ABSTRACT

Homeownership has been declining in favour of private renting in most developed English speaking countries since the early-2000s. Public debates in countries like Britain, Australia and the US have subsequently focused on the ostensible coming of age of ‘generation rent’, constituted of younger individuals excluded from home buying and traditional routes to housing asset accumulation. While the focus of this paper is the significance of access to housing assets as a means to offset potential economic and welfare precarity, our concern is landlords rather than tenants. Drawing on British survey data, we show that the rental boom has been accompanied by increasing multiple property ownership among classes of largely middle-aged and relatively affluent households. Over one-million small-time landlords have emerged in the last decade alone, who, we argue, are part product of historic developments in housing markets and welfare states. Generations of British have not only been orientated towards their homes as commodity assets, they have also begun to mobilise around multi-property accumulation in a context of shifting welfare and pension expectations.

Introduction

The unprecedented growth in individual homeownership and related housing equity across OECD countries between the 1980s and 2000s (cf. Doling and Ford Citation2007, Andrews and Sanchez Citation2011) has deeply embedded conceptions of housing as a market good. Moreover, in light of advancing public welfare rollback and growing socioeconomic inequality, housing has been increasingly perceived not merely as a home, but as a tradable economic asset, which households can potentially use as an alternative form of social insurance. An influential literature has thus signalled the importance of housing property in contemporary welfare capitalism (see Kemeny Citation1992, Castles Citation1998, Schwartz and Seabrooke Citation2008, Crouch Citation2009, Doling and Ronald Citation2010, Ronald and Doling Citation2012, Ansell Citation2014), with financial markets and state welfare policies aligned around the promotion of individual property ownership. The concomitant reconstitution of households as financial investor subjects meanwhile (Langley Citation2006, Finlayson Citation2009, Smith et al. Citation2009, Watson Citation2009) has in many ways centred on housing property as a means to cope with, and manage, individual risk.

Yet, while scholars in the 2000s conceptually grappled with the integration of housing property into frameworks of contemporary welfare capitalism, housing and welfare systems have evolved even further. A crucial trend in this context has been that the pillar of a property-based welfare regime, individual homeownership, has declined in numerous contexts since the mid-2000s (Forrest and Hirayama Citation2015). In the UK, for example, long-standing sector growth was reversed in the mid-2000s, with homeownership shrinking, from some 71 per cent of all households in 2003 to 63 per cent in 2014. Meanwhile, private renting has rocketed, effectively doubling since 2002. Today, more than 18 per cent of UK households rent privately up from less than 10 per cent just over a decade ago (ONS Citation2015).

A key concern in understanding the formation of a ‘post-homeownership’ society (Ronald Citation2008: 250) has been the particular fate of young people on the housing market. Volatile house prices, stricter equity requirements and deteriorating labour market conditions have combined to exclude increasing volumes of younger households from owner-occupation (Lennartz et al. Citation2016). The ostensible emergence of ‘generation rent’ represents a group not only more vulnerable to exploitative forms of private renting, but one also excluded from the primary form of asset accumulation (cf. McKee Citation2012). This has raised critical concerns about the longer term stability of a homeownership-based welfare regime and the future role of housing property in welfare relations (Searle and McCollum Citation2014, Montgomerie and Büdenbender Citation2015, Smith Citation2015).

In practice, the way households relate to, and draw on, housing property has become more differentiated (Ronald et al. Citation2017). This paper specifically focuses on how, for existing homeowners, buying an extra property to-let has become more compelling in context of the progression of property- or asset-based welfare strategies (Conley and Gifford Citation2006, Malpass Citation2008, Doling and Ronald Citation2010), especially since the Global Financial Crisis (GFC), that reflect the activation of more self-responsibilised, investment ready welfare subjects (Berry Citation2015). We, therefore, examine the private rental sector, how it has grown, and its emerging salience as an investment for households seeking to manage risk and insecurity. The following section establishes the historical context in terms of the development of housing and welfare policies and their relationship with shifting socioeconomic and political conditions. Through an analysis of the British Household Panel Survey (BHPS) among other sources, we go on to consider quantitative increases in small-time private landlords (who own just one or two properties to let) as well as explore their socioeconomic and demographic profile. This analysis of the extent and types of multi-property owners reveals how sector growth has been driven by particular cohorts of relatively affluent individuals who constitute a potential ‘generation landlord’. The final section considers implications of the emerging profile of landlords, from which we frame changes in the British tenure structure and property-based welfare regime. We ultimately consider how socioeconomic and welfare shifts have begun to shape marked inequalities in housing, asset and welfare security between cohorts and income groups.

Our analysis contributes to a number of broader debates. First, it advances extant understanding of tenure restructuring in Britain’s post-homeownership society, highlighting the characteristics of an emerging class of landlords and strategies towards housing property being adopted under conditions of declining access to homeownership. While analyses suggest that recent private rental sector revival is characteristically neo-liberal and a departure from traditional practices (Scanlon and Whitehead Citation2005, Rugg and Rhodes Citation2008, Leyshon and French Citation2009, Sprigings and Smith Citation2012, Kemp Citation2015), a few (i.e. Soaita et al. Citation2016, Ronald et al. Citation2017) have begun to recognise the significance of rental property investment as an alternative to a pension or a means of restructuring the management of economic risk. Second, it examines how resurgence in the private rental sector is driving new socioeconomic inequalities manifest through differentiated access to market housing and asset-based welfare practices. Specifically, we consider the development of ‘generation landlord’ in terms of the historic conditions that also produced ‘generation rent’, as well as the relationship between these groups.

From pre- to post-homeownership society

The post-war period provided a relatively stable growth model of welfare capitalism built around a consensus of labour and capital (Aglietta Citation1979), with state policies protecting workers becoming particularly important in fields such as pensions, health care and unemployment benefits (Esping-Andersen Citation1990). Although post-war welfare states produced their own exclusionary dynamics, de-commodification measures overall promoted rising living standards, improved employment and wage conditions, ensured the ordered reproduction of the work force and, coupled with the Fordist model of mass consumerism and standardised production, provided the conditions for continued economic growth and private profit-making. Housing policy, arguably, functioned as a largely unacknowledged part of the post-war welfare consensus (Torgersen Citation1987, Kemeny Citation1995, Hoekstra Citation2003). State interventions to ensure inexpensive housing of decent quality became evident in most Western industrialised countries, with social housing and rent regulation constituting key examples. Contrary to other welfare services, however, housing was more resistant to de-commodification and the market continued to play a comparatively greater role (Harloe Citation1995). As in other welfare spheres, housing policies varied considerably, with countries like the US promoting market-based approaches and others like Sweden favouring state-centred provision.

The UK, at least in terms of housing policies, fell somewhat in-between market-based and state-centred welfare models. Post-war house building programmes incorporated ‘council housing’,Footnote1 which by the late-1970s constituted almost a third of the housing stock. At the same time, individual homeownership also featured in policy endeavours and became particularly important to welfare state restructuring after the election of Thatcher’s Conservatives in 1979. Rising unemployment, stagnating growth and steep inflation in the 1970s had provided a challenge to the post-war consensus, creating space for a more neo-liberal conception of the welfare state, with housing a key arena for restructuring.

For Forrest and Murie (Citation1988), the state-subsidised promotion of individual homeownership in Britain’s emerging ‘Property Owning Democracy’ hinged on notions of social stability, individual responsibility and conservatism, making it a centrepiece of political attempts to reconfigure the post-war social consensus and undermine the logic of the welfare state. While homeownership had become the majority tenure after 1970, in the 1980s sector proliferation intensified, incorporating growing numbers of middle and even lower income households. Achieving a Conservative vision of a ‘stakeholder society’, in the form of a ‘nation of homeowners’ (cf. Saunders Citation1990), represented an antidote to a state-managed, collectivistic regulatory approach (Ronald Citation2008). The ‘Right-to-Buy’ for sitting council housing tenants (at up to 60 per cent discount) certainly became a critical policy initiative in this regard, with more than 2.5 million social rental units (equivalent to more than 12 per cent of total 1980 housing stock) subsequently sold-off as owner-occupied homes.

Rising housing property ownership essentially came to feature in the restructuring of welfare obligations between the state and individuals. Rather than public provision and social protection measures, the inherent contradiction of capital and labour was increasingly expected to be resolved through the market, with individuals acting as the bearers and managers of their own risk. In what Crouch (Citation2009) calls ‘privatised Keynesianism’, the extension of private debt supported households in actively investing in, and building up, private assets that supported the individual management of anticipated welfare expenses. Individualistic conceptions replaced collectivistic approaches of the Keynesian period, with household investor subjects expected to actively even out unpredictable outcomes of market cycles (Finlayson Citation2009). Housing loans and assets, and their wider distribution were central to this with, for Watson (Citation2009), the term ‘house price Keynesianism’ capturing the emerging centrality of housing property in welfare state relations. In context of rising homeownership rates and house prices, households could be expected to draw more on their own housing property wealth to both protect themselves and finance reproductive activities, with the state doing less (cf. Ansell Citation2014).

Housing property, at least for some time, seemed to provide a potential anchor point for a new consensus between labour and capital under conditions of an increasingly residual welfare state. On the side of labour, wider access to homeownership appeared to provide working households with more room to finance and organise reproductive activities in the context of declining state welfare provision, sluggish economic growth and stagnating incomes (cf. Streeck Citation2014). On the side of capital, the expansion of private housing property offered new opportunities for accumulation, in particular for finance capital. Indeed, homeownership and housing assets were growing rapidly by the turn of the millennium with lending and borrowing against housing at the heart of an emerging finance-led growth regime (Aalbers Citation2015).

In the UK, homeownership continued to expand its tenure share from some 67.5 per cent in 1990 to about 70.7 per cent by 2005 (Andrews and Sanchez Citation2011). Meanwhile, average house prices increased annually by more than 6.9 per cent, from around £20,000 in 1980 to over £180,000 in 2014 (ONS Citation2015). For Smith (Citation2015: 67), the extensive accumulation of individual housing assets encouraged, rather than succeeded, wider welfare reforms. As she argues, in a process of ‘welfare switching’,Footnote2 homeownership growth ‘legitimised, perhaps incentivised, the retreat of social insurance’. Regardless of the causal order, this arguably turned the redistributive role of housing property upside down. Whereas under conditions of deeper state welfare provision the possession of a home provided an additional financial advantage, from the 2000s on – when welfare retrenchment intensified – being without property increasingly came to constitute a social disadvantage, reinforcing the link between housing property and welfare.

As the financialisation literature has shown (cf. Aalbers Citation2008, Gotham Citation2009), neo-liberal housing reforms combined with the deregulation of financial markets in driving the expansion of property-based welfare. Linking global credit circuits with local mortgage markets enabled lenders to issue easy credit to potential home-owning households (Sassen Citation2009). This enhanced access to homeownership and helped turn housing into a highly liquid, but spatially fixed financial instrument. Fundamentally, financial institutions allowed households to delay costs and thereby access the housing market more easily despite sharp price increases that otherwise would have inhibited entry. New financial products – which made mortgages riskier and put higher debt burdens on first-time buyers – also supported continued upward movement in both house prices and homeownership, although access for first-time buyers became an increasing stretch (Forrest and Hirayama Citation2015).

An apex for Britain as a ‘nation of homeowners’ was ostensibly reached around the mid-2000s, when almost 71 per cent of all households owned their home. Since then, the sector has declined to 68.3 per cent in 2008 and then 63 per cent by 2014 (DCLG Citation2016). Britain has thus joined a growing number of post-homeownership societies including Australia, New Zealand, Ireland and the USA, as well as Japan and South Korea, where long-term sector augmentation has been exhausted with private renting recently becoming the dominant tenure among households aged under 35 (cf. Ronald Citation2008). In the UK, the private rental sector effectively doubled between 2002 and 2014 from around 9.5 per cent to 18.5 per cent of households. In absolute numbers, it grew by some 2.83 million dwellings in this period (DCLG Citation2017).

Demographic differences in the shift from owning to renting have been remarkable. Indeed, between 1991 and 2012, homeownership rates for those aged over 65 advanced from 58 per cent to 77 per cent (DCLG Citation2013). By contrast, for 25- to 34-year-old independent households it declined from 78 per cent to 43 per cent. Thus, renting privately, at 44.6 per cent, now represents the primary dwelling mode for this age group. The formation of ‘generation rent’ has firstly been considered problematic on grounds of the exploitative conditions, in terms of both affordability and quality under which many people in the private rental sector are housed, with for example about one-third of tenants living in structurally inadequate housing (Lansley and Mack Citation2015). There are, nonetheless, further issues in regard to the welfare and housing property link, with long-term residency as private tenant constituting a severe barrier for younger people in accumulating property assets. Critical concerns have thus been raised about the long-term role of housing property for individual welfare strategies and the viability of a property-based welfare regime in a post-homeownership context (McKee Citation2012, Montgomerie and Büdenbender Citation2015).

In practice, evidence suggests that households have continued to draw on property to hedge against rising insecurity, although approaches have become more complex and include recourse to equity release products and trading-down strategies as well as ‘doubling up’ with friends or family, or even taking in lodgers (cf. Fox-O’Mahony and Overton Citation2015, Ronald et al. Citation2017). The following analysis takes this notion as a starting point and draws attention to the specific, but so far largely unacknowledged strategy featuring multiple property accumulation. Concretely, we show how ‘generation rent’ is only one side of housing and welfare restructuring in the British post-homeownership context. It has been mirrored by the emergence of a new class of non-professional landlords largely made up of an earlier generation of homebuyers who have become focused on the acquisition of extra property to let, or ‘house hording’ (Dorling Citation2013).

Conceptually, the analysis not only adds to a more differentiated understanding of the housing property and welfare link in post-homeownership contexts. It also points to the emerging role of the private rental sector for property-based welfare strategies and thereby contributes to a more comprehensive view on the sector and its changing role. As Hulse and McPherson (Citation2014) recently suggested, there is a need to more broadly conceptualise the ways in which people relate to residential property in light of shifting welfare, housing and labour market contexts. Critically, a more profound consideration of private rental investment is necessary as it constitutes an underexplored dimension of household risk hedging responses. Indeed, while the recent return of private renting has received considerable attention in the housing literature (e.g. Rugg and Rhodes Citation2008, Crook and Kemp Citation2010, Sprigings and Smith Citation2012, Wallace and Rugg Citation2014, Kemp Citation2015) in more focused debates about housing and welfare, the sector has been considered primarily in terms of disadvantaged tenants, overlooking the emerging significance of property investment among an expanding range of households (see Soaita et al. Citation2016). As we argue, the previous era of homeownership and house price inflation has created conditions where an increasing number of households have been both able, and eager to buy up ever more housing property. In what follows, we provide a quantitative analysis of landlordism, considering demographic and socioeconomic profiles. We discuss central driving forces at the level of policies and investment conditions as well as at the households level in order to provide a deeper understanding of this landlord turn.

Multiple property ownership in a post-homeownership society

Data sources

Our analysis builds from the BHPS and covers the period 1991–2012, i.e. the period for which the survey is available. In 2009, the BHPS was replaced with the Understanding Society Survey (US). Consequently, we use the latter from the year 2009 onwards. Relevant weights in the data sample allow for a cross-sectional analysis of the two surveys. Since there is no weight available for the year 2009, this year has been interpolated between the years 2008 and 2010. Relevant information for the analysis was taken from individual-level data-sets and weighted cross-sectionally. As the BHPS and the US only provide data relative to the population of the UK and no absolute numbers, we applied population weights to the results to arrive at absolute numbers. This was done using mid-year population figures for relevant years from the Office of National Statistics. To complement our own analysis, we also make reference to other data-sets and secondary analyses, in particular by the Department of Community and Local Government Citation2011, the Office of National Statistics (Citation2014a, Citation2014b, Citation2015) and Lord et al. (Citation2013).

The advance of multiple property owners

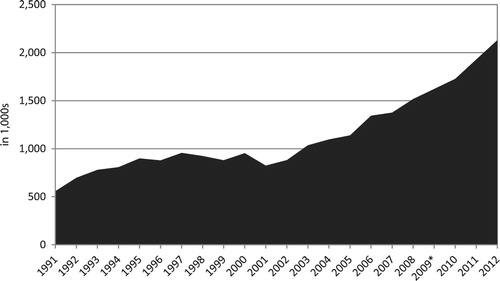

While the number of private renters in the UK has rocketed in recent years, the numbers of people who are active as private landlords have similarly advanced. Applying population weights to the sample of private landlords in the BHPS, one can see that the absolute number increased from about 558,000 in 1991 to more than 2.12 million in 2012. further illustrates three distinguishable phases in the growth of private landlordism in the last quarter century following more than 70 years of sector decline: an initial phase between 1991 and 1995 with quite rapid growth; a second phase between 1996 and 2001 with relative stagnation; and a third phase, since 2001, again with rapid increase, particularly since the onset of the crisis in 2008. Indeed, the GFC appears a catalyst rather than a break on investment in private rental property. This trend is not expected to reverse in the near future and according to government figures, by 2032, private landlords are expected to be responsible for more than one in three properties (Dyson Citation2014).

Figure 1. Private landlords in the UK, 1991–2012. Source: British Household Panel and Understanding Society Survey (author’s calculations). *Weighted with ONS mid-year populations to derive absolute numbers. **2009 interpolated due to data gap in Understanding Society Survey

This development is paralleled by a certain increase in institutional investors. Even though they continue to constitute marginal players in the sector, pension funds and insurance companies have become more active as private landlords, particularly in the prime markets of London and the South East where the chronic housing shortage promises relatively stable returns (cf. BNP Paribus Real Estate Citation2013, Kemp Citation2015).

The gentle increase in institutional investors, however, has been dwarfed by the profound influx of what might be called ‘small-time’ or ‘family’ landlords since the early-1990s. According to the most recent government landlord survey, private individuals or couples constituted some 89 per cent of landlords (DCLG Citation2011).Footnote3 While this group has long dominated the sector, their importance has clearly increased with, by way of contrast, private individuals or couples accounting for only 61 per cent of landlords in the early-1990s.

Although data is limited, there are various markers that illustrate significant transformations in the ownership and management of the private rental stock in the last decade. One such indicator is the length of time a landlord has been active. According to DCLG data, more than one-fifth (22 per cent) of private landlords started within the last three years and around 69 per cent began within the last decade. In terms of dwelling themselves, 51 per cent had been acquired after 2000 and about three-quarters over the last two decades overall. Rapid recent entry of small-time landlords has indeed accounted for much of the massive swell in private rental stock from 2.51 million to 4.96 million units between 2002 and 2012 (ONS Citation2014a). The indirect evidence suggests unit-level tenure conversions from owner-occupation to rent account for considerable parts of sector growth. For example, while there were 18.18 million owner-occupied units in 2007/2008 there were only 17.79 in 2011/2012, even though the total housing stock increased by more than 720 thousand (including 477 thousand new units built by private enterprise).

Certainly, the UK private rental sector has traditionally been a ‘cottage industry’ (Crook and Kemp Citation2010) and in 1994, some 26 per cent of the stock was owned by landlords who owned just one dwelling. Since then, the ‘informal’ character has evidently intensified and the overall trend has been towards smaller portfolios with fewer units (cf. Leyshon and French Citation2009, Crook and Kemp Citation2010). In 2010, among private landlords, some 78 per cent let just one unit, while 17 per cent let between two and four. Among private individuals or couples (family landlords), the small-scale character is even more apparent, with some 81 per cent owning simply one single unit (DCLG Citation2011). It seems that most British multi-property owners do not pursue landlordism as a professional business, as demonstrated by the fact that nine out of ten do it as a part-time rather than a full-time job (DCLG Citation2011). Moreover, professional expertise in letting is scarce. Even though some 23 per cent of landlords have experience in the building trade or a property-related sector, almost three-fifths have no relevant qualifications. The amateur character of emergent private landlordism is also demonstrated by how few landlords make a living from it, and while only 21 per cent earned more than a quarter of annual income from their property, a similar proportion made no profit at all.

The demographic and socioeconomic profile of landlords

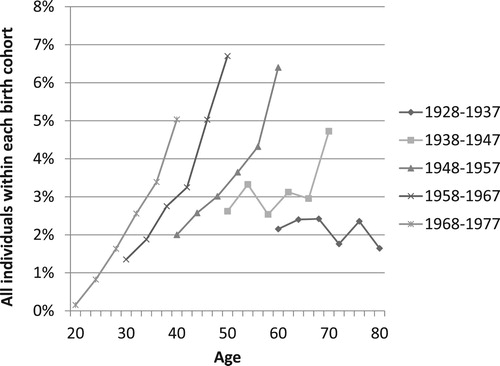

Overall, the combined evidence points to widespread growth in individual-level, small-scale rental market investment, typically the purchase of a single owner-occupied unit, which is subsequently converted to rental. But who are these landlords exactly? approaches this question through an analysis of landlords by age cohort since the beginning of the 1990s. The Y-axis shows the percentage of individuals in each age cohort that is an active landlord. The X-axis maps the age of landlords in different cohorts.

Figure 2. Private landlords among different age cohorts. Source: British Household Panel and Understanding Society Survey (author’s calculations).

Certainly, one would expect that landlords are more widespread among comparably older people, as it usually requires the ownership of assets, which people build up over their life-course. It seems, however, judging from the very two oldest cohorts in our sample (born 1928–1937 and 1938–1947) that becoming a landlord is not determined by age, with experience lowest among these groups. Landlordism is in fact far more prevalent among generations of baby-boomers. For those born between 1948 and 1957, who are now, on average, 60 years old, some 6.5 per cent of individuals (representing around 15 per cent of households in this cohortFootnote4) let property. By contrast, some 20 years ago, when this cohort was an average of 40 years old, only around 2 per cent were landlords. For the next age cohort, born 1958–1967, the increase is much sharper. Among this group (now 50 years old on average), some 6.7 per cent are landlords compared to 20 years earlier when the rate was only 1.4 per cent. This cohort then not only demonstrates higher active property letting, it also shows the most profound shift towards this activity over time. There is also a relatively sharp increase observable for the following age cohort, born 1968–1977. Although the share of landlords is currently lower, the ratio of landlords at (average) the age of 40 is already 5 per cent compared to 2 per cent and 3.2 per cent for those born 1948–1957 and 1958–1967, respectively. These cohort differences in the prevalence of landlordism are striking, with those currently aged between 40 and 60 appearing to represent a super-cohort where landlordism is ostensibly concentrated.

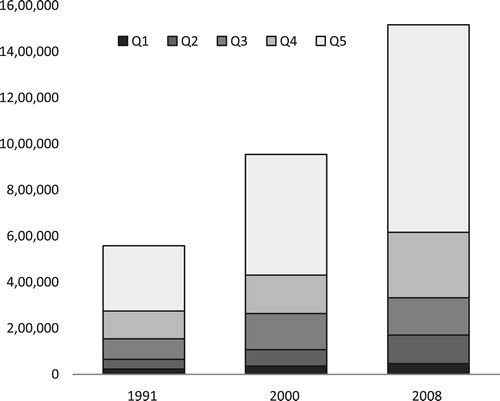

provides insight into the socioeconomic characteristics of landlords in terms of income. It maps how private landlords are distributed over five income quintiles and how this has developed, zooming in on three points in time between 1991 and 2008. Unsurprisingly, private landlords are disproportionately constituted of higher income households, with about 59 per cent from the top income quintile and 19 per cent from the fourth quintile in 2008. The top quintile is also the only one to show consistent growth, mostly at the expense of middle-income groups. That said, there is some notable dispersion of property letting across income categories with the first three income quintiles accounting for 22 per cent (with 8 per cent in the second quintile and 11 per cent in the third) in 2008. We can even find some landlords (3 per cent) in the poorest 20 per cent of the population. While this distribution may partly reflect inheritance patterns, it is also in line with the observation that private landlordism has become increasingly attractive to a broader cross-section of households, even less affluent ones (Wallace and Rugg Citation2014). Lord et al. (Citation2013) have confirmed the precarious financial state of many landlords, with some 17 per cent in their study who could only make ends meet for three months or less if household income dropped by one-quarter.

Figure 3. Private landlords by income quintile. Source: British Household Panel and Understanding Society Survey (author’s calculations)

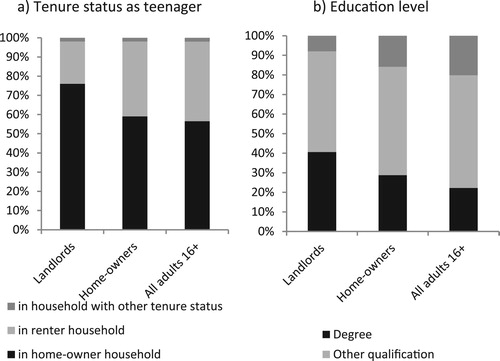

draws on the 2008 and 2010 Wealth and Asset Surveys, and provides some insight into the backgrounds of current landlords. On the one side, we can see that children who grow up in owner-occupied housing are far more likely to become landlords, which may reflect not only material inheritance but also socialisation effects (Mulder Citation2006). On the other hand, we see the importance of educational background suggesting, in context of , that landlords largely derive from relatively professional and well-educated backgrounds, and are distinct from regular homeowners in this regard.

Figure 4. Profiles of private landlords. (a) Tenure status as teenager. (b) Education level. Source: Lord et al. (Citation2013: 16f) (own illustration).

The political and economic context of the private renting revival

The relatively crude analysis above suggests some caution in the use of the moniker ‘generation landlord’, as income seems to play an important role. Nonetheless, becoming a landlord is not reserved to the very wealthy with 41 per cent coming from outside the top fifth of earners. Moreover, cohort does seem to play an important part. Understanding the rise in private landlordism then requires a closer examination of a number of driving forces that have shaped historic conditions.

Public policy has played a role. Post-war housing policies in the UK had, to a sizable extent, promoted owner-occupation and particularly social rental provision as preferred tenures. The private rented sector, meanwhile, became subject to a system of regulatory control to protect tenants from excessive profit-seeking by landlords (see Whitehead Citation1996, Crook and Kemp Citation2010). Rates of return in the sector, however, were kept low in that way, and by the 1980s, many landlords had turned away from private renting (Leyshon and French Citation2009). In the context of significant historical decline, steps were taken to deregulate the sector, making it less risky and more profitable. Specifically, security of tenure on short-term lets was relaxed and market rents were introduced on long-term contracts (cf. Rugg Citation2012). Furthermore, in 1988, rent regulation was abolished for new leases and landlords were granted the right to possession when a lease ended. Rent levels and increases could be freely set, with six-month to one-year contracts constituting the standard lease, after which, landlords could reclaim the property subsequent to a two-month notice period.

The Labour government of the late-1990s adopted an increasingly open approach to the sector, as Blair (Citation1996: 190–198) made clear shortly before becoming prime minister:

Labour is back in touch – the party of social housing, but the party of private housing too (…) In government I am firmly committed to ensuring a diversity of providers in rented housing. Part of that diversity must be to encourage the private rented sector.

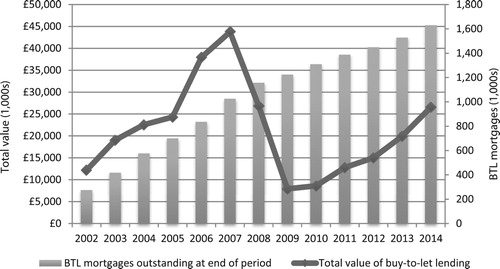

The Buy-to-Let (BtL) mortgage market became another driver of landlord growth (cf. Leyshon and French Citation2009). Introduced in 1996 by the Association of Residential Letting Agents (ARLA) together with a panel of mortgage lenders, it enabled potential individual landlords with an equity stake of around 30 per cent or more to buy an extra property. Initially, BtL had little effect following low demand in private renting resulting from the high numbers of first-time homebuyers in the late-1990s. However, BtL lending later boomed and between 2002 and 2007 the value of outstanding BtL mortgages escalated from £12.2 to £43.8 billion. Whereas BtL mortgages accounted for some 5 per cent of all mortgages in 2002, by 2007 their share was 17 per cent. In absolute numbers, outstanding BtL loans have risen overall from some 73,200 in 1999 to 1,630,000 in 2014 (CML Citation2015).

A part of the BtL growth was also caused by remortgaging, not house purchase. In 2006, for example, out of some 316,000 new BtL mortgages, about 146,000 were taken out for remortgaging. This proportion has overall remained stable since then, albeit with a dip in 2009/10, when house purchase loans outpaced remortgaging products by some 50 per cent for two consecutive years. In 2014, however, this had returned to pre-crisis levels again. Out of some 196,000 new BtL loans, 95,000 were for remortgaging (CML Citation2016).

The 2008 GFC was an important moment in the advance of small-time landlords, and, although many overleveraged landlords had their properties possessed during the initial downturn,Footnote5 as house prices continued to fall, more BtL buyers stepped in to acquire property cheaply. Indeed, as indicates, while the number of loans continued to rise, the value of new loans dropped sharply before starting to recover again after 2009. Low returns in alternative investment products like stocks and bonds have further encouraged investment in rental housing. For households with substantial savings, other financial investments have been unpredictable and bank interest rates disappointing (subject to central bank rates of 0.5 per cent).

Figure 5. Buy-to-Let Lending 2002–2014. Source: Council of Mortgage Lenders (author’s illustration).

Nevertheless, the influence of BtL lending has also faded with cash buying coming to the fore. According to lending sector data, around one-third of home purchases since the late-2000s have been cash-only, with the ratio in 2014 reaching 38 per cent nationally and higher than 50 per cent in London’s prime markets (Halifax Citation2015). It seems then that households are increasingly drawing on other savings and investments in order to finance home buying and landlord activities. Private rental sector growth is now outpacing BtL lending and is predicted to increase by another one million units in the next five years (IMLA Citation2014). A concern for the government, however, has been an unexpected strain on public budgets. On the one hand, rent allowances for low-income households doubled in cash terms in the decade to 2013 (Wilcox and Perry Citation2014), with private landlords now receiving an estimated 40 per cent of state housing benefit payments via their tenants. On the other hand, the increasing value of BtL mortgage relief led the Conservative government to announce the reduction for landlords to the lowest tax band from 2017. A surcharge of 3 per cent on top of stamp duty on properties bought with a view to letting has also been introduced (since April 2016). Nonetheless, the private rental sector continues to be eyed as the most viable alternative to social renting for low-income households (Gray and McAnulty Citation2010).

The household context of the ‘landlord turn’

While they illustrate a particularly opportune window, favourable policy and economic conditions alone do not explain the emergence of a generation where landlordism has become relatively common place, or at least why so many have turned to small-time private landlordism. Becoming a landlord is a long-standing approach to rent-seeking in the British context as are moralised discourses surrounding property ownership. However, both have arguably taken on a different hue in recent decades. Along with the deregulation and financialisation of housing since the 1980s, generations of households have been strongly oriented around housing property as a hedge against future risk (Smith et al. Citation2009), especially against poverty or welfare insecurity in later life. Indeed, survey data suggest that the use of property as a source for financing future welfare expenses is a key motivation for becoming a landlord. A recent study by Lord et al. (Citation2013), for example, found that some 70 per cent of private landlords consider selling or renting out another property – other than their main home – the expected method to fund retirement. Further, nearly half (49 per cent) see investing in property as the safest way to save for retirement. Similarly, according to a recent Landlords Association Survey (NLA Citation2012), four-in-five landlords consider their property income part of their pension, and three in-five (61 per cent) plan to live from rental incomes in retirement. Critically, it seems that renting out an extra property is commonly rationalised around an individualised welfare strategy that mirrors government policies and discourse that have sought to engineer a particular kind of market thinking, self-responsible, investment ready welfare subject.

A particular factor that has facilitated this shift in approaches to property letting has been the previous era of homeownership augmentation. The profound increase in owner-occupation rates in the UK since the 1970s created an older generation of homeowners who have been particularly effective in accumulating housing equity. While in 1981, approximately 49 per cent of households aged 65 and over and 54 per cent of 55–64 year olds were homeowners, by 2013 the rate was 77 per cent for both groups (DCLG Citation2013). Cohorts who purchased their homes before the 2000s have also been particularly advantaged by historical house price increases with the most notable property value increases occurring between 2002 and 2007 with the total value of UK housing rising from £2.9 to £5.7 trillion (Savills Citation2014).

Although house price advances have subsequently contributed to declining homeownership rates among younger cohorts, significant equity has been accrued by particular demographic segments, who have added to the liquidity of their homes as their mortgages have matured. For example, rates of ‘outright’ ownership in the UK advanced from 24.8 per cent to 32.5 per cent of households between 1991 and 2013 (Savills Citation2014). Consequently, the aggregate value of mortgage-free owner-occupied housing almost doubled between 2002 and 2012, increasing from £973 billion to £1.71 trillion. Critically, while homeownership rates diminished overall, net equity for those already in the sector increased substantially, despite the 2008 Financial Crisis, meaning homeowners in older cohorts (notwithstanding considerable inequalities in terms of geography and market sector) have often enjoyed both greater housing wealth and more freedom with their income to invest in even more property.

Housing inheritance has been another related factor driving multiple property ownership. Intensified homeownership and social ageing since the 1980s has facilitated a greater flow of housing property inheritance to generations below. Essentially, as the first generation to experience mass homeownership has begun to die-off, their middle-aged children have inherited more housing property wealth. Indeed, since the early-2000s the inheritance of housing assets has accelerated further and also contributed to a greater distribution of inheritance across the population (Karagiannaki Citation2015). Traditionally, legatees have tended to sell housing property in order to distribute the proceeds (Hamnett Citation1991). For inheritors in the 2000s, transferring an inheritance back into an extra property has presented itself as a lucrative opportunity in light of growing rental demand supported by flexible rental contracts, limited rent controls and poor returns offered by other savings and investment products. Moreover, along with declining fertility rates since the mid-1960s (averaging 1.7 births per woman in the UK between 1975 and 2005), increasing volumes of housing property are being inherited directly or between pairs of siblings (see also Piketty Citation2011). According to the latest government landlord survey, some 9 per cent of all rented dwellings were inherited properties (DCLG Citation2011). Certainly, for established homeowners looking to invest, housing has already proved itself a reliable and manageable investment vehicle in context of considerable economic turmoil and declining confidence in future pension resources. Real-estate agents have also catered to the emerging needs of amateur landlords in context of declining sales, deriving considerable new incomes from management fees (CAB Citation2015).

For some, then, it seems, favourable economic and policy conditions for rental investment, historic housing price developments and increasingly insecure pension outlooks have provided a context in which accumulating wealth in your own home as a means to enhance ‘welfare switching’ or offset reduced income in retirement is no longer adequate. For those who have realised significant housing equity (typically through house price inflation and mortgage repayment), or have been able to tap into family held (housing) wealth via inheritance or inter-vivo transfers, buying extra property seems to be a particularly salient means of hedging against income insecurity, market volatility and welfare state austerity. Arguably, small-scale or family landlordism is becoming a marked feature of British welfare capitalism and reflects the changing relationship between home ownership and property wealth – with a growing emphasis on the latter – in the political economy.

Discussion and concluding remarks

At the turn of the century, Britain looked on course to advance its status as a ‘nation of homeowners’. Since the mid-2000s, however, prospects for continued tenure expansion have been supplanted by the rapid resurgence of private renting, with the UK increasingly reverting towards a ‘nation of landlords and tenants’ once again. The latest government figures predict that by 2032 more than one-third of all UK households will be renting privately (IMLA Citation2014). Given the central role that homeownership and housing property have attained within contemporary welfare and capital relations, and more specifically in individual household investment strategies, the implications of this shift go well beyond housing. Indeed, realignment in the British tenure structure brings into focus uncertainties surrounding the future of the welfare system, the stable reproduction of the labour force and political legitimacy, and in particular the fate of ‘generation rent’.

This paper has focused on how the decline in homeowners and commensurable rise of private renters has been paralleled by a profound increase in multiple property owners acquiring extra housing to let. Our empirical analysis demonstrated that it is overwhelmingly households with small portfolio sizes and little experience, rather than professional institutional investors, who have driven increases in landlordism. Our findings provide some insight into the changing characteristics of the housing system under conditions of contemporary welfare capitalism, suggesting a more complex restructuring of property relations under post-homeownership conditions. It also highlights the emerging role of the private rental market, not only for tenants, but also for an asset- or property-based welfare regime.

Multiple property ownership is particularly prevalent among middle-aged households. Indeed, while landlordism has generally increased across age cohorts – except among very young (under 25) and very old (over 75) – people aged 40–60, who primarily flowed into property ownership via the owner-occupied housing boom between 1980 and the early-2000s, stand out, suggesting, in terms of the media rhetoric, that a potential ‘generation landlord’ is emerging alongside ‘generation rent’.

Caution is necessary when considering ‘generation landlord’ and ‘generation rent’ as merely parallel developments, as they are clearly interrelated at the level of the housing market. Ostensibly, the accumulation of owner-occupied housing equity critical to the rise of an older generation of property owners has contributed to shifting house price and borrowing conditions that have ultimately undermined access to subsequent generations who now represent demand for the extra homes older generations are buying up and letting out. In this sense, generation rent, to some extent, represents the development of, and gains made by, the first generation of homeowners – who defined the arrival of mass homeownership in the UK – that preceded it. More precisely, it can be understood as a maturation process in housing and welfare systems that began in the 1980s with stake holder capitalism (cf. Forrest and Murie Citation1988) and, later, privatised, or ‘house price’ Keynesianism (Crouch Citation2009).

Forrest and Hirayama (Citation2015) frame a similar transformation in terms of a shift from ‘social’ to ‘neo-liberal’ forms of homeownership. While the social project characterised an era in which owner-occupation was promoted and subsidised, and represented an economic buffer to households, the neo-liberal project is one in which housing has been rendered to processes of profit-making. In context of the generational dynamic outlined above, it appears that the very promotion of homeownership in the past – which has also normalised the tenure and helped stigmatise the alternatives – has undermined the tenure in the longer run. This process has nonetheless helped stabilise older cohorts of mostly middle-class homeowners who entered the tenure under conditions of the social project (i.e. the auspices of the property owning democracy).

The focus on tenure shifts in this paper, then, provides wider insights into the progression of property-based welfare and welfare security in the pre- and post-crisis period. If, after 1980, the reconfiguration of British welfare capitalism was an attempt to find a new consensus between capital and labour built around residual state service provision, deregulated housing and financial markets, flexible labour and a welfare system based on individual housing property, declining individual homeownership rates since the mid-2000s signal the apparent limits to this model (cf. Montgomerie and Büdenbender Citation2015). As this paper suggests, the current restructuring of asset accumulation strategies goes, however, even further, with the private rental sector becoming increasingly central to understanding the deepening failure, as well as the further progression, of property-based welfare strategies in an era of post-homeownership. Private renting has not only come into focus for those excluded from asset accumulation through homeownership – as has been covered in accounts of ‘generation rent’. As we demonstrate, the sector has also become part of a more widespread risk hedging response featuring private landlordism among financialised welfare subjects (cf. Langley Citation2006), with generational, as well as socioeconomic inequalities increasingly constitutive of the divide between renters and owners in the sector. There seems, thus, a need to more broadly consider private renting – including its function as property asset – in understanding the development of property-based welfare, welfare security, and related inequality dynamics in the current context.

The emerging division between increasingly property-poor and property-rich generations presents a policy challenge, particularly with regard to future welfare of ‘generation rent’. In light of declining state benefits and the inability to get on the ‘property ladder’, the very idea of individual welfare financing through housing assets is challenged (McKee Citation2012). Rising property accumulation among older people may, to some extent, ease this pressure, as it will enable them to support their decedent’s ascent up a housing ladder by passing on property wealth. Indeed, since the onset of the crisis in 2008, increased family solidarity has taken a firmer hold, signalling a trend towards re-familialisation of welfare relations, with housing forming a distinct pillar. There is evidence not only of young people staying longer in, or ‘boomeranging’ back to, the natal home, but also of parents tapping their own wealth to help their children get on the property (accumulation) ladder (cf. CML Citation2010, Heath and Calvert Citation2013, Druta and Ronald Citation2017). This might also take the form that parents buy an additional property in order to ensure their children’s access to housing. Certainly, this departs from the neo-liberal assertion that individuals are primarily responsible in satisfying their own needs (in the market), and instead emphasises family relations as a basis of emerging welfare security (Flynn and Schwartz Citation2017).

Given the overall demographic trend towards smaller family size, housing wealth is likely to flow more intensively to subsequent generations, supporting them, along with their own housing equity accumulation strategies, in managing risk and insecurity. However, how, and how much, the accumulated property wealth of older generations will be transferred will, among other things, hinge on taxation and pension conditions, care and health care costs, and, not least, house price developments. Another concern is that the ability to transfer housing wealth will clearly differ across families. Better-off parents with high housing equity, repaid mortgages and multiple properties will be more able to effectively pass on advantages to their children through their homes. The unequal distribution of housing equity and multiple property ownership will be reproduced and shape welfare security and patterns of inequality.

These factors have important implications for understanding the fate of generation rent and, in particular, prospects for social reproduction. Firstly, while prolonged rental status or extended residency in the parental home is likely to delay or even undermine family formation for many, those who receive a boost on the housing ladder from their parents or other relatives are likely to enjoy smoother life-course transitions and achieve desired reproductive outcomes (cf. Mulder Citation2006). Again, for those without equity-rich parents, this will be dramatically different, particularly in light of an eroded state welfare system. Secondly, if the expansion of homeownership and the distribution of housing assets helped facilitate, both materially and ideologically, the erosion of the welfare state (i.e. privatised Keynesianism), its reversal is likely to undermine this process. In other words, fewer households with access to housing wealth in the future (due to its growing concentration) will challenge political legitimacy, with the state potentially forced to apply other measures to support housing and welfare among the more vulnerable. Thirdly, as homeownership has come to form the basis of both middle-class adult identities and economic autonomy – providing household stability in context of more uneven life-course and labour market transitions – its erosion represents a challenge to the reproduction of middle-class status.

Our focus on the ‘landlord turn’ has necessarily dramatised the rise of generation rent and the prospects for the British housing and welfare systems. Despite the substantial recent upsurge, 2.1 million private landlords still constitute only a fraction of households. Policy discourse and practice also, at least in part, remain geared towards homeownership, and recent state Help-to-Buy interventions, which now also assist savings as well as lowering equity requirements for first-time buyers, appear to be improving housing transitions among younger households to some extent (FT Citation2015).Footnote6 Nonetheless, this paper has attempted to highlight the unevenness with which the private rental sector has developed in recent years and, beyond ‘generation rent’, has contributed to an emerging ‘generation’, or at least cohort concentration, of landlords. Given the centrality of housing property in contemporary welfare capitalism, and the complex ways it is interwoven with dimensions of labour reproduction, economic growth and fertility, shifts in the housing system provide a critical means for understanding dynamism in these domains (cf. Flynn and Schwartz Citation2017). The idea of a post-homeownership society (or societies), however, remains conceptually underdeveloped and empirically under-researched.

While this paper has focused on the UK, there are other societies where similar developments are evident, if not more so, with regard to the rise in generation rent. Ireland, for example, proves a highly salient comparison (Norris Citation2016), while in New Zealand, forms of property-based welfare have long been evident (Broome Citation2008). Recent media reports from the US identify similar developments in terms of baby-boomers relying on rental incomes from millennials (Bloomberg Citation2016). Clearly, more comparatively orientated research is necessary to establish more firmly the conditions under which private rental housing is gaining importance, verify relationships between different cohorts of owner and tenant, and explain interrelated shifts in welfare states, socioeconomic inequality and approaches to the management of individual risk and to social reproduction.

Acknowledgements

Thanks are due to the Office of National Statistics for the possibility to make use of the British Household Panel Survey (BHPS). We also thank Lindsay Flynn and Hermann Mark Schwartz as well as two anonymous reviewers for valuable comments and suggestions.

Disclosure statement

No potential conflict of interest was reported by the authors.

Notes on contributors

Richard Ronald is Professor of Housing, Society and Space at the Centre for Urban Studies at the University of Amsterdam. He is also an Honorary Professor at the University of Birmingham in the UK. He is the current editor of the International Journal of Housing Policy, coordinator of the Home Ownership and Globalization Working Group of the European Network for Housing Research and Co-editor of the Palgrave book series, ‘The Contemporary City’. He has published widely on housing in relation to social, economic and urban transformations in Europe and Pacific Asia.

Justin Kadi is an assistant professor at the Centre of Public Finance and Infrastructure Policy at Vienna University of Technology. His research is focused on housing policy, welfare states, gentrification, and urban inequality. He holds an MSc and a PhD in Urban and Housing Studies from the University of Amsterdam. Recent publications include Recommodifying housing in formerly ‘Red’ Vienna? (Housing, Theory and Society, Vol. 32, 247–265) and, with Richard Ronald and Christian Lennartz, Whatever happened to asset-based welfare? Shifting approaches to housing wealth and welfare (Policy & Politics, Vol. 45, 173–193).

Additional information

Funding

Notes

1 ‘Council Housing’ denotes social rental housing provided by Local Authorities, although in recent decades the term has come to denote all forms of social rental housing.

2 ‘Welfare Switching’ typically refers to the use of private housing equity to provide welfare goods or for retirement needs, potentially compensating for diminishing collective provision of pensions and services (cf. Smith et al. Citation2009, Smith Citation2015).

3 They were responsible for some 71% of all dwellings (DCLG Citation2011: 10).

4 Taking the UK average household size of 2.4 and accounting for potential ‘empty nesters’, as a crude measure (ONS Citation2014b).

5 Some 0.35% of BtL properties were foreclosed on by lenders in the first quarter of 2009, representing more triple the rate for regular mortgages (CML Citation2010).

6 Although increasing (state subsidized) demand is likely to stimulate prices and undermine overall affordability, as indicated by resurgence in property inflation since 2013 (see Halifax Citation2015).

References

- Aalbers, M.B. (2008), ‘The Financialization of Home and the Mortgage Market Crisis’, Competition & Change, 12 (2), pp. 148–66.

- Aalbers, M.B. (2015), ‘The Great Moderation, the Great Excess and the Global Housing Crisis’, International Journal of Housing Policy, 15 (1), pp. 43–60. doi: 10.1080/14616718.2014.997431

- Aglietta, M. (1979), A Theory of Capitalist Regulation: The US Experience (London: NLB).

- Andrews, D. and Sanchez, A.C. (2011), ‘The Evolution of Homeownership Rates in Selected OECD Countries: Demographic and Public Policy Influences’, OECD Journal: Economic Studies, 2011 (1), pp. 207–43.

- Ansell, B. (2014), ‘The Political Economy of Ownership: Housing Markets and the Welfare State’, American Political Science Review, 108 (02), pp. 383–402. doi: 10.1017/S0003055414000045

- Berry, C. (2015), ‘Citizenship in a Financialised Society: Financial Inclusion and the State Before and After the Crash’, Policy & Politics, 43 (4), pp. 509–25. doi: 10.1332/030557315X14246197892963

- Blair, T. (1996), ‘Speech to Labour Party Housing Conference, London, March 5th’, in T. Blair (ed.), New Britain: My Vision of a Young Country (London: Fourth Estate).

- Bloomberg (2016), Landlord Nation: Boomer’s New Retirement Plan is Millennials Paying Rent. Available from: http://www.bloomberg.com/news/articles/2016-08-04/landlord-nation-boomers-new-retirement-plan-is-millennials-paying-rent [accessed 4 August 2016]

- BNP Paribus Real Estate (2013), Housing the Nation (London: BNP Paribus Real Estate).

- Broome, A. (2008), ‘Neoliberalism and Financial Change: The Evolution of Residential Capitalism in New Zealand’, Comparative European Politics, 6 (3), pp. 346–64. doi: 10.1057/cep.2008.15

- CAB – Citizens Advice Bureau (2015), Still Let Down: How Letting Agents Are Still Ripping Off Private Renters. Available from: https://www.citizensadvice.org.uk/about-us/policy/policy-research-topics/housing-policy-research/still-let-down/ [accessed 20 October 2015].

- Castles, F G. (1998), ‘The Really Big Trade-off: Homeownership and the Welfare State in the New World and the Old’, Acta Politica, 33, pp. 5–19.

- CML – Council of Mortgage Lenders (2010), Affordability and First Time Buyers, Housing Finance. Available from: https://www.cml.org.uk/documents/affordability-and-first-time-buyers/012010Affordabilityandfirsttimebuyers.pdf [accessed 26 January 2017].

- CML – Council of Mortgage Lenders (2015), Buy to Let Market Summary Table MM6A. Available from: http://www.landlordzone.co.uk/news/buy-to-let-lenders-adopt-new-code-of-practice [accessed 20 October 2015].

- CML – Council of Mortgage Lenders (2016), Press Release Table January 2016. Available from: https://www.cml.org.uk/documents/20160309-january-2015-mlt-release-download-data/copy-of-20160309-press-release-table-january-2016-static.xlsx [accessed 27 January 2016].

- Conley, D. and Gifford B. (2006), ‘Homeownership, Social Insurance, and the Welfare State’, Sociological Forum, 21 (1), pp. 55–82. doi: 10.1007/s11206-006-9003-9

- Crook, T. and Kemp, P. (2010) Transforming Private Landlords (Oxford: Wiley Blackwell).

- Crouch, C. (2009), ‘Privatised Keynesianism: An Unacknowledged Policy Regime’, British Journal of Politics and International Studies, 11 (3), pp. 382–99. doi: 10.1111/j.1467-856X.2009.00377.x

- DCLG – Department of Communities and Local Government (2011), Private Landlords Survey, London, Communities and Local Government. Available from: www.communities.gov.uk [accessed 20 October 2015].

- DCLG – Department of Communities and Local Government (2013), English Housing Survey. Available from: https://www.gov.uk/government/collections/english-housing-survey [accessed 27 January 2017].

- DCLG – Department of Communities and Local Government (2016), English Housing Survey Headline Report 2014 to 2015: Section 1 Household Tables. Available from: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/501068/2014-15_Section_1_Households_tables_and_figures_FINAL.xlsx [accessed 27 January 2017].

- DCLG - Department of Communities and Local Government (2017), Table 101: by Tenure, United Kingdom (Historical Series), https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/519496/LT_101.xls [accessed 27 January 2017].

- Doling, J. and Ford, J. (2007), ‘A Union of Home Owners’, European Journal of Housing Policy, 7 (2), pp. 113–27. doi: 10.1080/14616710701309446

- Doling, J., and Ronald, R. (2010), ‘Property-based Welfare and European Homeowners: How Would Housing Perform as a Pension?’ Journal of Housing and the Built Environment, 25 (2), pp. 227–41. doi: 10.1007/s10901-010-9184-7

- Dorling, D. (2013), All That Is Solid: How the Great Housing Disaster Defines our Times and What We Can Do About it (London: Penguin).

- Druta, O. and Ronald, R. (2017), ‘Young Adults’ Pathways into Homeownership and the Negotiation of Intra-Family Support: A Home, the Ideal gift’, Sociology, 51, pp. 783–99. Online first, doi:10.1177/0038038516629900.

- Dyson, R. (2014), 1996: The Birth of Buy-to-let Britain – in Numbers. Available from: http://www.telegraph.co.uk/finance/personalfinance/investing/buy-to-let/11176988/1996-the-birth-of-buy-to-let-Britain-in-numbers.html [accessed 27 March 2017]

- Esping-Andersen, G. (1990), The Three Worlds of Welfare Capitalism (Cambridge: Polity Press).

- Finlayson, A. (2009), ‘Financialisation, Financial Literacy and Asset-Based Welfare’, The British Journal of Politics and International Relations, 11 (3), pp. 400–21. doi: 10.1111/j.1467-856X.2009.00378.x

- Flynn, L. and Schwartz, H. (2017), ‘No Exit: Social Reproduction in an Era of Rising Income Inequality’, Politics & Society, 45 (4), pp. 471–503. doi: 10.1177/0032329217732314

- FT – Financial Times (2015), Record Numbers Use Help to Buy Scheme. Available from: http://www.ft.com/cms/s/0/1bfa60fc-56d6-11e5-a28b-50226830d644.html#axzz3pATLlGq5 [accessed 27 January 2016]

- Forrest, R. and Murie, A. (1988), Selling the Welfare State: The Privatisation of Public Housing (London: Routledge).

- Forrest, R. and Hirayama, Y. (2015), ‘The Financialisation of the Social Project: Embedded Liberalism, Neoliberalism and homeownership’, Urban Studies, 52 (2), pp. 233–44. doi: 10.1177/0042098014528394

- Fox O’Mahony, L. and Overton, L. (2015), ‘Asset-based Welfare, Equity Release and the Meaning of the Owned Home’, Housing Studies, 30 (3), pp. 392–412. doi: 10.1080/02673037.2014.963523

- Gotham, K.F. (2009), ‘Creating Liquidity Out of Spatial Fixity: The Secondary Circuit of Capital and the Sub-Prime Mortgage Crisis’, International Journal of Urban and Regional Research, 33 (2), pp. 355–71. doi: 10.1111/j.1468-2427.2009.00874.x

- Gray, P. and McAnulty, U. (2010), ‘How Far Can the Residualisation of Council Housing Debate be Applied to the Private Rental Sector in Northern Ireland’, Policy Studies, 31 (5), pp. 523–39. doi: 10.1080/01442872.2010.495901

- Hamnett, C. (1991), ‘“A Nation of Inheritors?” Housing Inheritance, Wealth and Inequality in Britain’, Journal of Social Policy, 20 (4), pp. 509–36. doi: 10.1017/S0047279400019784

- Halifax (2015), House Price Index. Available from http://www.lloydsbankinggroup.com/media/economic-insight/halifax-house-price-index/ [accessed 20 October 2015].

- Harloe, M. (1995), The People's Home? Social Rented Housing in Europe & America (Oxford: Blackwell).

- Heath, S and Calvert, E. (2013), ‘Gifts, Loans and Intergenerational Support for Young Adults’, Sociology, 47 (6), pp. 1120–13. doi: 10.1177/0038038512455736

- Hoekstra, J. (2003), ‘Housing and the Welfare State in the Netherlands: An Application of Esping-Andersen’s Typology’, Housing, Theory and Society, 20, pp. 58–71. doi: 10.1080/14036090310000634

- Hulse, K. and Mcpherson, A. (2014), ‘Exploring Dual Housing Tenure Status as a Household Response to Demographic, Social and Economic Change’, Housing Studies, 29, pp. 1028–44. doi: 10.1080/02673037.2014.925097

- IMLA – Intermediary Mortgage Lenders Association (2014), Reshaping Housing Tenure in the UK: The Role of Buy-to-Let. Available from: http://www.imla.org.uk/perch/resources/imla-reshaping-housing-tenure-in-the-uk-the-role-of-buy-to-let-may-2014.pdf [accessed 20October 2015].

- Karagiannaki, E. (2015), ‘Recent Trends in the Size and the Distribution of Inherited Wealth in the UK’, Fiscal Studies, 36 (2), pp. 181–213. doi: 10.1111/1475-5890.12050

- Kemeny, J. (1992), Housing and Social Theory (London: Routledge).

- Kemeny, J. (1995), From Public Housing to the Social Market. Rental Policy Strategies in Comparative Perspective (London: Routledge).

- Kemp, P. A. (2015), ‘Private Renting After the Global Financial Crisis’, Housing Studies, 30 (4), pp. 601–20. doi: 10.1080/02673037.2015.1027671

- Langley, P. (2006), ‘The Making of Investor Subjects in Anglo-American pensions’, Society and Space, 24, pp. 919–34.

- Lansley, S. and Mack, J. (2015), Breadline Britain: The Rise of Mass Poverty (London: One World).

- Lennartz, C., Arundel, R. and Ronald, R. (2016), ‘Younger Adults and Homeownership in Europe Through the Global Financial Crisis’, Population, Place and Space, 22 (8), pp. 823–35. doi: 10.1002/psp.1961

- Leyshon, A. and French, S. (2009), ‘We all Live in a Robbie Fowler House: Geographies of Buy-to-Let in the UK’, The British Journal of Politics & International Relations, 11 (3), pp. 438–60. doi: 10.1111/j.1467-856X.2009.00381.x

- Lord, C., Lloyd, J. and Barnes, M. (2013), Understanding Landlords: A Study of Private Landlords in the UK Using the Wealth and Assets Survey (London: Strategic Society Centre).

- Malpass, P. (2008), Housing and the New Welfare State: Wobbly Pillar or Cornerstone?, Housing Studies, 23 (1), pp. 1–19. doi: 10.1080/02673030701731100

- McKee, K. (2012), Young People, Homeownership and Future Welfare, Housing Studies, 27 (6), pp. 853–62. doi: 10.1080/02673037.2012.714463

- Montgomerie, J. and Büdenbender, M. (2015), ‘Round the Houses: Homeownership and Failures of Asset-Based Welfare in the United Kingdom’, New Political Economy, 20 (3), pp. 386–405. doi: 10.1080/13563467.2014.951429

- Mulder, C.H. (2006), ‘Home-Ownership and Family Formation’, Journal of Housing and the Built Environment, 21 (3), pp. 281–98. doi: 10.1007/s10901-006-9050-9

- NLA – National Landlords Association (2012), UK Landlord Magazine, October. Available from: http://www.landlords.org.uk/news-campaigns/uk-landlord-magazine/september-october-2012 [accessed 27 January 2015].

- Norris, M. (2016), ‘Varieties of Homeownership: Ireland's Transition from a Socialised to a Marketised Policy Regime’, Housing Studies, 31 (1), pp. 81–101. doi: 10.1080/02673037.2015.1061107

- ONS – Office of National Statistics (2014a), Trends in the UK Housing Market. Available from: http://www.ons.gov.uk/ons/dcp171766_373513.pdf [accessed 27 January 2015]

- ONS – Office of National Statistics (2014b), Families and Households. Available from: http://www.ons.gov.uk/ons/dcp171778_393133.pdf [accessed 27 January 2015]

- ONS – Office of National Statistics (2015), Housing and Homeownership in the UK. Available from: http://visual.ons.gov.uk/uk-perspectives-housing-and-home-ownership-in-the-uk/ [accessed 20 January 2016]

- Piketty, T. (2011), ‘On the Long-run Evolution of Inheritance: France 1820–2050’, Quarterly Journal of Economics, 126, pp. 1071–131. doi: 10.1093/qje/qjr020

- Ronald, R. (2008), The Ideology of Homeownership (Basingstoke: Palgrave Macmillan).

- Ronald, R. and Doling, J. (2012), ‘Testing Homeownership as the Cornerstone of Welfare: Lessons From East Asia for the West’, Housing Studies, 27(7), pp. 940–61. doi: 10.1080/02673037.2012.725830

- Ronald, R., Lennartz, C. and Kadi, J. (2017), ‘What Ever Happened to Asset-Based Welfare? Shifting Approaches to Housing Wealth and Welfare security’, Policy & Politics, 45(2), pp. 173–93. doi: 10.1332/030557316X14786045239560

- Rugg, J. (2012), ‘Deposit Assistance Schemes for Private Rental in the United Kingdom’ in S.J. Smith (ed.), The International Encyclopaedia of Housing and Home (London: Elsevier), pp. 330–4.

- Rugg, J. and Rhodes, D. (2008), The Private Rented Sector: Its Contribution and Potential (York: The University of York, Centre for Housing Policy).

- Sassen, S. (2009), ‘When Local Housing Becomes an Electronic Instrument: The Global Circulation of Mortgages – A Research note’, International Journal of Urban and Regional Research, 33 (2), pp. 411–26. doi: 10.1111/j.1468-2427.2009.00868.x

- Saunders, P. (1990), Social Class and Stratification (London: Routledge).

- Savills (2014), Residential Property Focus Issue 1–4. Available from: http://www.savills.co.uk/research_articles/141285/189183-0 [accessed 20 January 2016].

- Scanlon, K. and Whitehead, C.M.E. (2005), The Profile and Intentions of Buy to Let Investors (London: Council of Mortgage Lenders).

- Searle, B.A and McCollum, D. (2014), ‘Property-Based Welfare and the Search for Generational Equality’, International Journal of Housing Policy, 14 (4), pp. 325–43. doi: 10.1080/14616718.2014.955334

- Schwartz, H. and Seabrooke, L. (2008), ‘Varieties of Residential Capitalism in International Political Economy: Old Welfare States and the New Politics of Housing’, Comparative European Politics, 6, pp. 237–61. doi: 10.1057/cep.2008.10

- Smith, S.J. (2015), ‘Owner Occupation: At Home in a Spatial, Financial Paradox’, International Journal of Housing Policy, 15 (1), pp. 61–83. doi: 10.1080/14616718.2014.997432

- Smith, S.J., Searle, B. A., and Cook, N. (2009), ‘Rethinking the Risks of Home Ownership’, Journal of Social Policy, 38 (01), pp. 83–102. doi: 10.1017/S0047279408002560

- Soaita, A.M., Searle, B.A., McKee, K., Moore, T. (2016), ‘Becoming a Landlord: Strategies of Property-Based Welfare in the Private Rental Sector in Great Britain’. Housing Studies, 32 (5), pp. 616–737.

- Sprigings, N. and Smith, D. H. (2012), ‘Unintended Consequences: Local Housing Allowance Meets the Right to Buy’, People, Place and Policy Online, 6 (2), pp. 58–75. doi: 10.3351/ppp.0006.0002.0001

- Streeck, W. (2014), Buying Time: The Delayed Crisis of Democratic Capitalism (London: Verso).

- Torgersen, U. (1987), ‘Housing: The Wobbly Pillar Under the Welfare state’, Scandinavian Housing and Planning Research, 4 (1), pp. 116–26. doi: 10.1080/02815737.1987.10801428

- Wallace, A. and Rugg, J. (2014), Buy-to-Let Mortgage Arrears: Understanding the Factors that Influence Landlords’ Mortgage Debt (University of York and Lloyds Banking Group). Available from: https://www.york.ac.uk/media/chp/Buy%20to%20Let%20Mortgage%20Arrears%20Report.pdf [accessed 16 January 2016].

- Watson, M. (2009), ‘Planning for the Future of Asset-Based Welfare? New Labour, Financialized Economic Agency and the Housing market’, Planning, Practice and Research, 24 (1), pp. 41–56. doi: 10.1080/02697450902742148

- Whitehead, C.M.E. (1996), ‘Private Renting in the 1990s’, Housing Studies, 11 (1), pp. 7–12. doi: 10.1080/02673039608720842

- Wilcox, S, Perry, J, 2014, UK Housing Review 2014 (Coventry: Chartered Institute of Housing).