ABSTRACT

In order to stimulate growth and competitiveness, many EU member states have implemented cluster-based development strategies. Several works underline the benefits of policy-driven clusters, but understanding how clusters can create value for their members is still an open issue. This work contributes to the literature by investigating 13 Competitiveness Clusters in Croatia, a special type of policy-driven clusters developed within the country’s smart specialization strategy, using original data from a survey on 250 cluster members. Our results indicate the existence of very different attitudes towards the rationale for the initiative. In particular, while some members are more interested in lobbying activities, others see networking and innovation as the most important objectives of clusters. Findings also show that the evaluation of cluster management, governance and performance varies according to the desired objectives. Overall the Competitiveness Clusters initiative in Croatia did not meet members’ expectations.

Introduction

Clusters are regarded engines of growth and have become a popular policy tool for boosting competitiveness, as they bring new dynamism in local and national economies by fostering sectoral diversification and the emergence of new industries (Ketels & Protsiv, Citation2016). In smart specialization strategies (hereafter S3), which is a new policy tool used to promote competitiveness and growth in the EU (European Commission, Citation2016), clusters are a key element. This is because S3 intends to bring together universities, local authorities, and businesses working for the implementation of long-term growth strategies supported by EU funds. As a response to this new development approach, a number of new EU member states have adopted a cluster-based policy scheme (European Commission, Citation2016).

A vast bulk of studies has acknowledged the importance and potential benefits of clusters. At the same time, scholars suggest that cluster effects may vary significantly across different clusters initiatives (e.g. policy driven vs spontaneous), their sectoral specialization (Uyarra & Ramlogan, Citation2012) and across different types of participants (e.g. companies, universities). In particular, it remains unclear how clusters can provide value for their members (Albahari, Klofsten, & Rubio-Romero, Citation2018). Furthermore, the successful development of policy-driven clusters initiated by the government may be challenging in developing and transitioning regions and countries (e.g. Feser, Citation2005; Richardson, Citation2010; Tambunan, Citation2005). This justifies further research on these types of initiatives, especially in the context of S3 in new EU members’ states.

This paper investigates the development of the Competitiveness Clusters in Croatia (hereafter CCC), a specific type of policy-driven cluster, initiated and supported by the government within the country’s Smart Specialization strategy (MINGO, Citation2016) to foster the industry competitiveness of the country and reduce the gap in economic development with more advanced EU countries. Specifically, we aim at investigating the process of value creation within CCC as perceived by cluster members and the extent to which different perceptions can be associated with a different evaluation of the cluster’s management and governance, and its overall performance. The analysis relies upon a survey of 250 members of 13 CCC.

Our paper contributes to the cluster literature by providing new evidence on the effectiveness of policy-driven clusters as perceived by members, accounting for the heterogeneity of both members and types of clusters (e.g. Albahari et al., Citation2018; Liberati, Marinucci, & Tanzi, Citation2016). In particular, we distinguish clusters’ members in terms of their desired objectives.

Our findings provide insights to policy-makers and cluster management organizations concerning the process of value creation within policy-driven cluster initiatives in transition countries. This is important for the future revision of the policy framework of competitiveness clusters, as well as for the improvement of their organizational and managerial practices. Since Croatia is a paradigmatic case of a small new EU member country, the findings might be interesting for other new EU members that are struggling to implement cluster-based strategies to boost national competitiveness.

The rest of the paper is structured as follows. Section 2 provides a review of the literature on policy-driven clusters. Section 3 describes the context of the study, the sample and the process of data collection. Section 4 presents the main empirical findings, Section 5 provides discussion, while section 6 concludes and describes policy implications.

Policy-driven clusters: a review of the literature

Clustering refers to a process of co-location of firms and other actors within a geographical area, who can cooperate and establish close linkages and alliances in order to improve their competitiveness (Andersson, Serger, Sörvik, & Hansson, Citation2004). Although it is a difficult task to provide a clear-cut definition of what a cluster should look like (Eisingerich, Bell, & Tracey, Citation2010) and various definitions have been proposed in the literature (Andersson et al., Citation2004; Iammarino & McCann, Citation2006), two major typologies of clusters can be identified: spontaneous clusters and policy-driven clusters (Chiesa & Chiaroni, Citation2005). As compared to clusters that develop spontaneously based on the geographic co-location of key actors, policy-driven clusters are the result of direct action of policymakers and include a strong commitment of governments who set the conditions for clusters’ creation (Chiesa & Chiaroni, Citation2005; Huang, Yu, & Seetoo, Citation2012; Su & Hung, Citation2009). Policymakers use policy-driven clusters as a tool for providing firms with access to human, physical and financial capital and different types of business support, ranging from marketing to training and funding (Richardson, Citation2010).

Policy-driven clusters are often labelled as cluster initiatives (hereafter CI) (Andersson et al., Citation2004; Ketels, Lindqvist, & Sölvell, Citation2006; Kowalski & Marcinkowski, Citation2014; Sölvell, Lindqvist, & Ketels, Citation2003), defined as ‘organised efforts to increase growth and competitiveness of clusters within a region, involving cluster firms, government and/or the research community’ (Sölvell et al., Citation2003, p. 9). CI are managed by specialized institutions – cluster organizations – with the mission to bring together important actors around common interests/ objectives, and initiate joint activities among them. CIs may range from non-profit associations to public agencies or companies, and the local and regional government might be more or less involved in the cluster development process (Sölvell et al., Citation2003).

The literature suggests that clusters’ members are heterogeneous (Liberati et al., Citation2016): they have different expectations towards the potential benefits of cluster membership and therefore different motivations to join the clusters (European Commission, Citation2013). Companies use clusters as a platform through which they can have easier access to the relevant information, have the opportunity to participate in research projects, to gain better access to financing, training activities, and knowledge/technology exchange, and to cooperate with research and education, and public sector institutions. Other actors such as universities and research centres benefit from clusters as they have great opportunities to apply for projects in cooperation with the business sector. Finally, the public sector can exploit clusters to communicate more efficiently with private actors, design cluster policies more efficiently, and apply for international funding schemes, since through CI, policy-makers can more easily identify beneficiaries and distribute public funds to support regional development and innovation.

Government and public authorities are involved in cluster development process more in emerging economies than in developed countries (Huang et al., Citation2012), where private initiatives are more common (Andersson et al., Citation2004). With the implementation of S3s, an increasing number of new EU member states has started to promote clusters, also following best practices of similar initiatives implemented in EU founding countries. However, the effects of those programmes are still largely unexplored, also because cluster performance is difficult to conceptualize (Eisingerich et al., Citation2010). Indeed, the impacts of cluster programmes can refer both to the overall functioning of the cluster organization and to their impact on members’ performance (Lindqvist, Ketels, & Sölvell, Citation2013). Some of these effects are short-term – like the creation of business infrastructure for technical assistance or training and the development of initiatives concerning collaboration and networking among members. Others are long-term and refer to the improvement of business performance in terms of productivity, export, employment, and growth (Maffioli, Pietrobelli, & Stucchi, Citation2016). In the specific context of S3, the impact of policy-driven clusters is achieved, if they stimulate new types of knowledge spillovers with a relevant effect on the growth path of the economy (European Commission, Citation2013).

Scholars have shown that several factors, such as a high level of trust, influential government decision-makers, sufficient budget to conduct projects, excellent cluster management, clear and explicit framework, facilitators with strong networks, positively influence the performance of policy-driven clusters (Sölvell et al., Citation2003; Su & Hung, Citation2009). However, the outcomes of clustering tend to be different, depending on whether public or private actors are in charge and whether public support is involved (e.g. Andersson et al., Citation2004; Chiesa & Chiaroni, Citation2005; Huang et al., Citation2012). Recent findings from Braune, Mahieux, and Boncori (Citation2016) suggest that SMEs that participated in collaborative research projects in France (‘poles de competitivité’) exhibited higher sales, employment, R&D investments, and value added, as compared to non-participants. Similar evidence from Spain shows that members of cluster associations supported by the cluster policy for cooperation and networking had higher productivity and productivity growth, were larger and were more likely to invest in R&D, and had higher survival rate than non-members (Aranguren, de la Maza, Parrilli, Vendrell-Herrero, & Wilson, Citation2014).

Studies on science parks, which are initiatives similar to policy-driven clusters, suggest that government support might be beneficial for tenants. Huang et al. (Citation2012) find that being located in a science park is positively associated with firm innovation performance, and that, firm innovative activities benefit from being in policy-driven parks and clusters that are organized by the central government more than by the local government.

Despite the potential benefits, there is also evidence that policy-driven clusters might fail (e.g. Feser, Citation2005; Manning, Citation2008; Richardson, Citation2010; Tambunan, Citation2005). Several authors argue that CI sponsored by governments are likely to fail because governments often underestimate the importance of entrepreneurial firms in the initial stage of the cluster development process (Manning, Citation2008). Furthermore, when governments ‘pick the losers’ and public subsidies are captured by declining firms, cluster programmes do not succeed (Martin, Mayer, & Mayneris, Citation2011). Moreover, firms operating in declining industries have higher incentives to lobby in order to obtain subsidies as compared to companies in expanding industries. In addition to the above-mentioned factors, weak programme execution and project management can explain the failure of cluster programmes (Jakobsen & Røtnes, Citation2012). Further evidence shows that poor management capacity, low-quality services and business support offered by the cluster organization, but also over-regulations and bureaucracy are factors that lead to cluster policy-programme failure (Albahari et al., Citation2018; Tambunan, Citation2005).

The literature also suggests that co-location does not necessarily guarantee that the effects arising from co-operation, intense networking and sharing of knowledge will occur, although authorities might succeed in attracting firms and other key actors to clusters (Nishimura & Okamuro, Citation2011; Richardson, Citation2010; Su & Hung, Citation2009). At the same time, the government support may lead firms in the cluster to become over-reliant on public funds, so that the lack of commitment and active involvement of key actors result in limited potential synergies (Jakobsen & Røtnes, Citation2012). Finally, even if the shared vision and the common understanding of the main objectives of the cluster create a collective identity and facilitate the materialization of economic benefits deriving from geographical proximity, they can also reduce the variety needed to foster innovation. In this context, the tension between cluster renewal and continuity might lead to lock-in and decline (Pinkse, Vernay, & D’Ippolito, Citation2018).

All these potential shortcomings of policy-driven cluster initiatives are exacerbated in transition countries (Sala, Maticiuc, & Munteanu, Citation2016; Sölvell et al., Citation2003). The most severe problems hindering the development of clusters in transition economies are the inaction of cluster members, the dominant role of CI coordinators, the lack of confidence among members, the lack of skilled labour force, and the lack of financial resources (Staniuliene & Dickute, Citation2017). Sölvell et al. (Citation2003) stress that disappointing results of CI exist due to weak frameworks for cluster development, a poor consensus among key actors, neglected brand building, facilitators lacking strong networks, lack of offices and sufficient budgets for conducting important projects. The governments’ long-term commitment in CIs is also questionable: indeed, in latecomers EU member states, the promoters of CI are not adequately supported by additional policies (Sölvell et al., Citation2003).

When evaluating policy-driven clusters, it is important to examine the process of value creation (e.g. Albahari et al., Citation2018; Ellegaard, Geersbro, & Medlin, Citation2009; Hsieh & Lee, Citation2012). Scholars recognize that the value creation should be a major concern to clusters’ management and that the concept of value creation is useful to investigate the clusters’ development (Hsieh & Lee, Citation2012). In the context of clusters, value creation represents a collective process that creates common benefits to all partners (Ellegaard et al., Citation2009). By joining a cluster, firms aim to capitalize on their experience and take advantage of synergies which reduces operation costs (Hsieh & Lee, Citation2012). Past research argues that the value for cluster members might be derived from a high-profile management, a high quality of services, firms’ structural characteristics (age, size, profitability, innovative activity), co-location with other firms and linkages with research institutions (e.g. Albahari et al., Citation2018; Liberati et al., Citation2016; Ratinho & Henriques, Citation2010).

From the perspective of CI, the process of management and governance includes initiation and planning of the initiative, financing, the scope of membership, availability of resources, the excellence of cluster managers, the framework and consensus about goals and activities, and the momentum of the initiative (Sölvell et al., Citation2003). Strong management team with established and recognized expertise can increase cluster effectiveness. The responsibility of management is to design services that respond to cluster members’ needs and to deliver them in an efficient way. Business support offered by cluster organizations impact members’ revenues, profitability and financial conditions (Liberati et al., Citation2016), and as such it affects the perceptions towards the benefits deriving from cluster membership.

Business support can take the form of legal support advice on project management, R&D and patenting activities, consultancy on technology transfer and networking, as well as help in designing and implementing human capital training (Albahari et al., Citation2018). Cluster organizations try to influence the development and evolution of legal frameworks, arrange network meetings, carry out business intelligence and work with international organizations, publish reports and communicate with external partners (European Communities, Citation2008; Koszarek, Citation2014; Lindqvist et al., Citation2013). The extent to which CI focus on long-term objectives related to innovation, competitiveness, and growth more than to short-term objectives related to lobbying activities affect the overall growth of clusters and the positive attitude of members towards the participation to these policy-driven initiatives.

Starting from the existing literature, we seek to provide the evidence on the process of value creation within policy-driven clusters in transition countries, focusing on the most important objectives and components of business support as perceived by cluster members. In doing so, we investigate how different desired objectives are associated with different modes of cluster management and governance, as well as with different perceptions towards cluster performance.

Study context and data collection

Over the last decade, the Croatian government has made many efforts to support entrepreneurship, innovation, the transfer of knowledge and commercialization of research. Since 2013, with the entry into the EU, it adjusted its competitiveness policies following the EU guidelines. Despite all this, the Croatian innovation system is inefficient and has a low impact on economic development (Bečić & Švarc, Citation2015). The Croatian economy is dominated by traditional, low technology sectors. Productivity is low and the economy is poorly integrated into global value chains. R&D expenditures and patenting activity are also low and different policy initiatives have failed to encourage companies to innovate and collaborate with the public research sector. Through the implementation of smart specialization strategies in 2016, Croatia has intended to address the major obstacles to an increase in competitiveness, productivity, innovations, and diffusion of new technologies (MINGO, Citation2016).

CCC represent an important tool for the implementation of S3. They were initiated and sponsored by MINGO, and share the characteristics of policy-driven clusters. They are ‘non-profit organizations/associations operating within sectors of strategic importance for the development of the country, linking private, scientific-research and public institutions’ (MINGO, Citation2016, p. 7). CCC are designed as

an instrument for raising sectoral competitiveness, efficient use of EU funds and programmes, instrument for internationalization and cross-sectoral networking, lobbying instrument, instrument for sector promotion and branding, an instrument for targeted attracting of investments and creating new value added on the sector level. (MINGO, Citation2016, p. 7)

CCC can generate similar dynamics as those of social networks in clusters (Iammarino & McCann, Citation2006) or those observed in similar initiatives, like the Strategic Research and Innovation Partnerships (SRIPs) in Slovenia. In social networks, social and business links and mutual trust relations among key actors in the form of joint lobbying, joint ventures, and informal alliances play an important role in fostering growth (Iammarino & McCann, Citation2006). This might be important for Croatian as well as it was in Slovenian clusters. SRIPs in Slovenia were developed around the coordination of R&D activities, the sharing of capabilities, the exchange of knowledge and experiences, and the collective representation of interests (Slovenian Government office for development and European Cohesion Policy).

The government created 13 CCC in the following sectors: automotive, wood processing, food processing, defence, health, chemicals, plastics and rubber, electrical and manufacturing machinery and technology, ICT, maritime, construction, textile, leather and footwear and creative and cultural industries (established in 2013), and personalized medicine (established in 2016). The members of CCC are legal entities from the business sector, business clusters, and professional organizations, and education and research institutions, local and regional government’s institutions from the sector.

Although CCC have the possibility to use various sources of funding, their resources have remained limited. There is no obligation to pay a membership fee: the majority of CCC do not have professional cluster managers, employees, and offices, but the Agency for Investments and Competitiveness (hereafter AIK) gives them technical and administrative support. The government has been the primary source of funding of CCC and it provided support for doing sectoral analyses, strategic guidelines, sectoral mapping, and sectoral promotion. The future of government funding of CCC is, however, questionable.

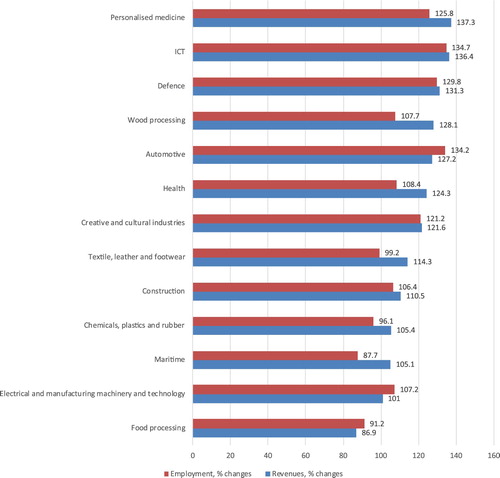

The performance of CCC-related sector has improved during the last few years after the economic crisis, even if with some variance, as shown in . Food processing sector was the worst performing sector, while the best performing sectors were personalized medicine and ICT.

Figure 1. Evolution of CCC-related sectors (% change in revenues and employment 2013–2016). Source: Authors’ elaboration based on FINA database (Croatian Financial Agency).

Data collection and sample characteristics

The empirical analysis in this paper relies on survey data, which allows a more insightful investigation of cluster members’ perceptions towards the objectives, governance, management practices and performance (Jakobsen & Røtnes, Citation2012; Lindqvist et al., Citation2013; Sölvell et al., Citation2003).

In order to develop a survey questionnaire, face-to-face interviews were held with experts at AIK and with the presidents of the CCC. A computer-assisted web interviewing method (Google forms) was used to collect the data during the period of March–July 2017. The survey was sent online to members of the assemblies and members of governing boards in all CCC (N = 621). In order to increase the response rate, each member received three reminders via mail, and every reminder included a link, which took the respondents to the page of the survey. For one month, a professional interviewer contacted CCC members, while MINGO reminded members to fill in the survey. This procedure resulted in the return of 279 questionnaires (with a 44.9% response rate), out of which 250 were completed and usable. shows the sample characteristics.

Table 1. Sample characteristics (N = 250).

The sample covers all the 13 CCC and includes different types of members. The majority of respondents are from the business sector (52.4%), and 17.6% are members from high education and research institutions (e.g. the Faculty of Mechanical Engineering and Naval Architecture, Ruđer Bošković Institute, Faculty of Textile technology, Brodarski Institute, and the Institute of Economics, Zagreb). 16.8% of respondents are from the regional and local government, while 10% come from Professional organizations such as the Croatian Chamber of Economy and the Croatian Employers’ Association. Finally, 3.2% are members of business clusters, i.e. legal entities representing networks of actors in the same geographical area, which include specialized suppliers and service providers, as well as associated business institutions in a specific sector.

The focus of our analysis is the relationship between the desired objectives of the cluster on the one hand, and its governance, the prevailing management modes and the perceived performance on the other hand. We exploit the information related to objectives, the process of governance, the management modes and the perceived performance of CCC which was collected via a survey administered to clusters’ members. The questions were developed based on the existing literature and the Global Cluster Initiative Survey (Lindqvist et al., Citation2013; Sölvell et al., Citation2003). Respondents were asked to state their agreement with different statements on a Likert scale (1 = disagree completely, 7 = agree completely).

As far as the desired objectives are concerned, the questionnaire asked respondents to evaluate the importance of a series of desired objectives of their CCC for the future. Examples of these objectives are ‘to foster collaboration and networks’, ‘to lobby for the sector’, ‘to promote innovations and new technologies’, ‘to provide training’. The desired objectives are an important indication of the expectations of the members towards the type of business support from the CCC.

As far as the management modes and governance processes are concerned, the survey asked respondents to evaluate the importance of a set of factors regarding the formulation of the cluster vision, goals and framework, the adequacy of the available budget for projects, the involvement of companies and the role of regional/local governments in the process of governance.

Finally, in terms of perceived performance of the CCC, the respondents had to assess the cluster’s contribution to the improvement of the sectoral competitiveness, revenues, employment, and export, to the development of science-industry links and innovations, and to the strengthening of the collaborations between CCC firms across the global value chains.

We complemented the survey data with financial data for participating firms (through the portal Poslovna Hrvatska). Finally, we obtained the figures on employment growth and firm revenues for the sectors covered by CCC (2013–2016) from the dataset of the Croatian Financial Agency (FINA). By using the national classification of economic activities of firms we were able to identify the existing businesses and to relate them within each CCC.

The most relevant characteristics of respondents by CCC are presented in and . shows the percentage of respondents belonging to different types of members by CCC. The largest share of respondents in governing boards comes from the CCC in construction, textile, leather, and footwear, automotive, maritime and wood processing industries. The majority of respondents comes from the business sector in five CCC, while business clusters are mostly represented in the automotive and wood processing CCC. The CCC with the highest percentage of responding members from professional organizations is the one related to the creative and cultural industries, while the education/research organizations are mostly represented in the health CCC, and the government institutions in wood processing sector CCC.

Table 2. Type of respondents in CCC (percentage).

Table 3. Respondents from the business sectors (percentage of total respondents).

If we focus on the respondents belonging to companies, we observe that private (77.9%) and small companies (50.4%) dominate in the sample, although state-owned and large companies are also present. Respondents from small companies are particularly present in the CCC related to defence, creative and cultural industries, health and personalized medicine. There are relatively few respondents from foreign companies in the sample (6.9%): the largest share of respondents from foreign companies is in the CCC related to the automotive, food processing, health, and personalized medicine industries. If we look at the firm performance, the most successful CCC are those related to automotive, wood-processing, chemicals, plastics and rubber, construction, electrical and manufacturing machinery, and technology and ICT sectors, while the CCC with a large share of declining companies include food processing, maritime, health, and textile, leather, and footwear.

provides information on revenues and employment of the respondents (firms) in the 13 CCC. On average, sampled firms in CCCs are small in terms of revenues and employment. Food processing companies generate the highest revenues, while the cluster of creative and cultural industries mostly includes micro companies.

Table 4. Average revenues and employment of sampled firms in CCC (2016).

Empirical analysis

The aim of the empirical analysis is twofold. First we show whether clusters’ members have different expectations about the objectives of the CCC initiatives. Second, we investigate if these different expectations are associated to different performances, as perceived by CCCs members.

With reference to the desired objectives, respondents were asked to assess the importance of a list of objectives that CCC should strive to fulfil in the future on a 7 point Likert scale (1 = disagree completely, 7 = agree completely). The most important future objectives are the promotion of innovation and new technologies (5.9), facilitation of higher innovativeness (5.8), improvements in regulatory policies (5.7), lobbying by the government for infrastructure (5.7), and diffusion of new technologies (5.7).

We performed an exploratory factor analysis on the responses related to future objectives to identify factors representing different types of objectives () and understand the expectations of cluster members in terms of business support.

Table 5. Factor analysis on the desired objectives.

Six factors emerged from the factor analysis. The first factor – Lobbying – is explained by four objectives: lobby government for infrastructure, improve regulatory policy, lobby government for subsidies, and improve FDI incentives. The second factor is explained by the following objectives: promote innovation and new technologies, facilitate higher innovativeness, diffuse the technology within the cluster/sector, attract new firms and talent to the industry, enhance production processes and create a brand for the industry. We label this factor Innovation. The third factor is explained by four objectives: assemble market intelligence, analyse technical trends, study and analyse the sector, and provide business assistance. We label this factor Market and sector analyses. The fourth factor – Infrastructure and standards – is explained by the following factors: conduct private infrastructure projects, establish technical standards and coordinate purchasing, provide incubator services. The fifth factor – Networks and collaborations – is explained by two objectives: foster networks among people and establish networks among firms. Finally, the last factor – Training – is explained by objectives related to the provision of technical and management training.

The factor analysis provides an input for a cluster analysis, which aims at classifying the variety of members expectations towards the CCC desired objectives. The purpose of the clustering exercise is to detect commonalities and differences across members belonging to different CCC.

Three groups of CCC members emerge out of the analysis () and statistical tests confirm that most factors are significantly different across clusters. Group 1 includes 146 CCC members and has high factor scores on lobbying, infrastructure and standards, and training. Members in this group are mostly interested in lobbying activities with the local and national government for the development of infrastructure and technical standards, as well as for the provision of subsidies label this cluster lobbying and infrastructure. We label this cluster Lobbying-oriented. Group 2 includes 35 members and has a relatively high factor score on network and collaboration: cluster members in this group see networking as the most important objective of the CCC. We label the group Networking-oriented. The third group of CCC members includes 69 members and is interested in objectives related to innovations and market and sector analyses. We label this group Innovation-oriented.

Table 6. Groups of CCC members by desired objectives.

We compare more in depth the three groups across some key variables related to the management and governance modes, as well as to the performance. As far as the management and governance modes are concerned, we asked the respondents to evaluate on a Likert scale (1 = disagree completely, 7 = agree completely) a set of statements concerning the management and governance modes of the CCC. The mean value of responses ranges from 2.33 to 4.26. The highest values were recorded by the statements related to the dominance of major companies in the governance of CCC (4.3), clearly formulated vision of CCC (4.3), consensus and agreement upon the activities that need to be carried out (4.2), and effort taken in the model of cooperation (4.1). Respondents assessed negatively the existence of adequate budget to carry out important projects (2.3) and the operational activities related to the opportunity of sharing experiences with other clusters (3.6) and to the existence of working teams (3.6).

In order to reduce the number of items, we performed a factor analysis that produced two factors (). The first factor is explained by items that define a clear vision of CCC based on the existing objectives and on a long-term experience at the national and international level in the specific sector. We label this factor Long-term vision. The second factor is explained by items related to the governance and availability of funds necessary for the implementation of important projects. Therefore, we label this factor Local governance.

Table 7. Exploratory factor analysis on management and governance items.

With reference to the evaluation of performance, we asked respondents to evaluate on a Likert scale (1 = disagree completely, 7 = agree completely) a set of 12 statements concerning the performance of CCC. Respondents assessed the performance of their CCC very negatively. The mean value of the items ranges from 2.7 to 3.9. The most relevant impact of CCC is on industry-academia links (3.8), while the worst results concern the attraction of new firms to the region (2.7), the attraction of FDI (2.7), the employment increase (2.9). Given that CCC are young organizations and that most of the above-mentioned impacts require a longer time to occur, respondents’ perception needs to be considered with caution.

We performed a factor analysis on these 12 items, which produced one factor – perceived performance. This factor accounts for long-term performance indicators such as the increase in employment, revenues, and FDI, the promotion of export and the upgrade of products and process (see ).

Table 8. Exploratory factor analysis on performance items.

In order to detect differences and similarities across the three groups of CCC members in their perception towards management, governance and performance variables, we performed an ANOVA ().

Table 9. Evaluation of management/governance and performance across members’ groups.

The Lobbying-oriented group is interested in future objectives related to lobbying, infrastructure and standards, and scores highly on local governance and long-term vision, while also displaying the highest value on the performance factor. The Networking-oriented group displays a very short-term orientation in terms of management and has negative values on performance. Members of this group are disappointed by the governance mode of their CCC and by the outcomes achieved, which results in low perceived performance. The Innovation-oriented group shows a positive attitude on long-term vision but displays a negative value on local governance and on performance. This might suggest that members of this group perceive a mismatch between the objectives/vision, and the implementation of activities that lead to high performance in the long-term.

The strong emphasis on lobbying and networking might depend upon the short period of implementation of programmes related to S3. In this scenario, the main achievement could be informal cooperation based on the exchange of information. Thus, concrete cooperation that results in product and/or process innovation may not be expected. illustrates the distribution of CCC across different groups.

Table 10. Distribution of CCC across members’ groups (number of members and percentage by group).

The highest share of members within group 1 (Lobbying-oriented) comes from food processing (13%), a traditional industry cluster, which is made of large and old state-owned companies. This industry recorded the worst performance between 2013 and 2016 in both revenues and employment. Other CCC with a high share of members in this group are those related to creative and cultural industries (12%) and to electrical, machinery and technology industries (11%). The latter CCC is made of old and large companies (42.9% of companies recorded a decline in employment), while the CCC related to creative and cultural industries includes mainly small and domestically owned companies, most of which recorded a decline in employment. Overall, it seems that large, old and low performing companies joined CCC mostly for lobbying, to have visibility and improve their position in the market. As indicated in the literature, firms operating in declining traditional industries have higher incentives to lobby in order to obtain subsidies, as compared to companies in expanding industries.

In the networking-oriented group, we find most of all members of the CCC related to creative and cultural industries (17%), defence (14%), electrical, machinery and technology (11%), maritime industries (11%), chemicals, plastic and rubber (9%) and health industries (9%). The majority of companies in those industries are small and domestic, with stable or growing performance. Companies in this group seek a high level of cooperation and networking in order to develop collaborations with more established actors within the cluster and boost their performance.

Finally, members in the innovation-oriented group mostly belong to the CCC of defence (14%) and ICT (10%). Both sectors recorded high growth of employment and revenues between 2013 and 2016 and mostly include small, young and domestic private companies. These actors are aware of the importance of innovations and new technologies for their long-run performance and require their CCC to create an environment that is conducive to innovation.

Discussion

Our findings show that members join CCCs for very different purposes, looking for various types of business support: while some aim at engaging in lobbying activities with local and national policymakers, others are interested in networking and support for developing innovation. The empirical analysis also shows that these differences translate into different perceptions of CCCs management/governance modes and performance. Lobbying-oriented members scored high on both long-term vision and local performance and had the highest value on perceived performance. Networking-oriented members have a short-term orientation and a negative perception towards performance, while innovation-oriented members give more weight to the long-term vision of the cluster management/governance, but also have a negative perception of cluster performance.

We also find confirmation that the heterogeneity of cluster members is an important factor in explaining the value and impact generated by clusters. Lobbying-oriented members come mostly from old and traditional industries and have higher chances to implement an effective lobbying activity to access key resources. Networking-oriented members aim at improving their performance through collaborations with more established actors in clusters, while innovation-oriented members mostly belong to high-growth emerging industries and see the development of innovations and new technologies as the most important value deriving from the cluster. As such, these members want CCC to create a context that facilitates the development of innovations. In terms of the effectiveness of this new programme, the findings show that the perceived performance of CCC is very low, meaning that CCC did not fulfil respondents’ expectations and objectives. This cluster development programme so far has not proven to generate the expected results, as the members of CCC have not been able to exploit the benefits of being in a cluster and to see any value of their participation in CCC.

The results, although based on a short terms assessment of CCC performance, lean towards the literature arguing that policy-driven clusters, initiated by the government, tend to fail in developing economies and countries in transition (Feser, Citation2005; Richardson, Citation2010; Sölvell et al., Citation2003; Tambunan, Citation2005). This literature highlights that when policymakers attempt to replicate policy initiatives and experiences developed in other institutional and economic contexts, often without taking into account local specificities, the cluster development programmes are less likely to succeed (Humphrey & Schmitz, Citation1996).

In the Croatian case, the failure mostly depends upon the characteristics of a challenging environment facing low levels of trust, innovations, and productivity, a situation that occurred also in other economies in transition (Lindqvist et al., Citation2013; Sala et al., Citation2016; Sölvell et al., Citation2003). In particular, a low level of trust among key actors and policy makers hinders the emergence and evolution of clusters, because mutual trust relations between members are the core building block of an effective clustering activity, as they allow the creation of joint lobbying processes, informal alliances, trading relationships, and reduce inter-firm transactions costs (Iammarino & McCann, Citation2006).

Furthermore, major elements that generate value, such as high-quality business support and high profile management are weak. The CCC do not have their own facilities and infrastructures, do not benefit from experienced cluster management, and do not have sufficient budget for the implementation of large-scale projects. Therefore, the limited management capacity and low-quality services have not responded to members’ needs, which all resulted in low perceptions of members about the effectiveness of the cluster programme. Finally, there was also a lack of commitment and involvement by participants, who were over reliant on public funds and support, and produced limited synergies (Jakobsen & Røtnes, Citation2012).

Conclusions

This paper has investigated the recent emergence of competitiveness clusters in Croatia, looking at the differences across members in terms of desired objectives and examining how these translate into different perceptions of the existing management and governance modes and of the overall cluster performance. While the literature has emphasized that the value creation for members should be a major concern of the clusters’ management (Hsieh & Lee, Citation2012), the available evidence on the effectiveness of policy-driven clusters reveals a number of shortcomings of policy-driven cluster initiatives, particularly in transition countries (Sala et al., Citation2016; Sölvell et al., Citation2003; Staniuliene & Dickute, Citation2017). Overall, the results of our study support the idea that top-down cluster initiatives developed and supported by the government display low levels of perceived performance, which is in line with past research (Andersson et al., Citation2004; Maticiuc, Citation2014).

The study provides original evidence showing that the high heterogeneity among cluster members translates in different expectations towards the type of services and business support provided by the cluster management. While some members are interested in joining clusters to engage in lobbying activities towards the local and national government, others look for research and business networking opportunities, and a third group participates in these initiatives in order to benefit from the processes of innovation development and knowledge/technology transfer. There is also a clear sectoral pattern with members of old and traditional industries belonging to the lobbying-oriented group, while young companies of high-tech sectors are looking for networking and innovation opportunities.

The results of the paper have important implications for policymakers and managers of CCC and can be useful for other new EU member states that are struggling to implement S3-related cluster policies. In order to boost the performance of CCC, it is important to involve a strong management team to design business support for the members and facilitate its effective implementation. Furthermore, the development of business support should be aligned with members’ expectations.

With respect to the lobbying activity, CCC managers should establish more effective communications with the EU and national institutions, with the aim to improve the existing legislation and regulatory framework, to develop infrastructure and technical standards, and to attract FDI and new firms. The development of research and business collaborations is another important priority of CCC. In this sense, the development of local and international networking events and activities, fostering the sharing of knowledge, experiences, and best practices represents a pivotal tool.

Finally, the development of innovation and diffusion of new technologies requires the promotion of joint research projects between businesses and research organizations, and the dissemination and possible commercialization of research results. Moreover, CCC should improve communication and facilitate cooperation within networks, facilitate human capital development, scout technology, and market trends, organize innovation workshops, and distribute information about funding programmes opportunities (Andersson et al., Citation2004; European Cluster Excellence Initiative [ECEI], Citation2012).

In line with the international best practices, CCC should aim at ambitious objectives related to innovation, which are the most important mechanisms to increase competitiveness and achieve long-run growth. While lobbying and networking activities are not subject to relevant budget constraints, the development of innovation strategies requires substantial investments in human capital and physical infrastructure, and therefore more funding (Sölvell et al., Citation2003).

A final consideration concerns the required changes in the current national framework for cluster development to strengthen the CCC’s capabilities. On the one hand, there is a need for professional managers and skilled employees with the capabilities to engage in fruitful lobbying activities at the national and the EU level. On the other hand, the introduction of membership fees would help increase the engagement of cluster actors in the development of strategies to enhance innovation and competitiveness and would lower the dependence upon local government funds (Sölvell et al., Citation2003).

The research has also some limitations. First, we carried out the analysis shortly after the beginning of the cluster programme, which does not allow us to evaluate the long-term effects. Second, the investigation relies on members’ perceptions and suffers from subjective biases in the responses. However, since the sample includes very different types of members, the bias is less problematic. Third, it is very hard to disentangle the cluster-specific impact from the sectoral evolution in terms of growth and competitiveness. For this reason, we have chosen to concentrate on the expectations towards the future (desired) objectives. Future research could replicate the study over a longer time horizon, in order to understand whether CCC members’ perceptions change over time and whether policy interventions are effective in making the CCC more aligned with the European guidelines on S3 in terms of innovation and competitiveness.

Acknowledgments

Draft version of the paper was presented during Training Workshop named ‘Training Workshop on Cluster Evolution’ held from 6 to 8 September in Milano 2017, within the project ‘Strengthening scientific and research capacity of the Institute of Economics, Zagreb as a cornerstone for Croatian socioeconomic growth through the implementation of Smart Specialisation Strategy’ (H2020-TWINN-2015-692191-SmartEIZ).

Disclosure statement

No potential conflict of interest was reported by the authors.

ORCID

Andrea Morrison http://orcid.org/0000-0002-1878-6780

Additional information

Funding

References

- Albahari, A., Klofsten, M., & Rubio-Romero, J. C. (2018). Science and technology parks: A study of value creation for park tenants. The Journal of Technology Transfer, first online March 23, 1–17. doi: 10.1007/s10961-018-9661-9

- Andersson, T., Serger, S. S., Sörvik, J., & Hansson, E. W. (2004). The cluster policies whitebook. Malmo: IKED, International Organisation for Knowledge Economy and Enterprise Development.

- Aranguren, M. J., de la Maza, X., Parrilli, M. D., Vendrell-Herrero, F., & Wilson, J. R. (2014). Nested methodological approaches for cluster policy evaluation: An application to the Basque Country. Regional Studies, 48(9), 1547–1562. doi: 10.1080/00343404.2012.750423

- Bečić, E., & Švarc, J. (2015). Smart specialisation in Croatia: Between the cluster and technological specialisation. Journal of the Knowledge Economy, 6(2), 270–295. doi: 10.1007/s13132-015-0238-7

- Braune, E., Mahieux, X., & Boncori, A. L. (2016). The performance of independent active SMEs in French competitiveness clusters. Industry and Innovation, 23(4), 313–330. doi: 10.1080/13662716.2016.1145574

- Chiesa, V., & Chiaroni, D. (2005). Industrial clusters in biotechnology—driving forces, development processes and management practices. London: Imperial College Press.

- European Cluster Excellence Initiative [ECEI]. (2012). Retrieved from http://www.clusterpolisees3.eu/ClusterpoliSEEPortal/resources/cms/documents/2012.05.22_The_quality_label_and_indicators_for_cluster_organisations_assessment.pdf

- Eisingerich, A. B., Bell, S. J., & Tracey, P. (2010). How can clusters sustain performance? The role of network strength, network openness, and environmental uncertainty. Research Policy, 39(2), 239–253. doi: 10.1016/j.respol.2009.12.007

- Ellegaard, C., Geersbro, J., & Medlin, C. J. (2009, December). Value appropriation within a business network. Paper presented at 4th IMP Asia Conference, Kuala Lumpur, Malaysia. Retrieved from https://openarchive.cbs.dk/bitstream/handle/10398/8231/IMPAsia2010FinalMedlinGeersbroEllegaard.pdf?sequence=1

- European Commission. (2013). The role of clusters in smart specialisation strategies. Luxembourg: Publications Office of the European Union.

- European Commission. (2016). Smart guide to cluster policy. Belgium: the European Publications Office.

- European Communities. (2008). The concept of clusters and cluster policies and their role for competitiveness and innovation: Main statistical results and lessons learned. Luxembourg: Office for Official Publications of the European Communities.

- Feser, E. (2005). On building clusters versus leveraging synergies in the design of innovation policy for developing economies. In U. Blien & G. Maier (Eds.), The economics of regional clusters, networks, technology and policy (pp. 191–213). Cheltenham: Edward Elgar. Retrieved from https://works.bepress.com/edwardfeser/25/

- Government Office for Development and European Cohesion Policy, Republic of Slovenia. Strategic research and innovation partnerships (SRIP) in detail. Retrieved from http://www.svrk.gov.si/en/areas_of_work/slovenian_smart_specialisation_strategy_s4/strategic_research_and_innovation_partnerships_srip_in_detail/

- Hsieh, P. F., & Lee, C. S. (2012). A note on value creation in consumption-oriented regional service clusters. Competitiveness Review: An International Business Journal Incorporating Journal of Global Competitiveness, 22(2), 170–180. doi: 10.1108/10595421211205994

- Huang, K. F., Yu, C. M. J., & Seetoo, D. H. (2012). Firm innovation in policy-driven parks and spontaneous clusters: The smaller the firm the better? The Journal of Technology Transfer, 37(5), 715–731. doi: 10.1007/s10961-012-9248-9

- Humphrey, J., & Schmitz, H. (1996). The Triple C approach to local industrial policy. World Development, 24(12), 1859–1877. doi: 10.1016/S0305-750X(96)00083-6

- Iammarino, S., & McCann, P. (2006). The structure and evolution of industrial clusters: Transactions, technology and knowledge spillovers. Research Policy, 35(7), 1018–1036. doi: 10.1016/j.respol.2006.05.004

- Jakobsen, E. W., & Røtnes, R. (2012). Cluster programs in Norway – evaluation of the NCE and Arena programs ( Report No. 1). Norway: MENON-Publication 1, Business economics.

- Ketels, C., Lindqvist, G., & Sölvell, Ö. (2006). Cluster initiatives in developing and transition economies. Stockholm: Center for Strategy and Competitiveness.

- Ketels, C., & Protsiv, S. (2016). European cluster panorama 2016. Stockholm: Center for Strategy and Competitiveness, Stockholm School of Economics.

- Kowalski, A. M., & Marcinkowski, A. (2014). Clusters versus cluster initiatives, with focus on the ICT sector in Poland. European Planning Studies, 22(1), 20–45. doi: 10.1080/09654313.2012.731040

- Koszarek, M. (2014). Supporting the development of clusters in Poland – dilemmas faced by public policy. Research Papers of the Wroclaw University of Economics, 365, 103–112.

- Liberati, D., Marinucci, M., & Tanzi, M. (2016). Science and technology parks in Italy: Main features and analysis of their effects on the firms hosted. The Journal of Technology Transfer, 41, 694–729. doi: 10.1007/s10961-015-9397-8

- Lindqvist, G., Ketels, C., & Sölvell, Ö. (2013). The cluster initiative greenbook 2.0. Stockholm: Ivory Tower Publishers.

- Maffioli, A., Pietrobelli, C., & Stucchi, R. (2016). The impact evaluation of cluster development programs methods and practices. New York: Inter-American Development Bank.

- Manning, S. (2008). On the role of western multinational corporations in the formation of science and engineering clusters in emerging economies. Economic Development Quarterly, 22(4), 316–323. doi: 10.1177/0891242408325585

- Martin, P., Mayer, T., & Mayneris, F. (2011). Public support to clusters: A firm level study of French “local productive systems”. Regional Science and Urban Economics, 41(2), 108–123. doi: 10.1016/j.regsciurbeco.2010.09.001

- Maticiuc, M. (2014). Top-town and bottom-up cluster initiatives in Europe. Annals of the University of Petrosami. Economics, 14(1), 205–2012.

- MINGO – Ministry of Economy, Entrepreneurship and Crafts. (2016). Croatian smart specialisation strategy 2016–2020. Retrieved from http://s3platform.jrc.ec.europa.eu/documents/20182/222782/strategy_EN.pdf/e0e7a3d7-a3b9-4240-a651-a3f6bfaaf10e

- Nishimura, J., & Okamuro, H. J. (2011). R&D productivity and the organization of cluster policy: An empirical evaluation of the industrial cluster project in Japan. The Journal of Technology Transfer, 36(2), 117–144. doi: 10.1007/s10961-009-9148-9

- Pinkse, J., Vernay, A. L., & D’Ippolito, B. (2018). An organisational perspective on the cluster paradox: Exploring how members of a cluster manage the tension between continuity and renewal. Research Policy, 47(3), 674–685. doi: 10.1016/j.respol.2018.02.002

- Ratinho, T., & Henriques, E. (2010). The role of science parks and business incubators in converging countries: Evidence from Portugal. Technovation, 30(4), 278–290. doi: 10.1016/j.technovation.2009.09.002

- Richardson, C. (2010). The internationalisation of firms in a policy-driven industrial cluster: The case of Malaysia’s multimedia super corridor (Doctoral thesis). The University of Manchester, Manchester, UK. Retrieved from https://www.research.manchester.ac.uk/portal/en/theses/the-internationalisation-of-firms-in-a-policydriven-industrial-cluster-the-case-of-malaysias-multimedia-super-corridor(392e5f1d-98cc-47d8-a9c4-cca1025a64ed).html

- Sala, D. C., Maticiuc, M. D., & Munteanu, V. P. (2016, November). Clusters influence on competitiveness. Evidences from European Union countries. Proceedings of the International Management Conference, 10(1), 10–17.

- Sölvell, Ö, Lindqvist, G., & Ketels, C. (2003). The cluster initiative greenbook. Stockholm: Ivory Tower Publishers.

- Staniuliene, S., & Dickute, V. (2017). Business clusters formation for region development in Lithuania. Research for Rural Development, 2, 118–125.

- Su, Y. S., & Hung, L. C. (2009). Spontaneous vs. policy-driven: The origin and evolution of the biotechnology cluster. Technological Forecasting and Social Change, 76(5), 608–619. doi: 10.1016/j.techfore.2008.08.008

- Tambunan, T. (2005). Promoting small and medium enterprises with a clustering approach: A policy experience from Indonesia. Journal of Small Business Management, 43(2), 138–154. doi: 10.1111/j.1540-627X.2005.00130.x

- Uyarra, E., & Ramlogan, R. (2012). The effects of cluster policy on innovation ( Nesta Working Paper 12/05). Manchester: Manchester Institute of Innovation Research/Manchester Business School.