Abstract

Antibiotic resistance is an urgent public health threat that has received substantial attention from the world’s leading health agencies and national governmental bodies alike. However, despite increasing rates of antibiotic resistance, pharmaceutical companies are reluctant to develop new antibiotics due to scientific, regulatory, and financial barriers. Nonetheless, only a handful of countries have addressed this by implementing or proposing financial incentive models to promote antibiotic innovation. This study is comprised of a systematic review that aimed to understand which antibiotic incentive strategies are most recommended within the literature and subsequently analyzed these incentives to determine which are most likely to sustainably revitalize the antibiotic pipeline. Through a case study of Canada, we apply our incentive analysis to the Canadian landscape to provide decision-makers with a possible path forward. Based on our findings, we propose that Canada support the ongoing efforts of other countries by implementing a fully delinked subscription-based market entry reward. This paper seeks to spark action in Canada by shifting the national paradigm to one where antibiotic research and development is prioritized as a key element to addressing antibiotic resistance.

Introduction

Antibiotics – drugs that target bacterial infections – have revolutionized modern medicine by allowing us to treat previously lethal communicable diseases. This has resulted in higher life expectancies worldwide, as people are living approximately 30 years longer than they were in the early 20th century.Citation1,Citation2 A century ago, communicable diseases were the leading cause of death; however, the incidence of death in this category has been on a downward trend since the commercialization of antibiotics in the 1940s. Communicable diseases have been replaced by non-communicable diseases, such as heart disease and cancer, as top causes of death in recent decades.Citation3 In addition to provoking a shift in mortality causes, the widespread use of antibiotics has also significantly lowered the risks associated with many medical procedures, including organ transplants, childbirth, and chemotherapy.Citation4–Citation6 However, the effectiveness of many antibiotics is diminishing at a concerning rate, as bacteria are becoming increasingly more resistant to the existing supply of antibiotics as a result of natural evolution, certainly, but also largely due to almost 80 years of inappropriate use.Citation7 Inappropriate use has been prevalent from commercialization onwards, with most recent studies reporting that between 45% to 66% of antibiotics prescribed at the primary care level are unnecessary and that the indicated drug, dosage, or treatment duration are unsuitable in approximately 50% of prescriptions.Citation5,Citation8–Citation10 The effects of antibiotic resistance (ABR) have already been devastating, with at least 700,000 deaths from drug-resistant infections occurring worldwide every year and experts estimating that this number will surpass 10 million deaths per year by 2050.Citation6 In Canada, 14,000 deaths from drug-resistant infections occurred in 2018 and 400,000 Canadians are expected to die from drug-resistant infections by 2050.Citation9 Notably, diminishing antibiotic effectiveness is leading to the resurgence of existing communicable disease threats and the emergence of novel ones, as illustrated by increasing prevalence of hard-to-treat multi-drug infectionsCitation11 and by the ongoing COVID-19 pandemic which has motivated superfluous antibiotic prescriptions in patients hospitalized with suspected COVID-19.Citation12

Although this problem has received significant attention in recent years, with influential agencies like the World Health Organization (WHO), the World Bank, and national governments investing significant resources into the development of action plans and surveillance systems to address ABR, little has been done in the area of encouraging the development of new antibiotic drugs in countries such as Canada.Citation13,Citation14 Worldwide, the antibiotic development pipeline has all but dried up, demonstrated by the fact that few antibiotics that provide a significant clinical benefit over existing drugs have been approved in the last 30 years.Citation15–Citation17 Rather, for many antibiotics, there are limited, if any, replacement products in development, with only 12 of 50 antibiotics in the development pipeline targeting priority Gram-negative pathogens, although these pose a great risk to humans.Citation16,Citation18,Citation19 To exacerbate matters, many pharmaceutical companies are abandoning their antibiotic research and development (R&D) programmes altogether, as seen by the exiting of 15 of the 18 largest global pharmaceutical firms from this space in the last 30 years.Citation9,Citation20 This concerning shift in pharmaceutical companies’ ventures is due to multiple scientific, regulatory, and economic barriers associated with the development and marketing of new antibiotics.

The purpose of this article is two-fold: (1) to analyze the existing and proposed antibiotic financial incentive strategies from around the world through a systematic literature review and (2) to present a case study of Canada to propose which – if any – financial incentives could be feasibly implemented in this country to support the global effort for inducing antibiotic innovation. These objectives were realized by critically analyzing the strategies recommended by articles meeting our inclusion criteria and assessing each recommended incentive strategy for their ability to productively foster R&D. Through a case study of Canada, we provide decision-makers with a possible path forward that could befit the Canadian landscape based on our financial incentive analysis.

Background

While scientific barriers, which consider the challenges associated with the discovery of new antibiotic molecules of clinical value, and regulatory barriers, such as the innate difficulties of meeting regulatory expectations for clinical trials involving antibiotics, are certainly significant, it has been argued that economic barriers present the biggest hurdle to antibiotic development, as this deters drug developers from investing in antibiotics at every point of the R&D process.Citation21

The production of new antibiotics is greatly hindered by profitability challenges which uniquely affect antibiotics. Antibiotic infections generally occur over a short period of time and then the patient is no longer in need of the drug – contrary to chronic diseases that tend to generate revenue over the span of the patient’s life post-diagnosis.Citation9,Citation22,Citation23 However, while other existing short-course pharmaceuticals (ie, vaccines) are nonetheless profitable, the threat of ABR requires increased antibiotic stewardship, meaning that any new antibiotics that would be introduced into the market would be reserved for infections caused by multi-drug resistant bacterial strains for which no other effective drugs exist, thereby keeping profits low.Citation21,Citation22,Citation24 Alternatively, if new antibiotics are active against multidrug-resistant bacteria for which few, if any, effective treatments exist, it is predicted that these drugs will become ineffective relatively quickly upon use as a result of ABR. Furthermore, since antibiotics of the same class typically have the same mechanism of action, resistance may develop towards a shelved product that belongs to the same class as a different drug that has higher volume sales, thereby rendering it less effective despite it being preserved.Citation25 This problem has no easy solution, due to the fact that increasing antibiotic drug prices to combat decreased pharmaceutical profitability would only serve to exacerbate the problem, as lower-income countries – which are disproportionally affected by ABRCitation26,Citation27 – require access to affordable drugs to prevent deaths due to treatable infections.Citation6,Citation28 Also, the prices of new antibiotics are generally kept low by the existence of a wide variety of inexpensive generic products that have similar clinical indications as branded products and which continue to have clinical utility.Citation6,Citation17,Citation21,Citation22,Citation29

Given these multi-layered challenges and the lack of significant progress – despite strategies to address antibiotic resistance at other levels (ie, stewardship programs, awareness campaigns, surveillance, etc.) – action is needed to stimulate the R&D of new antibiotics. In order to address ABR, we need a steady supply of new and clinically important antibiotics; therefore, a handful of antibiotics should be in development at any given time, rather than there being extremes where multiple antibiotic developments occur and then many years where they do not.Citation30 Around the world, incentives have been implemented and numerous more are being suggested as possible options to sustainably revitalize the antibiotic pipeline to tackle the presented issues. Financial incentives that motivate investment in antibiotics by drug companies can be classified into either push or pull mechanisms, whereby push mechanisms focus on decreasing antibiotic development costs and pull mechanisms aim to increase or ensure adequate market revenue for newly approved antibiotics (further discussed in the results section).Citation18,Citation19,Citation29,Citation31,Citation32

Methods

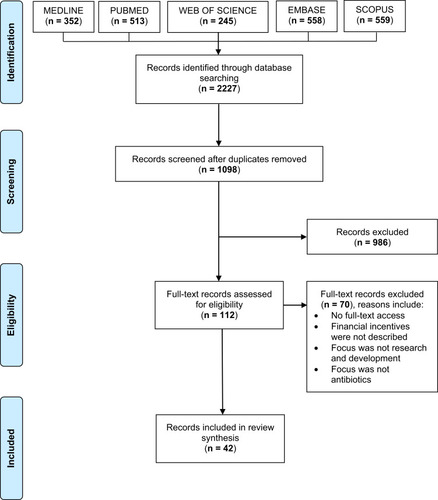

This research consists of two distinct methodological approaches: first we conducted a systematic literature review and secondly, building upon those results, we applied an incentive analysis to draw out our conclusions. The literature review was performed to answer the following question: should drug developers be given financial incentives to encourage the development of novel antibiotics to address the global health threat of ABR, and if so, which incentives would be most productive when applied to a Canadian case study? This systematic review was conducted in accordance with the Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA) guidelines.Citation33 On April 6, 2020 an electronic search of the following five databases was performed: Medline (Ovid), Pubmed, Embase, Web of Science (Science & Social Science Citation Indexes), and Scopus. The medical subject headers (MeSH) used in the search were “drug resistance, microbial” and “drug industry” and the key words used were “incentive”, “award”, “reward”, “antibiotic”, “antimicrobial”, “research”, and “development”. Appropriate variations were used to account for word variations and plurals.

In order to be included, studies had to:

Be published in English;

Be published after January 2010, to correspond with rising ABR awareness in the last decade;

Focus on the analysis or review of one or more financial incentive strategies for encouraging antibiotic R&D;

Be peer-reviewed or commentaries published in peer-review journals.

The literature search retrieved 2227 records. After duplicates were removed, 1098 titles and abstracts were screened, and 986 records were excluded for not conforming to the inclusion criteria. Studies were further excluded if they:

Comprised of records consisting of letters to the editor, correspondence, or conference papers and abstracts;

Did not specifically focus on financial incentives to promote new antibiotics or which only broadly addressed financial incentives, without offering an in-depth insight into any models or offering any incentive suggestions;

Focused on incentives to reduce inappropriate prescriptions, improve antibiotic stewardship, improve multi-country availability of antibiotics, or promote fewer antibiotic emissions into the environment;

Focused on the topic of scientific and/or regulatory incentives;

Focused on financial incentives but not specifically for antibiotic agents, as ideas from other sectors have been largely considered and applied to the antibiotics landscape.

The full texts of the remaining 112 articles were assessed for eligibility by the authors, of which 70 were deemed outside the inclusion criteria. The review encompasses 42 records which were included in the final analysis (). Notably, most of the included studies were either perspective, commentary, or review articles (88%), which was expected for two reasons: (1) since this research question is at the policy level and cannot be tested for safety and efficacy through observation or interventional trials at the individual level, original research is scarce, and (2) the scope of this paper is to determine a recommendation for a Canadian case study based on analyzing the recommendations from existing literature pertaining to this topic; therefore, opinion articles and review articles are particularly useful. Commentaries were included because they are taken up in the public domain by policy experts, and are therefore valuable for understanding current international trends in this subject area. All included articles were given equal weighting as perspective and reviews represent the current academic perspective whilst commentaries are readily applicable at the policy-level. Next, the recommendations provided by the articles included in this review were critically assessed to determine which incentive strategies could be effectively implemented within a Canadian context. To this effect, article-recommended incentives were analyzed using a modified version of the assessment framework developed by Renwick et al.Citation18 Renwick’s framework consists of four market criteria for selecting an optimal incentive model:

Does the incentive improve the net present value (i.e., the profitability metric) for antibiotic projects?

Does the incentive promote small to medium-sized enterprise (SME) participation?

Does the incentive promote large pharmaceutical company participation?

Does the incentive promote cooperation and synergy among key players (i.e., industry, academia, government)?

Figure 1 Study flowchart according to the PRISMA recommendations.Notes: PRISMA figure adapted from Liberati A, Altman D, Tetzlaff J, et al. The PRISMA statement for reporting systematic reviews and meta-analyses of studies that evaluate health care interventions: explanation and elaboration. Journal of clinical epidemiology. 2009;62(10). Creative Commons.Citation33

Besides these market criteria, Renwick’s framework also evaluates whether the incentive model aligns with public health objectives, namely:

Does the incentive promote antibiotic stewardship?

Does the incentive improve patient access to antibiotics?

However, given the pull incentive pilot schemes that have been recently launched in the United Kingdom and Sweden, we modified Renwick’s framework to ensure that these schemes were being taken into consideration as part of the incentive feasibility assessment. Additionally, while paying special attention to Canada as the setting for the proposed incentives, we opted to further modify Renwick’s framework to add new but related assessment criteria that preserve Renwick’s categories (ie, market attractiveness, public health objectives, and implementation feasibility) while providing more context, insight, and specificity to these categories. Our modified framework also assesses the following items:

Is the incentive strategy forecasted to entail large structural changes to the current business model in Canada?

Has the incentive strategy already been piloted or implemented in other countries?

Does the incentive strategy involve delinking the developer’s return from sales volume and price?

Does the incentive strategy involve conditional payments based on antibiotic performance?

Does the incentive strategy promote or reward innovation in antibiotic R&D projects?

To account for the heterogeneity between included articles, all article-recommended incentive strategies were subjected to the same criteria-based assessment and assigned a score between 0 and 11, with a greater score indicating a higher probability that the incentive strategy would productively increase the market value for antibiotics, be feasible to implement, and contribute to antibiotic conservation efforts. Each incentive strategy was given either a score of 1 if it met the respective criteria or a score of 0 if it did not. The total score was then calculated for each incentive strategy. While every effort was made to ensure the framework criteria and derived scores were as non-biased as possible, there is nonetheless a level of subjectiveness within the aforenoted assessment process. Bias was controlled to the extent possible by reaching consensus between authors on all scoring.

This modified framework was utilized to assign each incentive strategy recommended by the articles included in this review an individual score by which we were able to quantify the advantages and notable shortcomings each. These scores were taken into account within our wider discussion pertaining to the Canadian context and assisted us in coming up with recommendations for how Canada can work with the global community to sustainably improve the antibiotic market.

Results

and demonstrate the characteristics of the 42 articles included in this analysis. These articles were published between 2010 and 2020 with most of the records being published in 2018 (26%). indicates that interest in the topic of financial incentives rose significantly in 2016, evidenced by the increase in annual publications from that year onwards compared to the years before. Interestingly, recommendation trends have remained consistent over the decade – despite changes in particular implementation models, as discussed later – with market entry reward (MER)-based incentives representing the most recommended strategy type ().

Table 1 Characteristics of the Included Articles

Table 2 Trends Pertaining to Financial Incentive Models for Antibiotic Innovation in the Literature Between 2010 and 2020

Within the 42 articles, numerous types of push and pull incentive models were identified, with many being referenced in only one to three articles, whilst others, such as grants or MERs, being referenced in most of the articles. Despite this, there are broad categories of push and pull mechanisms that these articles identified (). Pertaining to push mechanisms, research grants, subsidies from public-private partnerships, and tax incentives (ie, tax credits or tax cuts) that can be offered for any stage of the R&D process represent the three broad categories of described mechanisms.Citation18,Citation34–Citation36 Moreover, pull strategies were identified as (1) patent extensions, which delay generic drugs from entering the market; (2) MERs, which reward drugs for entering the market and fully or partially delink the product from the amount sold; and (3) tradeable vouchers, which would be given to drug companies after regulatory approval of a new high-priority drug, and can be used by the drug company to fast-track the review process, extend the patent life of another one of their compounds, or sell it to another company.Citation1,Citation18,Citation29,Citation34,Citation37,Citation38 provides a simplified overview of each of these incentive strategies as well as their associated advantages and disadvantages, reflecting our literature findings. Importantly, this table describes incentives based on the general characteristics of the type of incentive strategy, which inherently overlooks differences between the characteristics of actual policies representing a strategy type that have been implemented.

Table 3 Characterizing the Advantages and Disadvantages of Financial Incentives for Antibiotic R&D

Of the 42 articles included for analysis, 21 compared two or more incentive models to determine which one(s) were superior to the others.Citation18,Citation19,Citation23,Citation28,Citation29,Citation31,Citation34,Citation37–Citation50 Thirty-eight articles recommended a particular push incentive, pull incentive, or a push-pull hybrid model.Citation1,Citation17,Citation18,Citation20–Citation23,Citation25,Citation28,Citation29,Citation31,Citation32,Citation35–Citation60 In terms of the four that did not make a recommendation, two of the studies simply reviewed different incentives and outlined possible benefits and disadvantages of each without offering a final recommendation,Citation19,Citation34 one focused on analyzing the disadvantages associated with exclusivity extension pull strategies,Citation61 and the last paper did not support any push or pull financial incentives.Citation62

Mix/Hybrid Models

The incentive strategy that was the most recommended among the included articles was a mix/hybrid model, suggested by 15 articles.Citation18,Citation20–Citation23,Citation29,Citation31,Citation32,Citation36,Citation37,Citation42,Citation46,Citation51,Citation52,Citation57 However, there was no consensus among authors on what a hybrid model should or could look like. The specific push and pull components varied from one article to the next, with many of the articles not specifying which particular push or pull incentives they would suggest for the model (). Nonetheless, the most recommended hybrid model among these articles was the Options Market Award (OMA) model, with four studies suggesting it as the optimal approach.Citation21,Citation22,Citation36,Citation52 The OMA model uniquely combines aspects of both push and pull mechanisms into one model, whereby interested stakeholders may purchase an “option” to buy a set volume of an antibiotic at a discounted price to be redeemed if and when the antibiotic drug is marketed.Citation22 The earlier the options are purchased, the lower its price but the greater the risk of the antibiotic not making it to market.Citation22 Another hybrid model, known as the Antibiotic Conservativeness and Effectiveness (ACE) model, was described by Kesselheim and Outterson,Citation42 whereby the value of MER payments is determined by the level of success that the antibiotic has in meeting conservation targets. A distinctive feature of the ACE model is that it is proposed as a voluntary program that antibiotic manufacturers or sponsors can choose to opt-out of after market approval.Citation42 Interestingly, five of the 15 articles suggesting a mix/hybrid model included an MER as one of the components for their suggested model.Citation31,Citation37,Citation42,Citation46,Citation51,Citation52

Other components of recommended mix/hybrid models consisted of research grants,Citation21,Citation23,Citation31,Citation42,Citation46,Citation52 advance market commitments,Citation23,Citation42,Citation46 tax credits,Citation51 conservation-based market exclusivity,Citation42 and open-source drug development.Citation32,Citation57 Three articles did not elaborate on the characteristics of their proposed mix/hybrid models, focusing instead on advocating for the strengths of concurrently implementing multiple mechanisms as opposed to just one on a general level.Citation18,Citation20,Citation29

Market Entry Award Models

The second most popular suggestion among the articles was an MER, with 14 articles recommending this pull mechanism.Citation17,Citation25,Citation28,Citation38,Citation39,Citation45,Citation47–Citation50,Citation54–Citation56,Citation59 Articles outlining how the MER should be implemented, awarded, and distributed varied widely in their proposed approaches, with model differences being observed between the eligibility criteria for marketed antibiotics, the value of award payments, the extent of disruptiveness to existing market systems, and whether or not they are concerned with promoting antibiotic stewardship.

Five articles suggested a partially delinked MER model, whereby conventional volume-sale revenues are topped up through annual payments.Citation28,Citation39,Citation47,Citation49,Citation50 These articles posited that a partially delinked MER model has the advantage of being minimally disruptive, since it would be implementable within current systems and would avoid the need for law changes associated with other proposed models.Citation28,Citation49 Årdal et alCitation49 suggested that the value of the MER should be established on a case-by-case basis, according to a predefined criteria for antibiotics. Daniel et alCitation39,Citation50 took this one step further, by advocating that financial awards should only be given for novel antibiotics that target the highest-priority pathogens, an idea that has been previously suggested in reports such as the Chatham House ReportCitation63 and O’Neill’s Review on Antimicrobial Resistance.Citation6 In addition, Daniel et alCitation39,Citation50 argued that the MER model needs to encourage antibiotic stewardship, therefore suggesting that MER payments should require drug manufacturers to negotiate value-based contracts (ie, where payments are dependent on the “value” of the antibiotic to society) with insurers. In this model, known as the Priority Antimicrobial Value and Entry (PAVE) award model, the MER would provide drug manufacturers with the majority of the annual revenue in the first year post-market approval and this revenue would subsequently decline over the remaining years of the five-year PAVE award period.Citation39,Citation50 Lastly, Towse et alCitation47 offered another take on a partially delinked model, suggesting that the payment should be based on an insurance model whereby the government or healthcare system pays an annual fee to access and use the antibiotic.

On the other hand, two articles disagreed that a partially delinked option represents the optimal MER model, advocating for a fully delinked MER incentive instead.Citation38,Citation56 These articles argued that the advantages of fully delinked models pertaining to ensuring long-term sustainable use trump the benefits of partially delinked models, as the former ensure that manufacturers no longer have incentive to increase unit prices to maximize sales whereas the latter do not.Citation38 Although Morel and EdwardsCitation38 did not provide suggestions pertaining to how such models should be implemented, Rex and OuttersonCitation56 recommended that these awards should be paid out to manufactures annually for a period of five years, with payment values being higher for antibiotics meeting one or more of the following criteria: a novel mechanism of action, addressing unmet clinical needs, targeting high-priority pathogens, and/or providing a cost-advantage over existing agents.

The remaining seven articles did not elaborate on the characteristics of their proposed MER models, endorsing delinkage models on a general level instead.Citation17,Citation25,Citation45,Citation48,Citation54,Citation55,Citation59 The general consensus among these articles seemed to be that there is a need for studies that pilot different MER models to determine which types hold the most promise.Citation45

Other Incentive Models

Finally, 10 articles recommended other push or pull mechanisms, including targeted research grants or R&D subsidies,Citation1,Citation35,Citation53,Citation58 taxing antibiotic use,Citation25,Citation40,Citation60 reimbursement reforms,Citation41 conservation-based market exclusivity,Citation41,Citation43 and antibiotic price increases.Citation44

It is worth noting that while other incentive mechanisms beyond the ones mentioned above exist and may have promising qualities, the aim of this review was to ascertain which financial incentives for antibiotics are currently being recommended within the literature and to subsequently determine their usefulness according to set criteria. Therefore, incentives not recommended by any of the included articles fell outside the scope of this review.

Global versus National Managing Body

Regardless of which types of financial incentive mechanisms are implemented, a managing body that determines eligibility criteria for new antibiotics and distributes these incentives to manufacturers must be determined. However, akin to the diversity among articles concerning incentive model recommendations, the included articles also varied widely in their suggestions of how and by whom proposed incentives should be enforced and managed. Some articles had completely opposing views, with 11 articlesCitation17,Citation19,Citation29,Citation37,Citation38,Citation52,Citation55–Citation57,Citation59,Citation60 arguing that incentives must be globally coordinated and enforced by a multi-national body, while six articlesCitation18,Citation47,Citation49,Citation51,Citation53,Citation54 suggested that appropriate incentives need to be determined at a national level and enforced by domestic governments. In contrast, seven articlesCitation21–Citation23,Citation25,Citation36,Citation40,Citation46 recommended that multiple systems should be involved in the implementation of financial incentives. For example, Brogan and MossialosCitation36 recommended their OMA model, envisioning it to be open to non-governmental organizations, government, or multi-national investors to purchase options for antibiotics in clinical development; therefore, this model would engage different systems in administering financial incentive payments to manufacturing and pharmaceutical companies. Alternatively, Renwick and MossialosCitation21 suggested that a global governing body should be established to mobilize and coordinate action and that this should be coupled with national investment from governments to fund antibiotic R&D. Relatedly, five articles were less concerned with whether incentives will be managed nationally or multi-nationally, advocating instead for the need to engage both the industry and the state and thereby recommending public-private partnerships (PPPs).Citation32,Citation39,Citation43,Citation50,Citation58 Ten articles did not provide any information, perspective, or suggestions pertaining to how a financial incentive for antibiotics should be administered.Citation1,Citation20,Citation28,Citation31,Citation34,Citation41,Citation44,Citation45,Citation48,Citation61

Incentive Analysis

For all incentive strategies recommended by one or more of the articles, depicts our incentive assessment based on market attractiveness, public health objectives, and feasibility of incentive implementation. In total, we ranked three push incentive strategies (open-source drug discovery, grants, and tax incentives), seven pull incentive strategies (conservation-based market exclusivity, diagnosis confirmation model, antibiotic use fees, increased antibiotic prices, fully delinked MER, partially delinked MER, and value-based reimbursement) and two hybrid models (OMA and ACE). Importantly, this table is not comprehensive as other incentive models exist or have been proposed; however, this analysis is focused on the recommended incentives from articles meeting our search inclusion criteria. Applying the modified Renwick frameworkCitation18 coupled with our scoring strategy, the fully delinked MER incentive strategy scored 6, the highest among all incentives, with partially delinked MERs, value-based reimbursements, the OMA model, and the ACE model all tied in second place with a score of 5. The majority of the remaining incentive strategies had a score of 4, including all three push incentives, as well as the conservation-based market exclusivity pull strategy and the increasing antibiotic prices strategy. The lowest-scoring incentive strategies were the fee on antibiotic use, with 3 points, and the diagnosis confirmation model, with only 1 point.

Table 4 Criteria-Based Assessment of Recommended Incentive Strategy Using Modified Renwick et alCitation18 Framework

The criterium that was unmet by most of the incentive strategies included in this assessment was the “promotes cooperation and synergy among key players” criterium, with only one incentive strategy (open-source drug discovery) scoring in this area. Other criteria with limited uptake on the assessment included the antibiotic conservation criteria (ie, “involves delinking” criterium and “conditional grants/payments” criterium), with only two incentives meeting each individual criterium within this category.

Discussion

The topic of financial incentives for antibiotic development has only recently become of interest to researchers and policymakers, as evidenced by the low number of records published on this topic between 2010 to 2015, with interest rising from 2016 onwards (), likely due to the publication of the World Health Organization’s Global Action Plan for addressing antimicrobial resistance in 2015. In this systematic review, it was found that there is consensus within the literature regarding the gravity of the problem of antibiotic resistance, with articles on the topic of antibiotic financial incentives agreeing that ABR rates are rising faster than the rate of production of clinically important antibiotic drugs. Included articles also generally agreed that although push incentives are necessary, a substantial pull incentive or hybrid model will be needed to tackle this complex issue. However, when it comes to what the optimal pull or incentive model should look like, there is no consensus in the literature, with diverging opinions on whether a national or international incentive strategy would be more effective in motivating the development of new antibiotics. Generally, the recommendations from the articles varied widely, as even the articles which recommended the same incentive mechanism (ie, push, pull, or a hybrid push-pull mechanism) still differed in regard to the suggested implementation approach, the managing body, the types of antibiotics which would qualify for the incentive, and whether the incentive would be a one-time payment or split-payments administered over a number of years.

There were 38 articles that supported financial incentives as promising for addressing the lack of new antibiotics being approved for use on a global scale. These articles agreed that while scientific and regulatory barriers to antibiotic innovation contribute to the lack of progress in new treatment options for hard-to-treat bacterial infections, the unattractive antibiotic market is the true hindrance for drug developers. Specifically, the fact that generic antibiotics that are capable of treating most common infections remain widely available coupled with the development of resistance occurring as soon as new antibiotics are clinically used unfortunately renders most antibiotics unprofitable. In order to stimulate impactful progress to ensure that future alternative treatments exist for even the most resistant pathogens – even if ABR rates keep rising – financial incentives must be implemented.

However, not all included articles endorsed financial incentives as promising solutions to the ABR problem. In particular, JamesCitation62 did not agree that a financial incentive of any kind was an appropriate way of combating ABR, arguing that any publicly-financed incentives will only encourage the development of marginally improved antibiotics, rather than truly innovative products. As a result, publicly financed incentives would have little overall clinical benefit to tackling antibiotic resistance. JamesCitation62 argues that since the public sector has limited resources, those resources would be better spent in creating a new international coordinating body that operates through public-private partnerships to overcome the antibiotic resistance challenges. JamesCitation62 also argues that the market works best when it is left to operate freely, possibly implying that pharmaceutical companies will respond to the need of new anti-bacterial therapies when there is truly an immediate need for more solutions. However, while James’Citation62 proposal for a global coordinating infrastructure to oversee the management of antibiotic resistance – regarding both R&D and antibiotic stewardship – is a valid recommendation, other parts of this argument overlook matters that consequently weaken the author’s position. For instance, the antibiotic market cannot operate freely due to the need to restrict the use of marketed antibiotics to preserve their effectiveness; therefore, the regulations imposed on antibiotic development and distribution inherently distort the market.Citation21 Also, as it takes between 10 to 15 years for a new antibiotic to progress through the antimicrobial development pipeline,Citation6,Citation31 there will be a significant lag in response time from when existing antibiotics will entirely lose their effectiveness to when new, effective anti-bacterial therapies will be introduced into the market. This lag time will result in hundreds of thousands of deaths, which could be prevented by acting now – through incentives, if need be – rather than waiting for the market to necessitate action. In addition, while it is certainly true that the public sector works within a budget and that there are other causes that require public funding, it is relevant to point out that governments in developed countries tend to have more money than many corporations – however, governmental budgets are constrained due to other priorities.Citation64,Citation65 Nonetheless, the percentage of public-financing of R&D incentives could vary depending on the nation, with higher percentages of funds coming from private sources through public-private partnerships in certain countries.

Besides James,Citation62 three other articles did not recommend any particular financial incentive model. Instead, one article solely focused on potential obstacles to implementation pertaining to different incentive mechanisms, identifying which mechanisms would be attractive or unattractive to not-for-profit research institutes, SMEs, or large pharmaceutical companies.Citation34 Another article exclusively focused on the potential negative economic effects of market exclusivity extensions, noting that such incentive strategies are quite costly and are not evidenced to particularly reward drug innovativeness or clinical value.Citation61 Similarly, Batista et alCitation19 concentrated on intellectual property-based incentives, providing a thorough analysis of the theoretical advantages (eg, longer exclusivities could encourage patent-holders to preserve the effectiveness of their antibiotic drugs for longer) and empirical challenges or disadvantages (eg, the extra cost associated with transferable exclusivity incentives would be unfairly borne by patients) pertaining to such mechanisms. In these articles, the reason behind the lack of final financial incentive recommendation is unclear; however, it is possible that this was simply outside the scope of their analyses. Alternatively, it should be considered that these articles may have refrained from recommending a model because they do not believe that any particular financial incentive strategy would be useful in motivating the development of clinically beneficial antibiotics. We argue, however, that if this were the case, this perspective would be indicated and discussed within the articles; yet, neither of these three articles contain such arguments.

Our incentive analysis revealed that while different push incentive strategies each have their own specific set of strengths and weaknesses, they all appear to be moderately productive in motivating change, as all were tied with a total score of 4 points each. The strengths of push incentives lie in their tendency to be more readily implementable than pull or hybrid incentive models coupled with their ability to encourage the participation of SMEs.Citation18,Citation21,Citation66 As push incentives of various types and sizes have already been implemented to motivate antibiotic R&D in many countries, they are relatively familiar, politically palatable, and cost-effective compared to many pull incentives, thereby facilitating implementation.Citation21,Citation66 In addition, push incentives benefit SMEs by providing them with the funding they need for investing in new antibiotic projects or completing expensive later-stage clinical trials.Citation18,Citation48,Citation67 However, such incentives are less likely to motivate large pharmaceutical firms to resume R&D in antibiotics if they have already abandoned this field. Additionally, push incentives do little in supporting public health goals such as antibiotic conservation, rewarding innovation, or improving patient access to antibiotics, as they are typically not tied to any post-approval conditions.Citation67 Therefore, we support the consensus in the literature that push incentives alone are not sufficient for addressing the antibiotic innovation problem; however, they are nonetheless a good place to start. Overall, our literature findings and assessments suggest that push incentives will be most productive when applied in conjunction with one or more pull incentives.

Interestingly, a much wider scoring variability was observed for pull incentive strategies, with both the lowest score and the highest score being awarded to strategies within this category. A commonality between all the pull incentives evaluated in this review was that none would be particularly helpful in encouraging the participation of SMEs; however, the majority of pull strategies are forecasted to encourage the participation of large pharmaceutical companies with access to R&D capital reserves instead.Citation18,Citation63 Moreover, most pull incentives are projected to have challenges pertaining to their implementation feasibility, as the majority would require significant change to the current business model and many have not yet been implemented in other countries. However, this could be subject to change given that a couple pilot projects are currently underway that may soon redefine how we view the implementation feasibility of pull incentives, if they are successful.

In the United Kingdom (UK), the National Institute for Health and Care Excellence (NICE) and the National Health Service (NHS) of England have begun to implement a pilot project that plans to use a hybrid subscription model to reimburse pharmaceutical companies for antimicrobial drug development.Citation68,Citation69 This subscription model combines a value-based reimbursement with a fully-delinked MER, with antibiotics being subjected to a health technology assessment that is to be conducted by NICE to determine the clinical value of the antibiotic in question.Citation69 Suppliers of antibiotics which pass this assessment will be reimbursed on the basis of a multi-year contract paid in yearly installments, with the antibiotic’s performance over time affecting the actual annual fee paid to suppliers.Citation69

In Sweden, another subscription model is being piloted by the Swedish Public Health Agency.Citation70 Similar to the UK model, this model will also pay suppliers of qualifying clinically-important antibiotics a value-based annual fee in exchange for access to the antibiotic.Citation71 Unlike the UK model, however, the Swedish pilot represents a partially-delinked MER whereby participating suppliers are able to perform volume-based sales while also being guaranteed a minimum annual revenue for qualifying antibiotics, as defined in the subscription contract between the Swedish Public Health Agency and the supplier.Citation70–Citation72

Both these models represent novel methods of reimbursement for antibiotics. By combining the MER strategy with a value-based component for reimbursement, these pilot projects may be better equipped than any other implemented incentive to begin addressing the antibiotic pipeline problem. While it is too early to tell how effective these projects will be as data are not yet available, the existence of these projects is certainly an extraordinary step in the right direction.

Lastly, the two hybrid incentives we analyzed both scored 5 points in our assessment, meeting several important framework criteria. The OMA model is unique in that it is the only assessed incentive that would be expected to encourage participation of pharmaceutical companies of all sizes, as it allows funders to share some of the venture risk with the pharmaceutical firm by investing in a drug regardless of where it is in the development pipeline.Citation18 However, the OMA model does not promote antibiotic conservation. On the other hand, the ACE model has antibiotic conservation as its primary goal, using conditional performance-based payments to reward innovative antibiotics and drug stewardship in post-market use.Citation18 Unfortunately, being a pull-centered incentive strategy, the drawback is that this model would appeal to large pharmaceutical firms much more than to SMEs.Citation18

In the next section, a case study using Canada as a country-based example will assess which of the recommended incentive strategies from the articles included in this review could best befit the Canadian landscape.

Applying Incentives in the Canadian Landscape: A Case Study

The Canadian Landscape

In Canada, the health care system, best known as Medicare, is a universal publicly funded system regulated by the federal government and delivered through Canada’s 13 provinces and territories.Citation73 At present, Canada is the only country with a universal health care system that lacks a national pharmacare program, with prescription drug coverage varying considerably among provinces, resulting in one in five Canadians struggling to afford prescription medicines.Citation74 However, a plan to implement a cost-saving national pharmacare program has recently been announced by the Canadian government.Citation74 In brief, this plan recommends the creation of a drug agency responsible for assigning and approving drugs to a national formulary (ie, the drugs which will be covered under pharmacare), with the initial list of national formulary drugs set to be available on January 1, 2022.Citation74 Over the next five years, the national formulary will expand to include drugs beyond essential medicines, including expensive drugs for rare diseases, with the goal of having a full, comprehensive formulary in place by 2027.Citation74

When it comes to addressing antibiotic resistance, proposed solutions lack focus on antibiotic innovation, with possible drug development financial incentive models or suggestions remaining largely unexplored. In fact, most reports, awareness platforms, or action plans in CanadaCitation14,Citation75–Citation77 have largely refrained from suggesting solutions that specifically address the lack of new antibiotics as one of the challenges contributing to the overall threat of antibiotic resistance, although treating drug-resistant bacterial infections in the future will become increasingly difficult without new antibiotics. So far, the only way that this problem has been addressed in Canada has been by the recent implementation of an expedited regulatory review process for antibiotic drugs that target pathogens from Health Canada’s “Pathogen of Interest” list, published in 2018, which contains a list of the pathogens responsible for the most hard-to-treat infections in Canada.Citation78

A Path Forward?

When translating antibiotic incentive recommendations from the literature into the context of a Canadian perspective, there are a couple criteria that are relevant to consider. First, it is likely that the implementation of a financial incentive model in Canada may involve a slow uptake due to the fact that the revitalizing of the antibiotic pipeline is not currently seen as a pressing issue within the national strategy for combatting antibiotic resistance.Citation14 Thus, the feasibility of implementation will be of particular importance in deciding an appropriate incentive strategy for implementation in Canada. Furthermore, the composition of Canada’s pharmaceutical industry must also be considered when assessing the suitability of different antibiotic incentive strategies for Canada. While some local pharmaceutical companies exist, foreign multinational companies with subsidiaries in Canada represent the majority of Canadian drug sales and R&D investment.Citation79 Despite this, interest in R&D investment in Canada by multinational companies is relatively low on the global priority list, with Canadian SMEs and contract research organizations carrying out an increasingly large proportion of Canadian R&D activities.Citation79,Citation80 In terms of antibiotic R&D, Canada is not a major global player, as evidenced by the fact that Canadian companies are only developing two of the 32 antibiotics targeting WHO priority pathogens which are currently in clinical development.Citation16

Based on our incentive analysis, we recommend that Canada follow in the footsteps of the UK and Sweden by implementing a subscription-based MER which would be accessible to both local and multinational drug developers selling into the Canadian market. While there may be some resistance to the implementation of such an incentive in Canada due to the high associated cost, we argue that investing in this field now will ultimately end up saving taxpayer money which would otherwise be spent on the health burden due to ABR if the status quo is maintained.Citation6,Citation81 As per our assessment (), MERs were highly ranked among analyzed incentive strategies, with fully delinked incentives receiving the highest score and partly delinked incentives being one of the four strategies awarded the next highest score. However, by combining a basic MER strategy with a value-based reimbursement strategy, the subscription-based model addresses the two major weaknesses of a basic MER strategy: an inherent disregard for the antibiotic’s level of innovativeness and its performance over time. The value-based reimbursement component of both the UK and Swedish subscription-based models ensures that only antibiotics of sufficient clinical importance receive the reward and calls for the value of the antibiotic’s annual subscription fee to be adjusted according to the antibiotic’s performance. The UK and Swedish pilot schemes could be used as models to inspire the creation of a similar pull MER incentive strategy in Canada, whereby the government will pay an annual subscription fee to suppliers of qualifying antibiotics. Referring to the details surrounding the implementation of these pilot schemes in other countries will facilitate the design and implementation of a subscription-based MER in Canada that complements, supports, and builds upon existing pull incentive pilot projects. Conversely, most other pull incentive strategies and both hybrid incentive strategies analyzed in this review have not yet been successfully implemented in other countries (), which may consequently render implementation in Canada more challenging. Beyond feasibility challenges, implementing an incentive that has not yet been implemented anywhere else in the world would result in a less positive effect than the translation of an existing incentive to the Canadian landscape. As ABR is an issue affecting all countries, a solution that contributes to a multi-national approach by supporting the work being done in other countries is needed; therefore, a subscription-based MER following an existing model is well-suited.

In terms of whether the UK’s fully delinked or Sweden’s partially delinked subscription model would be more effective, we posit that Canada would benefit from following the UK’s lead in order to implement a similar fully delinked subscription-based MER optimized for the Canadian landscape. Given Canada’s early stage of development for its new national pharmacare program, the integration of a similar program could be easier to achieve. A fully delinked MER model is distinguished from a partially delinked model as the former requires the drug developer to agree to not sell or promote the use of their product, with the developer’s main revenue stream consisting of the MER, whereas the latter allows the developer to continue selling their product for profit and also awards the developer with an MER.Citation37 The main advantage of the fully delinked model compared to the partial model is that it completely removes the motivation to maximize unit sales, aligning with antibiotic conservation and stewardship efforts. Additionally, given that more implementation design information and details are publicly available for the UK model at present, it will be easier to apply this pilot incentive model over the Swedish model to the Canadian landscape.

Alternatively, if the Canadian government does not have the political traction or appropriate resources to commit to a pull incentive strategy at this point in time, targeted grants for financing clinical development may also be productive given the considerations of the Canadian landscape. Despite being undervalued by our included articles, with only 10 articles (24%) suggesting grants as a component of their proposed mix/hybrid incentive model or as a standalone mechanism, we posit that this mechanism is an appropriate way forward in Canada. One advantage of grants is that they have been used as incentives to promote antibiotic research in other countries, such as the Biomedical Advanced Research and Development Authority (BARDA) in the United States (US), among others, which demonstrates that this is a feasible approach to implement in Canada.Citation35 The fact that such an incentive could be funded either by the government or by an NGO is also an attractive component, as it gives some flexibility regarding its implementation. Furthermore, this incentive would not radically change the market or pharmaceutical business model; instead, it would simply function to lower R&D cost for both small and large pharmaceutical companies, thereby encouraging them to develop new antibiotics. While it is true that grants mainly encourage the participation of SMEs over large pharmaceutical firms,Citation18 this type of incentive may be particularly well-suited in Canada, where R&D is being increasingly carried out by Canadian SMEs and contract organizations.Citation79 As access to capital is the biggest hurdle to drug commercialization for these Canadian SMEs,Citation79 implementing a grant incentive strategy may serve as an important motivator for driving projects forward. These targeted grants should only finance the development of antibiotics for high-priority pathogens for which limited treatment options currently exist, thereby allowing the managing body to control which antibiotics will enter the market, ensuring that future Canadians have access to alternative treatments for high-threat bacterial infections.

Importantly, given the Canadian government’s recent commitment to the implementation of a national pharmacare program, we must consider whether pharmacare would impact the suitability or success level of certain financial incentive mechanisms in motivating antibiotic innovativeness. We posit that a possible negative effect of introducing pharmacare could be that systemic changes to the pricing and reimbursement environment may result in drug manufacturing companies becoming even more demotivated to produce innovative antibiotics; however, there is much that is still unknown about how pharmacare will be implemented in Canada and its downstream effects.Citation82 If drastically reduced prices are enforced, this would provide Canada with all the more reason to invest in financial incentives as a mitigation measure. The introduction of a national pharmacare program in Canada would render the fully delinked subscription model developed as per the UK’s pilot as a particularly suitable mechanism to stimulate substantial innovation, as it will motivate drug manufacturers to develop clinically beneficial antibiotics whilst guaranteeing qualifying manufacturers revenue from successfully marketing such antibiotics. Additionally, it is possible that national pharmacare may bring new challenges pertaining to antibiotic stewardship at the community level, as it would eliminate cost-related barriers to antibiotic access and use; however, implementing an incentive similar to the UK subscription model – which fully unlinks product sales from revenue and also considers how well the antibiotic performs as a factor in determining a supplier’s actual payment – will significantly counteract this issue.

Conclusion

As more and more people become infected with hard-to-treat, multi-drug resistant infections, having reliable and effective antibiotic drugs will become more important than ever. However, multiple barriers exist that render antibiotic investment an unattractive business endeavor for pharmaceutical companies and novel solutions need to be explored by policymakers to urgently address this lack of innovation.

This systematic review identified 42 articles containing recommendations for solutions for revitalizing the antibiotic pipeline, with the majority advocating for the implementation of mix/hybrid financial incentive models. The lack of consensus regarding the specific design and size of a financial incentive model suggests that there is no one-size-fits-all solution; rather, it seems that some incentive schemes may be more useful for some countries than for others.

When applying the results of this literature review to a case study of Canada that considers Canada’s specific needs, we propose that Canada support ongoing efforts in other countries by implementing a fully delinked subscription-based MER similar to the pilot model that was recently launched in the UK. Following the model laid out by the UK provides Canada with a reference for facilitating implementation, despite the feasibility challenges otherwise associated with fully delinked incentives. Further, the fully delinked model removes the drug manufacturer’s desire to maximize revenue from unit sales and the annually adjusted subscription fee ensures that the payment reflects the antibiotic’s performance over time. On the other hand, if Canada is unwilling to implement a pull incentive, we also suggest an alternative and less disruptive incentive strategy: grants targeting high-priority pathogens for which there are limited treatment options. Implementing a financial incentive model suited to the Canadian context will be an overdue and crucial step forward for controlling antibiotic resistance and lowering the incidence of death due to drug-resistant infections in Canada as well as around the world.

Acknowledgments

We wish to thank Dr. Suzanne Hindmarch who provided thoughtful feedback on this manuscript.

Disclosure

The authors report no conflicts of interest in this work.

References

- Sinha MS, Kesselheim AS. Regulatory incentives for antibiotic drug development: a review of recent proposals. Bioorg Med Chem. 2016;24(24):6446–6451. doi:10.1016/j.bmc.2016.08.03327591793

- Office of National Statistics. Causes of death over 100 years. 2017 Available from: https://www.ons.gov.uk/peoplepopulationandcommunity/birthsdeathsandmarriages/deaths/articles/causesofdeathover100years/2017-09-18. Accessed 410, 2020.

- Jones DS, Podolsky SH, Greene JA. The burden of disease and the changing task of medicine. N Engl J Med. 2012;366(25):2333–2338. doi:10.1056/NEJMp111356922716973

- Podolsky SH. The evolving response to antibiotic resistance (1945–2018). Palgrave Commun. 2018;4:1. doi:10.1057/s41599-018-0181-x

- Aslam B, Wang W, Arshad MI, et al. Antibiotic resistance: a rundown of a global crisis. Infect Drug Resist. 2018;11:1645–1658. doi:10.2147/IDR.S17386730349322

- O’Neill J. Tackling drug-resistant infections globally: final report and recommendations. 2016 Available from: https://amr-review.org/. Accessed 410, 2020.

- Baraka MA, Alsultan H, Alsalman T, Alaithan H, Islam MA, Alasseri AA. Health care providers’ perceptions regarding antimicrobial stewardship programs (AMS) implementation—facilitators and challenges: a cross-sectional study in the Eastern province of Saudi Arabia. Ann Clin Microbiol Antimicrob. 2019;18(1):26. doi:10.1186/s12941-019-0325-x31551088

- Bianco A, Papadopoli R, Mascaro V, Pileggi C, Pavia M. Antibiotic prescriptions to adults with acute respiratory tract infections by Italian general practitioners. Infect Drug Resist. 2018;11:2199–2205. doi:10.2147/IDR.S17034930519057

- Council of Canadian Academies. When antibiotics fail. 2019 Available from: https://cca-reports.ca/wp-content/uploads/2018/10/When-Antibiotics-Fail-1.pdf. Accessed 49, 2020.

- Dekker ARJ, Verheij TJM, Van Der Velden AW. Inappropriate antibiotic prescription for respiratory tract indications: most prominent in adult patients. Fam Pract. 2015;32(4):401–407. doi:10.1093/fampra/cmv01925911505

- Knight GM, McQuaid CF, Dodd PJ, Houben RMGJ. Global burden of latent multidrug-resistant tuberculosis: trends and estimates based on mathematical modelling. Lancet Infect Dis. 2019;19(8):903–912. doi:10.1016/S1473-3099(19)30307-X31281059

- Abelenda-Alonso G, Padullés A, Rombauts A, et al. Antibiotic prescription during the COVID-19 pandemic: a biphasic pattern. Infect Control Hosp Epidemiol. 2020;41(11):1371–1372. doi:10.1017/ice.2020.38132729437

- World Health Organization. Global action plan on antimicrobial resistance. 2015 Available from: https://www.who.int/antimicrobial-resistance/global-action-plan/en/. Accessed 314, 2020.

- Government of Canada. Tackling antimicrobial resistance and antimicrobial use: a pan-Canadian framework for action. 2017 Available from: https://www.canada.ca/en/health-canada/services/publications/drugs-health-products/tackling-antimicrobial-resistance-use-pan-canadian-framework-action.html. Accessed 49, 2020.

- Sabtu N, Enoch DA, Brown NM. Antibiotic resistance: what, why, where, when and how? Br Med Bull. 2015;116(1):105–113. doi:10.1093/bmb/ldv04126491083

- World Health Organization. 2019 antibacterial agents in clinical development: an analysis of the antibacterial clinical development pipeline. 2019 Available from: https://www.who.int/publications/i/item/9789240000193. Accessed 415, 2020.

- Outterson K, Powers JH, Daniel GW, McClellan MB. Repairing the broken market for antibiotic innovation. Health Aff. 2015;34(2):277–285. doi:10.1377/hlthaff.2014.1003

- Renwick M, Brogan DM, Mossialos E. A systematic review and critical assessment of incentive strategies for discovery and development of novel antibiotics. J Antibiot (Tokyo). 2016;69(2):73–88. doi:10.1038/ja.2015.9826464014

- Batista H, Byrski D, Lamping M, Romandini R. IP-based incentives against antimicrobial crisis: a European perspective. Int Rev Intellect Prop Compet Law. 2019;50:30–76. doi:10.1007/s40319-018-00782-w

- Talbot GH, Jezek A, Murray BE, et al. The infectious diseases society of America’s 10 × ’20 initiative (10 new systemic antibacterial agents US Food and Drug Administration approved by 2020): is 20 × ’20 a possibility? Clin Infect Dis. 2019;69(1):1–11. doi:10.1093/cid/ciz08930715222

- Renwick M, Mossialos E. What are the economic barriers of antibiotic R&D and how can we overcome them? Expert Opin Drug Discov. 2018;13(10):889–892. doi:10.1080/17460441.2018.151590830175625

- Brogan DM, Mossialos E. Incentives for new antibiotics: the Options Market for Antibiotics (OMA) model. Global Health. 2013;9(58):1–10. doi:10.1186/1744-8603-9-5823327564

- Darrow J, Sinha M, Kesselheim A. When markets fail: patents and infectious disease products. Food Drug Law J. 2018;73(3):361–382. doi:10.2307/26661184

- Chit A, Grootendorst P. Policy to encourage the development of antimicrobials. Int J Health Gov. 2018;23(2):101–110. doi:10.1108/IJHG-12-2017-0062

- Hollis A, Maybarduk P. Antibiotic resistance is a tragedy of the commons that necessitates global cooperation. J Law Med Ethics. 2015;43:33–37. doi:10.1111/jlme.12272

- Anderson M, Clift C, Schulze K, et al. Averting the AMR crisis: what are the avenues for policy action for countries in Europe? 2019 Available from: https://www.oecd.org/health/health-systems/Averting-the-AMR-crisis-Policy-Brief-32-March-2019.PDF. Accessed 410, 2020.

- Klein EY, Van Boeckel TP, Martinez EM, et al. Global increase and geographic convergence in antibiotic consumption between 2000 and 2015. Proc Natl Acad Sci U S A. 2018;115(15):E3463–E3470. doi:10.1073/pnas.171729511529581252

- Årdal C, Røttingen J-A, Opalska A, Van Hengel AJ, Larsen J. Pull incentives for antibacterial drug development: an analysis by the transatlantic task force on antimicrobial resistance. Clin Infect Dis. 2017;65(8):1378–1382. doi:10.1093/cid/cix52629017240

- Luepke KH, Suda KJ, Boucher H, et al. Past, present, and future of antibacterial economics: increasing bacterial resistance, limited antibiotic pipeline, and societal implications. Pharmacotherapy. 2017;37(1):71–84. doi:10.1002/phar.186827859453

- Finland M, Kirby W, Chabbert Y, et al. Round table: are new antibiotics needed? Antimicrob Agents Chemother. 1965;5:1107–1114.5883409

- Ciabuschi F, Baraldi E, Lindahl O, Callegari S. Supporting innovation against the threat of antibiotic resistance: exploring the impact of public incentives on firm performance and entrepreneurial orientation. J Bus Res. 2019;112:271–280. doi:10.1016/j.jbusres.2019.12.021

- So AD, Shah TA. New business models for antibiotic innovation. Ups J Med Sci. 2014;119(2):176–180. doi:10.3109/03009734.2014.89871724646116

- Moher D, Liberati A, Tetzlaff J, Altman DG. Preferred reporting items for systematic reviews and meta-analyses: the PRISMA statement. PLoS Med. 2009;6(7):e1000097. doi:10.1371/journal.pmed.100009719621072

- Baraldi E, Ciabuschi F, Leach R, Morel C, Waluszewski A. Exploring the obstacles to implementing economic mechanisms to stimulate antibiotic research and development: a multi-actor and system-level analysis. Am J Law Med. 2016;42(2–3):451–486. doi:10.1177/009885881665827629086643

- Savic M, Årdal C. A grant framework as a push incentive to stimulate research and development of new antibiotics. J Law Med Ethics. 2018;46:9–24. doi:10.1177/107311051878291130146963

- Brogan DM, Mossialos E. Systems, not pills: the options market for antibiotics seeks to rejuvenate the antibiotic pipeline. Soc Sci Med. 2016;151:167–172. doi:10.1016/j.socscimed.2016.01.00526808335

- Sciarretta K, Røttingen J-A, Opalska A, Van Hengel AJ, Larsen J. Economic incentives for antibacterial drug development: literature review and considerations from the transatlantic task force on antimicrobial resistance. Clin Infect Dis. 2016;63(11):1470–1474. doi:10.1093/cid/ciw59327578820

- Morel C, Edwards SE. Encouraging sustainable use of antibiotics: a commentary on the DRIVE-AB recommended innovation incentives. J Law Med Ethics. 2018;46:75–80. doi:10.1177/107311051878291830146962

- Daniel GW, Schneider M, Lopez MH, McClellan MB. Implementation of a market entry reward within the United States. J Law Med Ethics. 2018;46:50–58. doi:10.1177/107311051878291530146957

- Hojgard S. Antibiotic resistance - why is the problem so difficult to solve? Infect Ecol Epidemiol. 2012;2(1):1–7. doi:10.3402/iee.v2i0.18165

- Kesselheim AS, Outterson K. Fighting antibiotic resistance: marrying new financial incentives to meeting public health goals. Health Aff. 2010;29(9):1689–1696. doi:10.1377/hlthaff.2009.0439

- Kesselheim AS, Outterson K. Improving antibiotic markets for long-term sustainability. Yale J Health Policy Law Ethics. 2011;11(1):101–167.21381513

- Laxminarayan R, Powers JH. Antibacterial R&D incentives. Nat Rev Drug Discov. 2011;10(10):727–728. doi:10.1038/nrd356021959280

- Mckellar MR, Fendrick AM. Innovation of novel antibiotics: an economic perspective. Clin Infect Dis. 2014;59(suppl_3):S104–S107. doi:10.1093/cid/ciu53025261536

- Okhravi C, Callegari S, McKeever S, et al. Simulating market entry rewards for antibiotics development. J Law Med Ethics. 2018;46:32–42. doi:10.1177/107311051878291330146961

- Simpkin VL, Renwick MJ, Kelly R, Mossialos E. Incentivising innovation in antibiotic drug discovery and development: progress, challenges and next steps. J Antibiot (Tokyo). 2017;70(12):1087–1096. doi:10.1038/ja.2017.12429089600

- Towse A, Hoyle CK, Goodall J, Hirsch M, Mestre-Ferrandiz J, Rex JH. Time for a change in how new antibiotics are reimbursed: development of an insurance framework for funding new antibiotics based on a policy of risk mitigation. Health Policy (New York). 2017;121(10):1025–1030. doi:10.1016/j.healthpol.2017.07.011

- Towse A, Sharma P. Incentives for R&D for new antimicrobial drugs. Int J Econ Bus. 2011;18(2):331–350. doi:10.1080/13571516.2011.584434

- Årdal C, Johnsen J, Johansen K. Designing a delinked incentive for critical antibiotics: lessons from Norway. J Law Med Ethics. 2018;46:43–49. doi:10.1177/107311051878291430146956

- Daniel GW, Schneider M, McClellan MB. Addressing antimicrobial resistance and stewardship: the Priority Antimicrobial Value and Entry (PAVE) award. JAMA. 2017;318(12):1103–1104. doi:10.1001/jama.2017.1016428772301

- Bhatti T, Lum K, Holland S, Sassman S, Findlay D, Outterson K. A perspective on incentives for novel inpatient antibiotics: no one-size-fits-all. J Law Med Ethics. 2018;46:59–65. doi:10.1177/107311051878291630146959

- Brogan DM, Mossialos E. A critical analysis of the review on antimicrobial resistance report and the infectious disease financing facility. Global Health. 2016;12(8). doi:10.1186/s12992-016-0147-y

- Livermore DM. The 2018 Garrod lecture: preparing for the black swans of resistance. J Antimicrob Chemother. 2018;73(11):2907–2915. doi:10.1093/jac/dky26530351434

- Lum K, Bhatti T, Holland S, Guthrie M, Sassman S. Diagnosis confirmation model: a value-based pricing model for inpatient novel antibiotics. J Law Med Ethics. 2018;46(1_suppl):66–74. doi:10.1177/107311051878291730146960

- Outterson K, Rex JH. Evaluating for-profit public benefit corporations as an additional structure for antibiotic development and commercialization. Transl Res. 2020;220:182–190. doi:10.1016/j.trsl.2020.02.00632165059

- Rex JH, Outterson K. Antibiotic reimbursement in a model delinked from sales: a benchmark-based worldwide approach. Lancet Infect Dis. 2016;16(4):500–505. doi:10.1016/S1473-3099(15)00500-927036356

- Singer AC, Kirchhelle C, Roberts AP. Reinventing the antimicrobial pipeline in response to the global crisis of antimicrobial-resistant infections. F1000Research. 2019;8:238. doi:10.12688/f1000research.18302.130906539

- Spellberg B. The future of antibiotics. Crit Care. 2014;18(3):228. doi:10.1186/cc1394825043962

- Theuretzbacher U, Årdal C, Harbarth S. Linking sustainable use policies to novel economic incentives to stimulate antibiotic research and development. Infect Dis Rep. 2017;9(1):28–31. doi:10.4081/idr.2017.6836

- Vågsholm I, Höjgård S. Antimicrobial sensitivity: a natural resource to be protected by a pigouvian tax? Prev Vet Med. 2010;96:9–18. doi:10.1016/j.prevetmed.2010.05.00320570379

- Rome BN, Kesselheim AS. Transferrable market exclusivity extensions to promote antibiotic development: an economic analysis. Clin Infect Dis. 2019. doi:10.1093/cid/ciz1039

- James JE. Can public financing of the private sector defeat antimicrobial resistance? J Public Health. 2018;41(2):422–426. doi:10.1093/pubmed/fdy116

- The Chatham House. Towards a new global business model for antibiotics: delinking revenues from sales. 2015 Available from: https://www.chathamhouse.org/sites/default/files/field/field_document/20151009NewBusinessModelAntibioticsCliftGopinathanMorelOuttersonRottingenSo.pdf. Accessed 122, 2020.

- Babic M, Heemskerk E, Fichtner J. Who is more powerful – states or corporations? Conversation. 2018.

- Rubin IS. The politics of public budgets In: Rubin IS, ed. The Politics of Public Budgeting: Getting and Spending, Borrowing and Balancing. CQ Press; 2016:1–37.

- Grace C, Kyle M. Comparative advantages of push and pull incentives for technology development: lessons for neglected disease technology development. 2009:147–151. Available from: http://www.margaretkyle.net/PushPull.pdf. Accessed 12, 2021.

- Renwick MJ, Simpkin V, Mossialos E, Schippers E. Targeting innovation in antibiotic drug discovery and development. 2016 Available from: https://www.euro.who.int/__data/assets/pdf_file/0003/315309/Targeting-innovation-antibiotic-drug-d-and-d-2016.pdf. Accessed 49, 2020.

- Shlaes DM. The economic conundrum for antibacterial drugs. Antimicrob Agents Chemother. 2020;64(1):1–7. doi:10.1128/AAC.02057-19

- National Institute for Health and Care Excellence, National Health Service. Developing and testing innovative models for the evaluation and purchase of antimicrobials: subscription-based payment model. 2020 Available from: https://amr.solutions/wp-content/uploads/2020/03/2020-03-25-NHS-AMR-Market-Engagement-Briefing-Final.pdf. Accessed 126, 2020.

- Public Health Agency of Sweden. Folkhälsomyndigheten utvärderar ny ersättningsmodell för viktiga antibiotika. 2019 Available from: https://www.folkhalsomyndigheten.se/nyheter-och-press/nyhetsarkiv/2019/juni/folkhalsomyndigheten-utvarderar-ny-ersattningsmodell-for-viktiga-antibiotika/. Accessed 126, 2020.

- Public Health Agency of Sweden. Analys Av Förutsättningar För Att Testa En Ny Ersättningsmodell För Antibiotika. 2016 Available from: https://www.folkhalsomyndigheten.se/publicerat-material/publikationsarkiv/a/analys-av-forutsattningar-for-att-testa-en-ny-ersattningsmodell-for-antibiotika/. Accessed 126, 2020.

- Rex JH. Sweden to test an access-focused model for new antibiotics: contracting for availability. 2020 Available from: https://amr.solutions/2020/03/16/sweden-to-test-an-access-focused-model-for-new-antibiotics-contracting-for-availability/. Accessed 126, 2020.

- Government of Canada. Canada’s health care system. 2016 Available from: https://www.canada.ca/en/health-canada/services/canada-health-care-system.html. Accessed 1010, 2020.

- Government of Canada. A prescription for Canada: achieving pharmacare for all. 2019 Available from: https://www.canada.ca/en/health-canada/corporate/about-health-canada/public-engagement/external-advisory-bodies/implementation-national-pharmacare/final-report.html. Accessed 1010, 2020.

- Public Health Agency of Canada. Canadian antimicrobial resistance surveillance system report. 2020 Available from: https://www.canada.ca/content/dam/hc-sc/documents/services/drugs-health-products/canadian-antimicrobial-resistance-surveillance-system-2020-report/CARSS-2020-report-2020-eng.pdf. Accessed 724, 2020.

- Government of Canada. About antibiotic resistance: preserving antibiotics now and in the future. 2019 Available from: https://www.canada.ca/en/public-health/corporate/publications/chief-public-health-officer-reports-state-public-health-canada/preserving-antibiotics/about-antibiotic-resistance.html. Accessed 1121, 2019

- Public Health Agency of Canada. Federal action plan on antimicrobial resistance and use in Canada. 2015 Available from: https://www.canada.ca/en/health-canada/services/publications/drugs-health-products/federal-action-plan-antimicrobial-resistance-canada.html. Accessed 49, 2020.

- Government of Canada. Notice - health Canada’s efforts to support innovative human therapeutic products to combat antimicrobial resistance. 2018 Available from: https://www.canada.ca/en/health-canada/programs/consultation-proposed-pathogens-interest-list/notice-efforts-combat-antimicrobial-resistance.html. Accessed 1121, 2019.

- Government of Canada. Canada’s pharmaceutical industry and prospects. 2013 Available from: https://www.ic.gc.ca/eic/site/lsg-pdsv.nsf/eng/hn01768.html. Accessed 126, 2020.

- Government of Canada. Pharmaceutical industry profile. 2019 Available from: https://www.ic.gc.ca/eic/site/lsg-pdsv.nsf/eng/h_hn01703.html. Accessed 126, 2020.

- Sharma P, Towse A. New drugs to tackle antimicrobial resistance: analysis of EU policy options; 2010 Available from: https://www.ohe.org/publications/new-drugs-tackle-antimicrobial-resistance-eu-policy-options. Accessed 49, 2020.

- Rawson NSB. National pharmacare in Canada: equality or equity, accessibility or affordability. Int J Health Policy Manag. 2020;9(12):524–527. doi:10.15171/ijhpm.2019.14632610769