ABSTRACT

Until the late 1980s, the former South Korean tobacco monopoly KT&G was focused on the protected domestic market. The opening of the market to foreign competition, under pressure from the U.S. Trade Representative, led to a steady erosion of market share over the next 10 years. Drawing on company documents and industry sources, this paper examines the adaptation of KT&G to the globalization of the South Korean tobacco industry since the 1990s. It is argued that KT&G has shifted from a domestic monopoly to an outward-looking, globally oriented business in response to the influx of transnational tobacco companies. Like other high-income countries, South Korea has also seen a decline in smoking prevalence as stronger tobacco control measures have been adopted. Faced with a shrinking domestic market, KT&G initially focused on exporting Korean-manufactured cigarettes. Since the mid-2000s, a broader global business strategy has been adopted including the building of overseas manufacturing facilities, establishing strategic partnerships and acquiring foreign companies. Trends in KT&G sales suggest an aspiring transnational tobacco company poised to become a major player in the global tobacco market. This article is part of the special issue ‘The emergence of Asian tobacco companies: Implications for global health governance’.

Introduction

Until the late 1990s, the contribution of Korea Tobacco Ginseng Corporation (KTGC), today known as KT&G, to the global tobacco pandemic has been concentrated in the domestic market. Under a government monopoly established in 1908 – which controlled all manufacturing, distribution and sales – domestic production and consumption flourished. By 1987 Korea’s domestic tobacco market ranked 12th in the world, producing 81 billion sticks and consuming 80–85 billion sticks annually (Lee, Citation2011; Lee, Lee, & Holden, Citation2014). By 1980, South Korea boasted the world’s highest rates of adult male smoking prevalence at 79.3% (Korean Association of Smoking or Health, Citation2007), with total tobacco-related deaths reaching 58,115 in 2012 (Jung, Yun, Baek, Jee, & Kim, Citation2013). Under pressure from the U.S. Trade Representative (USTR), the Korean government agreed in the late 1980s to open the domestic market to foreign competition.

Within this context, this paper analyses the shift by KT&G, from domestic monopoly to aspiring transnational tobacco company (TTC), since the late 1980s. The paper argues that the company’s ambitions to become a global company were initially fuelled by the erosion of domestic market share due to the influx of TTCs. By the mid-2000s, however, a decline in smoking prevalence among Koreans amid stronger tobacco control measures forced the company to look for new customers. The main strategies adopted, to transform the company from domestically oriented to outward-looking, initially focused on developing products for export. Since the mid-2000s, KT&G has actively sought to establish operations abroad through building manufacturing facilities, establishing strategic partnerships and acquisitions. This analysis suggests KT&G is an aspiring TTC poised to become a major player in the global tobacco market.

Background

The history of KT&G dates from 1899 when the government formed the Ginseng Division to regulate the national ginseng industry and collect funds for the National Treasury (Morris, Citation1978). In 1908 the Ginseng Division took over the tobacco industry and was transferred to the Ministry of Finance. Over the next five decades, ginseng and tobacco became so important to the national economy that they were placed under a separate entity, the Office of Monopoly (OOM), in 1952. The OOM exerted monopoly control over the manufacturing, distribution, sales and import/export of both products (Lee, Citation2011).

Following the Korean War in 1953, and the division of the country, expansion of the tobacco industry became part of South Korea’s rebuilding of its economy. The OOM encouraged more land to be used to grow tobacco leaf by paying farmers higher prices. It also established a national network of leaf processors, manufacturing facilities and retailers (Cohen, Citation2004). Consistent with Korea’s industrial policy, of building and protecting national companies in key sectors, foreign direct investment (FDI) was not permitted. Based on the rationale of protecting foreign currency reserves, cigarette imports were also banned (Lee, Holden, & Lee, Citation2013). The government even passed legislation making it a criminal offense for Korean nationals to sell, buy, possess or consume foreign tobacco products (Lee, Citation2011).

For TTCs, declining sales in traditional markets contrasted with Asia’s growing economies, large populations and high smoking rates. In 1981 RJ Reynolds (RJR), British American Tobacco’s (BAT) U.S. subsidiary Brown and Williamson (B&W) and Philip Morris (PM) formed the U.S. Cigarette Export Association (USCEA). The USCEA lobbied the USTR to press Asian governments to open their domestic markets. Failing to negotiate joint ventures with the OOM, and keen to exploit potential marketing opportunities at the forthcoming 1988 Seoul Summer Olympics (Lee, Fooks, Wander, & Fang, Citation2015), the companies claimed that Korea was engaging in ‘discriminatory trade practices’ that was worsening the substantial U.S. trade deficit (US General Accounting Office, Citation1990). Given the geopolitical importance of U.S.–Korean relations, and the need to maintain Korean access to U.S. markets amid bilateral trade negotiations, the Korean government agreed to relax the cigarette import ban in 1986. However, with sales restricted to 500 outlets, imports remained 1% of the market. TTCs successfully lobbied the USTR to threaten sanctions under Section 301 of the U.S. Trade Act. In May 1988 a Record of Understanding was agreed which removed all import and distribution restrictions on cigarette imports (Lee et al., Citation2013). The strategies used by TTCs to gain access to the Korean market, and increase domestic demand for foreign brands, notably among Korean females have been analysed by the authors elsewhere (Lee et al., Citation2009, Citation2014). There remains limited analysis to date of how KT&G has adapted since market opening and, in particular, its own efforts to compete in an increasingly global tobacco market.

Methods

We began by searching the scholarly literature in public health, business studies and regional studies on the Korean tobacco industry using Google Scholar, PubMed and JSTOR. The research found limited scholarly analysis of the business strategy of the Korean tobacco industry. We then reviewed available KT&G annual reports (2002–2014) and online company materials. While offering information on company activities and plans, we acknowledge that these sources are intended to present the company in a positive light to potential investors, shareholders and the public. To triangulate these sources, we searched trade publications Tobacco Journal International, Tobacco Reporter and Tobacco Asia focusing on KT&G’s global business strategy since the 1990s, along with more general sources of business news (e.g. Financial Times and Bloomberg News). This was supplemented by market research reports related to the Korean tobacco industry in Euromonitor International (http://www.euromonitor.com/) and Market Research.com, and data on tobacco exports from the UN trade database (http://comtrade.un.org/).

This paper drew upon internal industry documents held in the Truth Tobacco Documents Library (TTDL) which were previously searched (January 2009–October 2011) by one of the current authors to understand TTC market access strategy in Korea. Terms combined using Boolean terms, and a snowballing technique was used to generate further search terms for company names for individuals and relevant activities. Documents date to the mid-2000s only and offer supplemental albeit circumscribed insights on KT&G’s strategy in a more competitive domestic market. Around 1600 documents were reviewed, as relevant to this earlier study, of which 362 documents were used in the analysis (Lee, Citation2011; Lee et al., Citation2013, Citation2014). For the current study, given that there are currently no internal documents of KT&G in the TTDL comparable to existing TTCs, we conducted keyword searches from June 2015–August 2016 for information on KT&G in competitor reports in the collection. Using the keywords ‘Korea*’ and ‘competitor report’, 85 further documents were identified and reviewed.

To organize the above data sources, this paper adopts the heuristic framework set out in Lee and Eckhardt (Citation2016) which focuses on three key questions: (a) what are the primary factors behind the push for globalization? (b) What are the specific globalization strategies pursued? (c) To what extent has the industry as a whole, or the specific company in question, globalized to date?

Findings

What are the key factors behind KT&G’s global business strategy?

Liberalization of the Korean tobacco market from the late 1980s was shaped foremost by the government’s pursuit of export-led growth as a development model. Unlike Eastern Europe and Latin America where local tobacco companies were acquired by TTCs from the 1970s onwards (Shepherd, Citation1985), Korea protected KT&G’s monopoly status as one of the country’s key national industries. Pressured by the USTR to open the domestic market, the Korean government opted to liberalize access, resulting in competition between KT&G and TTCs (Lee et al., Citation2013).

Market opening under these conditions, in turn, explains KT&G’s path towards globalization. As TTCs entered a previously closed market, adaptation by the Korean monopoly was initially focused on protecting domestic market share by appealing to Korean nationalism, and cultivating competitively advantageous links with the country’s vast network (170,000 in 2002) of standalone retailers controlling more than 80% of cigarette retails sales (Lee, Citation2011). Alongside the triple price of foreign brands, these efforts initially helped KT&G to stave off competition. By the mid-1990s, however, TTCs had gained ground through intense marketing campaigns, acceptance of foreign brands among younger smokers, inroads into sales and distribution systems and corporate social responsibility (CSR) initiatives (Lee, Citation2011). Market share by TTCs increased, from 2.9% in 1990 to 12.4% by 1995 (Lee, Citation2011). This erosion of market share was described as the company’s ‘greatest challenge’ (KT&G, Citation2002).

Another important trend during this period was the decline in smoking prevalence among Korean adult males, from a peak of 79.3% in 1980 to 40.4% in 2008 (Lee, Citation2011). Stronger tobacco control legislation, shifts in public opinion and the adoption and implementation of the World Health Organization (WHO) Framework Convention on Tobacco Control (FCTC) since 2005 reduced the size of the domestic market. Like TTCs from the 1960s (Shepherd, Citation1985), KT&G global business strategy emerged as compensation for a declining domestic market.

South Korea was also among the countries most affected by the Asian financial crisis beginning in 1997. After years of remarkable economic growth and large-scale lending, the economic downturn saw a sharp decline in South Korean share values, weakening of the Korean currency (Won), bankruptcies by major conglomerates built to compete in the world economy, and a more than doubling of the rate of national debt-to-GDP from 13% to 30%. Faced with US$74 billion of short term debt by 1998 due within two years, the Korean government faced a serious cash flow squeeze. In the late 1990s, a process of privatization of KT&G was initiated. As stated by KT&G Chairman and CEO Joo Young Kwak,

The disposal of our remaining publicly held shares and the official renaming of the company as KT&G marked the beginning of a new era of the company. [W]e are now prepared to forge ahead and transform KT&G into a leading player in the tobacco industry (KT&G, Citation2002).

While we are proud of our tradition, we believe the simple elegance of the redesigned KT&G logo embodies the essential values of our organization today … it symbolizes our confidence that those values will soon be familiar to millions more people around the world, as we aspire to become a global name in the tobacco industry (KT&G, Citation2002).

KT&G’s readiness to compete globally was undoubtedly strengthened by its former monopoly status, combined with the decade-long experience of competing head to head with TTCs following market opening. Privatization then positioned KT&G to use these strengths to expand into new markets. By 2006 KT&G had developed a mid to long-term Masterplan, articulating the ‘vision and challenge to become a global company’ (KT&G, Citation2014), with the advice of global consulting firm Booz Allen Hamilton. Documents describe how KT&G saw the success of this Masterplan as integral to the company’s future. As stated in its Annual Report 2014, KT&G is ‘a company that looks toward Korea’s future and that of globalization’.

Notably KT&G’s shift, from inward looking state-owned monopoly to outward-looking market competitor, does not appear to have been driven by firm specific factors. Firm specific factors include such variables as firm size, human resources, debt ratio, assets and other factors which are specific to the firm. The 1990s saw increased labour costs but a reduced workforce, with productivity (cigarettes produced per employee hour) increasing by 10.9% annually from the early 1990s. Nor did KT&G experience disputes with the 8000-strong labour union unlike other sectors during this period (van der Hoeven, Sziráczki, & Korea Tobacco, & Gingseng Corp. (KTG), Citation1997, pp. 31–35).

Which global business strategies have KT&G pursued?

KT&G’s global business strategy initially focused on strengthening the domestic manufacturing base as part of the restructuring of the company under privatization. The company reduced employees from 9000 in 1996 to around 5000 by 2000, and shut some of its most inefficient factories. KT&G became a joint stock company in 1997, spinning off the ginseng business as a wholly owned subsidiary, and went public on the Korean Stock Exchange in 1999. Up to 25% of the company was opened to foreign ownership.

An important part of this restructuring was expanded manufacturing capacity and distribution channels to increase exports. An unsuccessfully foray into the Japanese market in 1985 was terminated four years later when local consumers rejected the heavier taste of the Korean brands Pine Tree and Ararang. The company’s renewed efforts to export came in 1990 when rioting over cigarette shortages, in the wake of the collapse of the Soviet Union, led KT&G to sign a five million pack contract to fill the gap (Cohen, Citation2004). In 1992 KT&G opened an overseas liaison office in Hong Kong which was converted to a full sales subsidiary, Korea Tobacco & Ginseng Hong Kong Ltd., in 1994. KT&G then re-entered the Japanese market in 1995 with an agreement with Mikuni to export one million packs (Cohen, Citation2004). This limited trade, however, was substantially scaled up by the building of three manufacturing facilities (Shintanjin, Youngju and Kwangju). In addition, these factories produce selected foreign brands under license for domestic sale () (Euromonitor International, Citation2016).

Table 1. KT&G manufacturing sites in South Korea for export markets, 2015.

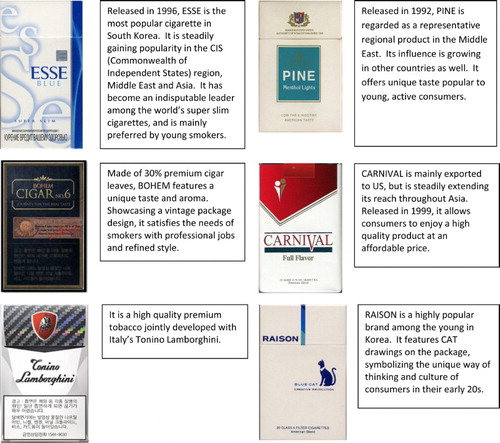

A second component of KT&G’s global business strategy was to develop higher quality western style brands (Cohen, Citation2004). Learning from domestic competition against foreign brands, KT&G introduced the superslim cigarette brand Esse in 1996. The company then dedicated significant resources to elevate the brand as its flagship for global expansion (KT&G, Citation2006a). Exports of the Esse brand family commenced in 2001 with 6 million cigarettes, reaching 10 billion sticks in 2006 (35% of total exports) and 20 billion sticks by 2011 (KT&G, Citation2006a, Citation2013a). As KT&G’s bestselling brand, in both the domestic and overseas markets, total sales reached 394.1 billion sticks by 2012, of which 140 billion sticks were sold in 45 export markets (KT&G, Citation2013a).

A related component of product development was ‘premiumisation’ – increasing the proportion of sales from luxury brands to earn higher profit margins. The creation of premium brands broadened the company’s product mix and repositioned the company albeit amid fierce competition. Premiumisation also enabled KT&G to increase revenues despite declining sales volumes (Euromonitor International, Citation2010; KT&G, Citation2007). For example, Esse Renewal and Esse King Size/Mini were introduced in 2008 and 2009 to increase export price per pack and the proportion of sales from mid- and high-priced brands (KT&G, Citation2008, Citation2009). Total export revenue thus continued to grow. Based on this success, KT&G developed further brands for the luxury domestic and overseas markets such as Cloud 9, Raison and Zest (KT&G, Citation2006b).

KT&G’s also placed greater importance on tailoring product ranges to local markets () (KT&G, Citation2007, Citation2013a). This was achieved by using product innovations, design, flavourings, tar ranges, brand names and packaging that appeal to specific market segments (Campaign for Tobacco-Free Kids, Citation2012; Thorton, Citation2006). In 2013 Esse Change, for example, was launched as the world’s first ultra-slim capsule cigarette that allows smokers to change the flavour to menthol. The product is described as aimed at smokers in emerging Asian markets with health concerns: ‘Markets are growing in some countries such as China, India and Indonesia … . As disposable income in these countries increases, the desire for better cigarettes is growing. People are also looking for options with lower tar and nicotine’ (White, Citation2013). Other products have been developed in collaboration with fashion houses or luxury automobile firms to attract aspirational smokers such as the Tonino Lamborghini cigarette brand (Euromonitor International, Citation2013b; KT&G, Citation2012).

Following restructuring and product development, a more recent strategy has been FDI to improve access to target markets. In 2011, KT&G acquired a 60% interest in Trisakti Purwosari Makmur for US$133 million to pave the way for the company’s expansion into the Indonesian market (Euromonitor International, Citation2013b). KT&G immediately benefited from Trisakti’s sales networks and manufacturing facilities for kreteks (clove-flavoured cigarettes). Trisakti was ranked sixth in kretek sales in Indonesia in 2010, and is being brought together with KT&G’s expertise in ‘white sticks’ (cigarettes) to develop new products to appeal to local consumers (KT&G, Citation2011). Since 2011, KT&G has identified Indonesia as a priority market given its open market policy, economic growth and market twice the size of the Korean market (Tobacco Reporter, Citation2015).

With 300 million smokers, rising incomes and geographical proximity, the Chinese market immediately attracted the global ambitions of KT&G (KT&G, Citation2007). KT&G’s limited access to China was achieved via North Korea. In 1999, KT&G agreed to build a 2-billion stick capacity manufacturing plant outside of Pyongyang. The joint venture launched two brands, IPS and Hanmaeum (One Mind) as evocations of Korean reunification. In return, Pyongyang supplied 50 tonnes of fresh ginseng to KT&G and agreed to cultivate ginseng for the company. KT&G’s sites, however, were more focused on access to a rail link between North Korea and China, which extended into Russia and Central Asia, including Uzbekistan and Afghanistan. The railway supported KT&G expansion into regional markets by lowering transport costs (Cohen, Citation2004). In 2001, China National Tobacco Corporation (CNTC) and KT&G signed a Memorandum of Understanding (MOU) to allow the former to sell Korean brands in China (Park, Citation2001). Further MOUs have followed since 2007, annually expressing commitments to build a stronger relationship between the two companies (KT&G, Citation2007). However, China to date has continued to maintain strict access to its domestic market, under the state monopoly, with strict import quotas and controlled distribution (Holden, Lee, Gilmore, Wander, & Fooks, Citation2010).

Another major target for expansion has been Central Asia and European markets. The 2003 announcement to privatize Tekel, Turkey’s state-owned cigarette company, presented an opportunity for KT&G to make inroads into the market. KT&G was one of seven companies to bid for Tekel, eventually acquired by British American Tobacco in 2008 for US$1.72 billion (Anonymous, Citation2008). Beyond the Turkish market, KT&G saw a Turkish base as a jumping off point for other regional markets, notably Eastern Europe and the Middle East (KT&G, Citation2008). In 2008, KT&G completed a manufacturing plant in Turkey (KT&G, Citation2006b) with ‘ultra-modern’ facilities and annual production capacity of 2.6 billion sticks (KT&G, Citation2007). The factory produced super-slim and regular cigarettes for local consumption and regional export (KT&G, Citation2008). In 2010, a third plant in Russia was built to facilitate direct management of operations in the market (KT&G, Citation2009). The 103,421 m2 production factory is equipped with lines for tobacco leaf processing and producing ultra-slim products in the Kaluga region near Moscow. A plant of this size allows KT&G to meet their needs for expansion, such as not having to relocate if the plant was to upgrade its technology or equipment (Xu, Citation2012). The target market of the Russia plant is the Russia and the Commonwealth of Independent States (Xu, Citation2012). With an annual capacity of 4.6 billion sticks, the factory produces Esse Blue, Esse One and Esse Menthol (KT&G, Citation2010). Importantly, should Turkey successfully join the European Union (EU), it was anticipated that this would provide KT&G with a base to supply member states without import tariffs. This ambition was solidified by the South Korea–EU free trade agreement effective from July 2011 (Korea Ministry of Foreign Affairs and Trade, Citation2010) which will phase out EU tariffs on Korean tobacco leaf and products (e.g. 57.6% on cigarettes) within 3–5 years (Miller, Nuthall, & Osborne, Citation2010).

The Middle East has been another regional market accessed via Turkey (KT&G, Citation2007). By 2009, two manufacturing plants had been completed in Iran, with an annual production capacity of one billion sticks, using tobacco leaf processed by KT&G’s Turkish plant. KT&G became a leading supplier of cigarettes in Afghanistan, Turkey and Iran. Since 2010, political instability in the region has hindered KT&G’s ambitions, with a decline in total revenues during 2010–2014. KT&G shifted to a strategy of indirect exporting through contract manufacturing, signing an agreement with Alokozay International, a conglomerate manufacturing a range of FMCGs (fast moving consumer goods). In 2013, this partnership accounted for more than 10% of KT&G’s total revenues (KT&G, Citation2013b).

With continued instability in the Middle East, there are reports of the company’s growing complicity in the illicit trade. It is alleged, for example, that KT&G brands dominate the illicit trade to Iran notably via the United Arab Emirates (Parker, Citation2010). There are concerns that a significant portion of KT&G’s Pine cigarettes supplied by Alokozay International to Afghanistan have been smuggled into Pakistan. In 2011 smuggled cigarettes were over 12% of the total tobacco trade, with Pine comprising more than two-thirds (Euromonitor International, Citation2013a). Over 90% of Pine available in Pakistan came from Afghanistan through illicit trade (Baloch & Khan, Citation2014). In 2012, the Pakistani authorities made a formal complaint to the Korean government and KT&G regarding the lack of health warnings and lost tax revenues. In a response reminiscent of TTCs (Collin, LeGresley, MacKenzie, Lawrence, & Lee, Citation2004; Nakkash & Lee, Citation2008), the company stated that it legally supplied official agents and had little control over subsequent distribution by ‘low level wholesalers’ (Kim, Citation2012). The continued scale of the trade led TTCs to complain about the non-competitive pricing of KT&G brands in 2014 (Baloch & Khan, Citation2014).

A final component of KT&G’s global business strategy has been growing involvement in CSR activities to ‘promote KT&G as a global player’ (KT&G, Citation2004). In 2003, the KT&G Social Welfare Foundation was launched as a charity to promote social welfare services in communities in South Korea and abroad. The Foundation’s major projects include ‘funding of programs for the underprivileged, support for various social welfare organizations, medical assistance to patients suffering from serious health conditions and other projects promoting social welfare’ (KT&G, Citation2003). As described in annual reports, ‘The KT&G name is renowned for more than the quality of its products. In communities at home and abroad, we are reliable partners to charitable institutes, humanitarian organizations and social welfare projects’ (KT&G, Citation2003). It was claimed that the company contributed about US$33 million (KRW39 billion), the equivalent to 8.4% of net earnings, to a variety of social welfare projects in 2003. Over the next four years, the company provided US$84 million (KRW100 billion) to the KT&G Social Welfare Foundation and another US$18 million (KRW21 billion) in direct donations to projects on national heritage preservation, social welfare and disaster relief (KT&G, Citation2003). Although the majority of the Foundation’s activities have taken place within South Korea, documents suggest KT&G initiated many of these CSR activities in strategically important overseas markets (). While currently available data are limited, these findings suggest the need for detailed monitoring and analysis of KT&G’s CSR initiatives in overseas markets, as part of its strategy to transform itself into an emerging TTC through, for example, improving its corporate reputation among local populations, circumventing marketing restrictions.

Table 2. Examples of CSR activities by KT&G.

How globalized is KT&G to date?

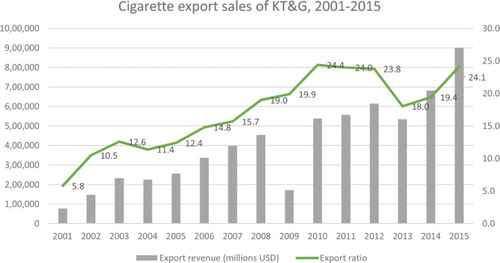

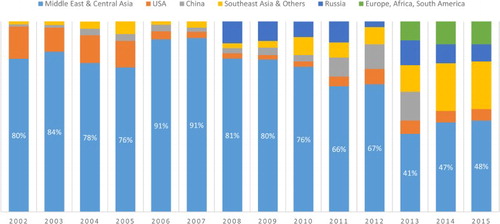

Applying key indicators set out in Lee and Eckhardt (Citation2016), this paper finds that KT&G’s global business strategy has been largely successful. First, unadjusted export revenues increased from US$33 million (KRW42 billion) in 2000 to a peak of US$589 million (KRW628 billion) in 2012, with volume increasing 34-fold since 2000 (Chung, Citation2015). In 2013, exports declined by 28% over the previous year to US$429 million (KRW453 billion), in large part due to U.S. sanctions against Iran. This caused local distributors to reduce their inventory to cope with reduced demand caused by a depreciation of the local currency (KT&G, Citation2013a). The ratio of exports to total sales rose from 2.5% in 2002 to 23.8% in 2012 ( and ). Despite instability in Middle East markets, the overall trend is towards export growth. In 2015, overseas sales surpassed its domestic sales for the first time, increasing by 30.2% from 2013, marking a ‘turning point’ in KT&G’s future trajectory (Chung, Citation2015).

Figure 2. Cigarette export sales of KT&G, 2000–2015. Source: Compiled from UN Comtrade, Citation2001–2015; KT&G. Annual Reports. 2002–2016.

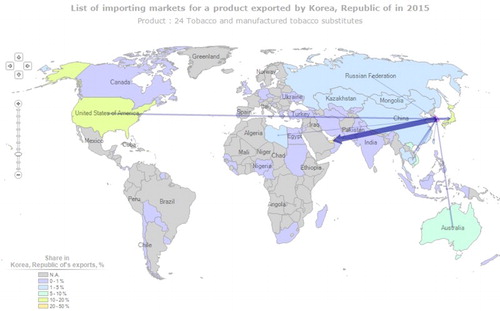

Figure 3. List of importing markets for tobacco and manufactured tobacco substitutes exported by all tobacco companies in South Korea (2015). Source: ITC calculations based on Korea Customs and Trade Development Institute (KCTDI) statistics.

shows that KT&G has ‘successfully diversified’ (Anonymous, Citation2015) its markets by region since 2002, with a balanced range of markets across six regions by 2013. This suggests a shift from dependence on the Middle East and Central Asia (80.4% of exports in 2002), to substantial markets in Asia (notably Indonesia), Europe and increasingly Africa, and Central and Latin America. In 2013, KT&G exported 100 brands to 50 countries (KT&G, Citation2013a). While the scale of these markets remain small, relative to existing TTCs (Euromonitor International, Citation2015), this market diversification suggests the company has spread its risks ahead of further expansion.

Figure 4. Percentage of total export revenue by KT&G region, 2002–2015. Notes: aThere was no separate category for Russia in KT&G Annual Reports from 2002–2007. Russia is likely included in the ‘Middle East & Central Asia’ category for these years; bU.S.A. includes U.S.A. and Canada; cChina includes China, Hong Kong, Macao, Taiwan, Vietnam and other markets; d‘Southeast Asia & Others’ includes China and Southeast Asia in 2014–2015; e‘Europe, Africa, South America’ includes ‘Other’ in 2014–2015. Source: Compiled from KT&G, Annual Reports. 2002–2016.

KT&G’s corporate structure has become more globalized (), with a shift from manufacturing domestically for export, to overseas production (). With established plants in Russia, Iran and Turkey employing 3600 local workers, to produce Esse, Pine and other leading KT&G brands for the host and neighbouring countries, the company will potentially expand manufacturing operations to Africa and the Americas (KT&G, Citation2015). The company is reported to be making major investment in advanced technology and equipment has enabled it to operate with higher productivity rates (Xu, Citation2012). The company’s largest overseas manufacturing plant in Russia, for instance, operates with 88 local and 8 Korean employees. KT&G also maintains major offices established in five countries (China, U.S., the Philippines, Kazakhstan and Lebanon) (KT&G, Citation2013a).

Figure 5. KT&G’s overseas subsidiaries and branches. Source: KT&G (Citation2013a). Annual Report.

Table 3. KT&G’s foreign manufacturing plants.

Finally, KT&G has diversified its products, developing and promoting a small number of global brands, among 100 exported brands. The company has shifted focus to premium brands led by Esse, maintaining revenues despite declining volumes.

Discussion

There has been limited study of the tobacco industry in South Korea to date, focused on the impact of market opening and trade liberalization on the domestic market and, in turn, public health outcomes. From the early 1990s, the entry of TTCs into Korea made the domestic tobacco market increasingly competitive. Previous analysis showed how KT&G adopted strategies, including product development, CSR and targeting of females to protect its eroding market share (Lee et al., Citation2009, Citation2013). During the same period, tobacco control policies were strengthened, underpinned by the FCTC, given increased competition among tobacco companies in South Korea.

This paper extends existing analysis to understand how, as part of KT&G’s adaptation to market opening and trade liberalisation, its global business strategy since 2002 has successfully reoriented the company, from domestically oriented, to outward-looking and aspiring TTC. Faced with a steady decline in domestic market share, from virtually 100% prior to the late 1980s to less than 50% in 2014 (Market Research.com, Citation2016), the state monopoly completed privatisation in 2002. The 2006 Masterplan marked a turning point in the company’s strategy, with a concerted shift to establishing overseas operations in various forms (i.e. joint ventures, manufacturing plants and acquisitions) reminiscent of existing TTCs. The exponential growth of export revenues, both directly and indirectly via contract manufacturing, diversification of regional markets and development of global KT&G brands, all suggests a successful transformation of KT&G since the 1990s, from a domestic monopoly to a company aspiring to join the ranks of existing TTCs.

The implications for global public health stem most directly from the increased production and consumption of tobacco products. With annual sales of US$2 billion in 2015, KT&G is now the world’s fifth largest tobacco company. Its rapid growth and reorientation, in turn, appears to be intensifying competition with existing TTCs in markets worldwide. The company has so far targeted many of the same markets as existing TTCs, notably China, Indonesia and Eastern Europe. Mid to longer term aspirations to expand sales in other regions, including the Middle East and Africa, through lower priced brands and the illicit trade, will add further momentum to the shift in the global burden of tobacco-related diseases to the developing world during the twenty-first century. While the Korean government has strengthened tobacco control measures domestically, KT&G’s compensatory pursuit of export markets has generated little opprobrium at home. In this sense, too, the globalization of the tobacco industry in Korea has followed a familiar pattern.

Acknowledgements

The authors are solely responsible for the contents of this paper.

Disclosure statement

No potential conflict of interest was reported by the authors.

ORCID

Kelley Lee http://orcid.org/0000-0002-3625-1915

Jappe Eckhardt http://orcid.org/0000-0002-8823-0905

Additional information

Funding

References

- Anonymous. (2008, February 23). BAT acquires Tekel. Tobacco Journal International. Retrieved from http://www.tobaccojournal.com/BAT_acquires_Tekel.48850.0.html

- Anonymous. (2015, June 19). KT&G: Another tobacco multinational emerging. Tobacco Reporter. Retrieved from http://www.tobaccoreporter.com/2015/06/ktg-another-tobacco-multinational-emerging/

- Baloch, F., & Khan, S. (2014, January 26). Dodging exchequer: Pine eats into market of legal brands. Express Tribune. Retrieved from http://tribune.com.pk/story/663710/dodging-exchequer-pine-eats-into-market-of-legal-brands/

- Campaign for Tobacco-Free Kids. (2012). Tobacco industry hasn’t come a long way, baby. Retrieved from http://global.tobaccofreekids.org/en/global_updates/detail/2012_01_19_esse

- Chung, J. W. (2015, March 16). KT&G turns eyes toward global expansion. Korean Herald. Retrieved from http://www.koreaherald.com/view.php?ud=20150316001294

- Cohen, M. L. (2004). KT&G corporation history. In T. Grant & M. H. Ferrara (Eds.), International directory of company histories (Vol. 62). Chicago: St. James Press.

- Collin, J., LeGresley, E., MacKenzie, R., Lawrence, S., & Lee, K. (2004). Complicity in contraband: British American Tobacco and cigarette smuggling in Asia. Tobacco Control, 13(Supp. II), ii96–ii111.

- Euromonitor International. (2010). Global Tobacco – Key findings part one – Tobacco overview and cigarettes: Resilience or decline? Passport.

- Euromonitor International. (2013a). Cigarettes in South Korea. Passport.

- Euromonitor International. (2013b). KT&G corp in Tobacco (South Korea). Passport.

- Euromonitor International. (2015). KT&G corp in Tobacco (South Korea). Passport.

- Euromonitor International. (2016). KT&G corp in Tobacco (South Korea). Passport.

- van der Hoeven, R., Sziráczki, G., & Korea Tobacco, & Gingseng Corp. (KTG). (1997). In lessons from privatization: Labour issues in developing and transitional countries. Washington, DC: Brookings Institution Press.

- Holden, C., Lee, K., Gilmore, A., Wander, N., & Fooks, G. (2010). The role of tobacco in China’s accession to the WTO. International Journal of Health Services, 40(3), 421–441. doi: 10.2190/HS.40.3.c

- Jung, K. J., Yun, Y. D., Baek, S. J., Jee, S. H., & Kim, I. S. (2013). Smoking-attributable mortality among Korean adults. Journal of the Korea Society of Health Informatics and Statistics, 38(2), 36–48.

- Kim, D. Y. (2012, May 13). KT&G cigarettes massively smuggled into Pakistan. Korean Times. Retrieved from http://www.koreatimes.co.kr/www/news/biz/2012/05/123_110892.html

- Korea Ministry of Foreign Affairs and Trade. (2010, October). Free trade agreement between the Republic of Korea, of the one part, and the European Union and its member states, of the other part. Seoul. Retrieved from http://www.fta.go.kr/webmodule/_PSD_FTA/eu/doc/Full_Text.pdf

- Korean Association of Smoking or Health. (2007). Gallop Korea Report of actual smoking rates in South Korea. Seoul.

- KT&G. (2002). 2002 annual report: Commitment. Retrieved from http://en.ktng.com/reportThumb?cmsCd=CM0045

- KT&G. (2003). Annual report 2003: Trust. Retrieved from http://en.ktng.com/reportThumb?cmsCd=CM0045

- KT&G. (2004). Annual report 2004: Integrity. Retrieved from http://en.ktng.com/reportThumb?cmsCd=CM0045

- KT&G. (2006a). KT&G mid-to-long term masterplan. Retrieved from http://en.ktng.com/report?cmsCd=CM0044

- KT&G. (2006b). Annual report 2006. Retrieved from http://en.ktng.com/reportThumb?cmsCd=CM0045

- KT&G. (2007). Annual report 2007. Retrieved from http://en.ktng.com/reportThumb?cmsCd=CM0045

- KT&G. (2008). Annual report 2008. Retrieved from http://en.ktng.com/reportThumb?cmsCd=CM0045

- KT&G. (2009). Annual report 2009. Retrieved from http://en.ktng.com/reportThumb?cmsCd=CM0045

- KT&G. (2010). Annual report 2010. Retrieved from http://en.ktng.com/reportThumb?cmsCd=CM0045

- KT&G. (2011). Annual report 2011. Retrieved from http://en.ktng.com/reportThumb?cmsCd=CM0045

- KT&G. (2012). Annual report 2012. Retrieved from http://en.ktng.com/reportThumb?cmsCd=CM0045

- KT&G. (2013a). Annual report 2013 Part I editorial. Retrieved from http://en.ktng.com/reportThumb?cmsCd=CM0045

- KT&G. (2013b). Annual report 2013 Part II financial. Retrieved from http://en.ktng.com/reportThumb?cmsCd=CM0045

- KT&G. (2014). Korea tomorrow & global. Retrieved from http://en.ktng.com/

- KT&G. (2015). Korea tomorrow & global. Retrieved from http://en.ktng.com/reportThumb?currtPg=1&cmsCd=CM0045

- Lee, K., Carpenter, C., Challa, C., Lee, S., Connolly, G. N., & Koh, H. (2009). The strategic targeting of females by transnational tobacco companies in South Korea following trade liberalization. Global Health, 5(2), 1–10.

- Lee, K., Fooks, G., Wander, N., & Fang, J. (2015). Smoke rings: Towards a comprehensive tobacco-free policy for the Olympics. PLoS One, 10(8), e0130091. doi: 10.1371/journal.pone.0130091

- Lee, S. (2011). The tobacco industry in South Korea since market liberalization: Implications for strengthening tobacco control (doctoral dissertation). London School of Hygiene and Tropical Medicine, London.

- Lee, S., Holden, C., & Lee, K. (2013). Are transnational tobacco companies’ market access strategies linked to economic development models? A case study of South Korea. Global Public Health, 8(4), 435–448. doi: 10.1080/17441692.2012.758762

- Lee, K., & Eckhardt, J. (2016). The globalisation strategies of five Asian tobacco companies: An analytical framework. Global Public Health. doi:10.1080/17441692.2016.1251604

- Lee, S. Y., Lee, K., & Holden, C. (2014). Creating demand for foreign brands in a ‘home run’ market: Tobacco company tactics in South Korea following market liberalization. Tobacco Control, 28, e8. doi: 10.1136/tobaccocontrol-2012-050534

- Market Research.com. (2016, June). Tobacco in South Korea. Retrieved from http://www.marketresearch.com/MarketLine-v3883/Tobacco-South-Korea-10158841/

- Miller, K., Nuthall, K., & Osborne, A. (2010, February 23). South Korea: New trade deal could boost tobacco business. Tobacco Journal International. Retrieved from http://www.tobaccojournal.com/South_Korea_New_trade_deal_could_boost_tobacco_business.49843.0.html

- Morris, J. E. (1978). This tobacco business Part VIII: Tobacco in Korea. Tobacco International, 180(20), 9–20.

- Nakkash, R., & Lee, K. (2008). Smuggling as the “key to a combined market”: British American Tobacco in Lebanon. Tobacco Control, 17(5), 324–331. doi: 10.1136/tc.2008.025254

- Overseas sales to overtake domestic sales at KT&G. (2015). Tobacco Reporter. Retrieved from http://www.tobaccoreporter.com/2015/03/overseas-sales-to-overtake-domestic-sales-at-ktg

- Park, Y. B. (2001, June 28). KT&G signs accord to export cigarettes to China. Korean Times.

- Parker, J. (2010, November 17). Export demand greater than estimated. Tobacco Journal International. Retrieved from http://www.tobaccojournal.com/Export_demand_greater_than_estimated.50302.0.html

- Shepherd, P. L. (1985). Transnational corporations and the international cigarette industry. In R. Newfarmer (Ed.), Profits, progress, and poverty: Case studies of international industries in Latin America (pp. 63–112). Notre Dame, IN: Notre Dame University Press.

- Thorton, V. (2006). Russian smokers becoming more quality-conscious. Tobacco Journal International. Retrieved from http://www.tobaccojournal.com/Russian_smokers_becoming_more_quality-conscious.47858.0.html

- UN Comtrade. (2001–2015). United Nations Commodity Trade Database. New York: UN Statistics Division. Retrieved from https://comtrade.un.org/db/

- US General Accounting Office. (1990). U.S. Trade and health issues: Dichotomy between U.S. Tobacco export policy and antismoking initiatives. Report to Congressional Requesters. Washington, DC: General Accounting Office.

- White, R. (2013, September 9). KT&G to introduce first superslim with capsule technology at TFWA WE. Asia Duty Free and Travel Retailing. Retrieved from http://www.dutyfreemagazine.ca/asia/brand-news/tobacco/2013/09/16/kt-and-g-to-introduce-first-superslim-with-capsule-technology-at-tfwa-we/#.VeoSZfm6dD8

- Xu, Z. Y. (2012). 从韩国烟草“国际化”看中国烟草“走出去 [Comparing KT&G’s globalization and CNTC’s ‘Go global’ strategy]. China Tobacco. Retrieved from http://www.echinatobacco.com/zhongguoyancao/2012-03/01/content_317225.htm