?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.Abstract

Background

Most economic evaluation models compare a new patented drug (NPRx) to a generic comparator. Drug costs within these models are usually limited to the retail cost of both drugs at the time of model conception. However, the retail cost of the NPRx is expected to drop once generic versions of this molecule are introduced following the expiration of the NPRx’s patent. The objective of this study was to examine the impact on the incremental cost-effectiveness ratio (ICER) of the future introduction of lower-cost generic versions of the NPRx within the model’s time horizon.

Methods

We examined the impact of this parameter with the use of two approaches: 1) a mathematical proof identifying its impact on the NPRx’s ICER; and 2) applying this parameter to a previously published economic model comparing a NPRx to a generic comparator and identifying what would have been the NPRx’s ICER had this model considered this parameter.

Results

As expected, both the mathematical proof and the application to the previously published economic model showed that considering the future introduction of lower-cost generic versions of the NPRx within the model’s time horizon lowers the NPRx’s ICER. The timing of the future entry of lower-cost generic molecules, their relative price compared to that of the patented version, and the discount rate applied to future costs all influenced the results.

Conclusion

An ICER estimated within economic evaluations comparing NPRx to generic comparators which ignore the future introduction of lower-cost generic versions of the NPRx within the model’s time horizon will tend to be overestimated. Inclusion of this parameter should be considered within future economic evaluations.

Background

Many drug funding agencies require that drug reimbursement submissions contain an economic evaluation. They normally compare the incremental cost-effectiveness ratio (ICER) of a new drug that is still under patent to a comparator drug, which may either be a generic or a patented drug at the time of the drug reimbursement submission (for the purpose of this paper, we assumed the existence of a single comparator despite the fact that multiple comparators may exist).

Although each economic evaluation is unique, both the new drug and the comparator drug costs are always included. These costing parameters are generally modeled as fixed-in-time parameters which are based on the cost of each drug at the time of model conception.Citation1 However, such an assumption does not truly reflect reality, as the cost of a patented drug drops once generic versions of the molecule are introduced. As previously shown by Shih et al,Citation2 economic evaluations that ignore this point will tend to overestimate the lifetime cost of a drug which is still under patent at the time of the economic evaluation. In order to more accurately reflect actual practice, Canadian and international guidelines recommend that the future introduction of lower-cost generic versions of patented molecules, if they are expected to appear within the examined time horizon, be considered within economic evaluations.Citation3,Citation4 Although international guidelines remain vague on the impact of omitting this possibility,Citation3 Canadian guidelines clearly state that without considering the future introduction of lower-cost generic versions of the comparator drug, the estimated ICER will be underestimated.Citation4 Such wording seems to ignore the fact that generic versions of a new patented drug may also be introduced within the examined time horizon, as many economic evaluations are conducted under a lifetime horizon which frequently exceeds its relevant patent period (ie, from the moment when a new drug is reimbursed until the end of its patent life) as well.

The objective of this paper is to examine the impact of failing to account for the future introduction of lower-cost generic versions of a new patented drug in hopes that it would be included by health economists within future economic evaluations to more accurately reflect the lifetime cost of both treatments. First, we highlight how failing to account for the future introduction of lower-cost generic versions of a new drug may overestimate its total lifetime cost by means of a mathematical proof and further examine which parameters will influence its impact. Next, we present the impact of failing to account for the future introduction of lower-cost generic versions of a new drug on the results of a previously published Canadian economic evaluation.Citation5 Lastly, we conclude this paper by highlighting several limits associated with modeling the future introduction of lower-cost generic versions of both drugs within economic evaluations.

Mathematical framework

We first revisit the mathematical framework originally presented by Shih et alCitation2 from which we examine the impact of considering the future introduction of lower-cost generic versions of a new patented drug when the generic versions of the comparator drug are available.

Let T = end of the model’s time horizon; C1(t) = mean total cost associated with the new drug at time t; C0(t) = mean total cost associated with the comparator drug at time t; ND1(t) = mean nondrug costs of the new drug at time t; ND0(t) = mean nondrug costs of the comparator drug at time t; P1(t) = price of the new drug at time t; P0(t) = price of the comparator drug at time t; Q1(t) = mean total quantity of the new drug consumed at time t; Q0(t) = mean total quantity of the comparator drug consumed at time t; E1(t) = mean effectiveness of the new drug at time t; E0(t) = mean effectiveness of the comparator drug at time t; r = discount rate; j=1 if new drug or 0 if the comparator drug; ∆C = incremental cost when ignoring the future introduction of lower-cost generic versions; ∆C′ = incremental cost when considering the future introduction of lower-cost generic versions; ∆E = incremental effectiveness when ignoring the future introduction of lower-cost generic versions; ∆E′ = incremental effectiveness when considering the future introduction of lower-cost generic versions; ICER = ICER when ignoring the future introduction of lower-cost generic versions; and ICER′ = ICER when considering the future introduction of lower-cost generic versions.

If we ignore the future introduction of lower-cost generic versions, the real prices of the new and comparator drugs will stay constant over time (ie, Pj(t) = Pj). Therefore, when we ignore the future introduction of lower-cost generic versions, ∆C, ∆E, and the ICER can be estimated with the following formulas:

(1)

(2)

(3)

Now, let us assume that generic versions of both drugs are introduced within the examined time horizon. For simplicity reasons, we assume that the price of the generic version (PjG) is lower than the price of the patented version (PjP) and that all patients switch to the generic version when it becomes available. Finally, let us assume that the time of generic drug entry differs for each drug. (T1* represents the time of generic drug entry for the new drug and T0* represents the time of generic drug entry for the comparator drug.) Under such settings the price of each drug can be defined as:

(4)

(5)

If we assume that the generic and the patented versions of a same molecule are as effective, then ∆E′ = ∆E. However, since both prices differ, ∆C′ will be given by:

(6)

The difference between ∆C and ∆C′ can be estimated with the following formula:

(7)

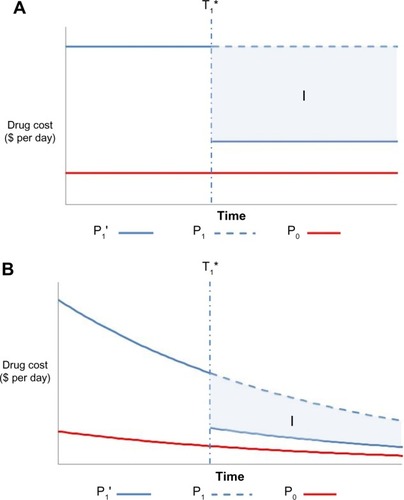

If the comparator drug is already a generic drug (P0 = P0P), then EquationEquation 7(7) can be simplified to:

(8)

As can be seen within EquationEquation 8(8) , in the context where the comparator drug is already generic, since Q1(t) is nonnegative and P1G is expected to be less than P1P, ∆C will be overestimated (ie, ∆C − ∆C′ > 0). The degree of overestimation will depend on: 1) the timing of the introduction of generic versions of the new drug; 2) the differential price between the patented version and generic version of the new drug; and 3) the discount rate applied to future costs (). As expected, under such settings, ICER′ will tend to be lower than the ICER:

(9)

Figure 1 Undiscounted (A) and discounted (B) price of the two drug comparators over the model’s time horizon when the comparator drug is already a generic drug.

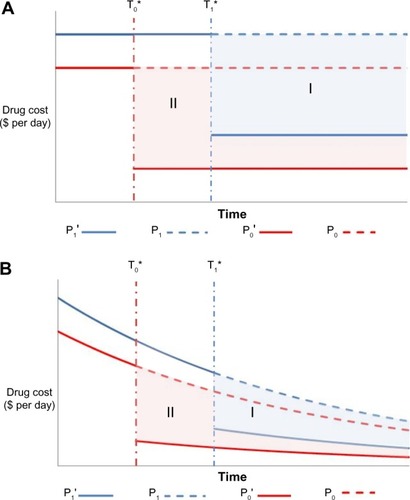

However, if both the new and the comparator drugs are patented drugs and if

(10) then ∆C′ > ∆C and ICER′ > ICER. As in the previous setting, the difference between ∆C’ and ∆C will depend on the timing of the introduction of generic versions of each drug (T0* and T1*), the differential price between the patented version and generic version of each drug, and the discount rate applied to future costs ().

Figure 2 Undiscounted (A) and discounted (B) price of the two drug comparators over the model’s time horizon when both drugs are patented molecules.

As presented in the original paper by Shih et al,Citation2 this mathematical framework demonstrates that failing to account for the future introduction of lower-cost generic versions of both drugs will lead to biased estimates of the ICER. However, unlike their conclusions, we highlight that failing to account for the future introduction of lower-cost generic versions in economic evaluations comparing a new patented drug to a generic comparator drug will likely overestimate the ICER of a new drug. Of course, the distinction we note is only relevant in the context where generic versions of the new drug are expected to be introduced within the economic model’s relevant time horizon (ie, if T1* < T).

Case study

In 2011, Sorensen et alCitation5 published an economic evaluation comparing the use of dabigatran etexilate to warfarin in the prevention of stroke and systemic embolism in atrial fibrillation in the Canadian setting. Although dabigatran etexilate was shown to be cost-effective compared to the use of “trial-like” generic warfarin (ICER = CAN$10,440/quality-adjusted life year), Sorensen et al fixed the daily drug cost of dabigatran etexilate at CAN$3.20, thereby ignoring the future introduction of a lower-cost generic version of dabigatran etexilate.Citation5 Using this study setting, we created a simplified model in which we examined the impact of the future introduction of lower-cost generic versions of dabiga-tran etexilate within the examined time horizon.

Model design

We created a Markov model which followed a simulated cohort of patients from the time of atrial fibrillation diagnosis up to time of death or up to a maximum age of 100 years using monthly cycle lengths. For this simplified model we assumed that patients’ persistence to both drugs was perfect and only considered all-cause mortality; patients would thus incur costs from model initiation up to their time of death. Our simplified model uses only the simulated drug-related costs, ignoring both the non-drug-related cost and the effectiveness components of the ICER, because the future introduction of generic dabigatran etexilate would only affect the drug- related costing component of the ICER (see EquationEquations 7(7) and Equation8

(8) ). Although the incremental effectiveness was not modeled, we assumed that the dabigatran etexilate arm provided added benefits compared to the warfarin arm. All model inputs are detailed in .

Introduction of generic versions of dabigatran etexilate

It is currently unknown when generic versions of dab-igatran etexilate will be introduced nor what will be their retail cost. In our base case analysis, we assumed that generic versions of dabigatran etexilate would be introduced 7 years after model initiation and that all surviving patients would switch to generic dabigatran etexilate once it becomes available. This assumption was based on the time difference between the publication of Sorensen et al’s paper and the expected date of dabigatran etexilate’s first patent expiration (ie, February 18, 2018).Citation5,Citation6 Such an assumption reflects data protection laws currently in place in Canada which guarantee 8 years of market exclusivity from the time the drug receives its Notice of Compliance from Health Canada. (Dabigatran etexilate’s first Notice of Compliance was issued on June 10, 2008.)Citation7,Citation8 In regards to the cost of generic dabigatran etexilate, we assumed that generic versions of dabigatran etexilate would be priced at 25% of the cost of the patented version based on current practice in Ontario, Canada.Citation9,Citation10 Under such settings, our results show that the undiscounted incremental cost of dabigatran etexilate compared to warfarin, when ignoring the future introduction of generic versions of dabigatran etexilate, would be overestimated by CAN$7,867 (70.1%) (CAN$3,988 [53.8%] when discounting future costs at a 5% discount rate) ().

Table 1 Incremental cost of dabigatran etexilate compared to generic warfarin when ignoring and when considering the future introduction of generic dabigatran etexilate

In order to take the uncertainty around these estimates into consideration, we conducted two-way sensitivity analyses for both inputs. The time to the introduction of generic dabigatran etexilate was arbitrarily varied from 5 to 15 years and the generic to patented drug price ratio was varied from a low of 18% to a high of 40% in order to reflect current price ceilings observed in Canada.Citation9–Citation12 As expected, the overestimation of the incremental cost was greater when generic versions were introduced earlier on and when the generic to patented drug cost ratio was lower ().

Table 2 Overestimation of the incremental cost based on different times to introduction of generic versions

Discussion

Shih et al had originally claimed that ignoring the future introduction of generic versions of a drug when both the new and comparator drugs are patented drugs would tend to underestimate the ICER.Citation2 However, we have shown that ignoring this parameter will only result in an underestimation of the ICER under specific conditions (ie, EquationEquation 10(10) ). In the context where the comparator drug is already a generic drug and lower-cost generic versions of the new drug are expected to be introduced within the examined time horizon, we have shown that ignoring this possibility will tend to overestimate the new drug’s ICER. Although we believe that health economists should include this possibility at least as a sensitivity analysis within future economic evaluations, many factors may limit its inclusion.

First, as highlighted by other authors,Citation1,Citation2,Citation4 the actual time of introduction of generic versions of a patented drug and the subsequent price of these generic versions may be unknown at the time of model conception. In our base case model, we assumed that generic versions of dabigatran etexilate would be introduced 7 years after model initiation and at 25% of the patented drug cost, but this may not be the case. There are situations where generic versions are introduced before patent expiration, and in other cases they are introduced years later.Citation1,Citation2 As we have shown, the impact of ignoring the future entry of lower-cost generic versions of a molecule on the ICER is highly dependent on both inputs ().

Second, we assume that all patients would switch to the lower-cost generic version of a drug once it is introduced. This assumption may not truly reflect reality. There are cases where a proportion of patients decide to remain on the higher priced patented drug even though a lower-cost generic version exists.Citation13,Citation14 Despite this fact, several jurisdictions only cover the cost of the lower-cost generic version and all other costs would be assumed by the patient.Citation15–Citation19 In such cases, if the economic evaluation is conducted under the societal perspective, EquationEquation 8(8) would have to be modified in order to take into account the proportion of patients remaining on the higher priced patented drug and those switching to the lower-cost generic versions (EquationEquation S1

(S1) ). However, if the economic evaluation is conducted under a third-party payer perspective, which imposes reference-based pricing schemes, no such modification would be needed.

Third, the proposed equations ignore the potential for additional comparators to be introduced within the examined time horizon. Although future comparators could affect medical practice following their introduction, most economic evaluations ignore this possibility. This is simply because economic evaluations are limited by the current state of knowledge at the time of their conception.

Finally, these proposed equations all assumed that generic versions of both drugs are as effective as their reference patented versions. Although some have critiqued their equivalency,Citation20 it is normally assumed that generic versions of a small molecule are as effective as their reference patented version.Citation16,Citation20,Citation21 Similarly, although some have highlighted the fact that subsequent entry biologics’ effectiveness may differ from that of their reference biologics, they are also generally considered to be as effective.Citation22–Citation24 However, in cases where this assumption would not hold,Citation25,Citation26 a traditional economic model (ie, one which ignores the future introduction of lower-cost generics) should be favored. As such, health economists who wish to use these equations within future economic models should justify that this assumption is appropriate.

Conclusion

It is obvious that if the price of a drug decreases during the examined time horizon, it should be included within the economic model. However, considering the limits associated within its inclusion, health economists may wish to incorporate it as an additional sensitivity analysis to provide decision makers with a more complete representation of the economic impact of funding the new drug. Therefore, we suggest that, unlike current recommendations,Citation4 the potential future introduction of lower-cost generic versions of the new and comparator drugs, and not only for the comparator drug, be considered within future drug reimbursement submissions. As highlighted by Shih et al and mentioned within current Canadian guidelines,Citation2,Citation4 when both drugs are patented drugs, ICER will likely be underestimated if economic evaluations omit the potential future introduction of lower-cost generic versions. However, within economic evaluations comparing a new patented drug to a generic comparator drug which omit the potential future introduction of lower-cost generic versions of the new drug, the ICER will likely be overestimated.

Supplementary materials

Equation S1 Incremental cost of the new drug under the societal perspective.

(S1)

Table S1 Base case parameters for the case study

Notes: ND1(t) represents the mean nondrug costs of the new drug at time t; ND0(t) represents the mean nondrug costs of the comparator drug at time t; P1P(t) represents the price of the patented new drug at time t; P1G(t) represents the price of the generic new drug at time t; P0P(t) represents the price of the patented comparator drug at time t; P0G(t) represents the price of the generic comparator drug at time t; Q1(t) represents the mean total quantity of the new drug consumed at time t; Q0(t) represents the mean total quantity of the comparator drug consumed at time t; S1G represents the proportion of individuals switching from the patented version to the generic version of the new drug once the generic version of the new drug is introduced; S0G represents the proportion of individuals switching from the patented version to the generic version of the comparator drug once the generic version of the comparator drug is introduced; and T represents the end of the model’s time horizon.

References

- Life Tables Canada Provinces Territories 2009 to 2011 [webpage on the Internet]Statistics Canada [updated September 25, 2013]. Available from: http://www.statcan.gc.ca/pub/84-537-x/84-537-x2013005-eng.htmAccessed October 2, 2014

- SorensenSVKansalARConnollySCost-effectiveness of dabigatran etexilate for the prevention of stroke and systemic embolism in atrial fibrillation: a Canadian payer perspectiveThromb Haemost2011105590891921431243

- Orange Book: Approved Drug Products with Therapeutic Equivalence Evaluations [webpage on the Internet]Silver Spring: US Food and Drug Administration Available from: http://www.accessdata.fda.gov/scripts/cder/ob/docs/patexclnew.cfm?Appl_No=022512&Product_No=001&table1=OB_RxAccessed October 2, 2014

- MoultonDProvincial squeeze on generic prices continuesCMAJ201118314E1049E105021896691

- BeallRFNickersonJWAttaranAPan-Canadian overpricing of medicines: a 6-country study of cost control for generic medicinesOpen Med201484e130e13525426181

Disclosure

No financial support was provided for this study. However, at the time of writing this article, Jason R Guertin was a Pfizer Canada Post-Doctoral Mentoree and Farzad Ali was a Pfizer Canada Inc. employee. Jacques LeLorier and Dominic Mitchell have both received consulting honoraria from Pfizer Canada Inc. The authors report no other conflicts of interest in this work.

References

- HoyleMFuture drug prices and cost-effectiveness analysesPharmacoeconomics200826758960218563950

- ShihYCHanSCantorSBImpact of generic drug entry on cost-effectiveness analysisMed Decis Making2005251718015673583

- HayJWSmeedingJCarrollNVGood research practices for measuring drug costs in cost effectiveness analyses: issues and recommendations: the ISPOR Drug Cost Task Force report – Part IValue Health20101313719874571

- Guidelines for the Economic Evaluation of Health Technologies: Canada3rd EditionOttawaCanadian Agency for Drugs and Technologies in Health2006

- SorensenSVKansalARConnollySCost-effectiveness of dabigatran etexilate for the prevention of stroke and systemic embolism in atrial fibrillation: a Canadian payer perspectiveThromb Haemost2011105590891921431243

- Orange Book: Approved Drug Products with Therapeutic Equivalence Evaluations [webpage on the Internet]Silver Spring: US Food and Drug Administration Available from: http://www.accessdata.fda.gov/scripts/cder/ob/docs/patexclnew.cfm?Appl_No=022512&Product_No=001&table1=OB_RxAccessed October 2, 2014

- Register of Innovative Drugs [webpage on the Internet]OttawaHealth Canada [updated August 12, 2015]. Available from: http://www.hc-sc.gc.ca/dhp-mps/prodpharma/applic-demande/regist/reg_innov_dr-eng.phpAccessed July 8, 2015

- Guidance Document: Data Protection under C.08.004.1 of the Food and Drug Regulations [webpage on the Internet]OttawaHealth Canada2011 Available from: http://www.hc-sc.gc.ca/dhp-mps/prodpharma/applic-demande/guide-ld/data_donnees_protection-eng.phpAccessed July 8, 2015

- MoultonDProvincial squeeze on generic prices continuesCMAJ201118314E1049E105021896691

- BeallRFNickersonJWAttaranAPan-Canadian overpricing of medicines: a 6-country study of cost control for generic medicinesOpen Med201484e130e13525426181

- The Council of the FederationProvinces and Territories Seek Significant Cost Savings for Canadians on Generic Drugs 2013 Available from: http://www.councilofthefederation.ca/phocadownload/newsroom-2013/nr-cof-generic_drugs_final-jan_18.pdfAccessed May 10, 2014

- LawMRMoney left on the table: generic drug prices in CanadaHealthc Policy201383172523968624

- KongYCompetition between brand-name and generics – analysis on pricing of brand-name pharmaceuticalHealth Econ200918559160618816580

- BalabanDYDhallaIALawMRBellCMPrivate expenditures on brand name prescription drugs after generic entryAppl Health Econ Health Policy201311552352923979876

- LexchinJThe effect of generic competition on the price of brand-name drugsHealth Policy2004681475415033552

- BellCGrillerDLawsonJLovrenDGeneric Drug Pricing and Access in Canada: What are the Implications?TorontoHealth Council of Canada2010 Available from: http://www.healthcouncilcanada.ca/rpt_det.php?id=156Accessed May 10, 2014

- AcostaACiapponiAAaserudMPharmaceutical policies: effects of reference pricing, other pricing, and purchasing policiesCochrane Database Syst Rev201410CD00597925318966

- NarineLSenathirajahMSmithTEvaluating reference-based pricing: initial findings and prospectsCMAJ1999161328628810463052

- DylstPVultoASimoensSThe impact of reference-pricing systems in Europe: a literature review and case studiesExpert Rev Pharmacoecon Outcomes Res201111672973722098289

- KesselheimASMisonoASLeeJLClinical equivalence of generic and brand-name drugs used in cardiovascular disease: a systematic review and meta-analysisJAMA2008300212514252619050195

- BaumgärtelCMyths, questions, facts about generic drugs in the EUGaBI J2012113438

- DuerdenMGHughesDAGeneric and therapeutic substitutions in the UK: are they a good thing?Br J Clin Pharmacol201070333534120716231

- SimoensSBiosimilar medicines and cost-effectivenessClinicoecon Outcomes Res20113293621935330

- StewartAAubreyPBelseyJAddressing the health technology assessment of biosimilar pharmaceuticalsCurr Med Res Opin20102692119212620649394

- KesselheimASStedmanMRBubrickEJSeizure outcomes following the use of generic versus brand-name antiepileptic drugs: a systematic review and meta-analysisDrugs201070560562120329806

- MintzerSBrand spanking? The presumptive risks of generic anti-epileptic drugsEpilepsy Curr2011112545521852877