind energy innovation system–challenges for policy intervention. Energy Policy, 63, 1182–1195. doi: 10.1016/j.enpol.2013.08.077

- Joerges, B. (1998). Large technical systems: Concepts and issues. In R. Mayntz & T. Hughes (Eds.), The development of large technical systems (pp. 9–36). Boulder, CO: Westview Press.

- Kay, J. (2012). The Kay review of UK equity markets and long-term decision making (report, together with formal minutes, oral and written evidence). London: House of Commons. Retrieved from http://www.publications.parliament.uk/pa/cm201314/cmselect/cmbis/603/603.pdf

- Kim, J. H., Shamsuddin, A., & Lim, K. P. (2009). Stock return predictability and the adaptive markets hypothesis: Evidence from century-long US data. Journal of Empirical Finance, 18, 868–879. doi: 10.1016/j.jempfin.2011.08.002

- Künneke, R. W. (2008). Institutional reform and technological practice: The case of electricity. Industrial and Corporate Change, 17, 233–265. doi: 10.1093/icc/dtn002

- Leete, S., Xu, J., & Wheeler, D. (2013). Investment barriers and incentives for marine renewable energy in the UK: An analysis of investor preferences. Energy Policy, 60, 866–875. doi: 10.1016/j.enpol.2013.05.011

- Lo, A. W. (2004). The adaptive markets hypothesis. The Journal of Portfolio Management, 30(5), 15–29. doi: 10.3905/jpm.2004.442611

- Lo, A. W. (2012). Adaptive markets and the new world order. Retrieved from http://hdl.handle.net/1721.1/75362

- Loock, M. (2012). Going beyond best technology and lowest price: On renewable energy investors’ preference for service-driven business models. Energy Policy, 40, 21–27. doi: 10.1016/j.enpol.2010.06.059

- Malkiel, B. G. (2003). The efficient market hypothesis and its critics. Journal of Economic Perspectives, 17, 59–82. doi: 10.1257/089533003321164958

- Marechal, K., & Lazaric, N. (2011). Overcoming inertia: Insights from evolutionary economics into improved energy and climate policies. Climate Policy, 10, 103–119. doi: 10.3763/cpol.2008.0601

- Markard, J., & Truffer, B. (2008). Technological innovation systems and the multi-level perspective: Towards an integrated framework. Research Policy, 37, 596–615. doi: 10.1016/j.respol.2008.01.004

- Masini, A., & Menichetti, E. (2012). The impact of behavioural factors in the renewable energy investment decision making process: Conceptual framework and empirical findings. Energy Policy, 40, 28–38. doi: 10.1016/j.enpol.2010.06.062

- Masini, A., & Menichetti, E. (2013). Investment decisions in the renewable energy sector: An analysis of non-financial drivers. Technological Forecasting and Social Change, 80, 510–524. doi: 10.1016/j.techfore.2012.08.003

- Mitchell, C. (2014, September). Governance and disruptive energy system change. Paper presented at the International Workshop on Incumbent–Challenger Interactions in Energy Transitions, University of Stuttgart.

- Mitchell, C., Bauknecht, D., & Connor, P. M. (2006). Effectiveness through risk reduction: A comparison of the renewable obligation in England and Wales and the feed-in system in Germany. Energy Policy, 34, 297–305. doi: 10.1016/j.enpol.2004.08.004

- Munoz, L. A., Huijben, J. C. C. M., Verhees, B., & Verbong, G. P. J. (2014). The power of grid parity: A discursive approach. Technological Forecasting and Social Change, 87, 179–190.

- Neely, C. J., Weller, P. A., & Ulrich, J. M. (2009). The adaptive markets hypothesis: Evidence from the foreign exchange market. Journal of Financial and Quantitative Analysis, 44, 467–488. doi: 10.1017/S0022109009090103

- Nelson, D., & Pierpont, B. (2013). The challenge of institutional investment in renewable energy. San Francisco, CA: Climate Policy Initiative. Retrieved from http://climatepolicyinitiative.org/wp-content/uploads/2013/03/The-Challenge-of-Institutional-Investment-in-Renewable-Energy.pdf.

- Nelson, R. R., & Winter, S. G. (1982). An evolutionary theory of economic change. Cambridge, MA: Harvard University Press.

- Neuhoff, K., Grubb, M., & Keats, K. (2006). Impact of the allowance allocation on prices and efficiency ( Cambridge Working Papers in Economics (CWPE) No. 0552). Retrieved from http://www.dspace.cam.ac.uk/handle/1810/131637

- Pinkse, J., & Van Den Buuse, D. (2012). The development and commercialization of solar PV technology in the oil industry. Energy Policy, 40, 11–20. doi: 10.1016/j.enpol.2010.09.029

- Pollitt, M. G., & Shaorshadze, I. (2011). The role of behavioural economics in energy and climate policy (Cambridge Working Papers in Economics (CWPE) No. 1165). Retrieved from https://www.repository.cam.ac.uk/bitstream/handle/1810/242021/cwpe1165.pdf?sequence=1.

- Price Waterhouse Coopers. (2012). Offshore wind cost reduction pathways study: Finance work stream. Retrieved from http://www.thecrownestate.co.uk/media/451398/ei-km-in-pe-cost-052012-offshore-wind-cost-reduction-pathways-finance-workstream.pdf

- Redpoint Energy & Trilemma U. K. (2010). Electricity market reform: Analysis of policy options. London: Redpoint Energy Ltd.

- Shiller, R. J. (2003). From efficient markets theory to behavioural finance. Journal of Economic Perspectives, 17, 83–104. doi: 10.1257/089533003321164967

- Simon, H. A. (1955). A behavioural model of rational choice. The Quarterly Journal of Economics, 69(1), 99–118. doi: 10.2307/1884852

- Sorrell, S. (Ed.). (2004). The economics of energy efficiency: Barriers to cost-effective investment. Cheltenham: Edward Elgar Publishing.

- Soufian, M., Forbes, W., & Hudson, R. (2014). Adapting financial rationality: Is a new paradigm emerging? Critical Perspectives on Accounting, 25, 724–742.

- Standard & Poor's. (2013). Industry report card: New finance structures set to spur a revival of debt issuance in the project finance industry. Retrieved from www.ijonline.com/MediaBrowser/GetFile/1181

- Stephens, J. C., & Jiusto, S. (2010). Assessing innovation in emerging energy technologies: Socio-technical dynamics of carbon capture and storage (CCS) and enhanced geothermal systems (EGS) in the USA. Energy Policy, 38, 2020–2031. doi: 10.1016/j.enpol.2009.12.003

- Styhre, A. (2014). Management and neoliberalism: Connecting policies and practices. New York, NY: Routledge.

- Unruh, G. C. (2000). Understanding carbon lock-in. Energy Policy, 28, 817–830. doi: 10.1016/S0301-4215(00)00070-7

- Verbong, G., & Geels, F. (2007). The ongoing energy transition: Lessons from a socio-technical, multi-level analysis of the Dutch electricity system (1960–2004). Energy Policy, 35, 1025–1037. doi: 10.1016/j.enpol.2006.02.010

- Wood, G., & Dow, S. (2011). What lessons have been learned in reforming the Renewables Obligation? An analysis of internal and external failures in UK renewable energy policy. Energy Policy, 39, 2228–2244. doi: 10.1016/j.enpol.2010.11.012

- World Economic Forum. (2011). The future of long-term investing. New York, NY: WEF.

- Wüstenhagen, R., & Menichetti, E. (2012). Strategic choices for renewable energy investment: Conceptual framework and opportunities for further research. Energy Policy, 40, 1–10. doi: 10.1016/j.enpol.2011.06.050