?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.

?Mathematical formulae have been encoded as MathML and are displayed in this HTML version using MathJax in order to improve their display. Uncheck the box to turn MathJax off. This feature requires Javascript. Click on a formula to zoom.ABSTRACT

This article investigates dairy farm investment behaviour and the presence of soft budget constraints in the dairy farms of Baltic and Central European transition countries – Estonia, Hungary and Slovenia – using individual dairy farm accountancy panel data for the years 2007–2015. The empirical results confirm that gross dairy farm investment is positively associated with gross dairy farm investment for the previous year for financially unconstrained dairy farms, and negatively for financially constrained dairy farms. It is also positively associated with public investment subsidies, and, except for Slovenia, with growth in real sales for financially unconstrained dairy farms. Mixed results are found for gross dairy farm investment squared and cash flow variables. A particularly significant negative cash flow regression coefficient implies significant soft budget constraints for financially unconstrained Estonian and Slovenian dairy farms, while insignificant cash flow regression coefficients imply weak soft budget constraints for financially unconstrained Hungarian dairy farms.

1. Introduction

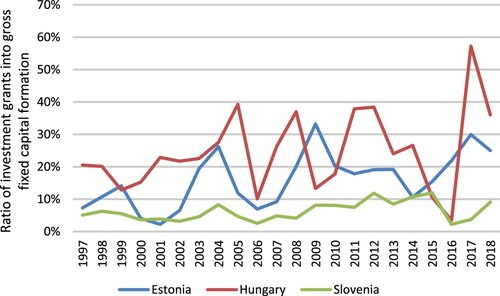

The liberalization and transformation of agriculture, agricultural support, credit and rural finance systems in the former post-command economies of Central and Eastern Europe have been complex undertakings (Lerman, Citation2000). The purpose of the study is to determine the investment behaviour and the presence of soft budget constraints (SBC) in the dairy farms of three Baltic and Central European (BCE) transition economies – namely Estonia, Hungary and Slovenia. The study applies a dynamic panel-data farm investment model that incorporates the presence of SBC and capital market imperfections in relation to state interventions in the form of Common Agricultural Policy (CAP) investment subsidies. Investments play an important role in the process of agricultural and farm modernization and restructuring, and they can be driven by subsidies on investment, which is one of the forms of CAP non-repayable aid (Kirchweger, Kantelhardt, Citation2015; Svoboda et al., Citation2016). During the period 2007–2015, investment grants comprised 8%, 18% and 26% of the gross fixed capital formation in Slovenia, Estonia and Hungary, respectively (Figure A1 in Appendix). The study provides an analysis of dairy farm investment behaviour in a cross-country comparative setting to explain the effect of state interventions with CAP investment subsidies, and it also presents a discussion of the evolution of dairy farm investments in the individual study countries during the post-European Union (EU) accession period.

The study quantifies the effect of a series of dairy farm characteristics and CAP investment subsidies on the dynamics of the farm-level investment-to-capital ratio. Kornai (Citation1986, Citation2001) and Kornai et al. (Citation2003) introduced and developed the concept of the SBC using the experience of former socialist and post-socialist economies. It could be interesting for academic literature, policy and practice to better understand whether SBC still persist in the BCE transition economies during the post-EU accession period, with CAP investment subsidies being available. The post-2020 CAP is expected to increase its environmental and societal focus. In order to respond to policy changes and societal expectations, dairy farmers need to invest into green and digital technologies (European Commission, Citation2020b). The ability of the EU and national governments to finance investment grants is limited, and financial instruments have recently been suggested as policy tools for boosting agricultural investment (fi-compass, Citation2020). Since loans comprise a large proportion of all financial instruments, it is crucial that policy makers, financing organizations, farmers and the research community have a better understanding of the investment behaviour and persistence of SBC in agriculture.

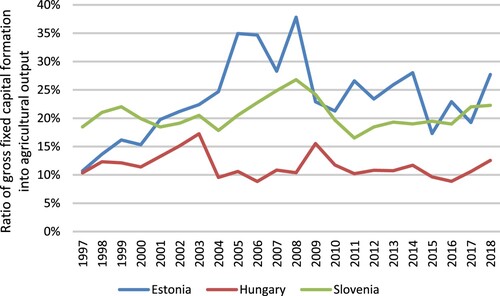

The choice of the three BCE transition economies that are compared in the study stems from the different initial pre-transition conditions that later affected the transition of the states from a centrally planned to a market economy, and EU accession. Masso (Citation2002) argued that in the initial stage of the transition to a market economy, the existence of financing and liquidity constraints was one of the main obstacles to investment in small Estonian manufacturing firms that relied on internal finance for investments and cash flow. In the Estonian agricultural sector, financing constraints hindered farm investment in the 1990s (Viira et al., Citation2009). During the period 1995–2000, the proportion of gross fixed capital formation in agricultural output was 12% in Estonia and Hungary, yet 20% in Slovenia. With the launch of the pre-accession SAPARD programme, this proportion increased to 22% in Estonia in the period 2001–2004. At the same time, in Hungary and Slovenia it remained similar to that of the 1995–2000 period (13% and 19%, respectively). After EU accession, in the period 2005–2015, the share of gross fixed capital formation in agricultural output in Estonia was 27% on average, while in Hungary it was 11% and in Slovenia 21% (Figure A2 in Appendix). This implies that investment in Estonian agriculture increased markedly after EU accession, while in Hungary and Slovenia the proportion of gross fixed capital formation in agricultural output was more stable. However, the role of investment subsidies in agricultural investment was highest in Hungary and lowest in Slovenia.

There is a wealth of research about farm investment behaviour (e.g. Bakucs et al., Citation2009; Bojnec & Latruffe, Citation2011; Bokusheva et al., Citation2007, Citation2009; Kallas et al., Citation2012; Petrick, Citation2005; Viaggi et al., Citation2011; Zinych & Odening, Citation2009). However, studies that deal with agriculture are generally limited to one country and exclude cross-country comparisons, except for Benjamin and Phimister (Citation2002), and Fertő et al. (Citation2017, Citation2020). There are few studies that investigate dairy farm investment behaviour, and no research has tested the hypothesis of the persistence of SBC in dairy farms in transition BCE countries.

Our study contributes to existing academic literature by describing some of the empirical aspects of investment behaviour and financial constraints – particularly SBC – in the context of the effect of CAP investment subsidies on the dairy farms of BCE countries. Dairy farms are of interest in each of the selected countries since they have always been subsidized, and they represent one of the most important forms of farm production (DG AGRI, Citation2018; Matthews, Citation2017). Dairy farmers use a large amount of capital on asset-specific investment (Emvalomatis et al., Citation2011; Latruffe et al., Citation2017). This investment behaviour could explain the effect of CAP investment subsidies. With market liberalization, dairy farms are facing the challenges of fluctuating prices and pressure to remain competitive. Therefore, an examination of dairy farm investment behaviour could be important to policy makers and dairy market participants by helping ensure the competitiveness of the sector and the sustainability of dairy farms in the long term (Kirchweger & Kantelhardt, Citation2014; Skevas et al., Citation2018b). Moreover, the issue of CAP investment subsidies and investment cash flow sensitivity in the dairy farms of BCE countries has been neglected. Bakucs et al. (Citation2009), Bojnec and Latruffe (Citation2011), Bojnec and Fertő (Citation2016), and Fertő et al. (Citation2017) found evidence for capital market imperfections in Hungarian and Slovenian farms during the times of transition, while Fertő et al. (Citation2020) found evidence of strong SBC for Estonian farms and weak SBC for Hungarian and Slovenian farms after 2007. This study focuses on whether SBC persists, and how it varies between BCE countries with different dairy farming structures and historical-institutional legacies in the new context of CAP subsidies in the post-EU accession period. Thus, it seeks to fill this gap in the investigation of the CAP investment subsidies and investment-cash flow sensitivity in BCE countries using micro dairy farm-level data.

The remainder of the paper has the following structure: The following section describes the investment behaviour framework and findings from academic literature about dairy farm investment, investment subsidies and SBC. This is followed by the methodology of the Euler equation investment models, the data that were used and descriptive statistics about the sample of dairy farms in Estonia, Hungary and Slovenia, and econometric empirical results are presented and discussed. The final section summarizes the main findings.

2. Dairy farm investment, investment subsidies and soft budget constraints: findings from academic literature

The use of farm bio-economic models for agri-food systems along with their development and policy impact assessment has become interdisciplinary. A few studies have investigated the economic performance of dairy farms (Irz & Jansik, Citation2015; Kimura & Sauer, Citation2015; Latruffe et al., Citation2017; Sipiläinen et al., Citation2014; Skevas et al., Citation2018a), but no research has investigated the role of CAP investment subsidies and SBC in the investment behaviour of dairy farms, particularly not through a comparative analysis of Estonia, Hungary and Slovenia. Therefore, this section introduces the academic literature on the link between dairy farm investment and CAP subsidies within the framework of SBC and capital market imperfections, focusing on BCE transition economies and referring to some of the experiences of Western economies.

Changes in agricultural policy following EU accession and the implementation of CAP measures may have affected investment decision-making at farm level. Technological change, as well as the increase in environmental and animal welfare standards, may require investment aimed at improving the capital stock of dairy farms, which due to dairy farms’ asset-specificity problem may be associated with high adjustment costs (Gardebroek & Oude Lansink, Citation2004). The asset specificity in agriculture, and specifically in the dairy sector, requires relatively large investments customized for highly specific and less flexible uses (Feinerman & Peerlings, Citation2005; Rosochatecká et al., Citation2008). Constrained conditions for accessing capital can occur for farms in transition economies where market institutions are still underdeveloped (Fertő et al., Citation2020; Hüttel et al., Citation2010). CAP subsidies can mitigate capital scarcity, thus fostering investment.

Different approaches to examining investment behaviour at firm/farm level have been used in existing academic literature, starting from assuming perfect capital market conditions to capturing the effect of financial constraints on investment decisions (Hüttel et al., Citation2010). We follow the stream of academic literature that examines how CAP subsidies and SBC can affect investment decisions at farm level (Bojnec & Latruffe, Citation2011; Fertő et al., Citation2020; Kallas et al., Citation2012; Sckokai & Moro, Citation2009; Viaggi et al., Citation2011). For example, O’Toole and Hennessy (Citation2015) found that decoupled subsidies affect farm investment. Through financial channels, the latter reduces credit constraints, particularly for constrained dairy and younger farms. As far as our specific focus on farm investment behaviour in BCE transition economies is concerned, in the academic literature on modelling investment behaviour at farm level, little attention has been paid to CAP investment subsidies and the possible persistence of SBC. Bojnec and Latruffe (Citation2011) found that, prior to EU enlargement, the investment decisions of Slovenian farms were based on market opportunities, ruling out the presence of SBC, although investment decisions were constrained by the availability of finance. The role of investment subsidies was found to be non-significant, though with a positive impact of operational subsidies for small farms in relation to the alleviation of financial constraints. Fertő et al. (Citation2017) found that investment behaviour among Hungarian, Slovenian and French farms, except for the presence of capital market imperfections in Hungary and Slovenia, was not substantially different. Following EU enlargement, public investment subsidies positively influenced farm investments. Therefore, in the short-term, investment subsidies have been found to be able to mitigate capital market imperfections.

Previous research provides evidence of capital market imperfections in BCE countries during transition and after accession to the EU (Bojnec & Fertő, Citation2016, Bojnec & Latruffe, Citation2011). Some papers have tested the hypothesis of the persistence of SBC in transition economies (Fertő et al., Citation2017, Citation2020). However, SBC may also persist once countries have shifted to a market economy, which can lead to the postponement of economic restructuring (Kornai, Citation2001; Kornai et al., Citation2003). SBC may have more impact within the agricultural sector (including dairy), since the government support that farms receive is greater than is the case with firms in the manufacturing sector.

This paper investigates the presence of SBC and credit market imperfections in Estonian, Hungarian and Slovenian dairy farms. An Euler equation model in a dynamic panel setting is applied as the methodological approach. The historical development and evolution of dairy farms in the EU vary by country, and this is also the case within the BCE region. In BCE countries, differentials in dairy farm size and growth are legacies of the communist system and the institutional and policy reforms of the 1990s and later. During the communist era, Estonian and Hungarian agriculture was collectivized and average dairy herd farm size in these two countries was, and still is, among the largest in Europe. In Slovenia, communist collectivization failed, and a small-scale dairy farm structure persisted; thus, the average dairy farm size is among the smallest in Europe (Bojnec & Latruffe, Citation2013). The evolution of dairy farm structure in the EU is shaped by policy support, in particular by CAP measures (Piet et al., Citation2012). The transition from a centrally planned to a market economy in Slovenia has further strengthened the development of smallholders’ farms and small-scale family dairy farms. In Estonia and Hungary, a new dairy farm structure has emerged with a greater number of small-scale dairy family farms and less numerous large-scale corporate dairy farms. Understanding the conditions of smallholder agriculture vis-à-vis large farms in transition economies is also a challenging research, practical and policy issue. Therefore, our comparative analysis includes three countries with different historical-institutional legacies and different dairy farm structures: small-scale dairy farms in Slovenia, and the predominant medium- and large-scale dairy farms in Estonia and Hungary. Different dairy farming structures may be important in relation to lobbying activities aimed at obtaining public support, including CAP investment subsidies.

The relevance of this study lies in the improved modelling approach that is applied to the investment behaviour of dairy farms, and in the comparative empirical evidence it provides to policy makers to improve investment policy and managerial investment practice. Dairy farming in transition economies is of interest, since farmers have made marked adjustments since EU enlargement and the implementation of CAP subsidy measures. These have also affected the investments of dairy farms.

3. Methodology: Euler equation investment models

Previous research on farm investment behaviour has applied different models (Elhorst, Citation1993). Based on the standard augmented accelerator model of Fazzari et al. (Citation1988), few studies have used different econometric estimators in empirical analysis (Bakucs et al., Citation2009; Bojnec & Latruffe, Citation2011). Hüttel et al. (Citation2010) implemented the structure of a generalized Tobit model, while Bokusheva et al. (Citation2009) applied the error-correction investment model and the adjustment-cost model to study farm investment behaviour. Our theoretical background for the Euler equation investment models (which explains the rationale behind the signs and magnitudes of various regression model parameters, and the methodology in terms of modelling assumptions and econometric approaches) is based on Rizov (Citation2004), Zinych and Odening (Citation2009), and Fertő et al. (Citation2017, Citation2020). Our baseline investment or adjustment-cost model specification is defined by the following Euler equation:

(1)

(1) where the investment (I) of dairy farm i in a particular year t is defined not only by sales growth (S) and dairy farm liquidity proxied by cash flow (CF) in the year t-1, but also by dairy farm investment in the year t-1.

is a farm effect and

is a time dummy. All variables are normalized using capital (K).

It is expected that the regression coefficient of the lagged investment term α1 will be positive and greater than one if a dairy farm’s real discount rate is positive. The regression coefficient of the squared investment term α2 is predicted to be negative and greater than one in absolute value, reflecting the costs of adjustment that increase and are convex in terms of the size of investment.

The sign of the regression coefficient of the cash-flow term α3 for the absence of financial constraints on investment behaviour should be negative or not significant under the assumption that a dairy farm can raise as much money as it desires at a given cost. If farms do not face financial constraints on investment behaviour, their internal financing, such as through profits, and their external financing, such as credit, have the same cost in equilibrium and thus are perfect substitutes. If farms do face financial constraints, there is a gap between the cost of internal financing and the cost of external financing (Hubbard, Citation1998). A positive and significant cash-flow regression coefficient (α3 > 0) is usually interpreted as a sign of credit rationing and thus an indicator of the presence of financial constraints on investment behaviour (Fazzari et al., Citation1988). Lizal and Svejnar (Citation2002) have suggested that the regression coefficient α3 should be considered an indicator of the presence of SBC, and they proposed two interpretations for the latter phenomenon: first, in the weak version of SBC when the regression coefficient α3 is zero and dairy farms have access to credit for investment irrespective of their profitability; and second, in the strong version of SBC when coefficient α3 is negative, suggesting that dairy farms with poor financial performance can access bank loans for investment purposes more easily. This protects them against the market selection process/constructive destruction and exit from the market, and it impedes efficiency, innovation and sustainable growth.

A non-significant, or significant but negative, regression coefficient (α4 < 0) for growth of real sales would indicate the presence of SBC. Such a finding would reveal that some dairy farms do not base their investment behaviour on market opportunities, but instead obtain external resources on soft terms to cover their investment expenditure. If the regression coefficient is positive (α4 ≥ 0) and significant, then internal and external capital are perfect substitutes, and hence there are neither capital market imperfections nor SBC. Under conditions of perfect competition and constant returns to scale, an increase in inputs causes the same proportional increase in outputs/sales and thus investment, and in the long term internal and external capital can substitute each other. Lizal and Svejnar (Citation2002) explain that a coefficient that is not significantly different from zero would signal that the access of farms to credit for investment does not depend on their profitability. A stronger version of the SBC concept is that when the coefficient is negative, it reveals that low performing farms are obtaining more investment credit than high performing farms. The presence of imperfect competition in the output market as a type of market structure can be due to monopolistic competition involving slightly differentiated dairy products, or due to a limited number of selling opportunities for dairy farms that are controlled by a monopsony market power in the form of a single buyer (e.g. a dairy processing company) or an oligopsony market power with a few buyers, which might divide the territory, and many dairy farm sellers (Stalgiene et al., Citation2017).

In addition, we include in the Euler equation investment model (1) the quadratic term for the debt (D) variable (Rizov, Citation2004) to allow for the testing of non-separability between investment and borrowing decisions (Bond & Meghir, Citation1994). The regression coefficient of the D variable, α5, in the augmented Euler equation investment model (2), is expected to be zero under conditions of perfect capital markets (α5 = 0). If it is positive and significant (α5 > 0), this signals that a dairy farm relies on borrowing to finance its investment, whilst if it is negative (α5 < 0) this can be interpreted as an indicator of dairy farm bankruptcy costs – i.e. the cost of financial distress associated with institutional, legal, management and other issues, such as higher costs of capital, because banks can increase the interest rate for financially distressed dairy farms.

Moreover, we include in the Euler equation investment model (1) the investment subsidy (X) as a controlling explanatory variable. The investment subsidy is accounted separately from cash flow and sales. Subsidies can influence the investment decision-making of farms (e.g. Sckokai & Moro, Citation2009). CAP investment subsidies, as an additional form of cash flow, can help to mitigate financial constraints. Two definitions of investment subsidy in the augmented Euler equation investment model (2) are used in the empirical procedure: first, a continuous variable (X/Ki,t), and second, a dummy (DXi,t) which takes a value of one if a dairy farm has received an investment subsidy in a given year, and is zero otherwise. According to existing academic literature (Fertő et al., Citation2020; O’Toole & Hennessy, Citation2015; Sckokai & Moro, Citation2009), the regression coefficient of the X variable, α6, is expected to be positive and significant (α6 > 0). Investment subsidies can help farmers overcome their financial constraints by providing additional cash to cover investment expenditure.

We estimate the following augmented Euler equation investment model (2):

(2)

(2) In investigating SBC, our main interest is the cash flow variable. In developed market economies, low cash flow investment sensitivity (α3 ≤ 0) is usually interpreted as evidence of perfect capital markets. However, this conclusion is not appropriate for dairy farms where the existence of policy support is typical. The presence of generous CAP subsidies may imply a soft financial environment in which unprofitable dairy farms have access to credit. This provision of money allows for the realization of investments independent of cash flow. Consequently, affected dairy farms exhibit lower cash flow investment sensitivity, which translates into a non-significant cash flow parameter in the Euler equation. This implies a non-positive cash flow parameter that may indicate the presence of the SBC phenomenon rather than perfect capital market conditions. Thus, the significant sensitivity of investment with regard to cash flow (α3 > 0) may reflect a process of hardening budget constraints, or binding liquidity constraints.

Moreover, a large share of the borrowing farms that are considered a priori financially unconstrained can be differently sensitive to investment demand in relation to capital structure with the potential presence of financial constraints in investment decisions. Thus, in line with Rizov (Citation2004) and Zynich and Odening (Citation2009), we divide our total sample into two subsamples according to their financial status: financially unconstrained versus financially constrained dairy farms. However, no uniform criteria are used for identifying financially constrained farms. It is difficult to differentiate between farm-specific effects on investment and the effects of financial constraints (Kaplan & Zingales, Citation1997; Zynich & Odening, Citation2009). To define financially constrained dairy farms, we employ an indicator for the availability of external funds (that is, financial status) as the time-specific dummy variable z. This variable equals one when no new borrowing is present, and is zero otherwise. More specifically, dairy farms are considered unconstrained if they borrow in at least two consecutive years. The dummy interacts with the other variables from equation (2) for the constrained regime and expresses the difference between the two financial regimes. Because the level of new borrowing is implicitly included in the debt-to-capital ratio, we omit the latter variable in the specification with sample separation and estimate the following model:

(3)

(3) The regression coefficients α1, α2, α3, and α4 in the Euler equation investment model (3) relate to the specified explanatory variables for financially unconstrained dairy farms, while the regression coefficients α5z, α6z, α7z, α8z and α9z have a similar economic meaning to α1, α2, α3 and α4, but for financially constrained dairy farms.

We employ the Generalised Method of Moments (GMM) estimator developed by Arellano and Bover (Citation1995) and Blundell and Bond (Citation1998), also referred to as the GMM-system estimator. Windmeijer (Citation2005) proposed a finite sample correction that provides more accurate estimates of the variance of the two-step GMM estimator (GMM-SYS). As the t-tests based on these corrected standard errors have been found to be more reliable, the paper estimates regression coefficients using finite sample correction.

In addition, we impose an outlier rule by removing dairy farms from the econometric estimation if their investment-to-capital ratio is above 99% in absolute terms, which is a parameter chosen based on existing academic literature (as in Benjamin & Phimister, Citation2002).

4. Data

Data that were used are presented in two steps: first, we present a description of the dependent and independent variables used in our study from Farm Accountancy Data Network (FADN) databases. Second, we present descriptive statistics and describe the developments of the studied variables focusing on farm investments and public investment subsidies.

4.1. FADN databases

Our analysis is based on Estonian, Hungarian and Slovenian individual dairy farm-level data. These data are extracted from national FADN databases, which provide homogenous accounting data for farms throughout the EU (European Commission, Citation2020a). Only farms above a specific size threshold are included in the FADN, the threshold being two European Size Units (ESUs; one ESU is equivalent to 1,200 euros of gross margin). FADN implements a yearly survey of farm businesses that employ bookkeeping, with a rotating panel of about five years. It follows that our panel datasets are unbalanced. The time span of the unbalanced panel dataset used for the analysis is the period 2007–2015 for each of the three countries under analysis.

Data on the variables that are used are available from the FADN database (European Commission, Citation2006). Gross dairy farm investment into fixed assets is the FADN variable coded SE516 (‘gross investment’), which is defined as the difference between the purchases and sales of fixed assets plus breeding livestock change of valuation. The cash flow variable is the FADN variable coded SE526 (‘cash flow’), which is defined as the difference between the dairy farm receipts and expenditure for the accounting year, not taking into account operations related to capital, debts and loans. The investment subsidy variable is the FADN variable coded SE406 (‘subsidies on investment’); such subsidies include those on agricultural land, buildings, rights, forest land including standing timber, machinery and equipment, and circulating capital. The list of CAP subsidies is much broader. In addition to subsidies on investments, the FADN provides data on various types of CAP subsidies, such as for SE605 ‘total subsidies – excluding on investments’, which includes various subsidies on crops (SE610), livestock (SE615), for rural development (SE624), intermediate consumption (SE625) and other subsidies (SE699). Our focus is on subsidies on investment, although various types of CAP subsidies can have a direct and/or indirect impact on farm investments (Unay-Gailhard & Bojnec, Citation2020). The sale growth variable is proxied by the change in total output between two consecutive years; total output is the FADN variable coded SE131 (‘total output’), defined as the total of output of crops and crop products, livestock and livestock products and other output. Debt is defined as the sum of short- (SE490) and long-term (SE495) loans. All the above-listed variables are related to capital, which is the FADN variable coded SE436 (‘total assets’) and includes fixed and current assets owned by the dairy farm. The FADN variables are deflated by price indices, which are obtained from the national statistical offices of Estonia, Hungary and Slovenia.

4.2. Descriptive statistics

presents descriptive statistics for the variables. Gross dairy farm investment to capital in period t-1 is highest for Estonian farms and lowest for Slovenian farms, on average. The data show disinvestments by some dairy farms in Estonia, Hungary and Slovenia.

Table 1. Descriptive statistics of dairy farms, 2007–2015 (euros at constant prices).

Growth in real sales to capital in period t-1 is highest for Estonian dairy farms and lowest for Slovenian dairy farms, on average. As for real cash flow to capital in period t-1, this is highest for Hungarian dairy farms and lowest for Estonian dairy farms on average.

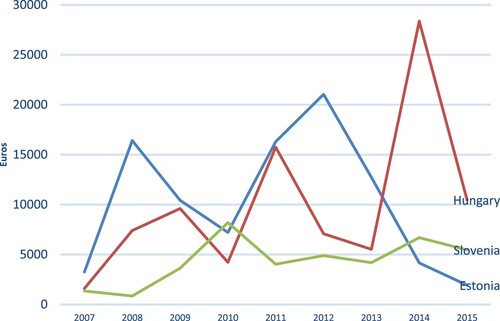

Public investment subsidy to capital in period t-1 is on average lower for Hungarian dairy farms compared to Slovenian and Estonian dairy farms. presents the developments in public investment subsidies on average per dairy farm in the countries we analysed during the 2007–2015 period of investigation. The mean values of public investment subsidies per dairy farm in Slovenia were more stable in comparison to the high volatility and cyclical oscillations in Estonia and Hungary. The maximum mean values of investment subsidies per dairy farm were achieved in different years: in Slovenia in 2010 and in Estonia in 2012, but these have rapidly declined since then, and in Hungary in 2014, with a substantial decline in 2015. In 2015, the decline in the mean value of investment subsidy per dairy farm can be seen in each of the analysed BCE transition economies. In that year, Estonia recorded the minimum value of investment subsidies per dairy farm. That was a time of crisis in the milk market after the introduction of the Russian import ban and abolition of the milk quota. In addition, it represented a time between CAP programming periods. These factors explain the low value. In addition to the availability of public funds for investment subsidies, it is important that farms apply for the investment subsidy and make the investment on-farm, including into machinery and equipment such as tractors and dairy milking machinery, or other capital investments into production, processing and marketing in the dairy farm value chain. Therefore, farmers can apply for an investment subsidy and conduct and implement investment and request reimbursement in the form of the post-factum compensation of costs. The fact of the availability of investment subsidies is considered when investment decisions are made. The latter are predictable and can be obtained under certain criteria and conditions. In terms of capital costs, investment grants require (own) co-financing. The design of the investment subsidy is important for farm investments. As investing farms can receive investment subsidies, this can affect the heterogeneity of results between investing and non-investing farms, but less so among investing farms because they can and are using investment subsidies.

Figure 1. Development of average investment subsidy per dairy farm in Estonia, Hungary and Slovenia, 2007–2015 (euros at constant prices). Source: authors’ calculations based on FADN data for Estonia, Hungary and Slovenia.

Debt to capital in the period t-1 is highest for Estonian and, to a lesser extent, Hungarian dairy farms, and lowest for Slovenian dairy farms.

As far as the number of cows per farm is concerned, the size of dairy farms in terms of both mean value and maximum value is largest for Hungary, followed by Estonia, and is much smaller for Slovenia.

5. Econometric results

In this section, econometric results are presented in two steps: first, the GMM-SYS estimation for dairy farms, and second, the GMM-SYS estimations with estimation on sub-samples of financially constrained and unconstrained dairy farms. In the initial step, a model formulation is estimated, which does not distinguish between different groups of farms in the sample. Subsequently, an additional model formulation is estimated, which enables model regression parameters to differ for financially unconstrained and financially constrained farms. In both model formulations, the regression models control the effect of the present period investment subsidy, defined as either a continuous or binary variable. The procedure with model estimations for each country separately results in the estimation of four model specifications for each study country.

5.1. GMM-SYS estimation

Our econometric results suggest that current dairy farm investments are significantly and positively associated with lagged dairy farm investments, but the regression coefficients are less than one in absolute terms, a finding which is valid for each country in the analysis (). This finding for dairy farms is consistent with the findings for all farms in the analysed countries (Fertő et al., Citation2020).

Table 2. Dynamic Panel Model (GMM-SYS) estimations.

The regression coefficient of the squared investment term is significantly positive for Hungarian and to a lesser extent for Estonian dairy farms, while it is significantly negative for Slovenian dairy farms, typically smaller family dairy farms. The magnitude of these results for Estonian and Slovenian dairy farms is similar to that for all farms in these countries (Fertő et al., Citation2020). The small regression coefficients of the squared investment term for Estonian and Hungarian dairy farms indicate that under unstable macroeconomic conditions, such as financial and economic crises (Karilaid et al., Citation2014), and unstable sectoral and market conditions, such as the abolition of the milk quota in the EU and Russian bans on food imports from the EU, dairy farms use large discount rates in their investments. In contrast, a significantly negative and a greater-than-one in absolute value regression coefficient for squared investment suggests high capital adjustment costs for farms in Slovenia. These mixed results imply complexity in investment adjustment costs in relation to the size of investments in dairy farming due to asset specificity and an unstable economic environment over time. Investments into dairy barns, dairy farm equipment and technology require relatively large sums of money for the following 15–20 years. Instabilities in the economic environment have required substantial adjustments in dairy production and investment decisions, which may have deterred short-term profit-maximising capital accumulation. Considering this, it is necessary to critically review the basic assumption underlying the adjustment cost model and its validity for studying dairy farm investment behaviour in periods associated with high market risks and the strong market power of the dairy industry in a number of EU countries (Čechura et al., Citation2015; Stalgiene et al., Citation2017).

Our estimations confirm the positive and significant association between gross dairy farm investment and growth in real farm sales for Estonian and Hungarian dairy farms, and a negative one for Slovenian dairy farms. The former finding is consistent with that of Fertő et al. (Citation2020) for all farms, implying that the investment behaviour of dairy farms is driven by the ability of dairy farms to sell output and invest in such a market environment. In addition, these results for Hungarian dairy farms are in line with findings of earlier studies from Hungary (Bakucs et al., Citation2009) and during the early years following EU accession (Fertő et al., Citation2017). On the other hand, the results for dairy farms are inconsistent with Fertő et al.’s (Citation2020) findings for all Slovenian farms, suggesting that dairy farms’ investment behaviour in Slovenia differs from that of non-dairy farms (Bojnec & Fertő, Citation2016; Bojnec & Latruffe, Citation2011). Accordingly, this finding suggests rejection of the validity of the real farm sales driven investment hypothesis and constant returns to scale.

Gross dairy farm investment is negatively and significantly associated with cash flow for Estonian dairy farms. This finding is consistent with Fertő et al. (Citation2020) for all Estonian farms, confirming the presence of the strong version of SBC when dairy farms with poor financial performance can access bank loans more easily. This striking finding raises the question as to why banks were willing to issue loans and take on greater credit risk even if dairy farms did not perform well, and whether this can be explained by the presence of CAP subsidies. On the one hand, while Estonian banking was found to be the most efficient in the Baltic countries after the latter county’s accession to the EU and during the financial crisis (Gallizo et al., Citation2018), commercial banks may have experienced an inverse U-shaped relationship between competition and financial stability. Moreover, at above a certain threshold, the lack of competition could exacerbate the individual risk-taking behaviour of banks (Cuestas et al., Citation2020). On the other hand, the strong version of SBC in Estonian dairy farms can be explained by (at least) the following four additional reasons: first, average direct payment rates and land prices have increased since 2004, and direct payment rates are converging towards the EU average. Agricultural land is the main collateral for agricultural loans, including for dairy farmers (fi-compass, Citation2020; Viira et al., Citation2020b). This may also incentivise the emergence of a soft(er) financial environment in the case of Estonia. Second, investments have been made into large dairy farms (Luik & Viira, Citation2016). Therefore, banks have loaned quite large sums to dairy farms, a situation that is visible in the relatively high debt/capital ratio in Estonia. Third, banks are not interested in fostering the bankruptcies of dairy farms. Therefore, assuming increasing subsidy rates and high asset specificity, banks tend to issue new loans even if dairy farms are not performing well. Finally, Estonia has set up a Rural Development Foundation that provides farms with additional guarantees (and, to a lesser extent, also loans) to back up bank loans (fi-compass, Citation2020; OECD, Citation2018; Viira et al., Citation2020b).

Differently than for all farms, cash flow regression coefficients are positive and significant for Slovenian and to a lesser extent for Hungarian dairy farms. These results for dairy farms are similar to those of earlier studies that found a positive and significant regression coefficient estimate for lagged cash flow for Hungarian and Slovenian farms, suggesting that the validity of SBC should be rejected, but confirming strong financing-investment credit rationing relationships across dairy farms and therefore the presence of capital market imperfections as financial constraints (Bojnec & Fertő, Citation2016; Fertő et al., Citation2017).

The significantly positive regression coefficient of the squared debt variable for Slovenian dairy farms in regression with a dummy for subsidies suggests that investment and financing decisions cannot be separated, as dairy farms may rely on borrowing to finance their investments, confirming the findings of previous studies (Bojnec & Fertő, Citation2016; Fertő et al., Citation2017, Citation2020). This conclusion is also similar to that of Bokusheva et al. (Citation2009) and Zinych and Odening (Citation2009) for farm investment behaviour in Russian and Ukrainian agriculture, respectively. The significantly negative regression coefficients of the squared debt variable as an indicator of bankruptcy costs suggest that investment and financing decisions can be separated in Estonian and Hungarian dairy farms. This finding for Hungarian dairy farms is different to the findings of previous studies, which did not identify capital market constraints for all Hungarian farms (Fertő et al., Citation2017, Citation2020).

Finally, gross dairy farm investment is found to be positively and significantly associated with public investment subsidies for each of the countries under analysis, confirming the findings of earlier research for all farms (Fertő et al., Citation2017, Citation2020). The regression coefficient is greater than one for Hungary and Slovenia, and less than one for Estonia. Public investment subsidies can mitigate capital market imperfections in the short term. In the transition countries, investment subsidies have been a crucial factor in overcoming a deficiency of investment, and in ensuring compliance with EU regulations and standards (Viira et al., Citation2009). However, in the long term, a dairy farm’s ability to successfully compete in the output market by selling produce and securing a sufficient cash flow for investment is crucial.

5.2. GMM-SYS estimation with estimation on sub-samples

The general specification of the Euler investment equation does not account for different financial regimes, which imply the unequal sensitivity of dairy farm investment to financial restrictions. Therefore, we turn to investigating the impact of an ex-ante sample separation involving an estimation of two sub-samples of financial regimes (). The first four regression coefficients from α1 to α4 in each regression relate to the sub-sample for which the basic Euler equation is expected to be valid, even in the presence of market imperfections (unconstrained dairy farms), while the remaining four regression coefficients, from α5z to α8z, estimate the difference between the coefficients for each variable across the two sub-samples (constrained dairy farms). Finally, the last two regression coefficients, α9z, relate to subsidies expressed as a continuous variable, and the other coefficient the dummy variable, respectively.

Table 3. Dynamic Panel Model (GMM-SYS) estimations, with estimation on sub-samples for financial constrained and unconstrained dairy farms.

The regression coefficients for the cash flow variable for Estonian and Slovenian financially unconstrained dairy farms – for the latter only with subsidies as a dummy variable – are significantly negative, but they are significantly positive for financially constrained dairy farms in Estonia, Slovenia, and, to a lesser extent, in Hungary. The latter finding of significantly positive cash flow regression coefficients suggests rejection of the validity of the SBC hypothesis for financially constrained dairy farms in the subsidy specifications of both regressions for all of the countries under analysis. Moreover, the regression coefficients for cash flow are insignificant for Hungarian financially unconstrained dairy farms and Slovenian financially unconstrained dairy farms with continuous subsidy specification. The negative cash flow regression coefficients are striking for Estonian financially unconstrained dairy farms and Slovenian financially unconstrained dairy farms with subsidies as a dummy variable, similar to Ukrainian farms (Zinych & Odening, Citation2009). These cash flow regression coefficients do not support rejection of the validity of the strong SBC hypothesis for Estonian financially unconstrained dairy farms and Slovenian financially unconstrained dairy farms with subsidies as dummy variable regression specification. In addition, insignificant and close to zero regression coefficients for the cash flow variable for Hungarian financially unconstrained dairy farms and Slovenian financially unconstrained dairy farms with the continuous subsidies specification suggest the presence of weak SBC. Therefore, these results clearly confirm the difference between the mixed results regarding the validity of the presence of strong or weak SBC for financially unconstrained dairy farms, and suggest rejection of the presence of SBC for financially constrained dairy farms. This suggests that the role of cash flow is significant at a higher level for the financially constrained subsample, which is expressed in terms of a positive cash flow regression coefficient in the investment equation.

Regarding other control variables, we observe considerable differences between the two sub-samples in each country. Current dairy farm investment is significantly and positively associated with lagged dairy farm investment for Estonia, Hungary and Slovenia for the unconstrained sample, but, with the exception of being positive or insignificant for Hungary, it is significantly and negatively associated with lagged dairy farm investment for financially constrained farms. The regression coefficients for Estonia and Hungary remain less than one in absolute terms. For Slovenia, the regression coefficients are also less than one in absolute terms; therefore, they are largely insignificant, except for constrained dairy farms with continuous subsidy specification.

The regression coefficients of the squared investment term are significantly positive for Estonian financially unconstrained and constrained dairy farms, Hungarian financially unconstrained dairy farms and Slovenian financially constrained farms, but they are significantly negative for Slovenian financially unconstrained dairy farms, and insignificant for Hungarian financially constrained dairy farms. The regression coefficients for Hungarian constrained dairy farms and Slovenian unconstrained and, to a lesser extent, constrained dairy farms are greater than one in absolute terms, implying adjustment costs that are increasing and convex relative to the size of investments.

The positive and significant association between gross dairy farm investment and growth in real farm sales is confirmed for financially unconstrained dairy farms in Estonia and Hungary, and for financially constrained dairy farms in Slovenia with subsidies as the continuous variable regression specification, confirming that the investment behaviour of dairy farms is driven by the presence of perfect competitive output market conditions and the ability of dairy farms to sell output and invest in such a market environment. The estimates obtained for the Slovenian model are close to the theoretically expected estimates for the reference group. The Slovenian sample farms, in contrast to the Estonian and Hungarian ones, appear to show decreasing returns to scale as confirmed by a significantly negative regression coefficient estimate for the sales variable in the model specifications that employ the continuous investment subsidy variable. However, there is a considerable difference in the sign of the regression coefficient between financially unconstrained and financially constrained dairy farms in Estonia and Slovenia: it is significantly negative for Estonian constrained dairy farms and for Slovenian unconstrained dairy farms with subsidies as a continuous variable specification. Finally, the regression coefficient is insignificant for Hungarian constrained dairy farms and Slovenian unconstrained and constrained dairy farms with subsidies as the dummy variable specification. These mixed results suggest that dairy market competition structures vary for individual dairy farms within and between the countries of analysis, as may also be the case with compliance with constant return to scale.

Gross dairy farm investment remains positively and significantly associated with public investment subsidies for each of the analysed countries. The regression coefficients are greater than one for only Hungary and Slovenia in regressions with subsidies as the continuous variable specification.

In summary, similarly to Rizov (Citation2004), Bokusheva et al. (Citation2009), Zinych and Odening (Citation2009) and Fertő et al. (Citation2017; Citation2020), our estimations suggest that there are significant differences in the investment behaviour of the sub-samples of dairy farms that are classified according to their financial status in each of the three countries under analysis.

6. Discussion

The study addresses the issue of the link between dairy farm investment and the importance of investment subsidies, SBC, and capital market imperfections or credit constraints. The econometric analysis represents an effort to compare investment decisions for Estonian, Hungarian and Slovenian dairy farms to contribute to theory, policy and practice. The results suggest a positive relationship between investment and the rate of growth of sales of output and investment subsidies. The confirmed positive effects of investment subsidies on dairy farm investment behaviour are consistent with some findings in academic literature (Fertő et al., Citation2020). Investment subsidies can be linked with investment demand and can reduce dairy farm financial constraints (Bojnec & Latruffe, Citation2011; O’Toole & Hennessy, Citation2015). However, the direct and indirect effects of CAP subsidies can be more complex both in terms of farm household income (Bojnec & Fertő, Citation2018, Citation2019a, Citation2019b) and different farm household investments (Unay-Gailhard & Bojnec, Citation2020).

Similarly to the situation with all farms (Fertő et al., Citation2020), we find evidence for the existence of strong SBC in Estonian dairy farms, particularly for financially unconstrained dairy farms. The validity of strong SBC is rejected for Hungarian dairy farms, but it confirms the presence of capital market imperfections. However, SBC in Slovenian dairy farms is confirmed for financially unconstrained dairy farms and the presence of weak SBC cannot be rejected for Hungarian financially unconstrained dairy farms. While strong or weak SBC may be present for financially unconstrained dairy farms in the BCE countries we analysed, it is less likely that this finding holds for financially constrained dairy farms where the role of cash flow is significant. This implies that a possible reduction of the role of investment grants in the future CAP, and an increase in the role of financial instruments (fi-compass, Citation2020) may hamper the future investments of financially constrained dairy farms. Therefore, it is important that policy changes – from investment grants to refundable investment support in the form of loans from financial instruments – increase the weight awarded to the productivity and efficiency of dairy farms. In a spite of being small, open and export-oriented economies (Trošt & Bojnec, Citation2016), the persistence of SBC in the dairy farms of the analysed BCE transition economies has not been abolished, particularly not in Estonia since the break-up of the Soviet Union, with the transition from a centrally planned to a market economy, and the introduction of CAP subsidies with EU enlargement. Dairy farms may not only play an important role in the farming structures of the analysed BCE transition economies; they might also contribute to some other income-, employment- and sustainability-related objectives of agricultural and rural development policies aimed at maintaining land cultivation in remote, hilly and mountainous areas, and to safeguarding the maintenance of permanent grasslands (Viira et al., Citation2020a).

Among the control variables, gross dairy farm investment is largely positively associated with gross farm investment for the previous year, particularly for financially unconstrained dairy farms, and negatively – except in Hungary – for constrained dairy farms.

Gross dairy farm investment is largely positively associated with growth in real dairy farm sales, particularly in Estonia and Hungary for financially unconstrained dairy farms, suggesting that financially unconstrained dairy farm investment decisions are based on dairy output market conditions and cash flow into dairy farms as a sign of financial constraints. However, this finding may suggest that, in the presence of perfectly functioning capital markets, internal and external capital are perfect substitutes. Investments could be made by farms in the growth phase of their life cycle that create the causality between investments and sales growth. Banks are also setting criteria for farm loan applications that farms can adjust to prior to the investment decision. The latter is less true of Slovenian unconstrained and constrained dairy farms, as well as for constrained dairy farms in Estonia and Hungary.

These findings suggest that the studied dairy farms are heterogeneous not only across the three BCE transition economies we analysed, but also on an intra-country basis, such as with respect to farm size and farm organization. Smaller Slovenian dairy farms are mostly family household farms, smaller Hungarian dairy farms are also household farms, while larger ones are corporate farms, and Estonian dairy farms are largely large corporate farms. Such farm structures are more likely to have different markets and lobbying power in relation to different policy measures and subsidies, and also require different dairy value chains, institutional, organizational and marketing structures with regard to dairy processing companies, and market outlets. Consequently, there may be differences in investment-related decision behaviour in response to the investigated drivers and outcomes in terms of the magnitude of the regression coefficients and the economic relevance of the different drivers of SBC and/or capital market imperfections.

Gross dairy farm investment is positively associated with public investment subsidies. As noted by Fertő et al. (Citation2017, Citation2020), for all farms, public programmes that support dairy farm investment with subsidies appear to be successful at enhancing investment in these countries in the short term. For example, virtually no investments were made by Estonian farms in the 1990s. This may be the main reason why investment subsidies were later so important in the agricultural policy agenda in Estonia (Viira et al., Citation2009). Since the launch of the SAPARD EU pre-accession programme, the policy idea has been that, due to ‘losses’ during the initial transitional decade in agricultural investment in the 1990s, investments should boost farms as much as possible. However, the investment behaviour of dairy farms pertaining to investment subsidies is more conservative in the long term. One reason for this may be the greater asset specificity in dairy farming and the potentially higher sunk costs of investment failure. Investment subsidies can mitigate some capital market imperfections, such as interest rate volatility, but in the long term what is crucial is dairy farm competitiveness and the ability of dairy farms to successfully compete on the output market: i.e. to generate sales and create sufficient cash flow to enable investment and thus ensure competitive survival and dairy farm growth. In the long term, the improvement of dairy farm profitability can also play an important role in the vertical integration of dairy farms in the dairy value chain (Iliopoulos et al., Citation2019).

The fact of major state intervention and subsidies in the dairy sector of developed countries, such as occurs in the EU Member States, including in the three BCE countries analysed here, is well known. Therefore, during the post-EU accession period under study and most recent CAP reforms, Estonian, Hungarian and Slovenian dairy farmers were able to benefit from investments and other types of CAP subsidies, which constituted a sizable share of the payments received by some dairy farms. Investment subsidies represent a smaller proportion of subsidies from the CAP support system. While the primary goals of other types of CAP subsidies are not farm-investment-related but other policy, agricultural and rural development goals, other types of CAP subsidies increase farm income and may indirectly contribute to dairy farm investment behaviour. Other types of CAP subsidies are designed to be harmonized with the other effects of EU farming and rural development support, including helping to preserve more traditional ways of life in rural villages, supporting the vitality of remote areas and promoting environmental protection (Hill, Citation2012; Zdeněk and Lososová, Citation2020). The majority of other types of subsidies are direct payments for crops and livestock, decoupled subsidies, payments to less favoured areas to maintain farming – such areas that are particularly important in Slovenia (Baráth et al., Citation2018) – and specific forms of support such as agri-environmental subsidies through voluntary contracting in compensation for the provision of environmental services (Unay-Gailhard & Bojnec, Citation2015, Citation2016). This highlights the role of the state in shaping dairy farm investment behaviour and the dairy farming structure of the three BCE countries. Therefore, SBC in the dairy farms of BCE countries may persist after full adoption of CAP. Privatization does not necessarily eliminate SBC problems because private dairy farms may also demand more subsidies from the government. State subsidies in dairy farms help them to cover their investment costs in the short term and therefore contribute to their longer term survival. However, in contrast to the situation with SBC, investment subsidies in the period we studied were not freely provided to dairy farms: dairy farmers needed to supplement their subsidy applications with detailed business plans and usually obtained only a specific share of subsidies (generally half) to cover investment costs. While the state subsidization of dairy farm investments may be partly justified (the production of dairy products is of crucial importance to a country; dairy farms help maintain economic activity in isolated, hilly and mountainous areas; and subsidies can incentivise dairy farmers to create positive environment externalities and to boost technology change and innovation), it is nevertheless costly for taxpayers. Therefore, public and private sector support alternatives such as financial instruments, rural microfinance and dairy-specific investments based on the financial assistance programmes of dairy companies might play a greater role in future (fi-compass, Citation2020). Dries and Swinnen (Citation2010), on the basis of an examination of the Polish dairy sector, suggest not providing subsidies but rather credit provision in the form of advance payments to farmers for some inputs by private dairy processing companies as a part of interlinked contracts associated with a predetermined milk price.

7. Conclusion

This paper investigates the investment behaviour of dairy farms in Estonia, Hungary and Slovenia using the Euler equation model and dynamic panel model estimation. The period under analysis covers the post-EU accession period for the analysed countries, the financial crisis and the most recent CAP reforms. It develops a version of an estimated econometric model that takes account of differential financial statuses across sub-samples of financially constrained and unconstrained dairy farms that appears to confirm the heterogeneity of the investment decisions of dairy farms. The differences in dairy farm investment behaviour between the sub-samples for financially unconstrained and financially constrained dairy farms and across the three countries confirm the unequal sensitivity of dairy farm investment behaviours to financial restrictions.

The importance of CAP investment subsidies and SBC-related differences among the BCE countries under study were confirmed, while the investment decisions of dairy farms were found to be constrained by the availability of finance. The significant negative regression coefficient for cash flow variable implies strong SBC for Estonian and Slovenian financially unconstrained dairy farms, while insignificant regression coefficients for cash flow imply weak SBC for Hungarian financially unconstrained dairy farms. In spite of high volatility in the average annual investment subsidy per dairy farm, particularly in Estonia and Hungary, public investment subsidies have helped dairy farms overcome their financial difficulties with investing.

Any reform of CAP instruments that involves a reduction in subsidies might constrain dairy farm investment and increase dairy farm exit, not only in the three transition economies analysed here, but in EU agriculture in general. Investments in dairy farms are assets-specific and are often made in remote, hilly and mountainous areas where alternative business opportunities can be rather limited. In unstable dairy markets and within a macro-economic and sector-specific policy environment, such investments in dairy farms can represent a high risk and include a significant amount of sunk costs. Less profitable dairy farms may not be able to survive and might exit, as the need to increase investment to comply with standards becomes prohibitive – for example, in relation to the production, processing and marketing of milk and dairy products, as well as increasing requirements for modernization and the introduction of green and digital technologies in downstream and upstream dairy value chains. While the growth of surviving dairy farms may improve efficiency in competitive dairy markets, it may also lead to long-term changes in the rural landscape, including agricultural land abandonment, with the attendant environmental and societal implications.

One policy issue for further research is therefore in determining whether the less costly subsidization of dairy farm investment alternatives is possible. Capital market constraints and capital market imperfections suggest that dairy farms might not be on the priority list of banks and other financial institutions when they allocate their credit portfolio. The reduction of CAP subsidies might further reduce dairy farm investment attractiveness for banks, depending on potential dairy farm collateral, which is smaller in less advantaged remote, hilly and mountainous areas. This can further increase capital market imperfections and worsen dairy farm investment behaviour.

The management of dairy farms is linked to their competitiveness and ability to successfully compete on the dairy chain output market through making sales and creating sufficient cash flow to enable investment and farm profitability, which are vital factors in ensuring competitive survival and dairy farm growth. The policy content of this finding suggests promoting competitive input and output markets in dairy value chains. Among the specific recommendations are market stabilization measures for dairy farms and specific provisions between participants and stakeholders in dairy value chains, including interlinked contractual relations between dairy farmers and the upstream and downstream segments of the value chain, particularly with dairy processing companies.

Acknowledgements

This study was supported by funding received from the Hungarian and Slovenian Research Agencies in the form of a joint research project within Project N5-0094 – Impacts of agricultural policy on the regional adjustment in agriculture: A Hungarian-Slovenian comparison. The authors gratefully acknowledge useful suggestions and comments made by Oleg Nivievskyi, the associate editor in charge of this paper, and the two anonymous journal reviewers.

Disclosure statement

No potential conflict of interest was reported by the authors.

Additional information

Funding

Notes on contributors

Imre Fertő

Imre Fertő (PhD) is the General Director of the Centre for Economic and Regional Studies in Budapest, and Professor at Hungarian Agricultural and Life Sciences University, Hungary. He holds a PhD in economics from the Hungarian Academy of Sciences, and a PhD in agricultural economics from the Newcastle University. His research focuses on international trade, investment behaviour, production efficiency and short food chains.

Štefan Bojnec

Štefan Bojnec (PhD) is Professor of Economics and Head of Department of Economics at the Faculty of Management, University of Primorska, Koper, Slovenia. He has published extensively on different aspects of economics, business, management and sustainable development in world-leading journals.

József Fogarasi

József Fogarasi (PhD) is Professor of Economics at the Faculty of Economics and Social Sciences, Partium Christian University, Oradea, Romania and at the Keleti Károly Faculty of Business and Management, Óbuda University, Budapest, Hungary. His research works covers the fields of production economics, natural resource economics and financial economics.

Ants Hannes Viira

Ants-Hannes Viira (PhD) is the Director of the Institute of Economics and Social Sciences at the Estonian University of Life Sciences in Tartu, Estonia. His research focuses on the dairy supply chain, agricultural economics and policy, and socioeconomics.

References

- Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68(1), 29–51. https://doi.org/10.1016/0304-4076(94)01642-D

- Bakucs, L. Z., Fertő, I., & Fogarasi, J. (2009). Investment and financial constraints in Hungarian agriculture. Economics Letters, 104(3), 122–124. https://doi.org/10.1016/j.econlet.2009.04.019

- Baráth, L., Fertő, I., & Bojnec, Š. (2018). Are farms in less favored areas less efficient? Agricultural Economics, 49(1), 3–12. https://doi.org/10.1111/agec.12391

- Benjamin, C., & Phimister, E. (2002). Does capital market structure affect farm investment? A comparison using French and British farm-level panel data. American Journal of Agricultural Economics, 84(4), 1115–1129. https://doi.org/10.1111/1467-8276.00372

- Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(1), 115–143. https://doi.org/10.1016/S0304-4076(98)00009-8

- Bojnec, Š, & Fertő, I. (2016). Financial constraints and farm investments in Slovenia. New Medit, 15(4), 2–9.

- Bojnec, Š, & Fertő, I. (2018). Assessing and understanding the drivers of farm income risk: Evidence from Slovenia. New Medit, XVII(3), 23–35. https://doi.org/10.30682/nm1803c

- Bojnec, Š, & Fertő, I. (2019a). Farm household income inequality in Slovenia. Spanish Journal of Agricultural Research, 17(4), e0112. https://doi.org/10.5424/sjar/2019174-13996

- Bojnec, Š, & Fertő, I. (2019b). Do CAP subsidies stabilise farm income in Hungary and Slovenia? Agricultural Economics (Zemědělská Ekonomika), 65(3), 103–111. https://doi.org/10.17221/190/2018-AGRICECON

- Bojnec, Š, & Latruffe, L. (2011). Financing availability and investment decisions of Slovenian farms during the transition to a market economy. Journal of Applied Economics, 14(2), 297–317. https://doi.org/10.1016/S1514-0326(11)60016-0

- Bojnec, Š, & Latruffe, L. (2013). Farm size, agricultural subsidies and farm performance in Slovenia. Land Use Policy, 32, 207–217. https://doi.org/10.1016/j.landusepol.2012.09.016

- Bokusheva, R., Bezlepkina, I., & Oude Lansink, A. (2009). Exploring farm investment behaviour in transition: The case of Russian agriculture. Journal of Agricultural Economics, 60(2), 436–464. https://doi.org/10.1111/j.1477-9552.2009.00200.x

- Bokusheva, R., Valentinov, V., & Anpilogova, V. (2007). The investment behaviour of Russian farms. Post-Communist Economies, 19(1), 53–71. https://doi.org/10.1080/14631370601163194

- Bond, S., & Megir, C. (1994). Dynamic investment models and the firms’ financial policy. The Review of Economic Studies, 61(2), 197–222. https://doi.org/10.2307/2297978

- Čechura, L., Žáková Kroupová, Z., & Hockmann, H. (2015). Market power in the European dairy industry. AGRIS on-Line Papers in Economics and Informatics, 7(4), 39–47. https://doi.org/10.7160/aol.2015.070404

- Cuestas, J. C., Lucotte, Y., & Reigl, N. (2020). Banking sector concentration, competition and financial stability: The case of the Baltic countries. Post-Communist Economies, 32(2), 215–249. https://doi.org/10.1080/14631377.2019.1640981

- DG AGRI. (2018). EU dairy farms report based on 2016 FADN data. European Commission Directorate-General for Agriculture and Rural Development.

- Dries, L., & Swinnen, J. F. M. (2010). The impact of interfirm relationships on investment: Evidence from the Polish dairy sector. Food Policy, 35(2), 121–129. https://doi.org/10.1016/j.foodpol.2009.11.005

- Elhorst, J. P. (1993). The estimation of investment equations at the farm level. European Review of Agricultural Economics, 20(2), 167–182. https://doi.org/10.1093/erae/20.2.167

- Emvalomatis, G., Stefanou, S. E., & Oude Lansink, A. (2011). A reduced-form model for dynamic efficiency measurement: Application to dairy farms in Germany and The Netherlands. American Journal of Agricultural Economics, 93(1), 161–174. https://doi.org/10.1093/ajae/aaq125

- European Commission. (2006). Community Committee for the Farm Accountancy Data Network (FADN) – farm return data definitions accounting years 2006, 2007. RI/CC 1256 rev. 4, Agriculture and Rural Development Directorate-General, Brussels, 10 October 2002.

- European Commission. (2020a). Farm Accountancy Data Network: Brussels: European Commission – Agriculture and Rural Development. https://ec.europa.eu/agriculture/rica/methodology1_en.cfm.

- European Commission. (2020b). Farm to Fork Strategy. For a fair, healthy and environmentally-friendly food system. https://ec.europa.eu/food/sites/food/files/safety/docs/f2f_action-plan_2020_strategy-info_en.pdf.

- Eurostat. (2020). Economic accounts for agriculture – values at current prices [aact_eaa01] (Accessed: 5.11.2020).

- Fazzari, S. M., Hubbard, R. G., & Petersen, B. C. (1988). Financing constraints and corporate investment. Brookings Papers on Economic Activity, 19(1), 141–195. https://doi.org/10.2307/2534426

- Feinerman, E., & Peerlings, J. (2005). Uncertain land availability and investment decisions: The case of Dutch dairy farms. Journal of Agricultural Economics, 56(1), 59–80. https://doi.org/10.1111/j.1477-9552.2005.tb00122.x

- Fertő, I., Bakucs, Z., Bojnec, Š, & Latruffe, L. (2017). East-West European farm investment behaviour-the role of financial constraints and public support. Spanish Journal of Agricultural Research, 15(1), e01SC01. https://doi.org/10.5424/sjar/2017151-10252

- Fertő, I., Bojnec, Š, Fogarasi, J., & Viira, A. H. (2020). Agricultural soft budget constraints in new European Union member states. Journal of Institutional Economics, 16(1), 49–64. https://doi.org/10.1017/S1744137418000395

- fi-compass. (2020). Financial needs in the agriculture and agri-food sectors in Estonia. Study report, 78 pages. https://www.fi-compass.eu/sites/default/files/publications/financial_needs_agriculture_agrifood_sectors_Estonia.pdf

- Gallizo, J. L., Moreno, J., & Salvador, M. (2018). The Baltic banking system in the enlarged European Union: The effect of the financial crisis on efficiency. Baltic Journal of Economics, 18(1), 1–24. https://doi.org/10.1080/1406099X.2017.1376430

- Gardebroek, C., & Oude Lansink, A. G. J. M. (2004). Farm-specific adjustment costs in Dutch pig farming. Journal of Agricultural Economics, 55(1), 3–24. https://doi.org/10.1111/j.1477-9552.2004.tb00076.x

- Hill, B. (2012). Understanding the common agricultural policy. Earthscan.

- Hubbard, R. G. (1998). Capital-market imperfections and investment. Journal of Economic Literature, 36(1), 193–225.

- Hüttel, S., Mußhoff, O., & Odening, M. (2010). Investment reluctance: Irreversibility or imperfect capital markets? European Review of Agricultural Economics, 37(1), 51–76. https://doi.org/10.1093/erae/jbp046

- Iliopoulos, C., Värnik, R., Filippi, M., Sinnott, L., & Laaneväli-Vinokurov, K. (2019). Organizational design in Estonian agricultural cooperatives. Journal of Co-Operative Organization and Management, 7(2), 100093. https://doi.org/10.1016/j.jcom.2019.100093

- Irz, X., & Jansik, C. (2015). Competitiveness of dairy farms in Northern Europe: A cross-country analysis. Agricultural and Food Science, 24(3), 206–218. https://doi.org/10.23986/afsci.50881

- Kallas, Z., Serra, T., & Gil, J. (2012). Effects of policy instruments on farm investments and production decisions in the Spanish COP sector. Applied Economics, 44(30), 3877–3886. https://doi.org/10.1080/00036846.2011.583220

- Kaplan, S. N., & Zingales, L. (1997). Do investment-cash flow sensitivities provide useful measures of financial constraints? The Quarterly Journal of Economics, 112(1), 169–215. https://doi.org/10.1162/003355397555163

- Karilaid, I., Talpsepp, T., & Vaarmets, T. (2014). Implications of the liquidity crisis in the Baltic-Nordic region. Baltic Journal of Economics, 14(1-2), 35–54. https://doi.org/10.1080/1406099X.2014.949603

- Kimura, S., & Sauer, J. (2015). Dynamics of dairy farm productivity growth: Cross-country comparison. OECD food, agriculture and fisheries papers, No. 87. OECD Publishing.

- Kirchweger, S., & Kantelhardt, J. (2014). Improving farm competitiveness through farm-investment support: a propensity score matching approach. Prague Czech Republic. http://purl.umn.edu/135791

- Kirchweger, S., & Kantelhardt, J. (2015). The dynamic effects of government-supported farm-investment activities on structural change in Austrian agriculture. Land Use Policy, 48, 73–93. https://doi.org/10.1016/j.landusepol.2015.05.005

- Kornai, J. (1986). The soft budget constraint. Kyklos, 39(1), 3–30. https://doi.org/10.1111/j.1467-6435.1986.tb01252.x

- Kornai, J. (2001). Hardening the budget constraints: The experience of the post socialist countries. European Economic Review, 45(9), 1573–1599. https://doi.org/10.1016/S0014-2921(01)00100-3

- Kornai, J., Maskin, E., & Roland, G. (2003). Understanding the soft budget constraint. Journal of Economic Literature, 41(4), 1095–1136. https://doi.org/10.1257/jel.41.4.1095

- Latruffe, L., Bravo-Ureta, B. E., Carpentier, A., Desjeux, Y., & Moreira, V. H. (2017). Subsidies and technical efficiency in agriculture: Evidence from European dairy farms. American Journal of Agricultural Economics, 99(3), 783–799. https://doi.org/10.1093/ajae/aaw077

- Lerman, Z. (2000). Agriculture in transition economies: From common heritage to divergence. Agricultural Economics, 26(2), 95–114. https://doi.org/10.1111/j.1574-0862.2001.tb00057.x

- Lizal, L., & Svejnar, J. (2002). Investment, credit rationing and soft budget constraint: Evidence from Czech panel data. Review of Economics and Statistics, 84(2), 353–370. https://doi.org/10.1162/003465302317411596

- Luik, H., & Viira, A.-H. (2016). Feeding, milking and manure systems in Estonian dairy barns. Agraarteadus: Journal of Agricultural Science, 27(2), 92–107.

- Masso, J. (2002). Financing constraints as determinants of the investment behaviour of Estonian firms. Baltic Journal of Economics, 3(1), 8–30. https://doi.org/10.1080/1406099X.2002.10840382

- Matthews, A. (2017). The development-related impacts of EU agricultural subsidies. TEP Working Paper No. 1617. Trinity College Dublin.

- OECD. (2018). Innovation, agricultural productivity and sustainability in Estonia. OECD food and agricultural reviews. OECD Publishing. https://doi.org/10.1787/9789264288744-en

- O’Toole, C., & Hennessy, T. (2015). Do decoupled payments affect investment financing constraints? Evidence from Irish agriculture. Food Policy, 56(C), 67–75. https://doi.org/10.1016/j.foodpol.2015.07.004

- Petrick, M. (2005). Empirical measurement of credit rationing in agriculture: A methodological survey. Agricultural Economics, 33(2), 191–203. https://doi.org/10.1111/j.1574-0862.2005.00384.x

- Piet, L., Latruffe, L., Mouël, C. L., & Desjeux, Y. (2012). How do agricultural policies influence farm size inequality? The example of France. European Review of Agricultural Economics, 39(1), 5–28. https://doi.org/10.1093/erae/jbr035

- Rizov, M. (2004). Firm investment in transition: Evidence from Romanian manufacturing. The Economics of Transition, 12(4), 721–746. https://doi.org/10.1111/j.0967-0750.2004.00200.x

- Rosochatecká, E., Tomšík, K., & Žídková, D. (2008). Selected problems of capital assets of Czech agriculture. Agricultural Economics (Zemědělská Ekonomika), 54(3), 108–116. https://doi.org/10.17221/242-AGRICECON

- Sckokai, P., & Moro, D. (2009). Modelling the impact of the CAP Single Farm Payment on farm investment and output. European Review of Agricultural Economics, 36(3), 395–423. https://doi.org/10.1093/erae/jbp026

- Sipiläinen, T., Kumbhakar, S. C., & Lien, G. (2014). Performance of dairy farms in Finland and Norway from 1991 to 2008. European Review of Agricultural Economics, 41(1), 63–86. https://doi.org/10.1093/erae/jbt012

- Skevas, I., Emvalomatis, G., & Brümmer, B. (2018a). Heterogeneity of long-run technical efficiency of German dairy farms: A Bayesian approach. Journal of Agricultural Economics, 69(1), 58–75. https://doi.org/10.1111/1477-9552.12231