Abstract

This research aims to investigate the significance of trust in financial institution and financial literacy in the investment decision-making of individual investors during the COVID-19 pandemic and investigates the strength of the theory of planned behavior (TPB) in this framework. This study considered a structured questionnaire to collect data from 460 individual investors of different districts in four states of India. For testing the research hypotheses, SPSS and PLS-SEM were taken into consideration. The findings enlighten that elements of TPB, i.e. attitude (ATT) and subjective norms (SNs), are significantly associated with investment intentions (INT) while perceived behavioral control (PBC) displays an insignificant association with INT. Furthermore, along with the original components of the TPB model, Trust in financial institution (TFI) and Financial Literacy (FL) were also incorporated in the model, which shows a significant affect on investors’ intention to invest in the stock market. The results stated that TFI is the most significant factor that enhances investors’ intention to participate in stock market during COVID-19 pandemic. The study describes that during the phase of uncertainty like COVID-19 pandemic trust is the most important factor that enhances investors’ participation in the stock market. Authors suggest SEBI and other financial institutions should promote trust and trusting behavior in financial institutions as it is significant not only from the perspective of financial development but also to empower the individuals to gain from institutional services as well as to guard them, from possible negative effects (like financial frauds), which are more likely to be present outside of regulatory boundaries. This study is one of the initial attempts in the context of the Indian Stock Market to introduce TFI as a dual (both mediating and moderating) variable between the basic constructs of TPB. Further, the study also examines the importance of trust in financial institution and financial literacy in enhancing investors’ intention to participate in stock market during COVID-19 pandemic.

1. Introduction

According to capital market theory, individuals must invest a portion of their income in stocks to earn a profit with the risk premium on their investments (Curcuru et al., Citation2010; Singh et al., Citation2022). Although, the prior researches on individual portfolio choice patterns display that several of them do not invest in the financial market or have limited participation in the stock market (Adil et al., Citation2022). The phenomenon of non-participation in financial markets is very common around the globe (Guiso et al., Citation2008a). Existing literature reveals that there is typically low investment participation of individuals in financial market and that a majority of individuals do not invest in stocks at all (Akhtar & Das, Citation2018). They prefer to invest their money into safe assets rather than stocks. Individuals with stable positions in stock markets hold small numbers of assets. These situations are known as the limited participation or non-participation puzzle of stock markets (Polkovnichenko, Citation2004; Vissing-Jørgensen & Attanasio, Citation2003). There is a plethora of research that examines the social and cognitive factors that act as obstacles to stock investment in order to explain the stock market non-participation puzzle. Literature suggests that individual stock market participation is influenced by factors such as financial sophistication and educational attainment (Christelis et al., Citation2011), cognitive ability (Benjamin et al., Citation2013), political orientation (Kaustia & Torstila, Citation2011), optimism (Puri & Robinson, Citation2007), experience regarding stock market return (Citation2009, investment ability (Graham et al., Citation2009) financial literacy (Van Rooij et al., Citation2011), sociability (Georgarakos & Pasini, Citation2011), and trust in financial institution (Guiso et al., Citation2008a).

Over the past several decades, stock market participation has attracted researchers’ attention (e.g., Shehata et al., Citation2021; Van Rooij et al., Citation2011), with several variables factors being introduced and scrutinized to elucidate investors’ investment intention. While the body of information is vast, there is a gap in the literature, i.e., limited research on individual investment behavior in the presence of an external source of stress, like the world health crisis, although existing researchers have acknowledged the influence of events like the Ebola virus outbreak (Ichev & Marinč, Citation2018) and several other disasters (Kowalewski & Śpiewanowski, Citation2020) on stock market returns. It is crucial to note that, while such events cause havoc, they also serve as a perfect natural ground to evaluate the investment behavior of investors. The COVID‐19 pandemic provides another such experimental setting for inspecting investors’ behavior to fill the gap in the linked results (Ortmann et al., Citation2020). Hence, this study tries to elucidate the investor’s intention to participate in stock market during COVID-19 pandemic.

On 30 January 2020, the World Health Organization announced a health-care emergency (Anser et al., Citation2021), and on 11 March 2020, it was proclaimed a global pandemic (Ciotti et al., Citation2020). A pandemic refers to a disease that spreads to a large number of individuals in multiple nations at the same time. The COVID-19 pandemic not only limits its influence on deteriorating people’s health but also negatively influences financial and economic activities (Hua & Shaw, Citation2020). While the number of infections increases, many governments have implemented considerable countermeasures, such as lockdowns. Due to this, the economic cycle is disturbed and individuals do not understand what they are supposed to do in such a crucial situation. In this situation of COVID-19, Francis Fukuyama states that the most important factor in dealing with the crisis is trust. As he puts it, trust is the single most important commodity that will determine the fate of a society” (Fukuyama, Citation2020). Trust in financial market may be defined as individuals’ perception that financial institutions are usually reliable and can be dependent on fulfilling their commitments (Van Der Cruijsen et al., Citation2021). According to Van Esterik-Plasmeijer and Van Raaij (Citation2017), individuals with a high level of trust are confident that the financial institution is looking out for their best interests. Trust in institutions plays a significant role in influencing stock market participation as a lack of trust in financial market reduces individual participation in financial market which, in turn, will affect overall economic growth (Jaffer et al., Citation2014). It is reasonable to expect that those who do not trust others or society in general will be less likely to invest in financial markets (Qiu et al., Citation2020). Hence, it is noteworthy to examine how trust in financial market enhances investors’ intention to participate in stock market in this war-like situation of uncertainty.

The COVID-19 pandemic wreaked havoc on economies all around the world, one of which was India, and economically, individuals are ill-equipped to deal with the economic stagnation. This unpreparedness is partly caused by the individual’s lack of financial literacy (Yuesti et al., Citation2020). Individuals with low financial literacy are usually oversensitive to informal financial institutions (Muñoz-Murillo et al., Citation2020) and resulting in high return costs (Meng & Choi, Citation2019). Financially illiterate individuals are unable to assess and make informed decisions about their personal finances (Chinen & Endo, Citation2012). This explains financial literacy as an important factor that can help in making an effective investment decision (Adil et al., Citation2022). Hence, this research also focuses on the importance of financial literacy, asking whether financially literate individuals are more willing to invest in the stock market during COVID-19 pandemic. According to Lusardi (Citation2019), individuals with high financial literacy make better investment decisions. For instance, the rate of interest is high on their savings accounts (Deuflhard et al., Citation2019), are more likely to own stocks (Van Rooij et al., Citation2011) and have better-diversified portfolios (von Gaudecker, Citation2015). In a study, Kersting et al. (Citation2015) stated that financial literate investors have high trust in financial institutions, which enhances their participation in the stock market. However, there is a lack of literature which explains that the importance of financial literacy regarding individual intention to participate in stock market and their trust in financial institutions, especially, during the phase of COVID19. Hence, authors incorporate financial literacy in the model to understand how financial literacy influences individual intention to participate in stock market. Overall, the research objective is to examine the association between trust in financial institution, financial literacy and investment intention among Indian stock market investors during COVID-19 pandemic. Accordingly, the following research questions will be explored in this study:

RQ1. Does trust in financial institution enhancing investor intention to participate in the Indian stock market during COVID-19 pandemic?

RQ2. Does financial literacy enhancing investor’s investor intention to participate in the Indian stock market during COVID-19 pandemic?

RQ3. What is the moderating and mediating role of trust in financial institution in the relationship between attitude, subjective norms perceived behavioral control and investment intention during COVID-19 pandemic?

RQ4. What is the moderating role of financial literacy in the relationship between trust in financial institution and investment intention during COVID-19 pandemic?

The present research seeks to answer these research questions by using data from 460 stock market investors and analyzing it using the structural equation modeling (SEM) technique. The present study tries to incorporate trust in financial institution and financial literacy in TPB to provide new insight in the literature of behavioral intention during the COVID‐19 pandemic. The research applies the mediation-moderation approach which helps to understand the importance of trust and financial literacy which enhance individual intention to participate in stock market during COVID-19 pandemic. Moreover, the study also helps to understand how trust in financial institution can be enhanced by increasing an individual’s level of financial literacy. To our knowledge, past studies on investors’ investment intentions have not captured this possibility.

2. Review of literature and hypotheses development

2.1. Brief description of the theory of planned behaviour (TPB)

The conceptual framework considered in the present study is based on TPB (Ajzen, Citation1991). TPB is a development of the theory of reasoned action (TRA) (Ajzen & Fishbein, Citation1975), which was created to address TRA’s limitations (Ajzen & Fishbein, Citation1975, Citation1980). TPB consists of three variables: attitude toward behavior (ATT), subjective norm (SN), and perceived behavioural control (PBC) (Ajzen, Citation1991). PBC is a new construct that was added to TRA to address its shortcomings (Ajzen, Citation1991). The theory is considered the most convincing model for analyzing individual behavior (Ajzen, Citation1991).

TPB confirms that people’s behavioural decision-making mechanism is valid. Behavioural finance is a novel arena. Therefore, it is reasonable to execute the TPB model in examining the investment intention which is particularly inadequate in the existing literature. The association between investment intention and the factors of the TPB model is enlightened further:

2.1.1. ATT and INT

Drawing on the TPB, attitude is a significant factor that influences behavioral intention. Attitude defines as “the degree to which a person has a favourable or unfavourable evaluation or appraisal of the behavior in question” (Ajzen, Citation1991). Attitude is determined as a process of fundamental beliefs, which can be altered by secondary information or observation (Abbasi et al., 2020a; Meng & Choi, Citation2019). Depending on these beliefs, individuals distinguish favorable or unfavorable attitudes regarding the results of their actions. Successively, attitudes affect the intentions to perform the behaviour. Most of the research has demonstrated that intention is positively influenced by attitude (Gopi & Ramayah, Citation2007; Phan & Zhou, Citation2014). In the current research, a person’s attitude regarding investing in the stock market might consider an essential element in establishing an investment intention to accomplish the ideal degree of financial stability (Adil et al., Citation2022). Prior research enlighten a significant impact of ATT on INT (Gamel et al., Citation2022; Mulyono, Citation2021; Natsir et al., Citation2021; Raut, Citation2020; Akhtar & Das, Citation2018; Maziriri et al., Citation2019; Alharbey & Van Hemmen, Citation2021. Ha, Citation2020; Ha et al., Citation2019; Raut, Citation2020; Raut and Das, 2017)

2.1.2. SN and INT

According to TPB model, SN is another component that determines behavioural intention. SN is defined as “the perceived social pressure to perform or not to perform the behavior” (Ajzen, Citation1991). In layman’s terms, SN refers to an individual’s feeling of social pressure from influential people to engage or not engage in a behavior (Adil et al., Citation2022). In TPB, subjective norms are revealed as a straight contributing variable to influence behavioural intention (Yee et al., Citation2022; Norisnita & Indriati, Citation2022; Gamel et al., Citation2022; Adil et al., Citation2022; Nugraha & Rahadi, Citation2021; Natsir et al., Citation2021; Prayoga et al., Citation2021; Khan et al., Citation2020; Ha, Citation2020). Therefore, the SN is considered a significant factor to inspect investors’ investment intention (Ha et al., Citation2019).

2.1.3. PBC and INT

PBC is the third variable under TPB. According to Ajzen (Citation1991) PBC defines as “the perceived ease or difficulty of performing the behavior”. In conclusion, the capacity to perform certain behaviour is associated with individual’s confidence in his or her ability to accomplish the behaviour (Ajzen, Citation1991). In a study Ibrahim and Arshad, Citation2018 results explained an insignificant association between PBC and investment intention while researchers like Adil et al. (Citation2022); Echchabi et al. (Citation2021); Natsir et al. (Citation2021); Raut (Citation2020); Raut and Das (Citation2017); Phan and Zhou (Citation2014); Raut et al. (Citation2018) reveals that PBC was positively associated with the investment intention regarding stock market participation. However, it is noteworthy to examine the influence of PBC on INT. Hence, the following hypotheses can be proposed

Hypotheses: ATT (H1), SN (H2), and PBC (H3) influences individual intention to invest in the stock market.

2.2. Addition of supplementary constructs into TPB

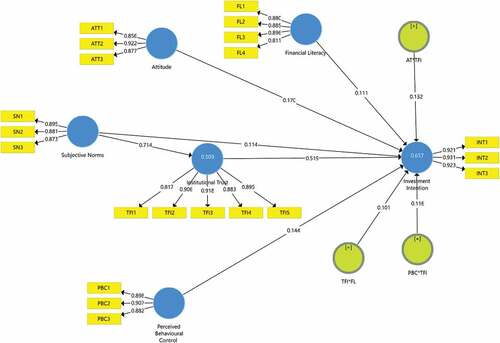

Adil et al. (Citation2022) suggest that specific-field variables can be incorporated in TPB to increase predictive capability. Further, TPB theory could enlighten the notion of investment intention with more explanatory power when conceptualized and instrumentalised along with other factors like traits, economic, and environmental factors (Adil et al., Citation2022; Herawati & Dewi, Citation2020; Raut, Citation2020). Similarly, two additional factors, i.e., trust in financial institutions (TFI) and financial literacy (FL) are incorporated in the basic variables of TPB to inspect the investment intention of investors during COVID-19 pandemic (see, Figure ). Literature of behavioural finance has exposed that trust in financial institutions (also known as institutional trust) (Kersting et al., Citation2015) and financial literacy is assumed to be an essential part in deciding investment behaviour (Adil et al., Citation2022; Raut, Citation2020).

2.3. Trust in financial institution (TFI)

Trust means “the willingness of a person to be vulnerable to the actions of another party based on the expectation that the other will perform a particular action important to the trust or, irrespective of the ability to monitor another party” (Mayer et al., Citation1995). In the present research, trust refers to the trust in financial institutions. Moreover, trust in financial institution is defined as the individual’s confidence in the financial institution’s integrity and dependability, and the belief that the financial institution has attributes that are beneficial to consumers. TFI is considered a significant element that enhances investor behavior (Engelhardt et al., Citation2021). It is well documented that an efficient and stable working of financial institutions impact on economic growth positively (Gurley & Shaw, Citation1955; Herwartz & Walle, Citation2014). However, trust is one of the key parameters which affect the working of financial institutions (Allen et al., Citation2012), as it is a crucial part of everyone’s life and also affects economic decisions (Baidoo & Akoto, Citation2019). Previous researchers explained the role of trust in making economic decisions (AJAYI, Citation2016; Delis & Mylonidis, Citation2015; Filipiak, Citation2016; Guiso et al., Citation2008b) and stock market participation (Kang et al., Citation2016; Georgarakos & Pasini, Citation2011b; Guiso et al., Citation2008a). In a study, Kang et al. (Citation2016) applied trust theory to examine funders’ motivations for investing in crowdfunding. Maziriri et al. (Citation2019) examined the influence of perceived risk elements on investor trust and the intention to invest in online trading platforms among students at a selected university in South Africa. The study found out that trust in online trading platforms enhances students’ intention to invest. Further, Alharbey and Van Hemmen (Citation2021) examined how trust effect investors intention in equity crowdfunding. The finding of the study specify that trust is the major factor that influence investors intention to invest. Existing literature reported the positive effect of trust on individuals’ attitude, perceived behaviour control, and behavioural intention (Ashraf et al., Citation2015; Hsu, Citation2013; Lin, Citation2011; Pavlou, Citation2002; Wu & Chen, Citation2005). However, previous research has not examined the relationship of trust with individuals’ behavioural intention toward stock market participation during COVID-19. Therefore, the following hypothesis is proposed:

H4: Trust in financial institution significantly influences investment intention during COVID-19.

2.3.1. Interaction effect of TFI on the association among ATT, PBC, and INT

The association between TFI and TPB can be investigated in a number of ways, in which trust is assumed as the common precursor of ATT, SN, and PBC. The current study tries to establish the interaction effect of trust in financial institution on the relationships between Attitude, PBC, and Investment intention. Trust can often be surmised on the trustworthiness displayed to other people or any organization (Robbins, Citation2016) and can be deduced as a deciding factor for decision-making or other associated market transactions (AJAYI, Citation2016). According to Wu and Chen (Citation2005) trust can be a perceptual resource that controls individual to gain control over stock market investment. When financial institution behaves according to the expectation of investors, the investors’ trust in financial institution increases and this will lead to enhances investors’ control on stock market investments. Hence, it can be stated that trust in financial institution may help in improving their level of PBC which thus would result in increasing the level of investment intention.

Trust is considered as a crucial behavioral belief that directly influences an individual’s attitude toward behavior (Hsu, Citation2013; Pavlou, Citation2002). As per the social cognitive theory, performance expectation refers to an individual’s assessment of a given behavior yielding a specific outcome, which is strongly tied to an individual’s attitude toward behavior (Bandura, Citation1986). According to Bachas et al. (Citation2016) trust in financial institutions plays an important role in stock market participation, because investors are unlikely to invest in the stock market if they do not trust the financial institution. Hence, it can be stated that individual attitude toward investment in the stock market can be enhanced as their trust in financial institutions increases. Therefore, the following hypotheses are proposed:

H5: TFI moderates the association amid PBC and investment intention

H6: TFI moderates the association amid ATT and investment intention

2.3.2. Mediation effect of TFI

According to previous literature, subjective norms play a significant part in deciding individual intention to execute a specific behavior (Phan & Zhou, Citation2014). According to (Ajzen, Citation1991), people’s intention of executing a specific behavior is affected by normative beliefs. This belief has been developed due to the trust of an individual on his/her referent group.

Beside subjective norms, trust is also an important psychological factor that influences individuals to execute a particular behaviour (Saparudin et al., Citation2020). Past literature also explains that there is a significant association between trust and subjective norms (Gong et al., Citation2019). Trust is considered as a basic pillar for an individual which leads to follow the advice of others. Trust and subjective norms go hand-in-hand (Gong et al., Citation2019). Hence, it is noteworthy to examine how trust mediates the relationship between subjective norms and investment intention. Therefore, the authors proposed the following hypothesis;

H7: TFI mediates the relationship between subjective norms and investment intention.

2.4. Financial literacy (FL)

John Adams of USA first coined the term Financial Literacy in the year 1787 when he addressed the then-President Thomas Jefferson, notifying the dire need for it in order to overcome the widespread confusion and distress prevailing in America, caused due to the mass ignorance of credit, along with the confusion prevailing over the nature of coins and their circulation (Corps, Citation2014). Following this phase, development in the field started gaining pace with Financial Literacy popping up every now and then, continuously being used by various researchers, organizations as well as the government, albeit differently (Hung et al., Citation2009). Remund (Citation2010) tried reviewing several studies since the year 2000 and concluded that research directed towards financial literacy was a humungous challenge due to the non-existence of a proper definition for financial literacy in the past literature. Some researchers believed that financial literacy was a supplementary term for financial knowledge (Bucher‐Koenen et al., Citation2017) whereas some other researchers felt that the basic knowledge of financial concepts and its concurrent ability of performing basic calculations was financial literacy (Lusardi, Citation2008a, b; Lusardi & Mitchell, Citation2011).

According to Mandell (Citation2008) financial literacy was the ability that could evaluate various upcoming and sophisticated financial instruments to make an analyzed decision for instrument choices as well as the long-term benefits that could be gained from its use. As per Lusardi and Tufano (Citation2015), debt literacy was a vital component of financial literacy and thus it had to do with the ability to perform decisions about debt and applying interest-compounding knowledge to actual life situations. Further, Organization for Economic Co-operation and Development (OECD) has defined FL as knowledge regarding financial concepts and risk, and the influential application of such knowledge to enforce efficient and effective decisions over a varied financial context to enhance the individuals as well as the society’s financial well-being, also promoting participation towards an economic life (OECD, Citation2016). Existing literature suggests that FL is a critical requirement for the processing of data that assists investors in making critical investment decisions that are in their best interests (Aren & Aydemir, Citation2015; Mandell, Citation2008) and enhance investor’s participation in the financial market (Thomas & Spataro, Citation2018; Van Rooij et al., Citation2011). It has been also established by the researcher and provide sufficient evidence to prove that FL significantly influences individual financial attitude (Akhtar & Das, Citation2018; Raut, Citation2020) and individual financial behavior to invest in the stock market (Hassan Al‐Tamimi & Anood Bin, Citation2009; Thomas & Spataro, Citation2018; Van Rooij et al., Citation2011).

H8: Financial Literacy significantly influences investment intention.

2.4.1. Moderation effect of financial literacy on the association between TFI and INT

Behavioural finance literature has shown that financial literacy plays a significant part in deciding investment intention (Raut, Citation2020) and investment decision-making (Akhtar & Das, Citation2018). Above all, researcher also explains how financial literacy enhances the individual investment intention and stock market participation (Adil et al., Citation2022; Raut, Citation2020; Sivaramakrishnan et al., Citation2017). So basically, financial literacy is considered as a significant factor in transforming individual investment intention. But financial literacy is not the only important factor that forecasts the investment intention of individuals. According to the literature on behaviour finance, trust in financial institution is also considered an important element in forecasting investment intention (Shim et al., Citation2008). The investment is viewed as an action that needs a sense of trust in financial institution while implementing the investment decision-making (Guiso, Sapienza, Zingales et al., Citation2008a).

According to the findings of the research which stated that there is a direct relationship between individual literacy and trust (Lee & Kim, Citation2020). In a study, Guiso et al., (Citation2008a) stated that better financial education about the stock market can reduce the negative effect of lack of trust. So, it can be stated that financial literate investors with the high level of trust in financial institution are more likely to invest in the stock market. Hence, in this research, authors assume that a high level of financial literacy enhances individual trust in financial institution and this leads to enhance individual investor intention to participate in stock market (Georgarakos & Pasini, Citation2011a). Therefore, the authors proposed the following hypothesis:

H9: Financial literacy moderates the relationship between TFI and INT

3. Research methodology

3.1. Questionnaire design and pre-testing

The questions used in the questionnaire were modified from the prior studies, consisting attitude—three items; subjective norm—three items (Chen, Citation2007), Taylor & Todd, Citation1995); PBC—three items (Bansal & Taylor, Citation2002; Taylor & Todd, Citation1995); behavioural intention—three items (Chen, Citation2007); trust in financial Institution five items—Moin et al. (Citation2017); financial literacy—four items (Raut, Citation2020). For responses, a 5-point Likert-type scale was provided. To acquire better evaluations, the scale building procedure followed suggestions to incorporate multi-item measures for each component (Churchill Jr, Citation1979). The questionnaire design was based on Dillman et al. (Citation2009) recommendations, which included asking basic and socio-demographic questions at the start. An expert team of one practitioner and four academic researchers assessed the questionnaire and certified its face validity. The questionnaire was put through a two-stage pilot test with 57 people, and small revisions were made to clarify some of the questions.

3.2. Data collection

This study is entirely based on original data gathered through the use of a descriptive survey approach. Primary data are important because it provides precise and real-time data that has never been utilised before. The convenience sampling approach was utilised first, followed by the snowball sampling method. In this study, data was acquired from Indian stock market investors using a well-structured questionnaire. To begin with, famous commercial firms in the cities of Delhi-NCR, Aligarh, Dehradun, Bangalore, Kishan Ganj, Malappuram, and Murshidabad were recognised. Second, with the assistance of brokerage business managers, a list of investors who invest in the Indian stock market and have at least two years of expertise has been compiled. Respondents were contacted in person and by e-mail and asked them to spread the word to other people in order to enhance the sample size. The total number of respondents who communicated was 650 while 560 questionnaires were circulated and received 488 filled-in questionnaires, but 28 responses were excluded due to their incomplete responses. Hence, a final 460 responses dataset was used for data analysis by excluding the serious outliers and data dismissal fault.

3.3. Multivariate normality

Using Web Power, the authors were able to obtain multivariate normality (Peng & Lai, Citation2012). The results of Mardia’s multivariate skewness and kurtosis exposed that the data is normal as the p-values were less than 0.05.

3.4. Data analysis

The current research considered “partial least squares-structural equation modelling (PLS-SEM)” to set up reliable and valid scales for every construct and to examine the causal association for theory verification. It concentrates on assessing and evaluating the associations amid the latent variables, allows to consider all path coefficients at the same time and results in more robust estimates of the structural model than covariance-based structural equation modeling (CB-SEM) (Ma et al., 2018). According to (Fornell & Bookstein, Citation1982), PLS-SEM, as a choice to CB-SEM, avoids two major issues: factor indeterminacy and unacceptable solutions. PLS-SEM is competent of modelling latent constructs with small-to-medium sample sizes under abnormal situations (Bagozzi & Yi, Citation1994; 12; Chin, Citation2010). Moreover, PLS-SEM can also be used with formative and/or reflective indicators (Rodríguez-Entrena et al., Citation2013). Therefore, PLS-SEM is suitable for use.

4. Results

4.1. Respondent profiling

After evaluating the collected data, the following respondent profile was created. Women made up only 38.70% of respondents, while men made up 61.30%. A post-graduate degree was held by 37.18 per cent of respondents, while a bachelor’s degree was held by 62.82 per cent; 59.56 per cent of respondents were single, while 40.44 per cent were married. 27 per cent of respondents were amid the ages of 18–30, 38 per cent were amid the ages of 31 and 40, 21 per cent were amid the ages of 41 and 50, and 14 per cent were over the age of 50; 29 per cent were salaried (see, Table ).

Table 2. Demographic profile of investors

Table 3. Reliability and validity

Table 4. Discriminant validity

Table 5. Path coefficients

4.2. Reliability and validity

The indicator reliability, construct reliability, convergent, and discriminant validity of the specified constructs were all evaluated in the measurement model, which was the first in SEM. Indicator reliability was measured on the basis of Cronbach’s alpha (CA), which had to be greater than 0.6. The findings demonstrate that the CA of all structures was acceptable. Hence, it confirms indicator reliability. In this study, Composite reliability (CR) and Cronbach’s alpha (CA) can be used to evaluate construct reliability. According to Hair Jr et al. (Citation2014) the value of CR should be more than 0.07 which implies that the construct is reliable. The measurement model’s results exhibited CR values larger than 0.7 (see, Table ), indicating appropriate construct reliability. Further, in the study, to test convergent validity, Average Variance Extracted (AVE) was taken into account. As per the suggestion of Fornell and Larcker, 1981, the AVE values should be more than 0.50. The findings demonstrated that all constructs had significant AVE values and convergent validity. In Table , the CR, CA, and AVE values are listed.

In this study, cross-loadings, heterotrait-monotrait, and the Fornell–Larcker criterion were taken into account to evaluate the discriminant validity. To analyse the cross-loadings of indicators, the construct’s initial discriminant validity was tested using another approach for testing discriminant validity (Hair Jr et al., Citation2014). The discriminant validity of constructs was estimated by considering the Fornell–Larcker criterion, which includes comparing the square root values of each construct’s AVE with the correlation between constructs. The approach of cross-loadings, on the other hand, advises that constructs’ outer loadings should be bigger than their related constructs’ loadings. With that, all construct’s discriminant validity can be justified. Table contains the findings of the Fornell–Larcker criterion, whereas Table has the findings of cross-loadings. Finally, the values of the variance inflation factor (VIF) were less than 5, indicating that multicollinearity was not present. According to the suggestion of (Kock, Citation2015), the present research examines complete collinearity diagnostics of all predicting variables. All the constructs are projected on the common variable and the value of VIF is less than 5 which displays that the single-source data is free of bias. There is no evidence of single-source bias in the full collinearity analysis.

Table 1. Loadings and cross-loading

4.3. Path analysis

The findings of the structural model exposed variables that affect individual investment intention (see, Table ). The present research shows the significant effects of attitude, subjective norms, trust in financial institution, and financial literacy on investment intention with a beta coefficient of 0.170, 0.114, 0.111, and 0.519, respectively (See, Figure ), hence, confirming hypotheses H1, H2, H4, H8; while the result for perceived control behavior displays an insignificant effect on investment intention with a beta coefficient 0.144, hence, rejecting hypothesis H3. According to the effect size (f2), the research construct displays a low effect size on INT ranging from 0.000 to 0.187. The blindfolding approach, according to Hair Jr et al. (Citation2014), demonstrated how the statistics of constructs were well observed by reconstructing the parameter estimations. Furthermore, the blindfolding process can only be used with endogenous constructs that have reflected indicators. The predictive significance of the model was determined at the individual level (single factor) using Q2 for all components. Table also represents the findings of the predictive relevance Q2. The blindfolding procedure results demonstrate that the model had a significant predictive relevance of 0.592 per cent, confirming the integration of the predictors regarding stock market intention to invest.

4.4. Mediating effect

In this study, trust in financial institution shows a partial mediating effect on the association between subjective norm and investment intention (see, Table ). The coefficient of subjective norms concerning investment intention was recorded at 0.371 (p-value = 0.000), hence, confirming hypothesis H7. This shows the mediating effect of trust in financial institution on the association amid subjective norms and investment intention.

Table 6. Mediation effect

4.5. Moderation analysis

In this research, trust in financial institution displays a moderation effect on the association amid attitude and investment intention with a beta coefficient of 0.132 (see, Table ). Hence, it indicates that trust in financial institution enhances investor’s attitude to invest in the stock market and confirms Hypothesis H5. Besides that, TFI also moderates the relationship between perceived control behavior with a beta coefficient of 0.116 (see, Table ), hence, confirming Hypothesis H6 this indicates that trust in financial institution increases investor control and this leads to enhance individual intention to participate in stock market. Furthermore, the study also stated FL moderates the association amid TFI and investment intention with a beta coefficient of 0.101 (see, Table ), hence, confirming Hypothesis H9. This indicates that investors’ financial literacy enhances investors’ trust in financial institution which increases in their intention to participate in the stock market.

Table 7. Moderation

5. Discussion

This research tries to comprehend the intention of individuals to invest in the Indian Stock Market during COVID-19 pandemic as this pandemic creates a situation of uncertainty which influences investor’s behavioral intention. The research investigates the influence of TPB model components that are ATT, SN, and PBC along with TFI and financial literacy on investment intention was assumed and judiciously inspected. The outcomes of current research displayed that all the key variables (i.e., ATT, SN and PBC) of the TPB model in predicting investors’ intentions were found to be significant. It was detected that among the fundamental constructs of TPB, ATT appeared to be the most influencing variable of investment intention which is similar to the results of Akhtar & Das (Citation2018), which showed that when it comes to investing in the stock market potential investors are more anxious with their attitudes (Adil et al., Citation2022; Gopi & Ramayah, Citation2007; Phan & Zhou, Citation2014). This might happen because during the phase of lockdown there is no opportunity for investment in offline businesses like shop holding, property, etc. but there is an opportunity in investing in the stock market, especially, in the growing business of pharmaceuticals. In this present research, the results also stated that subjective norms undoubtedly affect investment intentions. This could happen because, in addition to a global recession during COVID-19, there is occasionally good news, like government support programmes (such as PM announced a massive special economic package of Rs 20 lakh crore and it would be named “Atmanirbhar Bharat Abhiyan”), economic relief policy instruments, and commercial COVID-19 treatment hopes, all of which contribute to positive economic growth expectations (Qiu et al., Citation2020; Seven and Yılmaz, Citation2021) while the results of the study also enlighten the insignificant association of PBC with investment intension. This could happen because COVID-19 is the phase of uncertainty and there is nothing that is under the control of individuals. Hence, it reduces investors’ confidence regarding investment in the stock market during the phase of COVID-19.

Moreover, the study incorporates TFI in the model. The authors reveal that TFI significantly influences individual intention to invest in the financial market. Trust is the significant factor that enhances individual intention to participate in the financial market. Hence, the authors can conclude that as investor’s trust in financial market increases, their intention to participate in the financial market also increases during the phase of COVID-19. This might happen because trust reduces the feeling of uncertainty among investors. This research also investigates the moderation effect of TFI on the association amid ATT, PBC and INT. The results of the moderation effect depict that TFI moderates the association between ATT, PBC, and INT. Relying on the research findings, it can be demonstrated that when investor’s trust in financial market increases then the attitude toward investment and control of investors regarding stock market investment is also increasing during COVID-19 pandemic. As it has been also stated that PBC has an insignificant influence on investment intention but while adding trust as a moderator the relationship between PBC and investment intention turns significant. Hence, it can be stated that trust is a significant factor that helps individuals to build confidence and control their investment during this phase of uncertainty. Further, the authors also examine the mediation effect of trust on the association between SN and INT. The results of the study stated that TFI mediates the relationship between SN and INT. In simple words, the influence of SN on individual intention to invest in the stock market will be enhanced by keeping trust in financial institution in between. In other words, subjective norm directly influences investors’ intention to participate in stock market, but also influences trust in financial institution first, and then influences individual intention to invest in the stock market indirectly through trust in financial institution. Obviously, both direct and indirect effect of subjective norm on the investor’s intention to participate in stock market displays that subjective norm must consider while promoting stock market participation especially, during the phase of uncertainty.

The research also incorporates financial literacy in the model. The authors find FL as a strong influencing factor of individual INT and current research findings revealed in similarity with this idea. The study reveals that financially literate investors are more willing to participate in the stock market during COVID-19. This could happen because an individual with a high level of financial literacy is superior at collecting and evaluating information. Hence, it enhances individual intention to participate in the Indian stock market. Furthermore, the results for the moderation effect stated that the FL moderates the relationship between TFI and individual intention to participate in the stock market. It can be concluded that high financially literate investors are more likely to trust financial institutions and this will lead to enhancing their intention to participate in stock market during the phase of uncertainty, i.e., COVID-19. In simple words, as investor’s financial literacy increases, their trust in financial institutions also increases which enhances investor’s intention regarding stock market participation.

6. Implications and future scope of the study

6.1. Theoretical implications

The present research focuses on the behavioural measurements of individuals investing in the stock market. The results of current research suggest vital practical as well as theoretical suggestions for the individuals of various sections of society. Contribution concerning to the collection of knowledge current research notwithstanding the effective use of the TPB model delivers proof that how fine the factors of TPB along with TFI and FL can enlighten the intention of Indian investors to invest in financial market during COVID-19. It contributes to the knowledge of financial studies concerning investors’ decision-making in this pandemic. This contributes a reference for future research in developed countries concerning the socio-psychological dimensions of individual investors.

6.2. Practical implications

The present research generates a stream of inputs that may be used by both individuals and financial experts to make plans and investment decisions concerning India’s financial markets. A well-developed financial market with a diverse range of individual participation is critical for any economy’s progress. Because India is a developing country, there is a pressing need to enhance resources, which would in turn trigger financial needs and ensure the economy’s long-term stability. Despite having the world’s greatest savings rate, Indian investors are underrepresented in the stock market (Sivaramakrishnan et al., Citation2017). This may be due to ill financial literacy among Indian investors as only 24% of adults in India are financially literate (S&P Global FinLit Survey, 2019), and individuals are unable to understand market movement and information, stock rise and fall, the trend in the stock market, legal procedure, and other requirements for stock market participation, which is the primary reason for investors’ non-participation in the stock market. And during the phase of COVID-19, false news and rumor have been spread all over the place and in this situation investors’ knowledge helps them to take their financial decision. Hence, the study concludes that financial literacy can aid in enhancing individual behaviour to invest in financial market during the COVID-19 pandemic.

This study also suggests during this phase of uncertainty (i.e., the COVID-19 pandemic) trust plays a significant factor which enhances investors’ intention to participate. Authors suggest promoting trust and trusting behavior in financial institutions during COVID-19, as it is vital not only from the perspective of financial development but also to empower individuals to gain from institutional services as well as to guard them from possible negative effects (like financial frauds), which are more likely to be present beyond the regulatory limitations. Further, the research also suggests that better financial knowledge regarding the stock market can decrease the adverse effect of lack of trust (Guiso et al., Citation2008a). Financial education helps in intensifying investor’s financial attitude, trust in financial institutions, and also helps in making well-organized investment decisions in stock markets, which will in turn upsurge individual participation and overall economic development. Therefore, in current circumstances, the Security Exchange Board of India (SEBI), Financial Institutions (FI), and other government agencies should devise initiatives to improve financial literacy among citizens in this situation. The government should include an optional FL programme in the curriculum for college/university students to improve their FL skills and prepare them for future financial success. This education will not only help individuals to make decision rationally but also helps in developing trusting behavior among investors toward financial institutions.

7. Limitations

This study has several limitations, which we acknowledge. To begin with, because this study was cross-sectional in nature, longitudinal research would be preferable to capture changes and differences in human behaviour over time, especially during the highly volatile and uncertain scenario of COVID-19. Second, future research may focus on additional significant components that are not included in this model, such as cognitive ability, political orientation, religious and psychological aspects. Finally, we simply looked at individual individuals’ investing intentions. Future research could look into this issue from the perspective of professional investors/financial brokers to provide a more complete picture.

Disclosure statement

No potential conflict of interest was reported by the authors.

Additional information

Funding

Notes on contributors

Mohd Adil

Mohd Adil is currently pursuing a PhD from Department of Commerce, Aligarh Muslim University (AMU), Aligarh. His area of research is behavior finance and he studies financial literacy and its impact on investor’s decision-making. He completed his bachelor’s and master’s degree from Aligarh Muslim University. His expertise in primary data analysis techniques namely; structural equation modeling, mediation analysis, moderation analysis, and other statistical methods.

Yogita Singh

Yogita Singh is currently pursuing a PhD from Department of Commerce, Aligarh Muslim University (AMU), Aligarh. Her research areas are behaviour finance impact of financial literacy on investment decision-making. She completed her master’s degree from Aligarh Muslim University. Her expertise in primary data PLS-SEM, moderation and mediation analysis and other statistical methods

Mohammad Subhan

Mohammad Subhan currently pursuing a PhD from Department of Commerce, Aligarh Muslim University, Aligarh, India. His areas of research are energy economics, financial management and international trade. He completed his bachelor’s and master’s degree from Aligarh Muslim University. His expertise in secondary data analysis techniques mainly; NARDL model, ARDL model, wavelet coherence analysis and other econometrics models.

References

- Adil, M., Singh, Y., & Ansari, M. S. (2022). Does financial literacy affect investor’s planned behavior as a moderator? In Managerial Finance (Vol. 48 No. 9/10, pp. 1372–21). https://doi.org/10.1108/MF-03-2021-0130). Emerald Publishing Limited.

- AJAYI, K. F., 2016. Consumer perceptions and saving behaviour. Working Paper, Department of Economics and Center for Finance, Law and Policy, Boston University: https://pdfs.semanticscholar.org/bbe3/c7a90291bbad2c1be081ab939441d621b2ee.pdf

- Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, 50(2), 179–211. https://doi.org/10.1016/0749-5978(91)90020-T

- Ajzen, I., & Fishbein, M. (1975). A Bayesian analysis of attribution processes. Psychological Bulletin, 82(2), 261. https://doi.org/10.1037/h0076477

- Ajzen, I., & Fishbein, M. (1980). Understanding attitudes and predicting social behavior. Prentice –Hall.

- Akhtar, F., & Das, N. (2018). Predictors of investment intention in Indian stock markets: Extending the theory of planned behaviour. International Journal of Bank Marketing. https://doi.org/10.1108/IJBM-08-2017-0167

- Alharbey, M., & Van Hemmen, S. (2021). Investor intention in equity crowdfunding. Does trust matter? Journal of Risk and Financial Management, 14(2), 53. https://doi.org/10.3390/jrfm14020053

- Allen, F., Demirguc-Kunt, A., Klapper, L., & Peria, M. M. (2012). . Policy Research Working Paper (pp. 6290). World Bank, Washington, DC.

- Amromin, G., & Sharpe, S. A. (2009). Expectations of risk and return among household investors: Are their Sharpe ratios countercyclical? FEDS Working Paper No. 2008-17. Available at SSRN 1327134.

- Anser, M. K., Khan, M. A., Zaman, K., Nassani, A. A., Askar, S. E., Abro, M. M. Q., & Kabbani, A. (2021). Financial development during COVID-19 pandemic: The role of coronavirus testing and functional labs. Financial Innovation, 7(1), 1–13. https://doi.org/10.1186/s40854-021-00226-4

- Aren, S., & Aydemir, S. D. (2015). The moderation of financial literacy on the relationship between individual factors and risky investment intention. International Business Research, 8(6), 17. https://doi.org/10.5539/ibr.v8n6p17

- Ashraf, S., Robson, J., & Sekhon, Y. (2015). Consumer trust and confidence in the compliance of Islamic banks. Journal of Financial Services Marketing, 20(2), 133–144. https://doi.org/10.1057/fsm.2015.8

- Bachas, P., Gertler, P., Higgins, S., & Seira, E. (2016). Banking on trust: How debit cards help the poor to save more. In documento sin publicar. Documento sin publicar. https://economics.yale.edu/sites/default/files/bachasgertlerhigginsseira_v29.pdf

- Bagozzi, R. P., & Yi, Y. (1994). Advanced topics in structural equation models. In Advanced methods of marketing research (pp. 151). Blackwell Business, Cambridge, Mass., 1994.

- Baidoo, S. T., & Akoto, L. (2019). Does trust in financial institutions drive formal saving? Empirical evidence from Ghana. International Social Science Journal, 69(231), 63–78. https://doi.org/10.1111/issj.12200

- Bandura, A. (1986). The explanatory and predictive scope of self-efficacy theory. Journal of Social and Clinical Psychology, 4(3), 359–373. https://doi.org/10.1521/jscp.1986.4.3.359

- Bansal, H. S., & Taylor, S. F. (2002). Investigating interactive effects in the theory of planned behavior in a service-provider switching context. Psychology and Marketing, 19(5), 407–425. https://doi.org/10.1002/mar.10017

- Benjamin, D. J., Brown, S. A., & Shapiro, J. M. (2013). Who is ‘behavioral’? Cognitive ability and anomalous preferences. Journal of the European Economic Association, 11(6), 1231–1255. https://doi.org/10.1111/jeea.12055

- Bucher‐Koenen, T., Lusardi, A., Alessie, R., & Van Rooij, M. (2017). How financially literate are women? An overview and new insights. Journal of Consumer Affairs, 51(2), 255–283. https://doi.org/10.1111/joca.12121

- Chen, M. F. (2007). Consumer attitudes and purchase intentions in relation to organic foods in Taiwan: Moderating effects of food-related personality traits. Food Quality and Preference, 18(7), 1008–1021. https://doi.org/10.1016/j.foodqual.2007.04.004

- Chin, W. W. (2010). How to write up and report PLS analyses. In Wang, H. (Ed.), Handbook of partial least squares (pp. 655–690). Springer, Berlin, Heidelberg. 978-3-540-32827-8. https://doi.org/10.1007/978-3-540-32827-8_29

- Chinen, K., & Endo, H. (2012). Effects of attitude and background on personal financial ability: A student survey in the United States. International Journal of Management, 29(1), 33.

- Christelis, D., Georgarakos, D., & Haliassos, M. (2011). Stockholding: Participation, location, and spillovers. Journal of Banking & Finance, 35(8), 1918–1930. https://doi.org/10.1016/j.jbankfin.2010.12.012

- Churchill Jr, G. A. (1979). A paradigm for developing better measures of marketing constructs. Journal of Marketing Research, 16(1), 64–73. https://doi.org/10.1177/002224377901600110

- Ciotti, M., Ciccozzi, M., Terrinoni, A., Jiang, W. C., Wang, C. B., & Bernardini, S. (2020). The COVID-19 pandemic. Critical Reviews in Clinical Laboratory Sciences, 57(6), 365–388. https://doi.org/10.1080/10408363.2020.1783198

- Corps, F. (2014). History of Financial Literacy–The First 200 Years. Retrieved July, 24, 2015.

- Curcuru, S., Heaton, J., Lucas, D., & Moore, D. (2010). Heterogeneity and portfolio choice: Theory and evidence. In Ziemba, William T. (Ed.), Handbook of financial econometrics: Tools and techniques (pp. 337–382). North-Holland.

- Delis, M. D., & Mylonidis, N. (2015). Trust, happiness, and households’ financial decisions. Journal of Financial Stability, 20, 82–92. https://doi.org/10.1016/j.jfs.2015.08.002

- Deuflhard, F., Georgarakos, D., & Inderst, R. (2019). Financial literacy and savings account returns. Journal of the European Economic Association, 17(1), 131–164. https://doi.org/10.1093/jeea/jvy003

- Dillman, D. A., Phelps, G., Tortora, R., Swift, K., Kohrell, J., Berck, J., & Messer, B. L. (2009). Response rate and measurement differences in mixed-mode surveys using mail, telephone, interactive voice response (IVR) and the Internet. Social Science Research, 38(1), 1–18. https://doi.org/10.1016/j.ssresearch.2008.03.007

- Echchabi, A., Omar, M. M. S., & Ayedh, A. M. (2021). Factors influencing Bitcoin investment intention: The case of Oman. International Journal of Internet Technology and Secured Transactions, 11(1), 1–15. https://doi.org/10.1504/IJITST.2021.112867

- Engelhardt, N., Krause, M., Neukirchen, D., & Posch, P. N. (2021). Trust and stock market volatility during the COVID-19 crisis. Finance Research Letters, 38, 101873. https://doi.org/10.1016/j.frl.2020.101873

- Filipiak, U. (2016). Trusting financial institutions: Out of reach, out of trust? The Quarterly Review of Economics and Finance, 59, 200–214. https://doi.org/10.1016/j.qref.2015.06.006

- Fornell, C., & Bookstein, F. L. (1982). Two structural equation models: LISREL and PLS applied to consumer exit-voice theory. Journal of Marketing, 19, 440–452. https://doi.org/10.1177/002224378201900406

- Fukuyama, F. (2020). The pandemic and political order. Foreign Aff, 99, 26. https://heinonline.org/HOL/LandingPage?handle=hein.journals/fora99&div=97&id=&page=

- Gamel, J., Bauer, A., Decker, T., & Menrad, K. (2022). Financing wind energy projects: An extended theory of planned behavior approach to explain private households’ wind energy investment intentions in Germany. Renewable Energy, 182, 592–601. https://doi.org/10.1016/j.renene.2021.09.108

- Gaudecker, H. M. V. (2015). How does household portfolio diversification vary with financial literacy and financial advice? The Journal of Finance, 70(2), 489–507. https://doi.org/10.1111/jofi.12231

- Georgarakos, D., & Pasini, G. (2011a). Trust, sociability, and stock market participation. Review of Finance, 15(4), 693–725. https://doi.org/10.1093/rof/rfr028

- Georgarakos, D., & Pasini, G. (2011b). Trust, sociability, and stock market participation. Review of Finance, 15(4), 693–725. https://doi.org/10.1093/rof/rfr028

- Gong, Z., Han, Z., Li, X., Yu, C., & Reinhardt, J. D. (2019). Factors influencing the adoption of online health consultation services: The role of subjective norm, trust, perceived benefit, and offline habit. In Buttigieg, Sandra C. (Ed.), Frontiers in public health (pp. 286). Frontiers.

- Gopi, M., & Ramayah, T. (2007). Applicability of theory of planned behavior in predicting intention to trade online: Some evidence from a developing country. International Journal of Emerging Markets, 2(4), 348–360. https://doi.org/10.1108/17468800710824509

- Graham, J. R., Harvey, C. R., & Huang, H. (2009). Investor competence, trading frequency, and home bias. Management Science, 55(7), 1094–1106. https://doi.org/10.1287/mnsc.1090.1009

- Guiso, L., Sapienza, P., & Zingales, L. (2008a). Social capital as good culture. Journal of the European Economic Association, 6(2–3), 295–320. https://doi.org/10.1162/JEEA.2008.6.2–3.295

- Guiso, L., Sapienza, P., & Zingales, L. (2008b). Trusting the stock market. the Journal of Finance, 63(6), 2557–2600. https://doi.org/10.1111/j.1540-6261.2008.01408.x

- Gurley, J. G., & Shaw, E. S. (1955). Financial aspects of economic development. The American Economic Review, 45(4), 515–538. https://www.jstor.org/stable/pdf/1811632

- Ha, N. (2020). The impact of perceived risk on consumers’ online shopping intention: An integration of TAM and TPB. Management Science Letters, 10(9), 2029–2036. https://doi.org/10.5267/j.msl.2020.2.009

- Hair Jr, J. F., Sarstedt, M., Hopkins, L., & Kuppelwieser, V. G. (2014). An emerging tool in business research. In Partial least squares structural equation modeling (PLS-SEM): An emerging tool in business research. European business review (Vol. 26 No. 2, pp. 106–121). https://doi.org/10.1108/EBR-10-2013-0128

- Ha, N., Nguyen, T., Nguyen, T. P. L., & Nguye, T. D. (2019). The effect of trust on consumers’ online purchase intention: An integration of TAM and TPB. Management Science Letters, 9(9), 1451–1460. https://doi.org/10.5267/j.msl.2019.5.006

- Hassan Al‐Tamimi, H. A., & Anood Bin, K. A. (2009). Financial literacy and investment decisions of UAE investors. Journal of Risk Finance, 10(5), 500–516. https://doi.org/10.1108/15265940911001402

- Herawati, N. T., & Dewi, N. W. Y. (2020, January). The Effect of Financial Literacy, Gender, and Students’ Income on Investment Intention: The Case of Accounting Students. In 3rd International Conference on Innovative Research Across Disciplines 394, pp. 133–138).

- Herwartz, H., & Walle, Y. M. (2014). Determinants of the link between financial and economic development: Evidence from a functional coefficient model. Economic Modelling, 37, 417–427. https://doi.org/10.1016/j.econmod.2013.11.029

- Hsu, C.-L., Judy Chuan-Chuan Lin, and Hsiu-Sen Chiang. 2013. “The Effects of Blogger Recommendations on Customers’ Online Shopping Intentions.” Internet Research

- Hua, J., & Shaw, R. (2020). Corona virus (Covid-19)“infodemic” and emerging issues through a data lens: The case of China. International Journal of Environmental Research and Public Health, 17(7), 2309. https://doi.org/10.3390/ijerph17072309

- Hung, A., Parker, A. M., & Yoong, J. (2009). Defining and measuring financial literacy. RAND Working Paper Series WR-708. https://deliverypdf.ssrn.com/delivery.php?ID=424069105013092070073019084005106112050024004033095068067066004076107068117078106022028097000118014120007090113111065111101006029055059029004089127085107125015069027026037099003068093026074119108086065121121085117011108006010101001028104067022125006&EXT=pdf&INDEX=TRUE

- Ibrahim, Y., & Arshad, I. (2018). Examining the impact of product involvement, subjective norm and perceived behavioral control on investment intentions of individual investors in Pakistan. Investment Management and Financial Innovations, 14(4), 181–193. https://doi.org/10.21511/imfi.14(4).2017.15

- Ichev, R., & Marinč, M. (2018). Stock prices and geographic proximity of information: Evidence from the Ebola outbreak. International Review of Financial Analysis, 56, 153–166. https://doi.org/10.1016/j.irfa.2017.12.004

- Jaffer, S., Morris, N., Sawbridge, E., & Vines, D. (2014). How changes to the financial services industry eroded trust. In Morris, Nicholas., & Vines, David. (Eds.), Capital Failure: Rebuilding Trust in Financial Services (pp. 32–64). Oxford University Press.

- Kang, M., Gao, Y., Wang, T., & Zheng, H. (2016). Understanding the determinants of funders’ investment intentions on crowdfunding platforms: A trust-based perspective”. Industrial Management & Data Systems, 116(8), 1800–1819. https://doi.org/10.1108/IMDS-07-2015-0312

- Kaustia, M., & Torstila, S. (2011). Stock market aversion? Political preferences and stock market participation. Journal of Financial Economics, 100(1), 98–112. https://doi.org/10.1016/j.jfineco.2010.10.017

- Kersting, L. M., Marley, R. N., & Mellon, M. J. (2015). The association between financial literacy and trust in financial markets among novice nonprofessional investors. Academy of Accounting and Financial Studies Journal, 19(3), 201.

- Khan, O., Daddi, T., Slabbinck, H., Kleinhans, K., Vazquez-Brust, D., & De Meester, S. (2020a). “Assessing the determinants of intentions and behaviors of organizations towards a circular economy for plastics”. Resources, Conservation and Recycling, 163, 105069. https://doi.org/10.1016/j.resconrec.2020.105069

- Kock, N. (2015). Common method bias in PLS-SEM: A full collinearity assessment approach. International Journal of e-Collaboration (Ijec), 11(4), 1–10. https://doi.org/10.4018/ijec.2015100101

- Kowalewski, O., & Śpiewanowski, P. (2020). Stock market response to potash mine disasters. Journal of Commodity Markets, 20, 100124. https://doi.org/10.1016/j.jcomm.2020.100124

- Lee, S. T., & Kim, K. T. (2020). Propensity to plan, financial knowledge, overconfidence, and credit card management behaviors of Millennials. Family and Consumer Sciences Research Journal, 49(2), 123–143. https://doi.org/10.1111/fcsr.12381

- Lin, H. F. (2011). An empirical investigation of mobile banking adoption: The effect of innovation attributes and knowledge-based trust. International Journal of Information Management, 31(3), 252–260. https://doi.org/10.1016/j.ijinfomgt.2010.07.006

- Lusardi, A. (2008). Financial literacy: An essential tool for informed consumer choice? (No. w14084). National Bureau of Economic Research.

- Lusardi, A. (2019). Financial literacy and the need for financial education: Evidence and implications. Swiss Journal of Economics and Statistics, 155(1), 1–8. https://doi.org/10.1186/s41937-019-0027-5

- Lusardi, A., & Mitchell, O. S. (2011). Financial literacy around the world: An overview. Journal of Pension Economics & Finance, 10(4), 497–508. https://doi.org/10.1017/S1474747211000448

- Lusardi, A., & Tufano, P. (2015). Debt literacy, financial experiences, and overindebtedness. Journal of Pension Economics & Finance, 14(4), 332–368. https://doi.org/10.1017/S1474747215000232

- Mandell, L. (2008). Financial literacy of high school students. In Xiao, Jing Jian (Ed.), Handbook of consumer finance research (pp. 163–183). Springer.

- Mayer, R. C., Davis, J. H., & Schoorman, F. D. (1995). An integrative model of organizational trust. Academy of Management Review, 20(3), 709–734. https://doi.org/10.2307/258792

- Maziriri, E. T., Mapuranga, M., & Madinga, N. W. (2019). Navigating selected perceived risk elements on investor trust and intention to invest in online trading platforms. Journal of Economic and Financial Sciences, 12(1), 1–14. https://doi.org/10.4102/jef.v12i1.434

- Meng, B., & Choi, K. (2019). Tourists’ intention to use location-based services (LBS): Converging the theory of planned behavior (TPB) and the elaboration likelihood model (ELM). International Journal of Contemporary Hospitality Management, 31(8), 3097–3115. https://doi.org/10.1108/IJCHM-09-2018-0734

- Moin, S. M. A., Devlin, J. F., & McKechnie, S. (2017). Trust in financial services: The influence of demographics and dispositional characteristics. Journal of Financial Services Marketing, 22(2), 64–76. https://doi.org/10.1057/s41264-017-0023-8

- Mulyono, K. B. (2021). Decision Model for Saving Stocks Based on TPB and Financial Literacy. Dinamika Pendidikan, 16(1), 94–102. https://doi.org/10.15294/dp.v16i1.29164

- Muñoz-Murillo, M., Álvarez-Franco, P. B., & Restrepo-Tobón, D. A. (2020). The role of cognitive abilities on financial literacy: New experimental evidence. Journal of Behavioral and Experimental Economics, 84, 101482. https://doi.org/10.1016/j.socec.2019.101482

- Natsir, K., Arifin, A. Z., & Bangun, N. (2021, August). The Influence of Product Knowledge and Perceived Risk on Investment Intention of Stock Investors in the Covid-19 Pandemic Era. In International Conference on Economics, Business, Social, and Humanities (ICEBSH 2021) (pp. 473–479). Atlantis Press.

- Norisnita, M., & Indriati, F. (2022). Application of Theory of Planned Behavior (TPB) in Cryptocurrency Investment Prediction: A Literature Review. Economics and Business Quarterly Reviews, 5(2), 181–188. https://doi.org/10.31014/aior.1992.05.02.424

- Nugraha, B. A., & Rahadi, R. A. (2021). Analysis of young generations toward stock investment intention: A preliminary study in an emerging market. Journal of Accounting and Investment, 22(1), 80–103. https://doi.org/10.18196/jai.v22i1.9606

- OECD. (2016). Financial Education in Europe: Trends and Recent Developments. OECD Publishing. https://doi.org/10.1787/9789264254855-en

- Ortmann, R., Pelster, M., & Wengerek, S. T. (2020). COVID-19 and investor behavior. Finance Research Letters, 37, 101717. https://doi.org/10.1016/j.frl.2020.101717

- Pavlou, P. A. (2002). Institution-based trust in interorganizational exchange relationships: The role of online B2B marketplaces on trust formation. The Journal of Strategic Information Systems, 11(3–4), 215–243. https://doi.org/10.1016/S0963-8687(02)00017-3

- Peng, D. X., & Lai, F. (2012). Using partial least squares in operations management research: A practical guideline and summary of past research. Journal of Operations Management, 30(6), 467–480. https://doi.org/10.1016/j.jom.2012.06.002

- Phan, K. C., & Zhou, J. (2014). Factors influencing individual investor behavior: An empirical study of the Vietnamese stock market. American Journal of Business and Management, 3(2), 77–94. https://doi.org/10.11634/216796061706527

- Polkovnichenko, V. (2004). Limited stock market participation and the equity premium. Finance Research Letters, 1(1), 24–34. https://doi.org/10.1016/j.frl.2003.11.001

- Prayoga, P. R., Wirama, D. G., & Yasa, G. W. (2021). Intention to invest in peer to peer lending: Theory of planned behaviour approach. PalArch’s Journal of Archaeology of Egypt/Egyptology, 18(10), 2415–2427. https://archives.palarch.nl/index.php/jae/article/view/10185/9392

- Puri, M., & Robinson, D. T. (2007). Optimism and economic choice. Journal of Financial Economics, 86(1), 71–99. https://doi.org/10.1016/j.jfineco.2006.09.003

- Qiu, B., Yu, J., & Zhang, K. (2020). Trust and stock price synchronicity: Evidence from China. Journal of Business Ethics, 167(1), 97–109. https://doi.org/10.1007/s10551-019-04156-1

- Raut, R. K. (2020). “Past behaviour, financial literacy and investment decision-making process of individual investors”. International Journal of Emerging Markets, 15(6), 1243–1263. https://doi.org/10.1108/IJOEM-07-2018-0379

- Remund, D. L. (2010). Financial literacy explicated: The case for a clearer definition in an increasingly complex economy. Journal of Consumer Affairs, 44(2), 276–295. https://doi.org/10.1111/j.1745-6606.2010.01169.x

- Robbins, B. G. (2016). What is trust? A multidisciplinary review, critique, and synthesis. Sociology Compass, 10(10), 972–986. https://doi.org/10.1111/soc4.12391

- Rodríguez-Entrena, M., Salazar-Ordóñez, M., & Sayadi, S. (2013). Applying partial least squares to model genetically modified food purchase intentions in southern Spain consumers. Food Policy, 40, 44–53. https://doi.org/10.1016/j.foodpol.2013.02.001

- Saparudin, M., Rahayu, A., Hurriyati, R., & Sultan, M. A. (2020). Exploring the role of trust in mobile-banking use by Indonesian customer using unified theory of acceptance and usage technology. International Journal of Financial Research, 11(2), 51–60. https://doi.org/10.5430/ijfr.v11n2p51

- Seven, Ü., & Yılmaz, F. (2021). World equity markets and COVID-19: Immediate response and recovery prospects. Research in International Business and Finance, 56, 101349.

- Shehata, S. M., Abdeljawad, A. M., Mazouz, L. A., Aldossary, L. Y. K., Alsaeed, M. Y., & Noureldin Sayed, M. (2021). The moderating role of perceived risks in the relationship between financial knowledge and the intention to invest in the Saudi Arabian stock market. International Journal of Financial Studies, 9(1), 9. https://doi.org/10.3390/ijfs9010009

- Shim, G. Y., Lee, S. H., & Kim, Y. M. (2008). How investor behavioral factors influence investment satisfaction, trust in investment company, and reinvestment intention. Journal of Business Research, 61(1), 47–55. https://doi.org/10.1016/j.jbusres.2006.05.008

- Singh Y, Adil M and Haque S M. (2022). Personality traits and behaviour biases: the moderating role of risk-tolerance. Qual Quant. https://doi.org/10.1007/s11135-022-01516-4

- Sivaramakrishnan, S., Srivastava, M., & Rastogi, A. (2017). Attitudinal factors, financial literacy, and stock market participation. International Journal of Bank Marketing, 35(5), 818–841. https://doi.org/10.1108/IJBM-01-2016-0012

- Taylor, S., & Todd, P. (1995). An integrated model of waste management behavior. Environment and Behavior, 27(5), 603–663. https://doi.org/10.1177/0013916595275001

- Thomas, A., & Spataro, L. (2018). Financial literacy, human capital and stock market participation in Europe. Journal of Family and Economic Issues, 39(4), 532–550. https://doi.org/10.1007/s10834-018-9576-5

- van Der Cruijsen, C., de Haan, J., & Roerink, R. (2021). Financial knowledge and trust in financial institutions. Journal of Consumer Affairs, 55(2), 680–714. https://doi.org/10.1111/joca.12363

- van Esterik-Plasmeijer, P. W., & Van Raaij, W. F. (2017). Banking system trust, bank trust, and bank loyalty. International Journal of Bank Marketing, 35(1), 97–111. https://doi.org/10.1108/IJBM-12-2015-0195

- Van Rooij, M., Lusardi, A., & Alessie, R. (2011). Financial literacy and stock market participation. Journal of Financial Economics, 101(2), 449–472. https://doi.org/10.1016/j.jfineco.2011.03.006

- Vissing-Jørgensen, A., & Attanasio, O. P. (2003). Stock-market participation, inter temporal substitution, and risk-aversion. American Economic Review, 93(2), 383–391. https://doi.org/10.1257/000282803321947399

- Wu, L., & Chen, J. L. (2005). An extension of trust and TAM model with TPB in the initial adoption of on-line tax: An empirical study. International Journal of Human-Computer Studies, 62(6), 784–808. https://doi.org/10.1016/j.ijhcs.2005.03.003

- Yee, C. H., Al-Mulali, U., & Ling, G. M. (2022). Intention towards renewable energy investments in Malaysia: Extending theory of planned behaviour. Environmental Science and Pollution Research, 29(1), 1021–1036. https://doi.org/10.1007/s11356-021-15737-x

- Yuesti, A., Ni, W. R., & Suryandari, N. N. A. (2020). Financial literacy in the COVID-19 pandemic: Pressure conditions in Indonesia. Entrepreneurship and Sustainability Issues, 8(1), 884. https://doi.org/10.9770/jesi.2020.8.1(59)