?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.ABSTRACT

Several recent publications have argued that the use of heuristics by financial investors can distort global capital flows, but scholars have paid little attention to the scope conditions that determine when heuristics become influential (and when they don’t). Building on work in economic sociology and behavioural finance we suggest that the degree to which investment heuristics can bias aggregate capital flows depends on the levels of uncertainty and self-referentiality that structure the environments under which investment decisions are being made. Applying these insights to the two principal global markets for corporate investment, we argue that the institutional structure of markets for short-term portfolio equity investments (PEI) is far more conducive to trigger the mimetic adoption of a specific heuristic than in markets for long-term foreign direct investments (FDI). To test this hypothesis, we leverage the high level of arbitrariness of the selection of Brazil, Russia, India and China into the BRIC acronym and empirically examine the impact of its remarkable rise to prominence among communities of financial investors in the mid-2000s on global capital flows to emerging economies. In line with the theoretical argument, we find robust evidence of a strong BRIC-bias in markets for PEI but not FDI.

Introduction

Confronted with the devastating consequences of the near-breakdown of the global financial system in 2007–08, a growing number of scholars has emphasized that capital market participants are less ‘rational’ than standard economic theory tends to assume. Thus reinvigorating a long-standing research tradition on the boundedness of human rationality, this has led to an increasing re-recognition of the role of heuristics in investment decision-making processes in recent scholarship. This literature, however, has focused primarily on showing that heuristics can matter as determinants of global capital flows, and it has paid less attention to the question when they matter (and when they don’t). Against this background, this article aims to think more systematically about the scope conditions, which may play a role in making heuristics more salient in some investment-decision making processes than in others, and reflect on how they may affect different types of investments differently.

Taking inspiration from theoretical work in economic sociology and behavioural finance, we suggest that the susceptibility of heuristics to influence aggregate capital flows depends on the degrees of uncertainty and self-referentiality that characterise the environments under which investment decisions are being made. Applying these propositions to the two principal markets for global corporate investments, we hypothesise that fashion-like investment heuristics are more likely to drive short-term portfolio equity (PEI) than long-term foreign direct investment (FDI) decisions. While markets for PEI are built upon quick decisions taken by individual investors operating in self-referential environments, investment decisions in markets for FDI are normally the result of lengthy and careful deliberations by heterogeneous teams of specialists. Furthermore, opportunities for secondary trading are limited in markets for FDI. As a result, FDI assets are relatively illiquid and, in comparison to markets for PEI, financial returns are more strongly tied to the actual realisation of anticipated material trends than the perception thereof by other market participants. Accordingly, we suggest, following investment fashions and fads can be a profitable (and to some extent ‘rational’) strategy in markets for PEI, but not FDI. By implication we expect FDI decisions in aggregate to be more resistant to the unravelling of fashion-like investment trends than those driving the allocation of capital in markets for PEI.

To test this hypothesis, our empirical investigation centres on the remarkable rise to prominence of the BRIC acronym among financial investment communities in the mid-2000s as a ‘most likely case’ scenario of a situation in which an unfounded investment narrative had the potential to affect the material allocation of global capital. Leveraging the high degree of arbitrariness of the selection of Brazil, Russia, India and China into the acronym, we track its spread in the financial press through several word-frequency measures and use a series of error-correction models to assess its short- and long-term impacts on PEI and FDI flows destined to emerging markets. In line with theoretical expectations, we find a strong and robust positive association in the case of PEI, but no clear relationship in markets for FDI.

Although the empirical investigation is limited to the case of one specific heuristic and similar dynamics will have to be analysed in other contexts in future work, the results clearly indicate that the spread of investment fashions does not distort capital flows in an automatic manner. Instead, the degree to which heuristics affect capital market movements appears to critically depend on the structural-institutional features of the environment under which investment decisions are being made.

Theoretical background

From the early 1950s onwards, a strong emphasis on the rationality of economic agents and the efficiency of capital markets started to gain the upper hand in mainstream economic and financial theory. Since then standard neoclassical economic theory - building on Eugene Fama’s (Citation1970) (in)famous ‘efficient-market hypothesis’ - has promoted strong claims about the rationality of capital market behaviours. Most importantly, mainstream economists have generally defended the idea that aggregate capital flows follow (and correctly anticipate) real trends in economic fundamentals and that the collective judgments of capital market participants almost always ‘get it right’ (e.g. Krugman Citation1979). In contrast, a long tradition of research about economic decision-making closer to the fields of psychology and sociology (which dates back at least to Keynes’ General Theory and has gained new momentum in the aftermath of the Global Financial Crisis) has emphasized the boundedness of investor rationality (Tversky and Kahneman Citation1975, Simon Citation1991), arguing that cognitive shortcuts and heuristics can systematically bias individual and collective judgments. As studies in the latter camp have pointed out, individuals deciding where to invest confront two types of information problems simultaneously: on the one hand, there is more information available about past and current economic trends than they can possibly process (problem of information overload; see especially Mosley Citation2003). On the other hand, they possess too little information about the coming evolution of economic fundamentals because key parameters about what is going to happen in the future necessarily remain in the dark (problem of uncertainty; see especially Beckert Citation2016). To ‘solve’ these information problems, these scholars have argued, investors need to rely on heuristics, cognitive devices which make decision-making possible by providing focal points that tell investors what information (about the past and present) to look at while at the same time also enabling them to visualise the future by charting scenarios about the likely course of unknowable (future) events.

As various strands of research have shown, there is a great variety of types of such heuristics that investors can employ. The seminal work by Kahneman and Tversky that laid the foundations for the field of behavioural finance has emphasized general rules that guide individuals’ processing of statistical information, such as the availability, representativeness and anchoring heuristics (Tversky and Kahneman Citation1975). Scholars taking inspiration from sociological and literary theory have highlighted how broader narratives and fictive imaginations play an important role through the provision of imaginary ‘as-if-worlds’ that enable actors to visualise unknowable future trends (Beckert Citation2016, Shiller Citation2015, Leins Citation2018; also Nelson and Katzenstein Citation2014). Finally, several investigations in the field of International Political Economy have studied investors’ use of concrete judgmental devices in empirical detail: Layna Mosley (Citation2003) has shed light on the narrow set of macroeconomic indicators that investors refer to when evaluating a country’s economic prospects. Julia Gray (Citation2013) has focused on the use of a country’s membership in specific international organisations as a cognitive shortcut that investors employ to assess a government’s creditworthiness. Brazys and Hardiman (Citation2015) have shown how the discursive inclusion of Ireland into the ‘PIIGS’ acronym affected the country’s bond yield movements. And Brooks et al. (Citation2015) have found similar effects of various types of country groupings in a broader perspective.

A solid body of evidence thus suggests that heuristics do play an important role in the allocation of global capital. And Nobel laureate Robert Shiller’s (Citation2017) prominent call to take narratives seriously in his 2017 presidential address to the American Economics Association suggests that these views are also increasingly being taken into consideration in mainstream economics and finance. Yet, while the recognition that investors’ reliance on heuristics can influence global capital flows has spread more widely in recent years, a seemingly crucial issue that has so far received only little systematic attention is the question why heuristics appear to become salient in some instances but not in many others. In other words, what are the scope conditions that trigger or inhibit the influence of the use of heuristics on the allocation of global capital?

The scope conditions for the mimetic (non-)adoption of investment heuristics

When and why heuristics have a systematically distorting influence on aggregate capital flows depends not only on considerations at the level of individual investors, but primarily on the social dynamics under which they operate. As advocates of the efficient market hypothesis have pointed out, the observation that investors use heuristics does not necessarily mean that financial markets are inefficient. For as long as individual market participants employ heuristics independently, biases present in individual decisions are likely to cancel each other out at the aggregate level. Put differently: the use of heuristics by individual investors only leads to distortions in capital markets if many market participants rely on the same heuristic at the same time. In this view, the core question to consider is not simply whether investors use heuristics or not (they almost certainly do), but when and under what circumstances it becomes more likely that a significant number of market participants use the same heuristic simultaneously.

Classic studies in behavioural finance and economic sociology have suggested that the likelihood for this to occur critically depends on the degrees of uncertainty (cf. Knight Citation1921, Keynes Citation1935, Tversky and Kahneman Citation1975, Nelson and Katzenstein Citation2014, Beckert Citation2016) and self-referentiality (Callon Citation1998, Temin and Voth Citation2004, MacKenzie Citation2006, Turco and Zuckerman Citation2014; also Eichengreen et al. Citation1996, Obstfeld Citation1996) that structure the environments under which investors decide. If information about economic fundamentals is readily available and if investors have the time and resources to process that information, they have incentives to analyze it carefully in order to transform ‘unknown unknowns’ into ‘known unknowns’ (cf. Knight Citation1921).Footnote1 Yet, turning uncertainties into risks is a demanding and costly procedure that takes time. If information is unavailable or investors don’t have the necessary resources or expertise to perform such analyses, they become pressed to use cognitive shortcuts instead. One particularly available heuristic strategy that investors can rely on under such circumstances is to ‘outsource’ investment analyses by simply following the decisions taken by their peers – thereby triggering a process that can lead to the intersubjective convergence on one heuristic through mechanisms of mimetic diffusion (cf. DiMaggio and Powell Citation1983).

The second critical scope condition relates more closely to structural features of capital market institutions themselves, in particular the logic driving the generation of financial returns. In a situation in which financial profits are strictly dependent on the actual materialisation of fundamental trends, an investment decision based on a ‘wrong’ forecast comes at a cost. Therefore investors face strong incentives to avoid following unfounded fashion-like investment ideas when financial rewards or punishments stand and fall with the fulfilment of predicted material trends. Yet, as the connection between financial returns and the developments in underlying trends becomes weaker, the strength of these inhibitions wanes. In strongly self-referential environments, in which financial wins or losses are primarily determined by second-order obsevations, the logic can even turn the other way: in situations in which, as Keynes famously put it in his ‘beauty contest’ analogy, financial returns are not primarily a function of the actual unfolding of fundamental trends but of ‘what average opinion expects the average opinion to be’ (Keynes Citation1935, p. 156), anticipating upcoming investment fashions – in the hopes that one can ‘jump off’ before the bubble bursts – can turn mimetic investment behaviour into an altogether rational strategy (Soros Citation1987, Temin and Voth Citation2004, Turco and Zuckerman Citation2014).

While the importance of uncertainty and self-referentiality as structuring features of financial markets has been studied for decades, only few empirical studies have attempted to evaluate the impact of variations in these dimensions on investment decisions in a systematic manner. This study proposes to do so by leveraging variations in these dimensions across different segments of global capital markets.

The differential salience of heuristics in markets for short- and long-term investments

Given the breadth and complexity of global financial markets, systematic differences in the prominence of degrees of uncertainty and self-referentiality could potentially be evaluated at many levels. While more fine-grained comparisons may offer a fruitful avenue for future research, the approach that we pursue here deliberately focuses on a comparison at a high (but, we believe, compelling) level of abstraction: markets for portfolio equity (PEI) vs. foreign direct investments (FDI).Footnote2 Although investors in both areas in principle pursue a similar goal – i.e. to invest in the companies promising the greatest future profitability -, the two markets are characterised by distinct decision-making processes as well as different logics driving the generation of financial returns - and, by implication, clear differences in the degrees of uncertainty and self-referentiality that structure investment decisions.

The role of heuristics in markets for FDI

Markets for FDI refer to the international trading of large-stake ownership sharesFootnote3, in which foreign investors either build a new (oftentimes wholly owned) business or acquire a substantive equity stake in an already existing company. In contrast to the case of PEI, FDI investors intend to have some degree of managerial control over the company they are investing in. Because FDI projects are oftentimes highly specialised and the assets in question are frequently not traded publically, the liquidity of markets is thin. Accordingly, the predominant rationale for FDI investments is not to make a profit by re-selling stakes in the short- to medium term, but to benefit directly from revenue streams that the target company is projected to generate in the longer-term future (cf. Dunning Citation1988). While these features are particularly pertinent for greenfield projects, they are also relevant for mergers and acquisitions (M&A) FDI. Although takeovers may in some instances be driven by short-term incentives, this does not generally seem to be the case. One careful empirical investigation of cross-border M&A in emerging markets found that even foreign takeovers undertaken in times of financial crises – i.e. instance of so-called ‘fire-sale FDI’ –tend to have a clear long-term orientation (see Alquist et al. Citation2013).Footnote4 By implication, we suggest, the degree of self-referentiality is relatively low in markets for FDI and, given the limited opportunities for secondary trading, there is little potential to ‘play’ peers’ expectations – along the lines of Soros’ (Citation1987) suggestions - in markets for FDI.

At the same time, FDI decision-making processes are characterised by careful and thorough deliberation proceedings that involve multiple steps and heterogeneous groups of experts (Aharoni Citation1966, Thomas Citation1997, Buckley et al. Citation2007, Maitland and Sammartino Citation2015a, Citation2015b, Clark et al. Citation2018). A vignette experiment with high-level managers suggests that FDI decision-makers ‘follow fairly rational rules … in creating sets of investments to “consider”’, focusing on ‘basic fundamental operational factors’ (Buckley et al. Citation2007, p. 1086). Furthermore, location decision processes typically unfold over several years and involve many individuals. The careful in-depth investigation of an Australian mining company’s FDI decision by Maitland and Sammartino (Citation2015a, Citation2015b) reveals that one single acquisition required numerous site visits, the hiring of specialised location consultants, and in-house deliberations involving 11 high-level managers (including CEO, CFO, geologists, lawyers and public relations specialists) that together considered over 41 decision criteria that the authors categorise into seven separate knowledge domains (Maitland and Sammartino Citation2015b, pp. 746–747).

Although FDI investors are no more able to foresee the future than others, they can thus rely on expertise assembled from a diverse group of people specialised in various areas; they do have the necessary time to evaluate that information carefully; and they have to amply justify their reasoning in team meetings. This does not mean that FDI decision-makers are immune to the usage of heuristics. They too grapple with the intrinsic unpredictability of the future, absorb investment narratives circulating among their peer networks, and rely on contestable indicators and practices when coming to their decisions. But they benefit from the input of information from diverse sources and - given that the stakes are usually very high (FDI investment decisions are in most cases very costly and difficult to reverse) - , they face strong incentives to take that input seriously. In other words, the institutional procedures underlying a FDI decision involve a useful ‘rubbing [of] different interpretative schemes one against another’ (Doz and Prahalad Citation1984) that make it probable that the flaws of an unfounded investment heuristic will be exposed and effectively resisted at some stage of the lengthy FDI decision-making process.

Given the comparatively low degrees of self-referentiality and uncertainty resulting from these considerations, we view the likelihood for FDI decisions at the aggregate level to be shaped by the latest investment fashion to be relatively low.

The role of heuristics in markets for PEI

Trading of short-term equities in markets for PEI is characterised by notably distinct processes (cf. Santiso Citation1999, Beunza and Garud Citation2007, Turco and Zuckerman Citation2014, Leins Citation2018). Unlike FDI investors, participants in markets for PEI do not intend to control the companies they invest in. Their general strategy is to buy a minority stake in a company when prices are low and re-sell them when they are high. Decision-making environments are very different from the case of FDI: PEI investors usually act individually or in small teams and, seeking to exploit temporary mispricings before they are being priced in, they have to take decisions quickly (Santiso Citation1999, Leins Citation2018). In contrast to FDI investors, they can normally not base their decisions on project-specific in-depth expert assessments. Instead, their reasoning is centred around calculative frames (Beunza and Garud Citation2007) and plausible narratives (Leins Citation2018). Furthermore, the widespread use of benchmarking techniques by financial firms’ management– and in particular the ruthless punishment of investors who fail to meet market averages (cf. Santiso Citation1999; also Shleifer and Vishny Citation1997) - creates strong incentives for PEI investors to follow prevailing consensus among their peers in order to avoid being out-performed (Beunza and Garud Citation2007, p. 17). In short: the high degree of uncertainty and intense competitive pressures seem to provide a fertile ground for the rapid spread of heuristics among professional networks of PEI investors.

In addition, the logic of the generation of financial returns in markets for PEI further reinforces these pressures towards mimetic investor behaviour. As contributions from economic sociology (Kirshner Citation2003, MacKenzie Citation2006, Beunza and Garud Citation2007, Turco and Zuckerman Citation2014, Beckert Citation2016), behavioural finance (Shiller Citation2015) and anthropology of finance (Leins Citation2018) have argued, the short time horizon of PEI investors and the high liquidity of the assets they are trading make markets for PEI conducive to the triggering of self-fulfilling dynamics. While returns on FDI are largely determined by corporate revenue streams resulting from the materialisation of corporate-economic trends, the ups and downs of prices in markets for PEI are primarily a function of changes in present expectations about future trends (see especially Beckert Citation2016). By implication, financial rewards in markets for PEI are more strongly driven by second-order observations - i.e. other market participants’ simultaneous assessment and implicit pricing of anticipated future trends - rather than the actual playing out of material developments.

These characteristics can have crucial implications for the function of heuristics as decision-making devices in markets for PEI. If financial returns were clearly tied to the materialisation of underlying trends (as they are, in our view, in the case of FDI), the following of unfounded investment fashions would constitute a losing strategy. But in self-referential environments, in which the usage of a heuristic itself can directly influence the perceived value of an asset, this needs not be the case. In effect, under such circumstances the deliberate following of biased investment trends can result in financial rewards rather than losses (cf. Soros Citation1987, Temin and Voth Citation2004, Turco and Zuckerman Citation2014): if an unfounded investment fashion circulated in the financial media starts being taken up by some investors and capital starts flowing towards the promoted assets, their price will indeed increase for some time. As a result, as long as they are able to re-sell the assets before markets correct, investors who manage to ‘jump on’ the fashion-like trend early are bound to make financial gains even if their predictions ultimately turn out to be wrong. In this sense, the frequent characterisation of fashion-like heuristics as ‘irrational aberrances’ can be misleading, for in contexts marked by self-referential dynamics, they can also function as valuable coordination devices for shrewd investors eager to play the expectations game.Footnote5

In sum: although both FDI and PEI investors are likely to employ heuristics when taking investment decisions, the characteristics of the environment of FDI discourage and punish the uninformed following of peers, while mimetic investor behaviour is encouraged and (potentially) rewarded by the high degrees of uncertainty and self-referentiality that characterise markets for PEI. The remainder of this article evaluates the implications of these differences at the example of one of the most prominent investment heuristics of recent years: the remarkable rise to popularity of the BRIC acronym in finance in the mid-2000s.

Empirical analysis

In a research paper published in November 2001, Jim O’Neill (Goldman Sachs’ chief economist at the time) coined the acronym BRIC to draw attention to the considerable size of non-Western economies and call for a corresponding reform of global economic governance institutions. As O’Neill explains in his book-length treatment of the subject published ten years later (O’Neill Citation2011), his selection of Brazil, Russia, India and China into the acronym was not based on considerations about the economic fundamentals of these economies, but - in line with the nature of his original claims - merely their economic size and political influence (see also Armijo Citation2007): O’Neill, who had never properly visited three of the four BRIC economies before 2001, explains that China and India were ‘easy pick[s]’ (O’Neill Citation2011, p. 20) because of the sheer size of their populations. Given his focus on global governance reforms, Russia was an ‘obvious choice’ because it had already participated at the G7 (Ibid:20). Finally, to draw a geographically inclusive concept, O’Neill decided to also include a Latin American country. The choice of Brazil over Mexico, O’Neill describes, was not only based on the fitting metaphor of the resulting acronym but also the fact that ‘Brazil … happens to produce some of the world’s best football players (an ongoing subject of obsession for this author)’ (Ibid:22).

O’Neill’s paper didn’t immediately receive a lot of attention (Ibid:3), but from 2003 onwards the acronym started to become increasingly popular among communities of investors. By that time, the meaning attributed to the acronym had already transformed from a political into a financial message. Irrespective of the fact that a more systematic analysis of developing countries’ growth prospects by Goldman Sachs’ Research Department (O’Neill et al. Citation2005) had found the economic fundamentals of the four BRIC economies to be largely unimpressiveFootnote6, conference speakers, financial journalists and fund managers started using the term not to illustrate the size or political importance of emerging markets in the world economy, but simply as ‘a shorthand for big markets … with outsized growth prospects’ (Temple Citation2004; emphasis added). Against the original motivation for the creation of the term, the acronym thus came to be used as a discursive tool that aimed to emphasize the exceptional macroeconomic prospects of Brazil, Russia, India and China - the ‘shining stars’ among the emerging economies (see Sum Citation2013, p. 543; Wansleben Citation2013, p. 453; Fourcade Citation2013) promising ‘returns measured in 100s of per cent’ (Foster Citation2007). Although some investors openly criticised the highly arbitrary nature of the selection of these four specific countries into this messageFootnote7 and despite O’Neill’s (Citation2011, p. 28) own admission that he found it ‘amusing that it was considered so profound’, the term became immensely popular among financial market participants in the mid-2000s. For a few years in the build-up to the Global Financial Crisis of 2007–08, the acronym turned into what FT columnist Gillian Tett (Citation2010) described as a ‘near ubiquitous’ financial term at the epicenter of a wave of optimism about the perceived economic prospects of emerging markets more generally (see also Sum Citation2013, Wansleben Citation2013).

Ultimately, the financial crisis of 2007–08 led to sharp withdrawals of funds from all emerging market destinations (including all four BRICs), putting an end to the ‘BRIC dreams’ in financial markets. Interestingly, the acronym subsequently experienced a remarkable revival as a geopolitical conceptFootnote8 when the BRIC-turned-BRICS idea (including South Africa from 2010 onwards) gradually transformed into a political reality in the form of a series of high-level ministerial summits, a development bank and a bailout fund (see Ban and Blyth Citation2013, Fourcade Citation2013). Yet, in contrast to its enthusiastic uptake in geopolitics, the acronym failed to regain its previous appeal in financial markets where – bugged down by the dismal economic performance of Brazil and Russia as well as the marked slowdown of China - it was gradually supplanted by the emergence of various rival acronyms (e.g. the Next-11, MINTS or CEVITS).Footnote9

Our statistical analyses thus aim to assess whether and to what extent the rise and spread of the BRIC acronym among financial communities affected patterns in global flows of FDI and PEI before 2008. Three aspects make it a particularly well suited case to test our theoretical argument: First, it is an archetypical example of an unfounded fashion-like investment heuristic and its remarkable rise to prominence in the mid-2000s is highlighted – but not systematically tested - in several recent studies that theorise the influence of heuristics in financial markets (Beckert Citation2013, p. 227, Brazys and Hardiman Citation2015, p. 25, Brooks et al. Citation2015, p. 588, Leins Citation2018, p. 58). Second, the message which came to be attached to the acronym after its creation - suggesting that Brazil, Russia, India and China constituted the ‘shining stars’ among the emerging economies - is in principle similarly relevant for PEI and FDI investors. Third, the high level of arbitrariness of the selection of the four countries into the acronym means that the BRIC assignment was to some extent exogenous to the countries’ objective growth prospects, which allows us to better identify the effect of the spread of the acronym per se from the actual materialisation of predicted trends.

Hypotheses to be tested

The early 2000s were a period characterised by relatively low growth and interest rates in advanced economies. In this context, investment fund managers ‘discovered’ the BRIC acronym as an effective marketing tool to excite prospective investors for non-traditional investment vehicles (Fourcade Citation2013). Placing emphasis on various forecast scenarios, Goldman Sachs and other investment managers started to use the acronym from 2003 onwards to suggest that emerging markets were on track to overtake large advanced economies as the growth engines of the global economy, offering plenty of opportunities to foreign investors in the process (cf. Wilson and Purushothaman Citation2003, O’Neill et al. Citation2005). Simultaneously, this discourse came to be taken up by the financial press (Wansleben Citation2013, p. 464), which started to promote the idea beyond the fund managers’ direct networks, giving it a life of its own. Bearing the typical features of a fashion-like heuristic, the acronym thus provided a seemingly compelling visualisation of an unknowable future through the explicit usage of forecasting techniques aimed at stimulating excitement about opportunities to be exploited by prospective investors. By doing so, it proposed a new classificatory regime in international finance, which deliberately blurred the traditional distinction between developed and developing economies to indicate the emergence of ‘a selective group of emerging markets as solid-long-term investment destinations’ (Wansleben Citation2013, p. 453).

The main interest of our empirical analysis is to evaluate whether the spread of the acronym among communities of financial investors is associated with a distortion of global FDI and PEI flows towards the four BRIC economies. In principle the message of the acronym is similarly relevant for PEI and FDI investors and there is clear evidence that the BRIC term caught not only the attention of investment fund managers but also of executives in corporate boardrooms.Footnote10 A priori one might thus expect the consequences of the acronym’s spread to be similar for PEI and FDI flows. Our theoretical framework, however, suggests that structural-institutional differences in the decision-making environments characterizing the two markets will make FDI investors considerably more reluctant to follow fashion-like heuristics than their peers operating in markets for PEI. Accordingly, we predict the spread of the acronym in the financial press to be associated with greater distortions in markets for PEI than FDI.

Econometric framework

The effect of the BRIC nomination might just be a short-term disturbance with little impact on investments in the longer term, or it might be an effect that needs time to catch on. To adequately take this into account, we employ an error correction model (ECM), which allows us distinguishing between short-term and long-term BRIC effects. As pointed out by De Boef and Keele (Citation2008), ECM are not only well suited for cointegrated data, but can also be used in other settings with stationary series where one has theoretical reasons to embed both short-term and long-term relationships between variables.

Similar to Brooks et al. (Citation2015) we thus proceed with a model that takes the following form:Changes in Y (PEI or FDI as a fraction of GDP) are regressed upon it’s lagged value, the lagged values of a set of explanatory variables including the BRIC variable, and changes in these explanatory variables. In the above equation, short term effects are captured in the β0 vector, while long-term relationships are captured in β1 and α measures the rate of convergence back to the equilibrium – in other words, the error correction parameter. We can rewrite the equation above as

and estimate the model by OLS. Short term effects are now captured in the βk vector, while the long-term multiplier is now βj/-π. Using a panel dataset, we include country and time fixed effects and cluster standard errors on the country level. Any country-specific time-invariant effects are captured by country fixed effects, while common global macro-economic conditions such as liquidity or commodity prices are controlled for through the inclusion of time fixed effects.

Our sample consists of all forty countries denominated as ‘emerging markets’ in Wikipedia (Citation2015). Robustness checks restrict the sample to only the fifteen largest of these economies.

Operationalizations of the BRIC effect

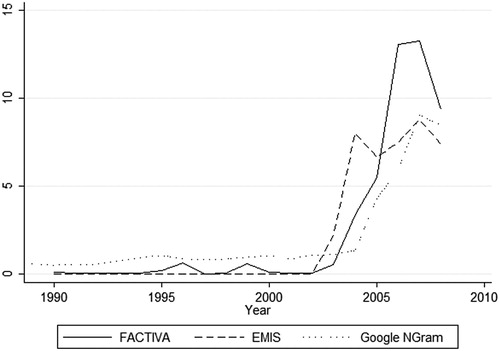

To operationalise the BRIC effect, we use two different strategies. Firstly, following Brooks et al. (Citation2015), we model the BRIC-effect as a country grouping peer effect allowing for interdependencies in inflows. More specifically, we measure the average of PEI or FDI inflows relative to GDP in the BRIC vs. non-BRIC groups, calculating out a country’s own contribution to the group average to avoid endogeneity issues (i.e. for each of the four BRIC countries, the relevant variables capture the average inflows of FDI/PEI in the three BRIC countries other than country i). As we do not expect any peer effects among non-BRIC countries, the group average for non-BRIC countries is set to zero. Secondly, similar to Brazys and Hardiman (Citation2015), we use three alternative indexes that we derive from electronic media databases to proxy the salience of the BRIC-acronym in the financial press. The three ratios, illustrated graphically in (reassuringly they are highly correlated with each other), are: (i) the FACTIVA ratio, i.e. the evolution of the frequency of the usage of the term ‘BRIC’ in the encompassing FACTIVA news databaseFootnote11 as a share of the frequency of the usage of the neutral term ‘economy’ over time; (ii) an analogous measurement derived from the alternative EMIS databaseFootnote12; and (iii) the Google NGram index for the term ‘BRIC’, tracking occurrences of the BRIC term in Google’s digitised book archive.Footnote13 Similar to the approach in group averages, all these measures are set to zero before the invention of the BRIC acronym (the measures are at low and constant levels even if we do not make this modification – cf. – and the change does not affect our substantive resultsFootnote14).

Figure 1. The mentions of ‘BRIC’ in news sources over time, 1990-2008.

Note: The x-axis indicates the number of articles in the database that mention the term ‘BRIC’ as a share of the number of articles that mention the neutral word ‘economy’, multiplied by 106.

It remains clear that not every mention of the acronym that these ratios capture carries the same weight in the process of diffusion as a whole, and the measurement strategy we employ does not take heterogeneities (such as the outlet, context and readership of the article) into account. Furthermore, it is also plausible that some of these mentions are themselves the result of observed increases in capital inflows to these countries, which means that we cannot interpret these relationships causally. Nonetheless, the measured trends provide a useful and relatively fine-grained measurement of changes in the salience of the use of the acronym in the financial press, which figured as an important conduit in the processes that drove the diffusion of the term among communities of financial investors (cf. Wansleben Citation2013).

Control variables

As the discussion in the previous section has shown, O’Neill’s selection of the four BRIC economies appears to have been based primarily upon idiosyncrasies and the economic size (rather than macroeconomic prospects) of the four countries. To avoid estimation bias, it is thus important for our empirical models to take the latter selection criteria into account. We do so by including countries’ reported size of GDP (in Mio USD, from the World Banks’ World Development Indicators Database (WDI)) into all models.Footnote15

Furthermore, to take other potential economic or political drivers of relative capital flows into a country into account, we apply fixed effects strategies and include a number of additional country-specific control variables. Although the determinants of FDI and PEI inflows cannot assumed to be identical, we use the same independent variables for our models predicting relative FDI and PEI inflows for reasons of consistency.

One important driver of global capital flows are global market conditions, such as business cycles in advanced economies (especially important for FDI), US interest rates (especially important for PEI) or commodity prices that determine the availability of funds, the risk appetite of global investors and the opportunity cost of investing in emerging markets rather than advanced economies. To the extent that these conditions affect all emerging markets equally, they are captured by time fixed effects. In addition, the existing literature has also identified various country-specific determinants of PEI (see Bekaert and Harvey Citation2002, Citation2003, Edison and Warnock Citation2008) and FDI flows (see Schneider and Frey Citation1985, Jensen Citation2003, Li and Resnick Citation2003). In order to take the unobserved variation that is constant for any one country over time into account we include country fixed effects in all models. Furthermore, we include several observables, which together aim to proxy for three categories of factors: current and prospective economic performance, economic and political risk and the availability of investment opportunities. To proxy a country’s economic growth prospects, we include the annual GDP growth rate (from WDI), GDP per capita (WDI), the share of the population under the age of 15 as a share of the working age population (15–64 years old) (ILO) and enrolment rates in tertiary education (UNESCO). To control for a country’s economic and political risks, we include inflation rates, public debt as a share of GDP (both from WDI), a dummy variable which indicates whether the Fitch ratings of government bonds were on or above investment-grade level (from Fitch Sovereign Ratings), the Polity IV index of democratization (from the Polity IV project), and two dummy variables indicating the ideological orientation of the government in office (from Keefer et al.’s (Citation2001) Database on Political Institutions). To control for investment opportunities we include a variable indicating the combined market capitalisation of all domestically listed companies as a share of GDP (WDI).Footnote16

Results

presents the results for PEI inflows and the results for FDI. In both tables, we first show results measuring the BRIC-effect as a group average of inflows in other BRIC countries, followed by models proxying the BRIC-effect via the FACTIVA, Google NGram and EMIS indices.

Table 1. Main results for PEI inflows.

Table 2. Main results for FDI inflows.

Turning to the results, our findings presented in show that being included in the BRIC-group does indeed have a positive impact on changes in relative PEI inflows. Changes in any of the BRIC measures have a small positive, but insignificant contemporaneous effect, while coefficients on the lagged BRIC measure are both larger in magnitude and statistically significant at the 5 percent level or lower. In combination with the estimated coefficient on the lagged dependent variable being close to one, the findings suggest that short-term deviations from equilibrium are corrected quickly and longer-term effects dominate, with the long run multiplier βj/-π being approximately equal to the coefficients βj in the table, as π is close to –1. Ceteris paribus, a 1 percent increase in the average PEI inflows of other BRIC members increases the inflows of the remaining BRIC-country by 1.36 percent. Unit increases in FACTIVA, Google NGram and EMIS indices have similar effects.

The results for the case of changes in FDI inflows, shown in , are different. First off, convergence back to equilibrium takes longer: After one year, 52.8 percent of the error is corrected, and it takes 5 years to get that rate above 95 percent for any of the changes measured in the X vector. Secondly, the effects of some of the control variables are also different in the case of FDI than in the case of PEI. But most importantly for our purposes, the findings strongly suggest that belonging to the BRIC group, in contrast to the case of PEI, appears to have no significant effect on changes in FDI inflows in the mid-2000s (if anything, coefficients even point towards a negative relationship).

Robustness checks

Given ongoing methodological debates about the appropriateness and estimation efficiency of the ECM model in various settings (see Enns et al. Citation2016, Grant and Lebo Citation2016), we also estimate simpler model specifications in a traditional OLS framework. The conclusion remains the same: While we find no influence of the BRIC denomination in markets for FDI, we find clear and significant increases in PEI inflows.

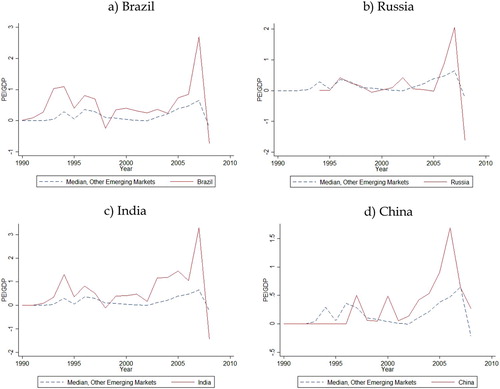

Next, we also want to make sure that the BRIC effect is not driven by the inflows into a single BRIC-country alone. We therefore run regressions excluding one BRIC country at the time. We find that the substantive results are unaffected by the exclusion of any one BRIC country (we omit the regression output here for reasons of space; in the appendix illustrates the country-specific patterns graphically).

Finally, to ensure that effects are not driven by an inappropriate control group, we run the same analysis restricting the control group to the 15 largest emerging economies as measured by GDP in 2001 (two of these countries had to be dropped due to missing data) and furthermore drop the time period from 1990 to 1998 to focus only on the years in which the BRIC-term was popularised. In both of these robustness checks, the results on the BRIC variable are confirmed and qualitatively unchanged (see in the appendix): the spread of the BRIC acronym in the mid-2000s was associated with a notable distortion in PEI flows to the four BRIC economies, while we find no such relationship in markets for FDI.

Conclusions

In the aftermath of the global financial crisis, the statement that global capital markets do not always behave rationally has become largely uncontroversial. And yet, our understanding of when and why the allocation of capital sometimes does follow rationalistic patterns and not at other times is still at early stages. Building on seminal theoretical literature in economic sociology and behavioural finance, we have argued that the degrees of uncertainty and self-referentiality that structure investment decision-making environments are important scope conditions that can encourage or hinder the mimetic diffusion of heuristics among financial investment communities. In line with this argument, we have suggested that the institutional structures of markets for PEI are generally more conducive to the spread of investment fashions than markets for FDI. Our examination of this hypothesis at the example of the rise to prominence of the BRIC-acronym in the mid-2000s as a ‘most likely case’ of a heuristic-induced investment boom has lent strong empirical support to this general argument.

Our finding that only PEI investors responded to the BRIC hype in the mid-2000s while FDI investors resisted these same temptations are at odds with the common portrayal of investment fashions as the inevitable product of the interaction of herds of foolish investors who can’t help but follow their innate ‘animal spirits’. Instead, our differential findings suggest that the occurrence of investment bubbles may not primarily be driven by a lack of intelligence on behalf of investors, but rather by specific structural-institutional circumstances that can make it ‘rational’ for them to behave ‘irrationally’.

Beyond the case of the BRICs, the article highlights the need for political economists to go beyond demonstrating that heuristics and fictive imaginations play a role in economic decision-making and to start examining more systematically the scope conditions under which such ideational forces become salient. In this sense, we hope that the article may serve as a useful starting point for further investigations, which may fruitfully evaluate similar dynamics at more disaggregated levels (through in-depth qualitative case studies as well as experimental designs) in future research.

Acknowledgements

Earlier versions of this article have been presented at EPSA 2015, ISA 2016 and a virtual meeting of IPES in November 2015. For helpful suggestions we are grateful to Rawi Abdelal, Renira Angeles, Mark Copelovitch, Jeff Frieden, Andreas Fuchs, Julia Gray, Barry Maydom, Layna Mosley, Amy Pond, Lena Rethel and Meredith Wilf. All errors remain our own.

Disclosure statement

No potential conflict of interest was reported by the authors.

Notes on Contributors

Lukas Linsi is a postdoctoral researcher at the University of Amsterdam. His research interests lie in the fields of international and comparative political economy, in particular the role of narratives in the world economy, the production and uses of macroeconomic indicators, and the politics of executive remuneration.

Florian Schaffner completed his PhD in economics at the University of Zurich. His research interests lie in the field of applied econometrics and he has previously done work on bank failures, choice under uncertainty with high-dimensional choice sets and matching and search behavior.

Additional information

Funding

Notes

1 We owe this formulation to an anonymous reviewer.

2 To avoid further conceptual complications we exclude debt markets, which follow somewhat different logics of operation and in which creditors’ ability and willingness to repay play a relatively more important role.

3 In statistical terms, FDI refers to ownership stakes involving 10 percent or more of the receiving company’s outstanding stock.

4 Because IFDI statistics are not broken down by type, we are unable to assess the patterns separately in the empirical analysis. This being said, existing comparisons of greenfield vs. M&A IFDI data suggest that more than two thirds of FDI activities in emerging markets concern greenfield FDI (see Alquist et al. Citation2013, p. 23).

5 We owe this formulation to Rawi Abdelal.

6 In an assessment of a total of 170 economies, Goldman Sachs’ ‘Growth Environment Score’ placed the BRICs respectively on ranks 53 (China), 81 (Russia), 95 (Brazil) and 97 (India) (O’Neill et al. Citation2005, p. 19).

7 One investment manager stated that

[i]t’s a cool acronym but what it contains is four emerging markets that are large but don’t have all the same prospects. Why is Bric ignoring Mexico, Turkey and Indonesia? It’s a selection based on the fact that it is a cool acronym (Foster Citation2007).

8 Ironically, this re-reinterpretation of the acronym corresponds fairly well to the logic of O’Neill’s (Citation2001) original formulation of the term.

9 Tellingly, in the aftermath of the crisis the Financial Times chose to re-label its emerging markets blog ‘beyondbrics’; and even Goldman Sachs, the institution behind the creation of the acronym, chose to close its very own ‘BRICs fund’ in September 2015 (McLannahan Citation2015).

10 In an interview in 2009, Jim O’Neill mentions that after the publication of the (follow-up) 2003 BRICs paper he ‘received letters from the CEOs of some important well-known companies around the world telling us that it was the most influential research that they had ever read’ (in Wansleben Citation2013, p. 467–468). See also Piotti (Citation2009), Beckert (Citation2013).

11 For more information, see: https://global.factiva.com/factivalogin/login.asp?productname=global [Accessed 13 November 2018].

12 For more information, see: https://www.emis.com/ [Accessed 13 November 2018].

13 For more information, see: https://books.google.com/ngrams [Accessed 13 November 2018].

14 The few uses of the term BRIC in the media before 2003 usually appear in the context of ‘bric-a-brac’.

15 Because our models also include GDP per capita (see below), we do not simultaneously include the size of the population – which would in principle be a valid alternative operationalisation of O’Neill’s apparent selection criterion - because these three variables are mechanically related.

16 Earlier models also included the KAOPEN capital account openness index from Chinn and Ito (Citation2008) to take country-specific regulations of capital inflows into account. However, the estimated effect is statistically insignificantly different from zero and its inclusion leads to estimation problems for the country-fixed effects because the index shows little variation over time. Separate more detailed research on the stock market liberalization in thirty emerging markets by Bekaert et al. (Citation2003) date the ‘official stock market liberalization’ for all emerging markets in their sample in the late 1980s and early 1990s, thus preceding the time period of our empirical analysis.

References

- Aharoni, Y., 1966. The foreign investment decision process. Boston: Graduate School of Business Administration, Harvard University.

- Alquist, R., Mukherjee, R., and Tesar, L. 2013. Fire-sale FDI or business as usual? NBER working paper series, No. 18837.

- Armijo, L.E., 2007. The BRICs countries (Brazil, Russia, India, and China) as analytical category: mirage or insight? Asian perspective, 31 (4), 7–42.

- Ban, C., and Blyth, M., 2013. The BRICs and the Washington consensus: an introduction. Review of international political economy, 20 (2), 241–255.

- Beckert, J., 2013. Imagined futures: fictional expectations in the economy. Theory and society, 42 (3), 219–240. doi:10.1007/s11186-013-9191-2.

- Beckert, J., 2016. Imagined futures: fictional expectations and capitalist dynamics. Cambridge, MA and London, UK: Harvard University Press.

- Bekaert, G., and Harvey, C.R., 2002. Research in emerging markets finance: looking to the future. Emerging markets review, 3 (4), 429–448. doi:10.1016/S1566-0141(02)00045-6.

- Bekaert, G., and Harvey, C.R., 2003. Emerging markets finance. Journal of empirical finance, 10 (1), 3–55. doi:10.1016/S0927-5398(02)00054-3.

- Bekaert, G., Harvey, C.R., and Lundblad, C.T., 2003. Equity market liberalization in emerging markets. Federal reserve bank of St. Louis review, 85 (4), 53–74.

- Beunza, D., and Garud, R., 2007. Calculators, lemmings or frame-makers? The intermediary role of securities analysts. The sociological review, 55, 13–39. doi:10.1111/j.1467-954X.2007.00728.x.

- Brazys, S., and Hardiman, N., 2015. From ‘tiger’ to ‘PIIGS’: Ireland and the use of heuristics in comparative political economy. European journal of political research, 54 (1), 23–42. doi:10.1111/1475-6765.12068.

- Brooks, S.M., Cunha, R., and Mosley, L., 2015. Categories, creditworthiness, and contagion: how investors’ shortcuts affect sovereign debt markets. International studies quarterly, 59 (3), 587–601. doi:10.1111/isqu.12173.

- Buckley, P.J., Devinney, T.M., and Louviere, J.J., 2007. Do managers behave the Way theory suggests? A choice-theoretic examination of foreign direct investment location decision-making. Journal of international business studies, 38 (7), 1069–1094.

- Callon, M., 1998. Laws of the markets. London: Wiley-Blackwell.

- Chinn, M.D., and Ito, H., 2008. A new measure of financial openness. Journal of comparative policy analysis: research and practice, 10 (3), 309–322. doi:10.1080/13876980802231123.

- Clark, D.R., Li, D., and Shepherd, D.A., 2018. Country familiarity in the initial stage of foreign market selection. Journal of international business studies, 49, 442–472.

- De Boef, S., and Keele, L., 2008. Taking time seriously. American journal of political science, 52 (1), 184–200. doi:10.1111/j.1540-5907.2007.00307.x.

- DiMaggio, P.J., and Powell, W.W., 1983. The iron cage revisited: institutional isomorphism and collective rationality in organizational fields. American sociological review, 48 (2), 147–160.

- Doz, Y., and Prahalad, C.K., 1984. Patterns of strategic control within multinational corporations. Journal of international business studies, 15 (2), 55–72.

- Dunning, J.H., 1988. The eclectic paradigm of international production: a restatement and some possible extensions. Journal of international business studies, 19 (1), 1–31.

- Edison, H.J., and Warnock, F.E., 2008. Cross-Border listings, capital controls, and equity flows to emerging markets. Journal of international money and finance, 27 (6), 1013–1027. doi:10.1016/j.jimonfin.2008.05.001.

- Eichengreen, B., Rose, A.K., and Wyplosz, C. 1996. Contagious currency crises. Working paper. National bureau of economic research, July 1996. Available from: http://www.nber.org/papers/w5681.

- “Emerging Markets.” Wikipedia. 2015. Available from: http://en.wikipedia.org/wiki/Emerging_markets.

- Enns, P.K., et al., 2016. Don’t jettison the general error correction model just yet: a practical guide to avoiding spurious regression with the GECM. Research and politics, 3 (1), 1–13.

- Fama, E.F., 1970. Efficient capital markets: a review of theory and empirical work. The journal of finance, 25 (2), 383–417. doi:10.2307/2325486.

- Foster, L. 2007. Brics: acronym or coherent strategy? Financial Times, 21 September 2007.

- Fourcade, M., 2013. The material and symbolic construction of the BRICs: reflections inspired by the RIPE special issue. Review of international political economy, 20 (2), 256–267.

- Grant, T., and Lebo, M.J., 2016. Error correction methods with political time series. Political analysis, 24 (1), 3–30.

- Gray, J., 2013. The company states keep. Cambridge, UK; New York: Cambridge University Press.

- Jensen, N.M., 2003. Democratic governance and multinational corporations: political regimes and inflows of foreign direct investment. International organization, 57 (3), 587–616. doi:10.1017/S0020818303573040.

- Keefer, P., et al., 2001. New tools in comparative political economy: the database of political institutions. World bank economic review, 15 (1), 165–176.

- Keynes, J.M., 1935. The general theory of employment, interest and money. New York: Harcourt, Brace and Company.

- Kirshner, J., 2003. Money Is politics. Review of international political economy, 10 (4), 645–660. doi:10.1080/09692290310001601911.

- Knight, F.H., 1921. Risk, uncertainty and profit. Boston: Houghton.

- Krugman, P., 1979. A model of balance-of-payments crises. Journal of money, credit and banking, 11 (3), 311–325. doi:10.2307/1991793.

- Leins, S., 2018. Stories of capitalism: inside the role of financial analysts. Chicago: University of Chicago Press.

- Li, Q., and Resnick, A., 2003. Reversal of fortunes: democratic institutions and foreign direct investment inflows to developing countries. International organization, 57 (1), 175–211. doi:10.1017/S0020818303571077.

- Lloyd, J., and Turkeltaub, A. 2006. India and China are the only real brics in the wall. Financial times, 4 December 2006.

- MacKenzie, D., 2006. An engine, not a camera. Cambridge, MA and London, UK: The MIT Press.

- Maitland, E., and Sammartino, A., 2015a. Decision making and uncertainty: the role of heuristics and experience in assessing a politically hazardous environment. Strategic management journal, 36, 1554–1578.

- Maitland, E., and Sammartino, A., 2015b. Managerial cognition and internationalization. Journal of international business studies, 46, 733–760.

- McLannahan, B. 2015. Goldman fund walks away from the brics era. Financial times, 9 November 2015.

- Mosley, L., 2003. Global capital and national governments. New York: Cambridge University Press.

- Nelson, S.C., and Katzenstein, P.J., 2014. Uncertainty, risk, and the financial crisis of 2008. International organization, 68 (2), 361–392. doi:10.1017/S0020818313000416.

- Obstfeld, M., April 1996. Models of currency crises with self-fulfilling features. European economic review, 40 (3–5), 1037–1047. doi:10.1016/0014-2921(95)00111-5.

- O’Neill, J. 2001. Building better global economic BRICs. Goldman sachs global economics paper, 2001.

- O’Neill, J., 2011. The growth map: economic opportunity in the BRICs and beyond. New York: Portfolio.

- O’Neill, J., et al., 2005. How solid are the BRICs? Goldman sachs global economics paper.

- Piotti, G., 2009. German companies engaging in China: decision-making processes at home and management practices in Chinese subsidiaries. MPIfg working paper, 09 (14), 1–35.

- Santiso, J., 1999. Analysts analyzed: a socio-economic approach to financial and emerging markets. International political science review, 20 (3), 307–330.

- Schneider, F., and Frey, B.S., 1985. Economic and political determinants of foreign direct investment. World development, 13 (2), 161–175. doi:10.1016/0305-750X(85)90002-6.

- Shiller, R.J., 2015. Irrational exuberance. 3rd ed. Revised and Expanded Third edition. Princeton: Princeton University Press.

- Shiller, R.J., 2017. Narrative economics. American economic review, 107 (4), 967–1004.

- Shleifer, A., and Vishny, R.W., 1997. The limits of arbitrage. Journal of finance, 52 (1), 35–55. doi:10.1111/j.1540-6261.1997.tb03807.x.

- Simon, H.A., 1991. Bounded rationality and organizational learning. Organization science, 2 (1), 125–134.

- Soros, G., 1987. The alchemy of finance: reading the mind of the market. New York: Simon and Schuster.

- Sum, N.-L., 2013. A cultural political economy of crisis recovery: (trans-)national imaginaries of ‘BRIC’ and subaltern groups in China. Economy and society, 42 (4), 543–570. doi:10.1080/03085147.2012.760348.

- Temin, P., and Voth, H.-J., 2004. Riding the south sea bubble. American economic review, 94 (5), 1654–1668.

- Temple, P. 2004. How solid are the brics? Financial times. 7 February 2004.

- Tett, G. 2010. The story of the brics. Financial times. 15 January 2010.

- Thomas, K.P., 1997. Capital beyond borders : states and firms in the auto industry, 1960–94. Houndmills, Basingstoke: Palgrave Macmillan.

- Turco, C.J., and Zuckerman, E.W., 2014. So you think you can dance? Lessons from the U.S. private equity bubble. Sociological science, 1, 81–101.

- Tversky, A., and Kahneman, D., 1975. Judgment under uncertainty: heuristics and biases. In: Utility, probability, and human decision making. Dordrecht: Springer, 141–162.

- Wansleben, L., 2013. ‘Dreaming with BRICs’: innovating the classificatory regimes of international finance. Journal of cultural economy, 6 (4), 453–471. doi:10.1080/17530350.2012.756826.

- Wilson, D., and Purushothaman, R. 2003. Dreaming with BRICs: the path to 2050. Goldman sachs global economics paper, 1 October 2003.