Abstract

At the turn of the century, writings on globalization were rife with worry that transnational integration will strip states of the ability to direct industrial development. More recent literature suggests that industrial policy is alive and well, if thoroughly reshaped by the changes in the organisation as well as regulation of the economy. This paper contributes to this burgeoning body of research by examining the transformation of industrial policy toward automotive industry in Spain from the start of its integration into the European Economic Community in the 1970s until today. It argues, first, that the claims about globalization restricting the ‘policy space’ of individual states tend to understate the extent to which policy decisions of developing countries had always been restricted by the international environment. Second, it shows how transnational integration not only takes away certain tools but also helps development of others. To make use of them, however, countries have to restructure their systems of industrial governance to make space for a more regionalized, collaborative, and competence-based instead of firm-based policy.

1. Introduction

The Spanish automotive industry is among the more spectacular examples of latecomer success. From modest beginnings in the autarchic environment of the 1960s, Spain has grown into the second largest producer of motor vehicles in Europe and eighth in the world (OICA, Citation2018). Automotive exports contribute on average EUR 10 billion per year in net surplus to the country’s foreign trade balance.1 Indeed, the success of its automotive industry puts Spain on par with the more famous examples of post-war ‘manufacturing miracles’, such as Korea or Taiwan.

Yet compared to these countries the Spanish trajectory is highly unusual. While the former had achieved success by nurturing domestic champions, the Spanish industry was largely taken over by foreign firms. Spanish-owned companies do feature among the leading global automotive suppliers, but more than 80% of the country’s output is produced by subsidiaries of foreign firms.2 Moreover, while East Asia’s breakthrough is usually credited to the region’s active developmental states, the ability of the Spanish state to direct its industry has been curtailed by its membership of the European Union (EU) as well as by the presence of powerful multinationals.

This makes Spain an excellent starting point for answering the question that has preoccupied scholars and policy makers around the world: What can states do to develop their industries in the age of high globalization? The spread of international regulation, from the ‘Washington consensus’ in the 1990s to trade liberalization within the World Trade Organisation, and – even more radically – through regional integration and the new generation of ‘deep’ bilateral agreements, has outlawed most of the traditional industrial policy tools: from capital controls and tariff manipulation to discriminatory application of intellectual property and public procurement laws.

These trends have raised concern among many development scholars who believe that industrial development requires not merely following one’s comparative advantage – for developing countries, usually in low-cost production – but actively shifting this advantage toward more complex and technology-intensive activities (Amsden, Citation2001; Rodrik, Citation2006; Wade, Citation2003). The loss of ‘policy space’ to do so, the argument goes, would thus effectively spell the end to development (Chang, Citation2005; DiCaprio & Gallagher, Citation2006; Gallagher, Citation2007).

Although policy space may have been radically reshaped, it has by no means disappeared. More recent research has produced valuable attempts to map the tools that the states can still use to improve their place in the global division of labor (Clift & Woll, Citation2013; Rodrik, Citation2009; Thatcher, Citation2014). Nevertheless, much of this research remains preoccupied with the question of protecting and promoting national champions, which often shifts the discussion toward industries such as finance, telecommunications, and utilities, in which the constraints imposed by transnational regulation and market integration remained more muted than in manufacturing (Bulfone, Citation2018; Garcia Calvo, Citation2016; Morgan, Citation2012).

This paper makes two contributions to this emerging literature. First, by focusing on a traditional sector like car manufacturing, it provides a more direct test of the space available for the new industrial policy. Once the industry is part of a highly integrated global production network and the state has lost both the traditional policy tools and direct access to the lead firms, what can it still do to strengthen its position in the international value chains? As one of the more successful examples of this form of development, Spain offers an opportunity to study the possibilities, as well as the limits, of industrial policy under such circumstances.

Second, by taking a long-term view of policy developments from Spain’s gradual opening in the 1970s to its full integration into the EU’s economic space, the paper seeks to provide a more precise account of the ways in which transnational integration has transformed the means, as well as the goals of industrial policy. In doing so, it adds a historical dimension to the distinction between ‘shallow’ and ‘deep’ modes of integration formulated in the introduction to this special issue (Bruszt & Langbein, this issue; see also Bruszt & Vukov, Citation2017), and highlights the reasons behind the waning attractiveness of the ‘shallow’ path, despite it seeming advantages in terms of policy autonomy.

The main argument of the paper is that the space for industrial policy was neither as broad before nor as narrow after the advent of high globalization as some of its more fervent critics maintain. All development policies that depart from autarchy must count with the constraints of the international environment (Mayer, Citation2009). At the same time, this environment is not merely a source of constraints, but can also offer individual states possibilities to expand their policy toolboxes.

The paper is structured as follows. Section 1 discusses the period of ‘shallow’ integration, from 1970 to 1986, in which asymmetric trade liberalization with the European Economic Community (EEC) allowed the Spanish state to continue pursuing a traditional, trade-based industrial policy while benefiting from access to the EEC’s markets. The section shows how even under this best-case scenario – a permissive international environment and a capable state – the lack of cooperation by resident firms, pressures from trade partners, and the burden of subsidies made industrial policy a risky enterprise. This eventually convinced the Spanish state that development in the automotive sector is better served by joining rather than by building value chains (Baldwin, 2011).

Section 2 then turns to the emergence of new industrial policy in the context of ‘deep’ integration after Spain’s accession to the EEC in 1985 and examines the ways in which the policy space changed. It argues that the efforts to upgrade national industries in ways compatible with transnational regulations and have required the emergence of a more distributed governance system. In the Spanish case, this meant shifting the focus of policy interventions from the national to the regional level, from firm targeting to competence targeting, and from centralized to collaborative policy making. This means that the new industrial policy requires substantial capacities not only at the level of the central state, but also at the level of sub-regional and sectoral authorities, as well as in the private sector. These shifts have, however, been facilitated by the simultaneous emergence of new resources and policy tools at the supranational (EU) level, which strengthened the ability of local actors to promote upgrading.

The importance of EU-level resources for the successful development of new industrial policy tools might render the Spanish experience less relevant to other parts of the world where the supranational level is weakly institutionalized. In a more general sense, however, this case offers a slightly more optimistic view of the role of transnational integration in development. The EU’s own policies were not developed overnight: they emerged gradually from greater awareness of interdependence brought on by deep integration between countries at different levels of development (cf. Bruszt & Langbein, this issue), and often built on local policy experiments. This evidence of two-way learning suggests that, rather than understanding integration in terms of more or less policy space, future research should focus on ways in which different types of interactions between the national and international levels structure development trajectories of different countries.

2. The fruits of shallow integration: scope and limits of traditional industrial policy

Industrial policy, broadly understood, refers to all attempts by the state to interfere with market-driven allocation of resources and direct them toward activities which it believes hold the most potential to accelerate growth. For those concerned about the shrinking policy space for development, it is precisely this feature of industrial policy that is being threatened by the market-making bias of transnational integration.

Yet the complaints about the loss of policy space through globalization often overlook the extent to which policy autonomy of developing countries has always been circumscribed, by both internal and external factors. One such factor is state capacity, frequently portrayed as the key ingredient that determines whether industrial policy leads to East Asian-style globally competitive manufactures or to the capture of state by private interests (Haggard, Citation1990; for poignant examples of industrial policy failure, see Krueger, Citation1996; Lal, Citation1984; Wade, Citation1990).

As several contributions to this special issue demonstrate (see especially Medve-Bálint & Šćepanović, this issue; Langbein & Markiewicz, this issue), state capacity remains key to effective deployment of industrial policy tools. This includes both the ‘core’ capacities to create a predictable environment for private firms and shield the state from capture, as well as more specific ‘midwifery’ and ‘husbandry’ capacities, i.e. the ability to achieve successful internationalization, sometimes against the desires of resident firms, and the ability to support further upgrading (Bruszt & Langbein, this issue; Chibber, Citation2006; see also Evans, Citation1995). However, the latter two are also strongly shaped by the international context.

This section uses the example of Spain’s ‘shallow’ integration with the EEC from 1970 to 1986 to showcase the external limits to state intervention even in the ‘golden age’ of industrial policy. The first part shows how a capable state may nevertheless struggle with resistance by private actors, and may find that trading in some policy autonomy will result in a better bargaining position. The second part highlights a number of additional constraints that rarely feature in the accounts documenting the impact of globalization on policy space: relations to other states, and the financial burden of raising internationally competitive firms. When brought to head by the combined shocks of the second oil crisis and Spain’s transition to democracy, these factors proved decisive in convincing policy makers to abandon plans for raising indigenous ‘national champions’.

2.1. Preferential agreement with EEC and the expansion of policy space through trade integration

At the peak of the industrialization campaign of the 1950s and 1960s, Spain bore most features of an activist and fairly capable developmental state. Under the tutelage of the Istituto National de Industria (INI) the country saw rapid growth of the steel, petrochemicals, and automotive industries. In 1950, INI founded SEAT (Sociedad Española de Automóviles de Turismo), its flagship company in the automotive sector. Lack of domestic expertise forced SEAT to seek a foreign partner, but although Italy’s FIAT was to provide most of the technology and design, INI retained nearly all control, with FIAT’s ownership limited to just 7% (Catalan, Citation2006).

In addition to restrictions on foreign ownership, domestic industry was protected by high tariffs and a 90% local content requirement. However, a degree of internal competition was deemed necessary to promote upgrading. Private capital was therefore allowed to set up own car manufacturing ventures, though their approval was conditional upon a certain level of output to avoid fragmentation (Fernández-de-Sevilla, Citation2014).

Production boomed on the back of domestic demand, but the strategy also suffered from the typical ailments of import-substitution industrialization. For all the heavy protection, rapid industrialization needed imports of capital equipment and other key inputs, which eroded the country’s foreign exchange stock. The solution was to increase exports, but to do so Spain had to overcome two hurdles: persuade the richest European states to open their markets, and convince its firms to start selling abroad.

The first task took 6 years of negotiation and was accomplished by the signing of the Preferential Trade Agreement between Spain and the EEC in 1970s. The agreement ushered in the era of ‘shallow integration’, and offered Spain privileged access to the Community markets while allowing it to keep most of its protections. Spain received especially generous treatment on industrial products, including motor vehicles:3 the EEC pledged to immediately remove all quotas and drop import duties by 60% in just 2 years. Spain, meanwhile, was to reduce its tariffs much more gradually, and then only for a small quota of vehicle imports, while the rest remained subject to prohibitively high duties (EEC, 1970; Lieberman, Citation1995)

The second task proved more challenging. Spanish carmakers lacked experience, distribution networks and technological edge to venture abroad. Moreover, their cars were mostly made with licenses of Italian and French firms which fiercely opposed Spain’s efforts at internationalization. It was not before INI agreed to cede the controlling stake in the company that FIAT agreed to allow SEAT to export up to 20% of its output (Catalan, Citation2006).

Faced with the reluctance of resident manufacturers, the government leveraged its newly found access to the EEC market to recruit assistance from outsiders: the American carmakers. Ford had been looking to restructure its operations in Europe and was eager to use Spain as a new export platform (Bordenave & Lung, Citation1988). General Motors was also showing interest, and the Spanish government found that it could use these firms not only to boost exports, but also to turn up competition in the domestic market and thus bully other producers into higher performance (Catalan, Citation2010).

In some ways then, the shallow integration actually increased policy space of the Spanish government, but this came at a price. Ford refused to comply with ownership restrictions, and complained that high local content requirements undermined export efficiency (Pérez Sancho, Citation2003). To accommodate its demands, the 1972 regulations, dubbed ‘decretos Ford’, lifted the restrictions on foreign ownership, and reduced local content requirements from 90% to 50%. In exchange, the state imposed a requirement – legal under the EEC agreement – that all automotive firms maintain a surplus of exports over imports by at least 20% (Pérez Sancho, Citation2003).

While some of the old policy tools had to be scaled back, new ones were developed to ensure that the domestic producers could rise to the challenge of increased competition. The automotive industry was declared a sector of ‘preferred interest’ which allowed for development of special tax and subsidy programs, and similar treatment was extended to the producers of automotive components.

2.2. Trade conflicts, rising costs, and the waning attractiveness of traditional industrial policy

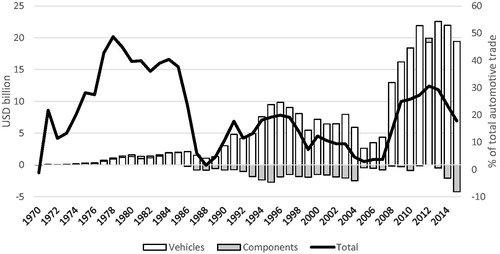

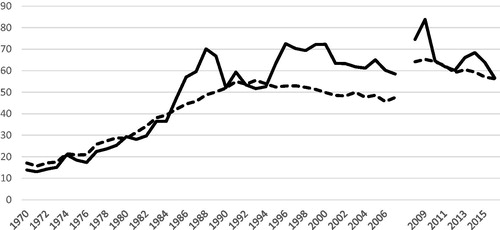

Recalibration of industrial policy that followed the trade agreement with the EECs brought a decade of heady growth to automotive industry. Production doubled to almost a million units between 1970 and 1979, and the share of exports increased from less than 10% to nearly 50% (García Ruiz, Citation2001). Tariffs, quotas and complicated import taxes kept imports less than 5% of sales, and the trade balance in a hefty surplus of nearly 40% (). Productivity, while still low by core country standards, also increased: from 13% to 30% of the German levels ().

Figure 1. Trade balance in bn USD and as % of total automotive trade.

Source: Author’s calculations based on UN COMTRADE database. Net exports of vehicles and components are represented in bn USD (left axis) and the overall balance as % total automotive trade (right axis).

Note: There is a break in the series in 1989 due to the change in COMTRADE industry classification from the SITC to HS system. The change only affects data on components. The two series have been aligned using the COMTRADE correspondence tables.

Figure 2. Productivity and cost in the Spanish automotive industry relative to Germany.

Sources: KLEMS database and EUROSTAT SBS.

Note: The figures before and after 2008 are not strictly comparable due to a change in European industry classification. The series until 2007 refers to NACE Rev 1.1 sector DM 34, after 2008 to NACE Rev. 2 C29. Productivity is expressed as gross value added per person employed. Cost equals total labor costs per person employed.

Successful internationalization and upgrading of the Spanish automotive sector in the 1970s were achieved through judicious use of trade and investment diplomacy and significant injections of public money. Unfortunately, both were to become more difficult as the second oil shock and political struggles accompanying transition to democracy collided in a full-blown industrial crisis at the turn of the 1980s.

The first effect of the crisis was to reveal just how much Spain’s policy space depended on the good will of its trading partners. As the European markets contracted many core countries began to feel that Spanish success was hurting their own production. The supranational nature of EEC’s trade policy prevented them from retaliating directly, but it did not stop demands to eliminate privileges granted by the 1970 agreement. In 1982, the UK unions threatened to block vessels bringing Spanish vehicles to the UK ports (Fetzer, Citation2005), and the UK MPs took to the European Parliament to protest preferential treatment of Spanish exports . French and Italian governments also pressured their firms to reduce production in Spain in order to preserve employment at home (El, Citation1983b).

The negotiations for Spain’s membership of the European Communities, which began shortly after the adoption of Spain’s democratic constitution in 1978 were also shaped by these concerns. Spain had hoped to dismantle its tariffs gradually in order to give its stricken industry some time to regroup, but this time the EC demanded quick liberalization. The motor vehicle industry was given just 3 years to abandon all import restrictions (EC, Citation1985), as well as import compensation and discriminatory sales taxes (Lieberman, Citation1995).

Spain was not the only country to be hit by the loss of confidence on the part of highly industrialized countries. The EC and the US also began to impose ‘voluntary export restraints’ on East Asian manufacturers. Indeed, some researchers maintain that these actually led to upgrading of Korean and Japanese products, forcing firms to launch a massive investment campaign in order to get most value out of the units they could sell (Hamilton, Citation1986). But the bar proved too high for the Spanish national champions. By the end of the decade SEAT was finally managing a solid export performance, but had lost the dominance of the lucrative domestic market to Ford (García Ruiz, Citation2001). As the crisis led to a further collapse in sales, FIAT decided to cut the losses and handed its share of the company back to the Spanish state (El, Citation1981).

FIAT’s departure left SEAT in a very difficult position. Its cars were closely based on FIAT’s, which now invoked intellectual property rights to block SEAT’s exports (El, Citation1983a). No longer able to use FIAT’s distribution networks, SEAT also had to invest in alternative sales outlets in Europe. The Spanish company staked everything on development of a new model, SEAT Ibiza, which was supposed to relaunch it as a fully independent carmaker. In later years this model would indeed carry the SEAT brand, but in the early 1980s the combination of the falling demand and the financial effort required to design and produce the new car took the company to the brink of bankruptcy (Catalan, Citation2006).

In 1985, the Spanish Socialist government finally gave up on the hopes of keeping its former national champion in Spanish hands. Even then, however, INI’s officials still fought to keep the higher value-added activities in Spain. The terms of the final agreement with the SEAT’s new owner, Volkswagen, obliged the German company to keep the SEAT brand and its R&D and design capacities. In exchange, the government promised to shoulder a lion’s share of company’s restructuring costs (El, Citation1985). Between 1986 and 1990, these are estimated to have come up to a total of USD 400 mn, nearly twice as much as VW eventually paid to buy the state’s share of the company (Chari, Citation1998). Similar operations were conducted to restructure and sell a large number of Spanish firms in many industrial sectors, including all of the commercial vehicle manufacturers and prominent supplier firms.4

The Spanish Socialist Party’s embrace of neoliberal ideas probably played a role in its decision to abandon traditional industrial policy and surrender the automotive industry to foreign capital. Yet, as Ban (Citation2016) points out, this variant of Spanish neoliberalism was grafted with a sound dose of developmentalist ideas which allowed for protection and support for promising companies. Nor did ideological preferences stop subsequent governments from promoting national champions in other industries, such as banking or telecommunications (Etchemendy, Citation2004; Holman, Citation1996). Manufacturing, however, was more difficult to save.

Automotive industry had always been dominated by a small oligopoly of lead firms, but the integration of European markets had intensified competition, privileging those that could wield greater economies of scale. At the supplier level too the industry was already showing signs of concentration that would lead to the rise of hierarchically organized value chains a decade later (Lung & Volpato, Citation2002). By comparison, most Spanish firms were small and, despite the upgrading campaign of the 1970s, technologically backward. They had also lost some of their cost advantage to inflation and labor unrests that accompanied the early years of transition.

Nursing them to international competitiveness would have required enormous investments. The Spanish banks, which held stakes in most major industrial firms, were unwilling to commit (Etchemendy, Citation2004). The state on the other hand found the ‘reconversion’ and sale operations to be expensive enough. More would have been impossible to justify in a newly democratized polity in which the Socialist government, elected at the peak of the crisis in 1982, was already straining the good will of its constituency by keeping a tight lid on wages and social spending (Ban, Citation2016).

The traditional industrial policy had served Spain well: by the late 1970s the country was already among the largest European automotive producers, even if its one national champion was not yet quite ready for the big league. This success was largely due to a highly capable state which managed to exploit opportunities offered by the ‘shallow’ integration far more successfully than other examples surveyed in this volume, i.e. Turkey or Ukraine (see Langbein, this issue; Langbein & Markiewicz, this issue). Importantly, however, the terms offered to Spain in the 1970s were also more generous than those extended to any of the future latecomers to EU integration. Once the demands for reciprocity in trade policy made protection impossible and the crisis made direct support to industry prohibitively expensive, the path of autonomous development became less appealing. The new task of industrial policy became not to safeguard the independence of domestic industry, but to help it thrive within transnational production networks.

3. Deep integration and the rebirth of industrial policy: policy space reconfigured

The second oil crisis brought home the downsides of traditional IP, but it was European integration that ultimately made a return to old policies impossible. Starting with the Single European Act in 1985 and culminating in the treaty on EU in 1992, growing regulatory integration gave the European Commission greater powers to oversee economic policies of the member states and sanction those it deemed incompatible with the common market. Early research into the consequences of this ‘negative integration’ (Scharpf, Citation1999) echoed the concerns over the effect of globalization of countries’ policy space: market liberalization was leaving less developed EU members without meaningful tools to pursue economic catch-up (Featherstone, Citation1998; Tsoukalis & Rhodes, Citation1997).

For the Spanish automotive industry, such concerns seemed displaced at first. As the crisis abated, the freshly restructured and now largely foreign-owned sector revved back into growth. Exports were no longer a problem: weak domestic demand, lower production costs, and full integration into the EU markets turned Spain into a lucrative export platform. Productivity, however, was becoming a concern.

By 1992 exports were already four times higher than at the peak of the 1970s boom, but the trade surplus dwindled due to growing imports of technology-intensive inputs such as engines: a sign that Spain might become locked in the lower tiers of the automotive value chains (). This was an untenable position for a country in which return to growth had reignited social demands, and whose cost advantage would soon become threatened by the even cheaper Eastern locations. A new industrial policy had to be found to support a shift toward less cost-dependent production, but in ways that would be compatible with the rules of ‘deep’ European integration.

In the 1990s, the EU shaped its member states industrial policies primarily by defining what was no longer possible. Tariff manipulation was obviously off-bounds, and so increasingly were subsidies to private firms. State aid had ballooned in the aftermath of the second oil shock, and the European Commission worried not only about its distortionary impact on the single market, but also about the declining external competitiveness of Europe’ coddled enterprises.

The automotive industry was among the prime offenders. Between 1977 and 1987, member states of the European Community spent around ECU 26 bn in support to the sector (Dancet & Rosenstock, Citation1995), but the industry continued to make losses, and to demand protection from outside imports. To enforce discipline, the Commission launched a new framework for state aid to the vehicle sector in 1990. All subsidies had to be first cleared by the Commission, and support to struggling companies was only permitted if accompanied by capacity reductions (EC, Citation1989).

There were some exceptions, however. The first concerned less developed regions of the EU, which were allowed to pay higher subsidies in order to attract investment.5 The second referred to the so-called ‘horizontal’ aid, i.e. subsidies given not to individual firms or sectors but offered on non-discriminatory terms to all companies pursuing certain developmental objectives – environmental improvements, innovation or training. Most importantly, subsidies falling under these exceptions were not only permitted, but also partly paid by the EU.

This was the result of another economic diplomacy victory for Spain, which found that from inside the EU it could actually shape some of the rules that constrained its domestic policy space. In 1990 it threatened to block the creation of the Economic and Monetary Union unless the other members agreed to double the funds for regional development and create a new Cohesion Fund for the recently acceded Southern members (Morata & Muñoz, Citation1996). This vastly expanded the amount of resources available for industrial upgrading, but within regulatory parameters set at the supranational level. To use them successfully, states had to reconfigure their policy systems.

In Spain, this meant developing ‘husbandry’ capacities in three interrelated areas. First, greater responsibility for policy-making was shifted from the national to the regional level, where it could be linked to the EU’s regional development policies. Second, to comply with the EU’s definition of horizontal interventions, firm-specific interventions were replaced by measures targeting specific competences: technologies, skills, or industrial processes. This was helped by the third shift: from top–down, centralized policy making to delegation of policy design and implementation to collaborative bodies that brought together representatives of government and industry. Many of these governance innovations received support from EU-level programs, which in turn often grew out of successful policy initiatives at state and local levels.

3.1. National to regional

The shift of industrial policy focus to the regional level was especially well placed to benefit the smaller industrial firms. These had never been the priority for the national industrial policy, and at the start of the 1990s they found themselves facing tough international competition. In the automotive industry in particular, the rise of globally integrated production networks called for rationalization of the number of suppliers to increase economies of scale and reduce coordination costs in multiple markets. Fewer suppliers became responsible for a greater number of orders, as well as for more demanding tasks such as co-designing components and coordinating sub-suppliers (Lung & Volpato, Citation2002; Sturgeon & Florida, Citation2000). Local companies had to grow into global firms, or risk being pushed out to the lower rungs of the supply chain (Barnes & Kaplinsky, Citation2000). And for that they needed the help of the state.

In Spain, devolution of industrial policy to the regional level had been part and parcel of the democratization process. Nevertheless, the competencies granted to the self-governing regions (Comunidades Autónomas) by 1978 constitution had been substantially strengthened by the EU’s regional development policy (Morata & Muñoz, Citation1996). The EU offered regions financial resources for policy experimentation, and increasingly provided them with networking opportunities, policy templates and direct technical assistance to improve their industry support systems (see also Vukov, this issue; Medve-Bálint & Šćepanović, this issue).

Decentralization also brought some inequality, as the regions with strongest initial capacities were also best positioned to take advantage of these opportunities.6 By the end of the 1990s, all Communidades had established regional development agencies (Agencias Regional de Desarrollo – ARD), but their exact form and capacities varied widely (Velasco, Citation2000). The ARDs of Spain’s wealthier and most industrialized regions – Catalonia, Valencia, and the Basque Country – adopted explicit mandates to promote industrial development, and were among the first in Europe to pioneer support programs for industrial parks, clusters, and internationalization of small and medium enterprises.

Probably the most notable example was the creation of the Basque automotive cluster (Asociación Cluster del Cluster de Automoción de Euskadi – ACICAE). The region had a long history of steel and metalworking, and in the 1970s and 1980s it accounted for nearly a third of all Spanish automotive suppliers. However, possibly because of its reputation for political turmoil, for a long time it did not attract a large car manufacturing plant.7 No more than 10% of region’s firms had any foreign capital, and as the Spanish industry became more integrated into the European production networks, they found it increasingly difficult to secure contracts (Camino Beldarrain, Bilbao Ubillos, & Aláez Aller, Citation2003).

In 1991, the Basque government contacted Monitor, a consultancy ran by the guru of the industrial ‘cluster’ movement Michael Porter, which helped to design a development program for these firms. ACICAE was given a dual mandate to provide financing, technology and management assistance to its members, and to communicate their needs to the regional department of industry (Ahedo, Citation2004). It also facilitated cooperation and mergers among firms, which allowed some of them to reach the scale necessary for success in international markets. Some of the largest Spanish automotive suppliers such as CIE Automotive and Gestamp have their origins in this initiative.

Other forms of support coordinated by the ARDs included grants and services for training, research, and technology development, assistance with certification and quality control, and support for internationalization. Some regional governments went as far as opening offices abroad in order to facilitate access of their automotive firms to foreign clients (El, Citation1993a).

Regionalization of industrial policy reshaped the domestic policy space by opening it to new actors and beneficiaries. Sometimes, however, it also allowed for old-style bargains with the lead firms. Such was the case of VW’s 1993 transfer of SEAT facilities to a new factory in Martorell, which allowed the company to upgrade capital equipment and increase efficiency. However, the closure of the old site at Zona Franca in Barcelona promised to be a costly affair. The VW struck a bargain with the regional government, which covered part of the expenses by converting Zona Franca into an automotive supplier park. To entice firms to settle into the park, the regional government offered grants, partly financed from the EU regional funds, and the VW promised to increase local sourcing for SEAT automobiles from 50% to 64% (El, Citation1993b, Citation1993c, Citation1994).

3.2. Firm targeting to competence targeting

The EU’s regulations outlawed most tools that relied on the policy of ‘picking winners’, i.e. concentrating public support on individual firms to help them beat the market. To preserve the integrity of internal competition, the EU insisted on ‘horizontal’ spending measures that did not overtly discriminate between companies and sectors.

Spain certainly stepped up investments in the general business environment: the spending on infrastructure alone reached 5% of GDP in the early 1990s (Boceta Álvarez & Espinosa de los Monteros, Citation2005). Direct subsidies to private firms, meanwhile, were redesigned to focus on modernization and technological upgrading. The 1990s saw development of the first multi-annual state aid programs with specific targets for industrial development,8 as well as substantial expansion of the Centre for Development of Industrial Technology (Centro para el Desarrollo Tecnológico Industrial – CDTI), which became the central body for the management of national and EU funds for industrial research and development.

The concern remained, however, that these broad policies would be insufficient to create structural change in specific industries. Foreign firms brought technology with them and had little need to develop it in Spain, while domestic firms lacked expertise or capital for large research-based projects. The horizontal approach also dispersed funding, instead of focusing it toward particular activities that could grow into the country’s next comparative advantage.

These concerns inspired a subtle adjustment that reintroduced targeting into the horizontal policy framework, but the focus remained on competences, such as specific activities or technologies, and not firms. New agencies were set up to identify the most fruitful directions for investment. One such was the Observatory of Perspectives of Industrial Technologies (Observatorio de Prospectiva Tecnológica Industrial – OPTI), established in 1997 to advise both enterprises and authorities on the ways of responding to newest technological trends. Funding for industrial R&D was targeted toward activities in which the Spanish enterprises were judged to have the most potential. The first National Automotive Plan developed within the 2000 program for development of Technological Research (PROFIT) thus offered financial assistance exclusively for projects dealing with vehicle security systems, recycling and maintenance of vehicles and components, and manufacture of public and special purpose vehicles (MEyC, Citation2005).

The competence-targeting approach was taken a step further with the ambitious plan to place Spain at the forefront of the renewable energy revolution. This included both the customary supply-side measures – subsidies, tax discounts, and publicly funded research into green technologies – and attempts to stimulate demand through public procurement and consumption subsidies.

The most relevant of these for the automotive industry were programs to encourage sales of electric and energy-efficient vehicles. The first such scheme was introduced in 1992 and made permanent in 1997, as a way of reducing emissions through regular substitution of aging vehicles, as well as encouraging continuous investment in environmentally-friendly technologies. Another budget line was added in 2009 to encourage demand for electric vehicles, and was accompanied by investments into charging infrastructure in Spain’s three largest cities.

3.3. Centralized to collaborative

Competence targeting is reminiscent of the traditional industrial policy approach of ‘picking winners’, and indeed the 1980s and 1990s saw a similar emphasis on technology in the policies of some East Asian neo-developmentalist states (Amsden, Citation2001). However, instead of relying on the expertise of government bureaucrats or leading firms’ research departments, in Spain the identification and design of new policy measures increasingly took place through cooperation between industry, government, and scientific bodies. This was most evident at the regional level, where such bodies helped to translate broad national programs into specific measures for upgrading, but some new initiatives also appeared at the national stage.

The most prominent example of these were Industrial Observatories, advisory bodies tasked with identifying weaknesses in the manufacturing system and suggesting measures to rectify them. Two were formed for the automotive industry: one for vehicle manufacturing, another for component production. The observatories brought together representatives of government bodies, peak sectoral associations ANFAC and SERNAUTO, metalworking departments of the two largest national trade unions, and the Federation of Technology Centres.9

The first round of consultations in 2005 discussed the consequences of EU’s Eastern enlargement for Spain’s automotive industry and the ways to strengthen its position vis-à-vis the newcomers. In addition to demands for greater investment into transport infrastructure and support for intra-industry cooperation, the Observatory also recommended various measures to increase workforce skills and flexibility (Observatorio Industrial, Citation2005).

This was a novelty for a system with little experience in sectoral coordination. Collective bargaining in Spain takes place mostly at the regional or plant level, with occasional national-level pacts, and neither ANFAC nor SERNAUTO ever acted as employer organizations. Observatories did not change the formal bargaining structures, but they provided an important forum for deliberation. The plant-level accords from this period display clear features of competitive corporatism in line with the recommendations formulated by the Observatories (Banyuls & Lorente, Citation2010; CC.OO, Citation2011).

3.4. The expansion of transnational policy toolbox

If initially the EU merely provided an external structure for national policy making, by banning some forms of intervention and financing others, over time it began to play a bigger role in the reinvention of industrial policy. The first sign of change came with the 2002 European Commission’s Communication on Industrial Policy in an Enlarged Europe, which called for more active industrial policy to address Europe’s slow productivity growth, the threat of competition from emerging economies, as well as the challenges raised by the accession of the eight poorer East European members (EC, Citation2002). Though it brought few substantive novelties, and mostly emphasized the importance of horizontal measures, the paper also made a conciliatory nod toward sector-specific support (EC, Citation2002).

The following years saw launch of several EU-level initiatives for individual industrial sectors. One of them was the high-level working group for the automotive sector formed in 2005, 'CARS 21' (Competitive Automotive Regulatory System for the 21st Century). The group brought together representatives of the EU institutions, industry, member states, and civil society10 to suggest regulatory improvements that could boost competitiveness of European car manufacturing. Programs for regional development also began to feature EU-level initiatives to support development of automotive clusters in various member states.11 These funded study visits, benchmarking reports to promote mutual learning and exchange of best practices, as well as ‘matchmaking’ events to help internationalization of local supplier firms.

Developments at the EU level helped transformation of the Spanish industrial policy in several ways. They redefined what policies were acceptable: sectoral and technology-centered targeting had been around in Spain since the mid-1990s, but the EU’s approval opened up the space for experimentation. This was especially true of subsidies for the purchase of ‘clean’ and electric cars, which linked up with the EU 2020 program to reduce CO2 emissions.

EU initiatives also provided local actors with policy ideas and networking forums. For example, Spain’s Technological Platform for Automotive Industry, another collaborative body initiated jointly by the association of automotive suppliers and two technology centers to advance innovation in the development of automotive components, was established as the Spanish counterpart of the European Road Transport Research Advisory Council (ERATRAC). The Platform used its membership of ERATRAC to monitor anticipated regulatory changes at the European level and formulate recommendations for domestic industry.

Finally, many of the EU’s new policy initiatives also brought additional funding. The rise of EU-level cluster policy helped the old automotive clusters in the Basque Country and Catalonia to improve their offer, but it also mobilized local forces in many other regions to launch new clusters and supplier development programs (Velasco, Citation2000).

While in some new member states these EU-level initiatives led the way for domestic development policies (see e.g. Langbein & Markievicz, this issue; Medve-Balint & Šćepanović, this issue), in Spain this was rather a two-way process. The formation and internationalization of clusters, the use of scrappage schemes to support and direct demand, and the sectoral targeting of horizontal policies had all been pioneered in Spain long before they became accepted by the EU. Analysis of the origin of ideas behind EU’s new industrial policies exceeds the scope of this paper, and more research is needed to determine the extent to which these transnational policies were inspired by successful experiments in the member states. What is clear though is that the transformation of industrial policy in Spain is neither a matter of ‘downloading’ pre-formatted EU policies (Borzel, Citation2002), nor of autonomous development indifferent to the transnationally defined constraints and opportunities. Rather, they are a result of an activist state creatively mobilizing different elements of an evolving transnational policy framework to expand its policy space and improve its industry’s position in the integrated European production networks.

4. The performance and prospects of the new industrial policy

This paper tried to provide a more nuanced account of the relationship between transnational integration and policy space for industrial development. First, it showed that this space has always been restricted, not only by states’ own capacities but also by the international environment. In the 1980s, strained relations with trade partners and investors and escalating costs of support for national firms forced the Spanish state to abandon traditional policy tools and hand over its automotive industry to foreign capital. Second, it argued that deep transnational regulatory integration did not mean elimination of policy space for development, and that in some cases it even provided states with resources for a new industrial policy which was more decentralized and focused on technological upgrading. summarizes the key characteristics and tools of both policy modes.

Table 1. Key characteristics and tools of old and new industrial policies.

The question that logically follows is how effective the new industrial policy is compared to the old one. Unfortunately, the question is impossible to answer directly. The two differ not only in means, but also in goals: while the old industrial policy was focused on helping national firms build production networks at home and compete abroad, the new policy is concerned with assisting domestically based firms in moving up transnationally distributed and externally controlled value chains.

It is also hard to disentangle the effect of policy from other trends that influenced the fortunes of the Spanish industry in this period. One of these is the rise of the East Central European automotive cluster, whose low costs and proximity to Germany made it the prime destination for automotive investments in Europe, sometimes at the expense of older production locations. Another is the structural shift in the Spanish economy away from industry, vastly accelerated by the tide of cheap capital that flowed into construction and services sectors in the wake of Spain’s entry into the Eurozone (Johnston, Hancké, & Pant, Citation2014).

Judged against these adverse trends, the Spanish automotive industry in the deep integration era holds up rather well. After a vertiginous rise in the 1990s the production numbers stagnated and even declined in the 2000s, but Spain held its ground better than any other West European location except Germany and France. Southern countries fared especially badly, but so did Belgium and the UK – two formerly major production locations without own lead firms (). Also unlike Portugal, Belgium, and the UK, which suffered multiple plant closures, Spain saw very few relocations, mostly in the more labor-intensive component production (Bilbao-Ubillos & Camino-Beldarrain, Citation2008; CC.OO, Citation2011). Meanwhile, production upgrading allowed Spain to reduce trade deficit in high-value added components which had plagued the industry since liberalization, even as soaring imports of expensive vehicles eroded its overall surplus ().

Table 2. Changes in production volumes in various countries.

The resilience of the Spanish industry is especially remarkable if we take into account the enormous inflationary pressures on manufacturing from a flood of cheap capital into the construction sector that was partly sparked by the process of monetary integration (Johnston et al., Citation2014). Yet despite the wage pressures from the sectors most affected by capital inflows, investments into upgrading and the new sectoral structures that facilitated wage coordination made sure that productivity and unit labor costs in the Spanish automotive industry kept pace with the German levels (). This is all the more impressive if we remember that in this period the German industry greatly boosted its own productivity by outsourcing labor-intensive production to the East European ‘extended workbench’ while using the threat of relocations to keep wages stable at home (Krzywdzinski, Citation2014).

On balance, though the new industrial policy helped Spanish automotive industry to remain successful in a fiercely competitive environment, its achievements were mostly of incremental nature. This became a problem with the arrival of the global financial crisis, which seemed to call for more radical measures. The automotive industry was hit hard, suffering a by 25% production decline in 2009 alone. The Socialist government at first responded with a generous stimulus package, but as the fiscal bill mounted the country lost the confidence of the financial markets and was forced to seek financial support from the EU and IMF. These came at a price: if the EU had previously offered a source of support for industrial policy innovations, it now demanded tough austerity measures which significantly reduced space for policy intervention. Worse, the crisis coincided with the effects of the 2007 reform of EU funds which significantly reduced the amount of funding available to the Spanish regions (OECD, Citation2010). In 2011 a new conservative government resorted to sharp spending cuts and an aggressive labor market reform, seemingly indicating that the country had decided to restore competitiveness primarily via labor cost reductions.

In some way, the new industrial policy in Spain had thus ran against the same barriers that had brought an end to the old industrial policy: a deep crisis, financial exhaustion and new constraints at the international level. Yet underneath the appearance of radical liberalization, the industrial policy of the conservative government actually strayed very little from the neo-developmentalist path of the previous years. Subsidies for transition to more efficient and alternative energy vehicles continued and were even expanded, and even the observatories were reconstituted after a short pause as the Forum for Dialogue in the Automotive Sector. In cooperation with regional authorities, the government also negotiated generous support packages for new investments, which helped to prevent plant closures and by 2016 brought the production figures back to the pre-crisis levels. A new collaborative form of skills training is being put into place to ensure continuous supply and productivity of labor (Echeverría Citation2016).

Domestic politics might offer an explanation of this remarkable resilience in the face of crisis. As argued by Ban (Citation2016), ideological differences notwithstanding, the two main Spanish parties in fact share a fundamental consensus on the need for state intervention to support economic competitiveness, and the previous two decades have certainly seen strong continuity in industrial policy. Another explanation might come from the very character of new industrial policy, which relies on building distributed capacities at various governance levels. This ensures that many actors have a stake in its continuation and possibly makes it more stable than a policy that depends predominantly on the central government.

At the same time, these very features might make the new industrial policies less effective in other sectors. The success of the automotive industry stands out against decline of many other Spanish manufacturing branches. The fact that the new industrial policy requires strong capacities not only in the central bureaucracy, but also at the local levels and in the private sector might be a reason for these failures, but further comparative research is necessary to properly understand the institutional and political prerequisites for successful policy adaptation.

Finally, probably the most important factor for the future prospects of Spanish industrial policy, and a crucial area for research into industrial policies under deep transnational integration, is the process of policy development at the supranational level. This paper has offered evidence that the EU at least has been broadening its policy toolbox, though its effects have been largely overridden by the insistence on fiscal austerity in response to the sovereign debt crisis. The bleak economic performance in nearly a decade post-crisis has reopened the debate on the need for industrial policy in the EU, which will hopefully strengthen these tools further, and allow the member states more space to implement them.

Disclosure statement

No potential conflict of interest was reported by the author.

Notes

Additional information

Funding

Notes on contributors

Vera Šćepanović

Vera Šćepanović is a university lecturer in European Union Studies at the History and International Studies Department, Institute for History of Leiden University. She received her PhD in political science from Central European University. Her research focuses on issues of development and industrial policy, labor relations and economic nationalism.

Notes

1 Author’s calculations based on Eurostat International Trade Statistics.

2 Author’s calculations based on Eurostat and Amadeus databases. Three Spanish firms (Gestamp, CIE Automotive, and Grupo Antolin) are among top-100 global first-tier suppliers by sales (AutomotiveNews, Citation2018).

3 This was not true of all sectors. In fact, the most competitive Spanish products – agricultural products, textiles and garments – remained subject to high tariffs and quotas, to be reduced only after long phase-in periods.

4 Notable examples include the sale of truck manufacturer Motor Ibérica to Nissan (1987), SANTANA to Suzuki (1988), ENASA to FIAT (1990) and of the largest supplier of electrical components for motor vehicles, FEMSA, to Robert Bosch (1985).

5 These ‘disadvantaged’ areas are defined as predefined subnational statistical units with per capita GDP of less than 75% of the EU average.

6 This is supposed to be mediated by the regional policy rules that direct resources explicitly at the ‘disadvantaged’ regions (per capita GDP under 75% of EU average). However, initially at least all Spanish regions fell under this bar.

7 The Mercedes factory in Vittoria was opened in the 1970s, but until the expansion in 2000 it remained a boutique operation that assembled small runs of commercial vehicles and had few connections to the local firms.

8 The Plan for Technological and Industrial Modernization (Plan de Actuación Tecnológico Industrial – PATI) which subsidized trainings and upgrading of capital equipment, and Environmental Programme for Industry and Technology (Programa Industrial y Tecnológico Ambiental – PITMA) to minimize environmental impact and improve energy efficiency of the industry.

9 ANFAC (Asociación Española de Fabricantes de Automóviles y Camiones) is the association of vehicle makers, SERNAUTO (Asociación Española de Proveedores de Automoción) of the suppliers. Federation of Technology Centres is an association of nonprofit R&D bodies such as techno-parks, research centers, incubators, etc., which provide services to private companies. They are organized independently and can take a variety of legal forms, but must fulfil certain criteria to be recognized as Technology Centres, which then allows them to participate in public R&D programs (OECD, Citation2007).

10 The original group included the vice-president of the European Commission, as well as Commissioners for Transport and Environment; representatives of the ministries of environment, economy, industry and transport of five member states (UK, Germany, France, Italy and the Czech Republic); two MEPs; presidents of EU-level automotive associations, chief executives of Ford, Renault, Fiat and Volvo; and representatives of the Institute for European Environmental Policy, Fédération Internationale de ‘Automobile, and the European Metalworkers’ Federation.

11 These included BeLCar (Bench Learning in Cluster Management for the Automotive sector in European Regions) and TCAS (Transnational Clustering in the Automotive Sector) funded by the INNOVA FP 6 initiative; Network of Automotive Regions and Network of European Automotive Competence (NEAC), funded by the European Regional Development Fund, and I-CAR-O (Innovative Regional Strategies for the Sustainability of Employment in the European Automobile Industry), financed by the European Social Fund.

References

- Ahedo, M. (2004). Cluster policy in the Basque country (1991–2002): Constructing “industry–government” collaboration through cluster‐associations. European Planning Studies, 12(8), 1097–1113. doi:10.1080/0965431042000289232

- Amsden, A. H. (2001). The rise of “the rest”: Challenges to the West from late-industrializing economies. Oxford: Oxford University Press.

- Automotive News (2018). 2018 top suppliers. Retrieved from https://www.autonews.com/article/20180625/DATACENTER/180629914

- Ban, C. (2016). Ruling ideas. How global neoliberalism goes local. Oxford University Press.

- Banyuls, J., & Lorente, R. (2010). La Industria del automóvil en España: Globalización y Gestión Laboral. Revista de Economía Crítica, 9(1), 33–52.

- Barnes, J., & Kaplinsky, R. (2000). Globalization and the death of the local firm? The automobile components sector in South Africa. Regional Studies, 34(9), 797–812. doi:10.1080/00343400020002949

- Bilbao-Ubillos, J., & Camino-Beldarrain, V. (2008). Proximity matters? European Union enlargement and relocation of activities: The case of the Spanish automotive industry. Economic Development Quarterly, 22(2), 149–166. doi:10.1177/0891242408316959

- Boceta Álvarez, V., & Espinosa de los Monteros, C. (2005). Un análisis de la política industrial española. Información Comercial Española, ICE: Revista de Economía, (826), 223–242.

- Bordenave, G., & Lung, Y. (1988). Ford en Europe: crises locales, crise globale du fordisme. Cahiers de recherche du GIP. Mutations industrielles, No. 17, Paris.

- Borzel, T. A. (2002). Member state responses to Europeanization. Journal of Common Market Studies, 40(2), 193–214.

- Bruszt, L., & Langbein, J. (this issue). Introduction. Manufacturing development: How transnational market integration shapes opportunities and capacities for development in Europe’s three peripheries. Review of International Political Economy.

- Bruszt, L., & Vukov, V. (2017). Making states for the single market: European integration and the reshaping of economic states in the Southern and Eastern peripheries of Europe. West European Politics, 40(4), 663–687. doi:10.1080/01402382.2017.1281624

- Bulfone, F. (2018). The state strikes back: Industrial policy, regulatory power and the divergent performance of Telefonica and Telecom Italia. Journal of European Public Policy, 26, 752–771, doi:10.1080/13501763.2018.1459790

- Camino Beldarrain, V., Bilbao Ubillos, J., & Aláez Aller, R. (2003). El desarrollo de la industria auxiliar de automoción en la economía vasca. Ekonomiaz: Revista Vasca de Economía, (54), 104–127.

- Catalan, J. (2006). La SEAT del desarrollo, 1948-1972. Revista de Historia Industrial, 30, 143–193.

- Catalan, J. (2010). Strategic policy revisited: The origins of mass production in the motor industry of Argentina, Korea and Spain, 1945–87. Business History, 52(2), 207–230. doi:10.1080/00076791003611863

- CC.OO (2011). Interview with Maximo Blanco Muñoz, Secretary of Industrial Strategies, Comisiones Obreras, 23.10.2011.

- Chang, H.-J. (2005). Kicking away the ladder: “Good” policies and “good” institutions in historical perspective. In K. P. Gallagher (Ed.), Putting development first: The importance of policy space in the WTO and IFIs. London: Zed Books.

- Chari, R. S. (1998). Spanish socialists, privatising the right way?. West European Politics, 21(4), 163–179. doi:10.1080/01402389808425276

- Chibber, V. (2006). Locked in place: State-building and late industrialization in India. Princeton, NJ: Princeton University Press.

- Clift, B., & Woll, C. (2013). Economic patriotism in open economies. London: Routledge.

- Dancet, G., & Rosenstock, M. (1995). State aid control by the European Commission: The case of the automobile sector. Retrieved from http://ec.europa.eu/competition/speeches/text/sp1995_043_en.html

- DiCaprio, A., & Gallagher, K. P. (2006). The WTO and the shrinking of development space: How big is the bite?. The Journal of World Investment & Trade, 7(5), 781–804. doi:10.1163/221190006X00397

- EC (1989). Community framework for state aid to the motor vehicle industry. Official Journal, C, 123, 3.

- EC (2002). Industrial policy in an enlarged Europe (communication from the Commission to the Council, the European Parliament, the Economic and Social Committee and the Committee of the Regions No. COM(2002) 714). Brussels: Commission of the European Communities.

- EC (1985). Treaty of accession of Spain and Portugal, Protocol 6. Official Journal L, 302.

- Echeverría, B. (2016). Transferencia del sistema de FP Dual a España. Revista de Investigación Educativa, 34(2), 295–314. doi:10.6018/rie.34.2.249341

- El, P. (1981, May 30). La multinacional Fiat cede al Estado español su participación Seat. Retrieved from http://elpais.com/diario/1981/05/30/economia/360021606_850215.html

- El, P. (1983a, January 20). Fiat anuncia haber llevado a Seat ante el TribunaI de París. Retrieved from http://elpais.com/diario/1983/01/20/economia/411865212_850215.html

- El, P. (1983b, April 10). Presiones de Francia para reducir la competencia de sus filiales del automóvil en España. Retrieved from http://elpais.com/diario/1983/10/04/economia/434070014_850215.html

- El, P. (1985, December 29). Seat, el final de la aventura. Retrieved from http://elpais.com/diario/1985/12/29/opinion/504658802_850215.html

- El, P. (1993a, January 10). La Generalitat crea en Alemania una oficina de apoyo al sector auxiliar. Retrieved from http://elpais.com/diario/1993/10/01/economia/749430021_850215.html

- El, P. (1993b, September 10). 700 empresas y 509000 personas afectadas en la industria auxiliar. Retrieved from http://elpais.com/diario/1993/10/09/economia/750121201_850215.html

- El, P. (1993c, October 12). La Generalitat aprobará la próxima semana reducir 7.600 empleos en Seat. Retrieved from http://elpais.com/diario/1993/12/10/economia/755478029_850215.html

- El, P. (1994, May 1). Largo adiós para la Zona Franca. Retrieved from http://elpais.com/diario/1994/01/05/economia/757724418_850215.html

- Etchemendy, S. (2004). Revamping the weak, protecting the strong, and managing privatization: Governing globalization in the Spanish takeoff. Comparative Political Studies, 37(6), 623–651. doi:10.1177/0010414004265880

- Evans, P. (1995). Embedded autonomy: States and industrial transformation. Princeton, NJ: Princeton University Press.

- Featherstone, K. (1998). Europeanization’ and the centre periphery: The case of Greece in the 1990s. South European Society and Politics, 3(1), 23–39. doi:10.1080/13608740308539524

- Fernández-de-Sevilla, T. (2014). La emergencia del capitalismo industrial en España: FASA-Renault y la triple inversión, 1965-1974. Revista de Historia Industrial, (55), 135–168.

- Fetzer, T. (2005). Driven towards inter-nationalisation: British trade union politics at Ford and Vauxhall, 1960–2001 (PhD dissertation). European University Institute (EUI), Florence.

- Gallagher, K. P. (2007). Understanding developing country resistance to the Doha Round. Review of International Political Economy, 15(1), 62–85. doi:10.1080/09692290701751308

- Garcia Calvo, A. (2016). Institutional development and bank competitive transformation in late industrializing economies: The Spanish case. Business and Politics, 18(1), 27–62. doi:10.1515/bap-2014-0034

- García Ruiz, J. L. (2001). La evolución de la industria automovilística española, 1946-1999: Una perspectiva comparada. Revista de Historia Industrial, 19–20, 133–164.

- Haggard, S. (1990). Pathways from the Periphery. Ithaca, NY: Cornell University Press.

- Hamilton, C. (1986). The upgrading effect of voluntary export restraints. Weltwirtschaftliches Archiv, 122(2), 358–364.

- Holman, O. (1996). Integrating Southern Europe: EC expansion and the transnationalization of Spain. London: Routledge.

- Johnston, A., Hancké, B., & Pant, S. (2014). Comparative institutional advantage in the European Sovereign debt crisis. Comparative Political Studies, 47(13), 1771–1800. doi:10.1177/0010414013516917

- Krueger, A. O. (1996). The political economy of trade protection. Chicago, IL: University of Chicago Press. doi:10.1086/ahr/101.2.555

- Krzywdzinski, M. (2014). How the EU’s Eastern enlargement changed the German productive model: The case of the automotive industry. Revue de La Régulation, 15(1), 1–61. Retrieved from http://journals.openedition.org/regulation/10663 doi:10.4000/regulation.10663

- Lal, D. (1984). The political economy of the predatory state [World Bank Discussion Paper]. Washington, DC: World Bank.

- Langbein, J. (this issue). Shallow market integration and weak developmental capacities: Ukraine’s pathway from periphery to periphery. Review of International Political Economy.

- Langbein, J., & Markiewicz, O. (this issue). Changing modes of market integration, domestic developmental capacities and state-business alliances: Insights from Turkey’s automotive industry. Review of International Political Economy.

- Lieberman, S. (1995). Growth and crisis in the Spanish economy, 1940-93. London: Routledge.

- Lung, Y., & Volpato, G. (2002). Redesigning the automakers-suppliers relationships in the automotive industry. International Journal of Automotive Technology and Management, 2(1), 3–9. doi:10.1504/IJATM.2004.005325

- Mayer, J. (2009). Policy space: What, for what, and where? Development Policy Review, 27(4), 373–395. doi:10.1111/j.1467-7679.2009.00452.x

- Medve-Balint, G., & Šćepanović, V. (this issue). EU funds, domestic state and the development of transnational industrial policies in Europe’s periphery. Review of International Political Economy.

- MEyC (2005). El Plan Nacional de I + D+I 2000-2003 en cifras. Ministerio de Educación y Ciencia, Secretaría General de Política Científica y Tecnológica.

- Morata, F., & Muñoz, X. (1996). Vying for European funds: Territorial restructuring. In L. Hooghe (Ed.), Cohesion policy and European integration: Building multi-level governance. Oxford: Oxford University Press.

- Morgan, G. (2012). Supporting the city: Economic patriotism in financial markets. Journal of European Public Policy, 19(3), 373–387. doi:10.1080/13501763.2011.638134

- Observatorio Industrial. (2005). ‘Propuestas de actuaciones para la mejora de la competitividad del sector’. Observatorio Industrial del Sector de Fabricantes de Automóviles y Camiones. Ministerio de Industria, Turismo y Comercio.

- OECD (2007). International investment perspectives: Freedom of investment in a changing world. Paris: Author.

- OECD (2010). Catalonia, Spain. [OECD reviews of regional innovation.]. Paris: Author.

- OICA (2018). Production statistics 2017. Retrieved from International Organisation of Motor Vehicle Manufacturers website: http://www.oica.net/category/production-statistics/2017-statistics/

- Pérez Sancho, M. (2003). La industria del automóvil en la Comunidad Valenciana: el caso de Ford España. In J. L. García Ruiz (Ed.), Sobre ruedas: una historia crítica de la industria del automóvil en España (pp. 127–166). Madrid: Síntesis.

- Rodrik, D. (2006). Goodbye Washington consensus, hello Washington confusion? A review of the World Bank’s Economic Growth in the 1990s: Learning from a decade of reform. Journal of Economic Literature, 44(4), 973–987. doi:10.1257/jel.44.4.973

- Rodrik, D. (2009). One economics, many recipes: Globalization, institutions, and economic growth. Princeton, NJ: Princeton University Press.

- Scharpf, F. W. (1999). Governing in Europe: Effective and democratic? Oxford: Oxford University Press.

- Sturgeon, T. J., & Florida, R. (2000). Globalization and jobs in the automotive industry (No. MIT-IPC-00-012). Cambridge, MA: Massachusetts Institute of Technology.

- Thatcher, M. (2014). From old to new industrial policy via economic regulation. Rivista Della Regolazione Dei Mercati, 2, 6–22.

- Tsoukalis, L., & Rhodes, M. (1997). Economic integration and the nation-state. In Rhodes, M., Heywood, P., & Wright, V. (Eds), Developments in West European politics (pp. 19–36). London: Macmillan Education UK.

- Velasco, R. (2000). La descentralización de la política industrial española 1980-2000. Economía Industrial, 335–336, 15–34.

- Vukov, V. (this issue). European integration and weak states: Romania’s road to exclusionary development. Review of International Political Economy.

- Wade, R. (1990). Governing the market: Economic theory and the role of government in East Asian industrialization. Princeton, NJ: Princeton University Press.

- Wade, R. (2003). What strategies are viable for developing countries today? The World Trade Organization and the shrinking of ‘development space. Review of International Political Economy, 10(4), 621–644. doi:10.1080/09692290310001601902